They may revoke the POA

Poa

Poa is a genus of about 500 species of grasses, native to the temperate regions of both hemispheres. Common names include meadow-grass, bluegrass, tussock, and speargrass. Poa is Greek for "fodder". Poa are members of the subfamily Pooideae of the family Poaceae.

How to change power of attorney?

In canceling your power of attorney, you should confirm that no one can use your revoked power of attorney. Notify Your Power of Attorney. Once you complete your revocation, notify your agent of the cancellation in writing. Through this notification, you should send a copy of the revocation attached to a power of attorney to your agent. Additionally, you should follow up with a formal …

What is the purpose of power of attorney?

May 05, 2021 · They may revoke the POA in two ways: Verbal revocation: As long as you are of sound mind, you can revoke someone’s POA privileges simply by telling them out loud and in front of witnesses that you no longer wish for them to retain power of attorney privileges over your property and/or affairs. It’s that simple.

What is a durable power of attorney?

Printable Power of Attorney Revocation form for dissolving a Power of Attorney Agreement. As my attorney-in-fact for the purposes and powers as set forth in the attached Exhibit "Power of Attorney". Notice is hereby given that I have revoked the above mentioned attached Power of Attorney, and all the power and authority thereby granted or ...

What is a power of attorney (POA)?

Jul 25, 2012 · To revoke power of attorney, start by checking the laws governing power of attorney in your state, since the procedure varies. In most states, the principal should prepare a revocation document saying that the power of attorney has …

How to revoke POA?

They may revoke the POA in two ways: Verbal revocation: As long as you are of sound mind, you can revoke someone’s POA privileges simply by telling them out loud and in front of witnesses that you no longer wish for them to retain power of attorney privileges over your property and/or affairs. It’s that simple.

How to revoke a power of attorney?

Revocation. The principal of a power of attorney can revoke it at any time. The only caveat is that they must be competent at the time of revocation. They may revoke the POA in two ways: 1 Verbal revocation: As long as you are of sound mind, you can revoke someone’s POA privileges simply by telling them out loud and in front of witnesses that you no longer wish for them to retain power of attorney privileges over your property and/or affairs. It’s that simple. However, depending on the circumstances, simply verbalizing this wish leaves the matter open to question and interpretation. 2 Written revocation: In order to avoid any issues, executing a written revocation identifying the POA and sending it to your agent is by far the better option. It should be signed by you in front of a notary public and delivered to the attorney-in-fact – plus any third parties with whom your agent has been in contact on your behalf (your bank, doctors, nursing facility, etc.).

What is a POA?

A signed POA appoints a person – an attorney-in-fact or agent – to act upon behalf of the person executing the POA document when he or she is unable to do so alone . There are generally four ways these privileges may be granted: Limited Power of Attorney. Gives an agent the power to act for a very limited purpose. General POA.

Why is the POA termination date not included in the POA?

Many times, the termination date is not included in the document, which makes it “durable’ or valid indefinitely. Other reasons someone might have a termination date include: if the POA is meant to cover ...

What is a springing POA?

Springing POA. One effective only in the event the principal becomes incapacitated. Due to the powerful nature of POA privileges, sometimes situations arise in which it is necessary to remove appointed individuals from this role.

What to do if someone refuses to cooperate with a court order?

If the recipient of your request refuses to cooperate, ask the court to issue an order to produce the records you seek. Subpoena any witnesses who might provide favorable testimony – bank officer, doctor, etc.

What is an agent in a fiduciary?

An agent retains legal authority over someone else’s finances and/or medical care decisions. He is also a fiduciary, held to the highest duty of care known to the law. This means he or she must act strictly in the best interests of the principal, and manage the principal’s affairs with reasonable care.

How to revoke a power of attorney?

To revoke power of attorney, start by checking the laws governing power of attorney in your state, since the procedure varies. In most states, the principal should prepare a revocation document saying that the power of attorney has been revoked, then take it to a notary to be signed.

How old do you have to be to have a springing power of attorney?

A situation for a springing power of attorney could be when the principal specifies in the power of attorney document that the agent would not have power until the principal was 75 years old, but once the principal reached that age, the agent would have the specified powers, regardless of the principal’s capacity.

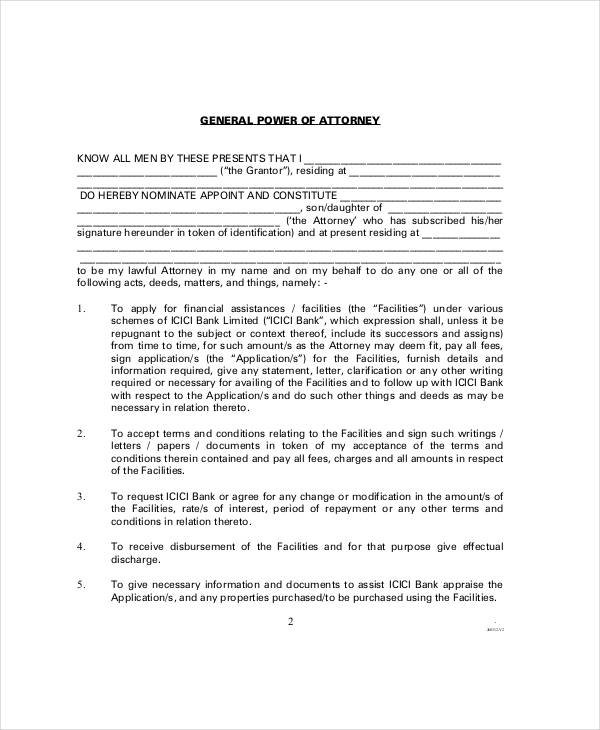

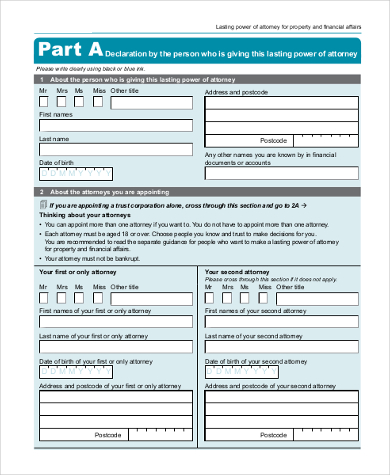

What is the name of the person who is granting power of attorney?

The form should include the full name of the “principal,” the person granting power of attorney. It should also name the "agent, " the person to whom the power is being granted. Alternate agents may also be named, in the event that the first agent is unable or unwilling to act on his or her authority.

Why do people need a durable power of attorney?

Many seriously ill people choose a durable power of attorney because they want their agent to continue to make their decisions after they can no longer communicate their wishes, and, because of their illness, want the power of attorney to go immediately into effect.

Who can revoke a POA?

Learn who can revoke power of attorney. The person for whom the document provides power of attorney is known as the principal. The principal is the only one who can revoke the power of attorney (POA) while the principal is competent.

Do you have to sign a power of attorney if it is revoked?

However, most states require a more thorough approach. Most states also require that the principal sign a revocation document stating that the power of attorney is revoked. Some states require this document to be signed in front of a notary.

Can a family take a POA to court?

If the document names the agent (this is the person receiving power of attorney for the principal) a “durable power of attorney”—meaning the power of attorney includes the principal becoming incapacitated—the family of the principal can take the agent to court to attempt to get a judge to revoke the POA.

What to do if a principal refuses to revoke power of attorney?

An attorney can also work with experts to determine the Principal’s mental competence, and serve as a reliable support in what can be a difficult experience ...

What are the different types of power of attorney?

There are two main types of power of attorney: 1 Financial POA — A financial power of attorney is the standard POA form. It gives your Agent the authority to make financial decisions on your behalf. 2 Medical POA — A healthcare or medical power of attorney grants the Agent you appoint the authority to make decisions about your care if you are unable to do so.

What to do if a power of attorney refuses to stand down?

Prepare for Court — If the Agent refuses to stand down, and a competent Principal refuses to revoke the power of attorney, you will need to go to court. Your lawyer can petition the court to set aside the power of attorney and transfer guardianship or conservatorship to someone else while the case is ongoing. ...

What is a POA form?

There are two main types of power of attorney: Financial POA — A financial power of attorney is the standard POA form. It gives your Agent the authority to make financial decisions on your behalf. Medical POA — A healthcare or medical power of attorney grants the Agent you appoint the authority to make decisions about your care if you are unable ...

What happens if an agent refuses to stand down?

In the event that the Agent refuses, the role falls to the Alternate Agent named on the document. If no Alternate Agent is named, you will need to make a court application for a guardian and/or conservator to take care of the Principal’s interests. Prepare for Court — If the Agent refuses to stand down, and a competent Principal refuses ...

What happens if an agent takes advantage of their principal?

If you believe an Agent is taking advantage of their Principal and wish to override power of attorney, you may need to challenge it in court and provide evidence that the Agent is being grossly negligent or abusive.

What are the rights of a power of attorney?

With power of attorney, your Agent can legally sign documents, make healthcare decisions, and perform financial transactions on your behalf. Your Agent is legally obligated to act in your best interest.

What can a challenger argue about a power of attorney?

A challenger can focus on the document’s creation or claim the document was revoked. In some cases, a person challenging the validity of the power of attorney can argue both. The burden in either scenario is on the person challenging the document. Perhaps the most straightforward claim is the document was not executed properly. If, for example, the law requires witnesses to watch the signing, and the required number of witnesses did not watch the signing, the document is probably void. Proving a lack of capacity, the existence of fraud or undue influence, or the document was revoked is more challenging. Witnesses who can testify as to the creator’s mental condition, or to the circumstances surrounding the document’s creation or revocation, can be invaluable, as can a letter from a physician stating the creator lacked the capacity to sign the document.

What does it mean when a power of attorney is void?

A power of attorney document signed as a result of fraud or undue influence is void. Fraud can mean the person who signed the document was misled as to what she was signing. For example, if a person was fooled into signing a power of attorney rather than some other document, the power of attorney is void.

What is undue influence?

Undue influence is a form of extreme pressure. Assume that Jane develops a close relationship with her caretaker and depends on her caretaker for her daily needs. If the caretaker influences Jane to create a power of attorney naming the caretaker as the person with the power, the document is likely void on the ground of undue influence.

What happens if you don't watch the signing?

If, for example, the law requires witnesses to watch the signing, and the required number of witnesses did not watch the signing, the document is probably void. Proving a lack of capacity, the existence of fraud or undue influence, or the document was revoked is more challenging.

What happens if a power of attorney is not signed?

Lack of Capacity. If the principal did not have the mental capacity to sign a power of attorney document, any power granted under the document is void. Mental capacity, sometimes referred to as “sound mind,” is a legal requirement that the person who creates a power of attorney have the ability to understand what she is doing.

What happens to Jane's daughter in Jane's Power of Attorney?

Jane becomes incapacitated and her daughter, Sus an, wants to void the power of attorney. If Susan can show that her mother’s medication prevented her from understanding that she was signing a power of attorney, the document is probably void. In all states, only an adult may create a power of attorney, as a minor is presumed to lack ...

Who must sign a power of attorney?

At a minimum, the person who granted the power of attorney must sign the document. In some cases, a person can sign on the creator’s behalf if the creator is unable to do so. Some states require witnesses to watch the signing of the document. Other states require only that a notary public watch the signature. ...

What is a fiduciary notice?

Use Form 56, Notice Concerning Fiduciary Relationship, to notify the IRS of the existence of a fiduciary relationship. A fiduciary (trustee, executor, administrator, receiver, or guardian) stands in the position of a taxpayer and acts as the taxpayer, not as a representative.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is Form 2848?

The individual you authorize must be eligible to practice before the IRS. Form 2848, Part II, Declaration of Representative, lists eligible designations in items (a)– (r). Your authorization of an eligible representative will also allow that individual to inspect and/or receive your confidential tax information.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

How to change last known address?

To change your last known address, use Form 8822, Change of Address, for your home address and Form 8822-B, Change of Address or Responsible Party—Business, to change your business address. Both forms are available at IRS.gov. . Authorizing someone to represent you does not relieve you of your tax obligations. .

What is the APO number for Guam?

855-214-7522. All APO and FPO addresses, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States. Internal Revenue Service. International CAF Team.

How to revoke a power of attorney?

A Power of Attorney is a legal document that grants power to an individual (the Agent) of your discretion, should you (the Principal) become incapacitated. A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document. The common reasons to revoke a Power of Attorney are: 1 The Agent is no longer interested in holding the Power of Attorney. 2 The Principal believes the Agent is not completing the requirements appropriately. 3 The Power of Attorney is no longer desired. 4 The Principal would like to change Agents. 5 The purpose has been fulfilled.

How to send a copy of a revocation to an agent?

It is best to send a copy of the revocation to the agents via certified mail. This will give proof to the principle that the form was received by the agents. If the agents are to act further on behalf of the principal it would be considered a criminal act.

Where should a revocation of a power of attorney be filed?

The revocation along with the new Power of Attorney, if applicable, should be filed in the same place the original Power of Attorney was filed (i.e., county clerk), to prevent it from not being recognized as a legal document in a court of law or other legal proceedings.

Can a principal be incapacitated?

However, a specific reason for revocation is not required. The Principal may not be incapacitated and must be of sound mind at the time of revocation. In the event the Principal is not in a competent state, the family may take measures in a court of law to complete the revocation.

Can a power of attorney be revoked?

A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document.

Can a power of attorney be revocable verbally?

Verbal revocations are not acceptable unless it was previously documented in the original Power of Attorney. Once the revocation of the Power of Attorney takes place, it will nullify the existing document and will serve as confirmation.

Who should be made aware of a Power of Attorney revocation?

Any third-parties that had copies of the previous Power of Attorney (i.e., financial institutions, healthcare or other agencies) should be made aware of immediately and a copy of the revocation should be supplied. Once all parties have been made aware, they are no longer legally able to complete business with the Agent.

Popular Posts:

- 1. according to texas’s attorney, why should the flag be protected

- 2. 911 phone call time how long for prosector attorney to get record

- 3. who won the silver city nm district attorney race

- 4. when is the next vote for wa state attorney genera

- 5. attny who was the attorney who represented the headmaster charged with child porn

- 6. how to become durable power of attorney

- 7. how can you prove medical record altering by your attorney

- 8. "when may an attorney in ny issue a subpoena duces tecum?

- 9. who does a power of attorney have to be witnessed in ny notary public

- 10. vegas attorney who became mayor