How to Set Up a Trust Without an Attorney

- Visit an Online Wizard. Websites such as Rocket Lawyer or Legal Zoom have tons of information about trusts and offer...

- Choose a Trust Structure. There are many different types of trusts so read around the subject before you begin. The main...

- Write the Paperwork. To create the trust, you’ll need a trust establishment date, the...

How to set up a trust in the USA?

Feb 16, 2022 · How to Set Up a Trust Without an Attorney Visit an Online Wizard. Websites such as Rocket Lawyer or Legal Zoom have tons of information about trusts and offer... Choose a Trust Structure. There are many different types of trusts so read around the subject before you begin. The main... Write the ...

Do I need an estate lawyer to set up a trust?

The following are detailed steps for setting up and funding a trust: Decide on the type of trust you need, based on your goals. Determine which assets you are putting into the trust. Designate your trustee or trustees. List your beneficiaries and decide how your estate will be …

Do you need an accountant to set up a trust account?

Jul 21, 2021 · How to Set Up a Trust Setting up a trust is a two-step process: 1. Creating the Trust Agreement The grantor creates a trust agreement, which is a legal document that designates the grantor, the trustee, and the beneficiaries, and outlines how the trust assets are to be managed and distributed.

How do you set up a testamentary trust with no assets?

Feb 15, 2022 · Five years of annual gifts of up to $15,000 from one individual, a maximum of $75,000, can be contributed at one time without incurring a …

How to set up a trust account?

For other assets, designate the trust as beneficiary. 1. Decide how you want to set up the trust. You can set up a trust by hiring an estate planning attorney, using an online service, or opening one on your own.

How to set up a living trust?

To set up a living trust, you must write a trust agreement and then properly fund the trust with assets. The trust document requires notarization in most states. You can set up a revocable living trust on your own, but an irrevocable trust will likely require the services of an attorney.

What can you do with an irrevocable trust?

Trusts that cannot be closed, called irrevocable trusts, can also help you do the following: Retain eligibility for government benefits, such as Medicaid. Minimize taxes, including income tax, capital gains tax, or estate tax. Provide asset protection. Donate to charities while creating a stream of income.

How to fund a trust with money?

4. Set up a trust bank account. You'll want to fund your trust with money and the easiest way to do that is by setting up a trust bank account. This is especially important if you're setting up a trust fund, which provides money to your beneficiaries.

Why do you need a trust after you die?

One of the main advantages of setting up a trust is having more control over how your assets are distributed, as a will distributes your estate after you die, but a trust can be set up to distribute assets only when certain conditions are met. After your death, trust assets can pass more seamlessly to your beneficiaries outside ...

Why do people get living trusts?

One reason to get a living trust is to avoid probate, which can lengthen the amount of time it takes for someone to receive the deceased’s assets and property. (Learn more about how to avoid probate .) Using a trust keeps details private, while wills become public record eventually.

How to put a house in a trust?

Putting your house in a trust means creating a new property deed with the trust’s name and filing it with the county recorder's office. If you want your trust hold stock certificates or bonds, you would similarly need to reregister them into the name of the trust. 6. For certain assets, name the trust as beneficiary.

What is a trust?

A trust is a legal structure that contains a set of instructions that includes exactly how and when to pass assets to your beneficiaries. There are dozens of trust structures available, and only after careful consideration should you determine the type of trust that works best for you. Contrary to popular belief, ...

Who will manage a trust when you die?

You’ll need to include your own name (as the grantor or trustee) and who will manage the trust (you). The name of who will take over as trustee and distribute property in the trust when you die or becomes incapacitated (this person is called the successor trustee).

What are the benefits of a trust?

1. One key benefit of creating a Trust is that your loved ones will avoid probate — a long, complicated court process. When you transfer assets to your trust, you own everything in your trust while you’re still alive. After you die, your assets go directly to your beneficiaries.

What is a grantor trust?

Grantor Trust. A grantor trust is a trust that involves the elements of control listed in the federal income tax code. It includes the power to revoke the trust, the right to receive the trust’s income and/or principal and the role of trustee.

What type of trust protects the property of the beneficiary?

Spendthrift Trust. This type of trust is protected against the creditors of a beneficiary. In other words, a spendthrift trust protects trust property from an irresponsible beneficiary and his or her creditors. It’s a type of property control trust that limits the beneficiary’s access to trust principal.

What is a special needs trust?

Special needs trusts are usually specialized spendthrift trusts created for a beneficiary who suffers from a disability. It may include instructions about the beneficiary’s public benefits, like Supplemental Security Income or Medicaid.

What is a revocable trust?

Specifically, a revocable trust, also called a revocable living trust, is a document that can be modified by the person who creates it at any time while he or she is still alive. In order to make sure your trust is exactly what you want, it’s important to choose the right service for the right reasons.

What are the steps involved in setting up a trust?

To truly understand the steps involved in setting up a trust, you must first know the parties and their roles. Grantor. The person whose assets fund the trust. Trustee.

How to fund a trust with no title?

Open a trust fund account in the name of the trust. Fund the trust by transferring the title of the property or, in cases of personal property with no title, by describing the property in detail and noting that it is part of the trust. Register the trust with the IRS to obtain a taxpayer identification number for filing your tax returns.

How to draft a trust instrument?

The following are detailed steps for setting up and funding a trust: Decide on the type of trust you need, based on your goals. Determine which assets you are putting into the trust. Designate your trustee or trustees.

What is a living trust?

A living trust is a trust that is created while you, the grantor, are still alive. A testamentary trust, on the other hand, is a trust that is established upon your death by your last will and testament.

What is a deed of trust?

The process of drafting a trust instrument — sometimes called a deed of trust or a declaration of trust — can be done relatively quickly. When you take into account the time it takes to determine your goals and how to best achieve them, however, the timeline expands significantly.

How many steps are involved in creating a trust?

Some sources refer to the creation of a trust as a two- or three-step process. In reality, though, each of these steps can, and should, be broken down further to better illustrate the time and attention involved in the setup and management of a trust.

Who is the grantor of a trust?

Grantor. The person whose assets fund the trust. Trust ee. The person or institution that takes over ownership of the assets. Grantee. The beneficiary of the trust, to whom the assets will be distributed upon the death of the grantor. And then, of course, the assets themselves are a necessary component of a trust.

Who creates a trust agreement?

The grantor creates a trust agreement, which is a legal document that designates the grantor, the trustee, and the beneficiaries, and outlines how the trust assets are to be managed and distributed.

How much does it cost to set up a trust?

How Much It Costs to Set Up a Trust? If a lawyer sets up your trust, it will likely cost from $1,000 to $7,000, depending upon the complexity of your financial situation. For example, some situations might require a revocable trust for some assets, and an irrevocable trust for other assets.

What is a living trust?

Living trust. A trust that is set up while the grantor is alive (also known as an inter vivos trust ). Testamentary trust. A trust that is set up by the grantor's last will and testament. Revocable trust. A living trust that the grantor may change or cancel at any time. Irrevocable trust.

What is an irrevocable trust?

Irrevocable trust. A living trust that the grantor may not change or cancel. Trust agreement. The legal document that sets up a trust. It is sometimes called a Declaration of Trust; however, the title on the document may simply read "The Jones Family Trust," or something similar.

What is the second step in a trust?

The second step, called funding the trust, is for the grantor to transfer assets to the trust. A trust agreement is worthless unless the trust is funded. How this is done depends upon the nature of the property: Real estate. To transfer real estate, the grantor executes a deed that transfers the title to the property to the trust.

How to transfer real estate to a trust?

To transfer real estate, the grantor executes a deed that transfers the title to the property to the trust. Personal property with a title document. Some assets, such motor vehicles, boats, RVs, airplanes, and mobile homes (also known as modular or manufactured homes) have some type of title document, which can be transferred to the trust.

Why set up a trust?

A trust is set up to achieve certain benefits that cannot be achieved with a will. These can include: Avoiding probate. Avoiding or delaying taxes. Protecting your assets from creditors of both you and your beneficiaries. Maintaining privacy regarding your assets.

Why do people set up irrevocable trusts?

If you, the trustor (the person establishing the trust) is in a higher income tax bracket, setting up the irrevocable trust allows you to remove these assets from your net worth and move into a lower tax bracket .

What is trustee in a trust?

A trustee is a bank, attorney, or other entity set up for this purpose. 2 . Since the assets are no longer yours, you don't have to pay income tax on any money made from the assets. Also, with proper planning, the assets can be exempt from estate and gift taxes. These tax exemptions are a primary reason that some people set up an irrevocable trust.

What is a trust fund?

Trust funds are designed to allow a person's money to continue to be useful well after they pass away. You can place cash, stock, real estate, or other valuable assets in your trust. A traditional irrevocable trust will likely cost a minimum of a few thousand dollars and could cost much more.

Why do people use trust funds?

Trust funds are designed to allow a person's money to continue to be used in specific ways after they pass away, and to avoid their estate going through probate court (a time-consuming and expensive legal process).

What is a 529 college savings plan?

Similar to a 529 college-savings plan, these types of accounts are designed to place money in custodial accounts that allow a person to use the funds for education-related expenses. You could use an account like this to gift a certain amount up to the maximum gift tax or fund maximum to reduce your tax liability while setting aside funds that can only be used for education-related expenses. 3 4

Is a trust considered need based financial aid?

Eligibility for Need-Based Financial Aid. Although the trust is irrevocable, the money is not the property of the person receiving it. 1 Because of this, a child applying for financial aid would not have to claim these funds as assets. As a result, there will be no impact on eligibility for need-based financial aid.

Can you set up a trust fund if you don't want to?

If you don't want to set up a trust fund, there are other options, but non e of these leave you, the trustor, with as much control over your assets as a trust.

What to do if you don't have a trust?

If you don't have one, the bank should be able to direct you to one who specializes in the field. The trust documents should also be stored in a safe place since they will be among the most important legal documents you will possess.

Who can help you choose a revocable trust?

Whether you choose a revocable or irrevocable trust, it’s best to enlist the help of professionals. Trusts are complicated legal entities, so you’ll need to get input from an accountant, a trust attorney, a financial planner, or any other professionals necessary.

What happens to a trust after the grantor dies?

Upon the death of the grantor: The trust assets are distributed to the named beneficiaries. This type of trust has the advantage of providing access to the assets of the trust to the grantor, but it provides less protection against creditors and lawsuits. There are also no tax advantages to a revocable trust.

What is the difference between a living trust and a testamentary trust?

The difference between the two is simple: A living trust is created while the grantor is still alive, while a testamentary trust is created upon the death of the grantor. There are two basic types of trusts to consider:

What are the parties to a trust?

Parties to the trust include: 1 The grantor 2 The trustee (the bank that will hold the trust) 3 Any beneficiary of the trust

What does a trust do when you are incapacitated?

If you were to reach a state of health where you either lack the physical or mental capacity to manage your finances, a trust can provide for both of management of your estate, as well as the distribution of funds as needed .

Who pays taxes on income earned in a trust?

Taxes on income earned within the trust are paid by the trust , not the grantor. This is the type of trust that provides protection from creditors and lawsuits. However, this is the case grantor precisely because the grantor no longer has legal ownership of the assets in the trust.

LegalFuel: The Practice Resource Center of The Florida Bar

Then, check out the materials and forms on LegalFuel: The Practice Resource Center website. This webpage addresses the creation of trust accounts, management, and applicable rules:

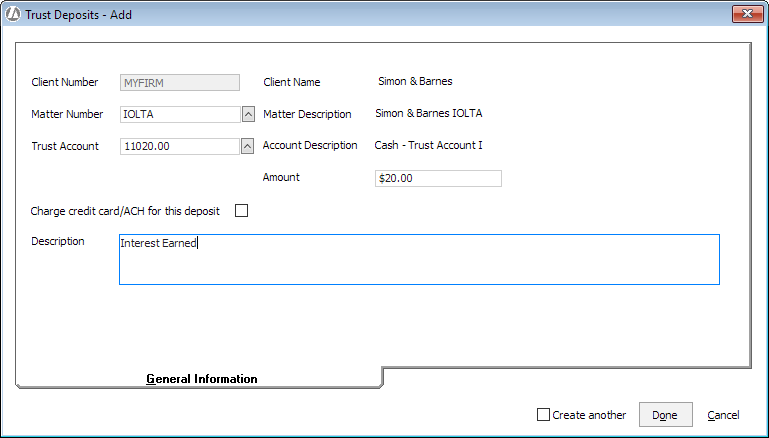

Reconcile Your Trust Account

After your Trust Account has been opened for one month, you need to make it a habit to reconcile your Trust Account. And then reconcile your Trust Account every month thereafter. Check out the Practice Resource Institute for templates, spreadsheets, and helpful information to make trust reconciliation fast and simple.

Maintain a Trustworthy Trust Account

Last, but certainly not least, check out this video about Maintaining a Trustworthy Trust Account.

Popular Posts:

- 1. what does lateral attorney mean

- 2. how to change an appeal by an attorney general

- 3. what to email a real estate attorney

- 4. what were the charges of thomas j. hilligan attorney in red bluff ca.y

- 5. power of attorney for healthcare and how it works

- 6. which attorney in the united states to gm motors and won

- 7. how to write an email to attorney

- 8. how much recent graduate attorney makes

- 9. who is a good appellate attorney in milwaukee

- 10. famous attorney whose wife was murdered