What is the probate fee in California?

Statutory probate fees under §10810 are as follows: 4% of the first $100,000 of the estate. 3% of the next $100,000. 2% of the next $800,000.Feb 14, 2020

Who pays probate attorney fees in Florida?

Under Florida law, personal representatives charge fees based on the size of the estate and are generally compensated up to 3% of the value of the probate assets up to $1 million.Jul 13, 2021

How much can an attorney charge for probate in Florida?

In Florida the fees for a Summary Administration vary but will typically range from $1,500.00 to $3,500.00 depending on the nature of the assets, creditor claims, the number of beneficiaries and any complexities associated with getting the Last Will and Testament admitted to Probate Court in Florida.Jun 5, 2021

How much does it cost to hire a probate attorney?

Lawyers usually use one of three methods to charge for probate work: by the hour, a flat fee, or a percentage of the value of the estate assets. Your lawyer may let you pick how you pay—for example, $250/hour or a $1,500 flat fee for handling a routine probate case.

Who is responsible for probate in California?

In the grand scheme of things, when it comes to the probate process, the executor or administrator is the individual responsible for generally overseeing the probate of an estate. This authority is subject to varying degrees of judicial or court oversight, depending on the type of probate procedure being pursued. If the most formal probate process on the books in California is being used (for example), there will be a good amount of judicial or court oversight. If the informal probate process is permitted, very little court oversight occurs.

What happens if you challenge a will?

If the person challenging the will loses the case, a probate court may order that person to pay the estate’s attorney fees. This is likely to occur if the probate court determines the challenge to the will to be without merit. Sometimes the court orders payment of attorney fees on its own volition. In most cases, the estate files a request or demand for payment of attorney fees when it prevails in a will challenge case.

Do you need a written agreement to represent an estate in probate?

As part of hiring an attorney to represent an estate in a probate case, a written agreement must be obtained setting forth the specific fee arrangement. In some cases, a court will need to approve the proposed fee arrangement before it goes into effect. This requirement may exist if a formal estate process is being used in a particular case.

Probate Administration Fees

A probate attorney helps many different people during probate administration, whether it be a personal representative or the beneficiary of a will. During probate administration, a probate attorney may assist in the execution of the decedent’s estate.

Who pays probate attorney fees? Talk to Bret Jones, P.A

Who pays probate attorney fees depends on a few factors. At Bret Jones, P.A., we can speak with you about any questions you have regarding who pays probate attorneys fee and more. Our probate attorneys and legal staff would be happy to answer any questions that you may have about the probate, including who pays probate attorney fees.

What is the billing method for probate?

Another popular billing method is the flat fee. An attorney who's done a lot of probates knows about how long the work takes, and charging a lump sum means the attorney doesn't have to keep careful records of how the lawyers and paralegals spend their time. Some attorneys also find that clients are more relaxed and comfortable dealing with the attorney when they know the meter isn't always running.

What are some examples of real estate fees?

Some examples include court filing fee, postage, publication of legal notices in the newspaper, property appraisals, and recording fee for real estate deeds.

Do you have to get a fee agreement for an estate attorney?

When you hire an attorney on behalf of the estate, get a fee agreement in writing. It's required by law in some states, and it's a good idea no matter where you are.

Do lawyers collect percentage of estate value?

In a few states, lawyers are authorized by law to collect a percentage of the value of the estate as their fee. They're not required to do so—you are free to negotiate an hourly rate or flat fee with them. But many prefer it because it usually pays so well in relation to the amount of work actually required.

Total Fees Charged by Estate Administration Lawyers

In our survey, more than a third of readers (34%) said that their lawyers received less than $2,500 in total for helping with estate administration. Total fees were between $2,500 and $5,000 for 20% of readers, while slightly more (23%) reported fees between $5,000 and $10,000.

How Lawyers Charge for Probate and Other Estate Administration Work

The total fees that estates paid for legal services were based on one of three types of fee arrangements charged by attorneys for probate and other estate administration work: hourly fees, flat fees, and fees based on a percentage of the estate’s value.

Free Consultation With Probate Lawyers

More than half (58%) of the probate attorneys in our national study reported that they offered free consultations. The typical time for these initial meetings was 30 minutes, though the overall average was higher (38 minutes).

Publication Costs

Amount: In for a Petition for Probate to be granted, the court must receive proof that notice of the petition has been published in a “publication of general circulation” in the county that the decedent lived in. Publication fees vary widely, from around $50 up to several hundred dollars.

Court Filing Fees

Amount: These fees are set by statute in California and include $435 to file the DE-111 Petition for Probate . Some counties also include a relatively small surcharge in addition to this amount. The same $435 amount, plus surcharge if applicable, also applies to the Petition for Final Distribution.

Executor and Attorney Fees

Amount: Executor and attorney fees typically comprise the largest portion of probate costs and are calculated as a percentage of the estate’s total assets. The percentages are calculated as follows:

Probate Referee Fees

Amount: Probate referee’s fees set by law and are 0.1% of the estate property that is appraised by the probate referee. Such property would include most non-cash assets like real estate, mutual funds, stocks, or mineral rights.

What is a House in Probate?

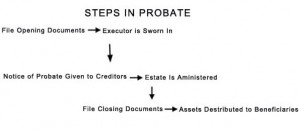

Before we can get into probate fees, it’s important to understand the probate process and what it means.

Probate Cost and Fees

When it comes to the costs and fees involved with an estate in probate, you can expect to pay between four and seven percent, though it can be more in some cases.

Probate Lawyers Fees

When you have a house in probate, that comes with certain costs and fees that need to be paid for. One of the biggest costs you need to consider is that of a probate lawyer. The good news is that the estate pays for a probate lawyer, not the executor and not the heirs.

Who Pays for Probate Fees?

When it comes to probate fees, there are many options for how the estate can pay for them. First, if there is enough cash available, the estate can simply pay for the fees upfront and consider that part of the cost of doing business.

Conclusion

If you’re looking for a solution to pay probate fees on a property and don’t have the money on hand, consider selling your house as-is to a cash buyer like Ocean City Development. We buy houses in Massachusetts and surrounding areas. We can make you a fair, no-obligation offer is as soon as 24 hours.

How does a probate attorney work?

Most probate attorneys work on retainer, which means paying the lawyer thousands of dollars upfront for their services. The attorney then works on your case and deducts money from the retainer for his or her work. At the end of the case, any money that was not spent is given back to the client.

What happens to an estate after a person dies?

After a person passes away, his or her estate goes to probate, and if that person wrote a final will and testament, the estate will be distributed in probate according to his or her wishes.

Why do people contest a will?

Some of the most common causes for contesting a will include claims of a lack of mental capacity when the will was written, undue influence, fraud, duress, or procedural issues with the way that the will was written or executed .

What happens at the end of a case?

At the end of the case, any money that was not spent is given back to the client. If the case is particularly complex or lengthy, the retainer might be completely used, and the client will be required to pay an additional retainer to continue the services of the attorney.

Popular Posts:

- 1. what type of attorney does amendement violations

- 2. how to select an estate planninng attorney

- 3. how to sign as attorney in fact for llc

- 4. how to discharge a attorney you signed paperwork with auto accident

- 5. how much an hour does a paten attorney cost

- 6. what qualities are good in an attorney general

- 7. what is the difference between attorney and counsel8

- 8. how to find out abot complaints against a district attorney

- 9. who is north carolina current attorney general when did he become gernal

- 10. 1099 misc which copy do attorney get