Form 1099 reporting is based on a calendar year. The reporting entity must issue a copy (1) to the recipient by January 31 following the calendar year-end or February 15 following the calendar year-end for gross proceeds paid to at-torneys; and (2) to the IRS on paper by the last day in February following the calendar year-end, March 31 following the calendar year-end if filing electronically, or January 31 following the calen-dar year-end if any payments for nonemployee compensation are reported in Box 7 on Form 1099-MISC. Electronic filing may be mandated, depending on several factors concerning the quantity of the reporting entity’s other required filings with the IRS.

Full Answer

Who must receive a 1099 MISC?

gross proceeds (in box 10 of Form 1099-MISC), as described earlier, to corporations that provide legal services. Taxpayer identification numbers (TINs). To report payments to an attorney on Form 1099-MISC, you must obtain the attorney's TIN. You may use Form W-9 to obtain the attorney's TIN. An attorney is required to promptly supply

Will I get money back from a 1099 MISC?

Furnish Form 1099-MISC to the claimant, reporting damages pursuant to section 6041, generally in box 3; and • Furnish Form 1099-MISC to the claimant’s attorney, reporting gross proceeds paid pursuant to section 6045(f) in box 10. For more examples and exceptions relating to payments to attorneys, see Regulations section 1.6045-5.

How to give someone a 1099 MISC?

To report payments to an attorney on Form 1099-MISC, you must obtain the attorney's TIN. You may use Form W-9 to obtain the attorney's TIN. An attorney is required to promptly supply its TIN whether it is a corporation or other entity, but the attorney is not required to certify its TIN.

What do I do with this 1099 MISC?

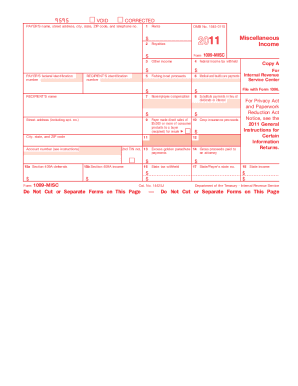

1099-MISC (Rev. January 2022) Miscellaneous Information. Copy B. For Recipient. Department of the Treasury - Internal Revenue Service. This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it

Who gets which copies of 1099-MISC?

Know the Different Copies of a 1099 Form Copy A—Goes to the IRS. Copy 1—Goes to the state tax agency. Copy 2—Goes to the recipient. Copy B—Goes to the recipient.

Does an attorney get a 1099-NEC or 1099-MISC?

Payments to attorneys. The term “attorney” includes a law firm or other provider of legal services. Attorneys' fees of $600 or more paid in the course of your trade or business are reportable in box 1 of Form 1099-NEC, under section 6041A(a)(1).Jan 31, 2022

Do you send 1099s to attorneys?

How should payments to attorneys be reported? Payments to attorneys of $600 or more will be reported on either Form 1099-MISC or Form 1099-NEC according to the following rules: Attorney fees paid in the course of your trade or business for services an attorney renders to you are reported in box 1 of Form 1099-NEC.Jan 5, 2021

Which copies of the 1099-NEC do I send to recipient?

For every Form 1099-NEC, there are two copies that will be filled out with the same information: Copy A and Copy B. If you hired an independent contractor and paid more than $600 in the year, you must report their total earnings in that year. Copy A is for the IRS while Copy B is to be sent to the contractor.Dec 9, 2021

Do lawyers get 1099 if paid by card?

here may have been a time when blue blood law firms didn't take credit cards. These days, however, most lawyers are happy to get paid via check, credit card or even cash. ... Clients issue lawyers and law firms Forms 1099 for payments of services totaling more than $600 each year.Feb 4, 2013

What happens if I use 1099-MISC instead of 1099-NEC?

What are the penalties for not reporting Form 1099 income? If you receive a Form 1099-MISC or Form 1099-NEC that reports your miscellaneous income, that information also goes to the IRS. If you don't include this and any other taxable income on your tax return, you may also be subject to a penalty.Dec 15, 2021

Do lawsuit settlements get a 1099?

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

How do I fill out a 1099-NEC for a contractor?

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees. ... Form 1099-MISC. ... Payer's name, address, and phone number. ... Payer's TIN. ... Recipient's TIN. ... Recipient's name. ... Street address. ... City, state, and ZIP.More items...•Feb 11, 2021

How do I file 1099-NEC?

Form 1099-NEC can be filed online or by mail. A version of the form is downloadable and a fillable online PDF format is available on the IRS website. You can complete the form using IRS Free File or a tax filing software.Nov 12, 2021

Do I send a copy of 1099 to state?

Some states require you to send them a copy of the 1099 forms you filed with the IRS. Other states don't require you to send a copy because they participate in the Combined Federal/State Filing Program (CF/SF). ... Through the CF/SF Program, the IRS electronically forwards 1099 forms to participating states.Feb 13, 2022

Do I need to send a 1099-NEC to my accountant?

If Your Accounting Firm is Organized as a Partnership, the IRS Requires 1099s for Fees Paid. The IRS requires businesses, self-employed individuals, and not-for-profit organizations to issue Form 1099-MISC for professional service fees of $600 or more paid to accountants who are not corporations.

Do I need to file both 1099-MISC and 1099-NEC?

Depending on who you paid during the year, you may be required to file both Form 1099-MISC and Form 1099-NEC. If you pay an independent contractor nonemployee compensation and also make payments to other workers, separate nonemployee compensation payments from all of your other Form 1099-MISC payments.Jan 19, 2021

What does it mean to have an X in your TIN?

You may enter an “X” in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN. If you mark this box, the IRS will not send you any further notices about this account.

Who is Z Builders?

Z Builders is a contractor that subcontracts drywall work to Ronald Green, a sole proprietor who does business as Y Drywall. During the year, Z Builders pays Mr. Green $5,500. Z Builders

Do I need to report 1099-NEC?

Some payments do not have to be reported on Form 1099-NEC, although they may be taxable to the recipient. Payments for which a Form 1099-NEC is not required include all of the following.

What is excess golden parachute?

Enter any excess golden parachute payments. An excess parachute payment is the amount over the base amount (the average annual compensation for services includible in the individual's gross income over the most recent 5 tax years).

Do I need an account number for 1099?

The account number is required if you have multiple accounts for a recipient for whom you are filing more than one Form 1099-NEC. See part L in the 2021 General Instructions for Certain Information Returns.

What is the form 8596-A?

CAUTIONand Form 8596-A, Quarterly Transmittal of Information Returns for Federal Contracts, if a contracted amount for personal services is more than $25,000. See Rev. Rul. 2003-66, which is on page 1115 of Internal Revenue

What is a caution box?

CAUTIONbox alerts IRS scanning equipment to ignore the form and proceed to the next one. Your correction will not be entered into IRS records if you check the VOID box.

What is a 1099-MISC?

Check the box if you are a U.S. payer that is reporting on Form (s) 1099 (including reporting payments on this Form 1099-MISC) as part of satisfying your requirement to report with respect to a U.S. account for the purposes of chapter 4 of the Internal Revenue Code, as described in Regulations section 1.1471-4 (d) (2) (iii) (A). In addition, check the box if you are a foreign financial institution (FFI) reporting payments to a U.S. account pursuant to an election described in Regulations section 1.1471-4 (d) (5) (i) (A). Finally, check the box if you are an FFI making the election described in Regulations section 1.1471-4 (d) (5) (i) (A) and are reporting a U.S. account for chapter 4 purposes to which you made no payments during the year that are reportable on any applicable Form 1099 (or are reporting a U.S. account to which you made payments during the year that do not reach the applicable reporting threshold for any applicable Form 1099).

When to report 1099-MISC?

. Trade or business reporting only. Report on Form 1099-MISC only when payments are made in the course of your trade or business.

Do you report attorney fees on 1099?

Are not reportable by you in box 1 of Form 1099-NEC. Generally, you are not required to report the claimant's attorney's fees. For example, an insurance company pays a claimant's attorney $100,000 to settle a claim. The insurance company reports the payment as gross proceeds of $100,000 in box 10.

What does it mean to have an X in your TIN?

You may enter an "X" in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN . If you mark this box, the IRS will not send you any further notices about this account.

Do you report death benefits on 1099-MISC?

Death benefits from nonqualified deferred compensation plans or section 457 plans paid to the estate or beneficiary of a deceased employee are reportable on Form 1099-MISC. Do not report these death benefits on Form 1099-R. However, if the benefits are from a qualified plan, report them on Form 1099-R.

When will the IRS issue tax tip 2020-80?

On July 6, 2020 , the IRS issued Tax Tip 2020-80 to remind business taxpayers that, commencing with payments made in 2020, they must report any payments of over $600 per year for services by non-employees on Form 1099-NEC (for Non-Employee Compensation), a form last used by the IRS in 1982. Box 7 of the pre-2020 Form. More.

Is 1099 C discharged?

The court says “discharge” is not “actual discharge.” While acknowledging that a common consumer may not easily understand the distinction, the court held that “discharge” for IRS reporting purposes is not necessarily “actual discharge” of the obligation.

Popular Posts:

- 1. how can an oklahoma doc inmate pay their attorney from their account

- 2. in civil law what if the plaintiff cannot afford an attorney?

- 3. who are the past bryan county ok district attorney

- 4. how long to keep power of attorney documents after death

- 5. how to word limitations on health card decisions on a power of attorney

- 6. how to find if an attorney is licensed

- 7. where to record a power of attorney in maricopa county az

- 8. which agent usually has the power of attorney fl real esate

- 9. how long should it take your attorney to file a motion for court

- 10. how to find an advocate attorney