What is QuickBooks for lawyers?

QuickBooks simplifies legal billing and accounting for lawyers. Track billable hours, record expenses, bill clients, send reports, and more. Access everything 24/7, from your office, your car, or the courthouse. Free 30-day trial.

Is there a free trial of QuickBooks?

Sep 05, 2017 · QuickBooks provides a wide range of accounting features that work for solo lawyers or medium-sized firms, alike. In order to do this, Intuit offers multiple pricing plans. Not all plans include the above features. Security Client information security is a real concern for lawyers.

Which accounting software is best for a small law firm?

Sep 02, 2021 · When you team QuickBooks Online up with Clio Manage, you can keep client and financial data in sync. At the same time, you can reduce time spent on bookkeeping and reactive time tracking. Using QuickBooks Online with Clio Manage empowers lawyers to save time, maintain more accurate financial data, and focus on ensuring the client is cared for.

Is Clio manage QuickBooks good for lawyers?

Jun 15, 2021 · Broadly speaking, QuickBooks Online is a good fit for law firms that: Are Solo or Very Small Practices Have Very Simple Accounting Needs Prefer Accounting in a Web Browser QuickBooks Professional QuickBooks Professional (sometimes also referred to as QuickBooks Desktop) is the traditional, desktop-installed version of QuickBooks.

How much is QuickBooks Online for personal use?

QuickBooks OnlineNamePriceSimple Start$25/month.Essentials$50/month.Plus$80/month.Advanced$180/month.Jan 21, 2022

Does LawPay integration with QuickBooks?

You can include your LawPay payment page link on your QuickBooks Online invoices so your clients can pay in one easy click.Apr 20, 2020

What is like QuickBooks but for personal use?

Some of the most popular alternatives to QuickBooks include Xero, FreshBooks, Sage, Zoho, and Wave.

Is QuickBooks good for personal use?

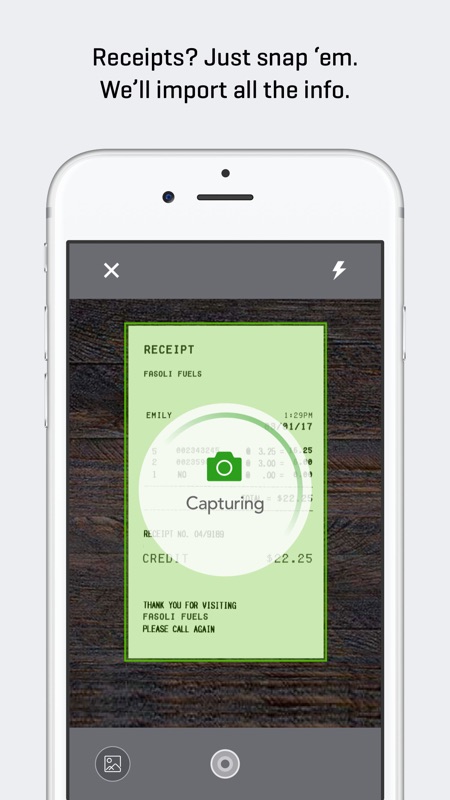

QuickBooks Home Accounting and Personal Finance software is among the top home accounting software options as it is user-friendly, cost-effective, helps you track expenses, manage bills, prepare budgets, scan receipts all in one place.Sep 25, 2020

How do I add venmo to QuickBooks?

Open your QBO account, then click on Banking at the left pane. Go to the Banking page, then click on Connect account or Link account (if you have existing bank connected). Search and select Venmo. Input the login credentials, then follow the onscreen pop-ups to complete the process.Apr 18, 2021

How does LawPay work?

LawPay gives you numerous ways to collect client payments. Send clients a link to enter their own card information, email clients a bill for a specific payment amount, or schedule payments in advance to make getting paid faster and easier than ever.

Can I use QuickBooks online for business and personal?

Hello there, walshpr1. We don't recommend combining personal and business transactions. The reason why we have to separate them is because of tax purposes, including writing off business expenses. However, if you only want a subscription for both personal and business finances.Mar 11, 2020

What is replacing QuickBooks online?

Here are the top alternatives to QuickBooks Online as an accounting software:Best for tech novices: FreshBooks.Best for tight budgets: Wave Accounting.Best for growing businesses: Sage 50cloud Accounting.Best for fast onboarding: Sage Business Cloud Accounting.Best for desktop users: AccountEdge Pro.More items...•Jan 24, 2021

How do I set up QuickBooks for personal use?

6:077:55Using QuickBooks for your Personal Finances - YouTubeYouTubeStart of suggested clipEnd of suggested clipIt's important to find that balance. So you want to put it in detail here when you're creating theseMoreIt's important to find that balance. So you want to put it in detail here when you're creating these accounts but not too much because remember within each account I might have multiple payees.

Is Mint the same as QuickBooks?

Mint is a Personal Finance and Budgeting application that is used by individuals worldwide to manage their income and savings. Quickbooks is a full-fledged Accounting and Bookkeeping software used by individual business owners and companies of all sizes to manage their business accounts and finances.Nov 12, 2021

Do Quicken and QuickBooks work together?

Although Quicken files can't be opened natively in QuickBooks, you can use QuickBooks' built-in tools to convert Quicken files for use in QuickBooks. You can also take advantage of a dedicated piece of software called Quicken Converter to make Quicken files compatible with QuickBooks.

What is Mint app?

Mint is a popular free online personal finance application from Intuit that offers a variety of easy-to-use financial planning and tracking tools. The online app is complemented by the free Mint mobile apps for iPad, iPhone, Android, and Windows mobile devices.

What is QuickBooks for law firms?

QuickBooks is industry-neutral accounting software, which means it can be (and is) used by many different industries, including law firms.

What do law firms need?

However, law firms have unique needs when it comes to accounting. Most law firms need: General / Business Accounting. Trust / IOLTA Accounting. Cash Basis (vs. Accrual)

Is QuickBooks Online web based?

QuickBooks Online (Web-based) Your third option is to simply use of the editions of QuickBooks Online, which is web-based and lightweight. This involves simply signing up for a QuickBooks Online account (pricing information is below), and creating logins for each person in your firm that needs it.

Does QuickBooks have time tracking?

Track billable hours and related expenses for a particular client or matter. However, time tracking is very limited, and best managed in dedicated Law Practice Management software.

Is QuickBooks Online good for law firms?

Broadly speaking, QuickBooks Online is a good fit for law firms that:

Ramp up your productivity

Streamline your workflows and increase your productivity with tools built for legal firms.

Track your profitability at a glance

Advanced gives you robust tools to quickly and easily monitor your business so you can make adjustments to improve profitability.

Keep your information secure

The most flexible user permissions of any QuickBooks Online plan gives you greater control of your data.

Advanced helps Brown Immigration Law keep growing

Brown Immigration Law switched to Advanced not only for its ease of use and ability to process thousands of monthly invoices at once, but for the data and insights it offers to help its business grow.

What is Quickbooks legal?

QuickBooks legal allows you to generate financial statements and share them with partners. Get information about your law firm’s cash flow, profit and loss, and more. Combined with Smokeball law firm insights reporting, you can have a complete picture of your firm’s financial health.

Is Quickbooks legal software good?

QuickBooks legal is a good choice for your legal billing software needs because it will grow with your law firm. QuickBooks for lawyers, when integrated with Smokeball, will remain easy to use no matter how small or large your law firm becomes. This scalable accounting solution for lawyers will allow you to keep the same system as you grow ...

Does Smokeball work with QuickBooks?

Smokeball with QuickBooks for attorney integration keeps your data secure while still giving you full access to client and case information from anywhere. Since your data is stored in the cloud, you won’t lose data if your computer drive becomes corrupted and you can review data even from your mobile phone.

Is Smokeball a good time tracking software?

The standa lone out-the-box version of QuickBooks doesn’t do a good job of tracking time for lawyers. This is why Smokeball’s automatic lawyer time tracking software combined with QuickBooks for law firms is a better solution. Using QuickBooks for lawyers you can easily track the time of each associate according to which matter they worked on.

Is QuickBooks a good accounting software?

QuickBooks is a powerful accounting software program that can help law firms wrangle their billing issues, but because QuickBooks out-the-box isn’t an accounting solution specifically tailored to law firms, many lawyers believe that QuickBooks isn’t a good solution for their legal billing software needs. Fortunately, case management software like ...

What is the main liability account in QuickBooks?

The main liability account for the law firm will be the client trust liability account, which should correspond to the trust account and to the retainer service item (discussed later). Depending on the method of trust accounting chosen for QuickBooks, you may also need to set up separate liability accounts for each client.

What is equity in QuickBooks?

The default equity accounts in QuickBooks include the opening balance equity account (which should be used as a clearing account), retained earnings, an owner's contribution account for each owner, and an owner’s distribution account for each owner. Equity accounts should be set up with your CPA and based on how they are tracking equity on the tax returns.

How to add a new client to a law firm?

To set up a new client, go to the Customer center and add a new customer. Law firms often have the potential to handle multiple matters for clients. Therefore, it may be good practice to set up “jobs” under each customer for each separate case per client. To add a new job/case for a client, in the customer center, right click on the client’s name and hit “Add Job.” When you create invoices and receive payments for clients, make sure it’s created and received to the appropriate job. If you decide not to use jobs, keeping track of multiple cases per client will be more difficult.

What are service items in QuickBooks?

Service items serve two main purposes within QuickBooks – they create the line items you will use to invoice clients, and they create items that employees can use to track and enter their time within QuickBooks. Creating specific service items within QuickBooks will streamline your invoicing process, especially for flat fee services. The easiest way to create your service items is to break down the practice into its main areas. Take a look at the second list of service items. The main service items include commercial, conference, estate planning, litigation, probate, and tax matters because those are the firm’s main areas of practice. Underneath those services, they create sub-services to provide more detail on their invoices to clients. They were also able to associate a price per hour with each item or a flat fee for the service. Additionally, they created items for common costs, for retainers, subtotal, and common discount items.

How to add a new employee to QuickBooks?

To set up a new employee, go to the Employee center and add a new employee. QuickBooks allows you to add a lot of detail concerning the employees. If you’re planning on processing payroll through the QuickBooks software, it will be important to input all the information. If you’re not planning on processing payroll through QuickBooks, the basic information you want stored, such as name and hire date, is all that is necessary. You will only be using this as a field in time tracking and in the payee transaction field in the bank account.

Do fixed assets need to be set up with CPA?

Fixed Assets should be set up in conjunction with your CPA and how they are tracking assets on the tax returns.

How to track time in QuickBooks?

There are two ways to track time within QuickBooks – the single time activity or the weekly time sheet. The single activity only allows the entry of one matter or block of time. It includes a timer feature with a “start,” “stop,” and “pause,” which could be useful in tracking billable time. However, if you want all the staff to use the timer within the single activity entry, each staff member would need to have QuickBooks open at the same time, which requires multiple QuickBooks licenses, which can get expensive, even for small firms. Third party applications may provide similar timer features with less cost burden. QuickBooks Online does not have this timer feature; however, it does have the single activity time keeper option as well as a weekly time sheet option.

What is LeanLaw Law?

LeanLaw is a technology company that helps solo lawyers and small law firms leverage technology to achieve Lean Practice, which we define as overhead of 20% of revenue or less.

Can you track expenses in QuickBooks?

Tracking expense in QuickBooks doesn’t connect to client matters. Expenses are tricky especially with trust accounting as it relates to contingency. QuickBooks has the ability to record expenses, but lacks the context relative to client matters.

Can you see what is being billed in QuickBooks?

In QuickBooks, you can see what has been billed, but you don’t see what is yet to be billed (work-in-progress) nor do you easily see by attorney revenue reports, by timekeeper reports, or by origination reports.

Is there an invoicing workflow in QuickBooks Online?

There is an invoicing workflow in QuickBooks Online, it just isn’t customized for attorneys, so it’s cumbersome and requires a lot of manual workarounds. For example, QuickBooks Online can’t be set up so a principal attorney has to approve all of his or her invoices before they are sent.

What is a general retainer in QuickBooks?

In your QuickBooks chart of accounts, a General Retainer represents monies paid by a client for a service that has not yet been rendered but that is allowed by state regulations and the Client Retainer Agreement and you intend to deposit them in your Operating Bank Account. It is critical to check with the Bar Association in your state to see if they allow General Retainers. If so, you can setup a double sided service item (see below). Every item will now point to a Suspense general Retainer account for both income as well as expense. Typically it is not necessary to have more than one General Retainer account and not likely a good idea.

What is reimbursed client cost?

Reimbursed Client Costs are expenses to be billed to a client but that are paid from the Firm Operating Bank Account. You will need to setup a double sided service item for each expense that is provided by your law firm and paid by your law firm. Each item should point to Reimbursed Client Costs for both income as well as expense. We recommend you set up separate Reimbursed Client Cost items for any items to be billed to a client at a different rate than is to be paid to a vendor. Using these items will help you accurately bill clients if you are billing within your QuickBooks. We do not recommend using multiple Advanced Client Cost accounts and it is certainly not necessary.

Can you track a soft cost in QuickBooks?

QuickBooks currently does not have the ability to track as well as charge clients for any Soft Costs incurred. A soft cost is a cost you need to charge a client for, however you do not actually write them a check for the cost. This might include something like photo copies for faxes. We recommend you setup a single sided service item for every soft cost. The service item should point to an expense account being used for the cost, i.e. lease for copier expense. If you point it to the expense account, using the item reduces total expense.

How to set up a trust account in QuickBooks?

Start the QuickBooks trust accounting process In QuickBooks Online by setting up a trust account by either adding or modifying your trust bank account. The chart of accounts is found under “Accounting” on the black menu bar along the left side of the screen. To set up a new trust bank account, go into your chart of accounts and click on the green “new” button in the upper right of the screen. Set the account type to be “bank,” and the detail type to “trust account.” You can name the account “Trust Account” or “IOLTA Account.”

How to create a client ledger in Clio?

A firm’s client ledger report can be created in Clio. On the black menu bar on the left of your screen, click on “Reports,” then go to the section Client Reports . The report that will show the client’s detailed activities of their trust funds, it is called the Trust Ledger. There is also a report that will show just the client’s balance of their trust funds called the Trust Listing.

How to keep a trust account?

According to The ABA Model Rules of Professional Conduct Rule 1.15: Safekeeping Property, there are 3 requirements for trust accounts that most lawyers have to deal with: 1 You need to keep your trust account separate from your own property 2 Your trust account needs to be in the same state as your legal office (whether you work from a physical or remote office) 3 You need to keep complete records of your trust account funds for about 5 years (or as long as 10 years)

What is matter dashboard in Clio?

The matter dashboard in Clio gives you an instant overview of the financials, like work in process, outstanding balance, and matter trust funds. In QuickBooks Online, it would take three different reports to see these amounts.

What is client ledger?

A client ledger will tell you how much money belongs to a client, how much money you’ve paid out on behalf of that client, and how much money you have left in the trust account for the client. For example, if you have 10 clients with trust funds, you need to maintain 10 separate client ledgers.

Does Clio include trust balance?

Clio has another trust accounting feature that is frequently required by state bar associations: Including a client’s trust balance on their invoice. In Clio, choose a bill theme that automatically includes the current trust balance that you want on the invoice. QuickBooks Online does not offer this option on an invoice.

What is a three way reconciliation?

A three-way reconciliation is the process by which a firm validates the bank statement agrees with the QuickBooks Online trust bank account balance, and the QuickBooks Online trust bank account balance agrees with the trust liability account and the trust liability account agrees with Clio’s trust ledger report.

Popular Posts:

- 1. how do i appeal dhs and attorney general in texas

- 2. who is the district attorney connected to

- 3. why does each new york city borough have a district attorney

- 4. how much does a domestic violence attorney cost

- 5. what is a commercial power of attorney in pennsylvania

- 6. how is el chapo paying for attorney

- 7. how to file non.performsnce lawsuit against attorney

- 8. how to add someone to power of attorney

- 9. how to afford private attorney for dui

- 10. who pays power of attorney to consult lawyer