- 1) Choose the right person(s). ...

- 2) Talk to an attorney. ...

- 3) Choose what kind of power of attorney is best suited to your needs. ...

- 4) Decide on the details. ...

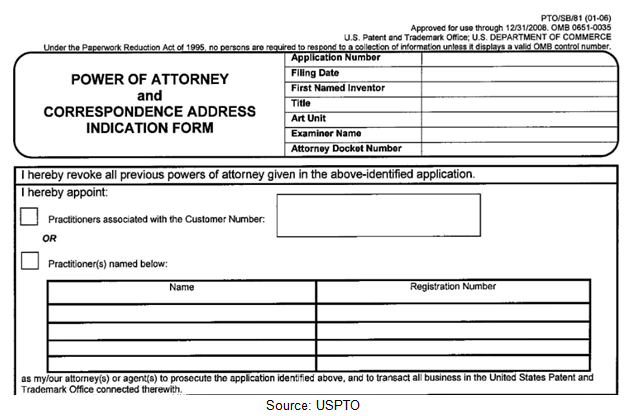

- 5) Fill out the power of attorney form. ...

- 6) Sign your power of attorney form in front of a notary or witness.

How do I give someone power of attorney?

Sep 04, 2020 · Many people sign a financial power of attorney, known as a durable power of attorney, to give a friend or family member the power to conduct financial transactions for them if they become incapacitated. People also commonly sign health care powers of attorney to give someone else the authority to make medical decisions if they are unable to do so.

Can I add another person to my mother's power of attorney?

Dec 14, 2018 · To give someone power of attorney, you simply complete a power of attorney form. Depending on your state's laws, you may have to record the document with the state or file it with a court. You must be legally competent to execute an enforceable power of attorney.

Can a person with power of attorney make decisions for You?

Power of attorney allows a third party, known as the attorney-in-fact or the agent, to make financial, legal and sometimes health decisions on someone's behalf. Without a power of attorney, loved ...

Can you give more than one power of attorney?

Jul 18, 2021 · Power of Attorney must be authorized with your signature. Here’s how to do it: Authorize in your online account - Certain tax professionals can submit a Power of Attorney authorization request to your online account. There you can review, electronically sign and manage authorizations.

How to give someone a power of attorney?

To give someone power of attorney, you simply complete a power of attorney form. Depending on your state's laws, you may have to record the document with the state or file it with a court. You must be legally competent to execute an enforceable power of attorney.

Why is a power of attorney necessary?

It might be necessary if you’re concerned that you won’t be able to handle your own affairs at some point. Your agent or attorney-in-fact – the individual to whom you’re giving power of attorney – is obligated by law to protect you, your assets and your money.

Can a financial power of attorney be durable?

A financial power of attorney can be either “durable” or “springing.”. If you give your agent durable power of attorney, it means she can act for you currently and later, after you become incapacitated. A springing power of attorney doesn’t give her the right to act for you unless or until you become incapacitated or some other designated event ...

Do you have to sign a POA before a notary?

If you want the power of attorney to be durable, you must make it clear that any potential incapacitation doesn’t revoke the document. You and your agent must sign the POA, and most states require that you both sign before a notar y.

Can a power of attorney be revoked?

Certain events can revoke a power of attorney, even if you don’t intend for it to happen, so you might think you have a valid POA in place when, in fact, you don’t. In many states, divorce voids your POA if you’ve named your spouse as your agent. Even a legal separation may end your spouse’s rights to act on your behalf.

Can a power of attorney be used for medical decisions?

You can create a financial power of attorney to deal with your personal business, or a health care POA so your agent can make medical decisions on your behalf in an emergency. An agent with a power of attorney for health care can only instruct physicians to follow the decisions you’ve laid out in the document.

How to set up a power of attorney?

To get started, follow these basic guidelines for designating power of attorney: 1 How to set up power of attorney. 2 Consider durable power of attorney. 3 Limited vs. general power of attorney. 4 Immediately effective vs. springing power of attorney. 5 Power of attorney for health care.

What is a power of attorney?

Power of attorney is a written legal document that allows an agent or attorney-in-fact to take financial and legal actions for you.

When does a power of attorney go into effect?

A springing power of attorney goes into effect in a predetermined situation, such as after the principal becomes incapacitated. Typically, the legal document will specify the circumstances under which the power takes effect. An immediately effective or nonspringing power of attorney is in place once the paperwork is signed.

What happens to a durable power of attorney?

That's where durable power of attorney comes in. A durable power of attorney continues after the individual is incapacitated. So if you are unable to make financial or medical decisions on your own after an accident or illness, the document will remain in effect.

Can a power of attorney be used as a proxy?

Generally, power of attorney applies to legal and financial matters, but a separate document can also allow a proxy to make health care decisions for you if you are incapacitated. The rules for designating power of attorney vary from state to state, so it's important to know your own state's laws. Here's what to know about power ...

What are the two forms of power of attorney?

There are two primary forms of power of attorney: medical and financial. For example, you might want to grant someone a medical power of attorney to make medical decisions for you when you become incapacitated. Also, you might want grant someone the power to manage your finances.

What happens if you don't have a durable power of attorney?

If the power of attorney is not “durable,” then it ceases to be effective upon your incapacitation.

Can a power of attorney be witnessed?

You should make sure that your agent understands exactly what is included in the power of attorney as well. Once you have completed the document, you might want to sit down with your agent and go over the form together. Make sure to sign in front of your witnesses. It will not be legal if not witnessed.

Do you need a power of attorney notarized?

Several states require that power of attorney forms be notarized. If you are signing a medical power of attorney form in Missouri, North Carolina, South Carolina, or West Virginia, then you need it notarized.

What is a health care provider?

a health care provider. anyone who is a spouse, employee, or the spouse of an employee of your health care provider. someone who works for a government agency that has financial responsibility for your care. a court-appointed guardian or conservator. someone who is already an agent for 10 or more people.

Can you grant access to medical records?

You can also grant access to medical records: “To have access to medical information and records to the same extent that I would be entitled to, including the right to disclose health information to others.”. Review the ABA’s sample power of attorney form for other common powers given to agents. ...

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

What is an oral disclosure?

Oral Disclosure. If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

What is a power of attorney?

First off, power of attorney is a legal designation that gives an individual (or individuals) the authority to act on behalf of someone else, typically when that third party is unable to make decisions for themselves for reasons of ill health.

What are the three levels of understanding?

Camargo outlines three levels of understanding he thinks are crucial: 1 Parents must understand the great power they are bestowing 2 The sibling who has been named must understand the range of responsibilities they now have 3 The siblings who have not been named must and respect the arrangement, while, as Camargo puts it, “being cognizant of the potential for mismanagement of affairs”

Is a power of attorney a fiduciary duty?

It’s important to remember that the power of attorney is a fiduciary obligation, meaning the person who holds it must act in the best interests of the parent, not their own, and abide by certain rules that ensure this. Still, things can get dicey if there isn’t proper trust among siblings, ...

What is an enduring power of attorney?

This is called an enduring power of attorney. The authority of an attorney ends if the attorney becomes incapable or dies. An adult who has made an enduring power of attorney can change it, but not if they are "incapable of understanding the nature and consequences of doing so.".

What is a representation agreement?

A representation agreement is another type of legal document that enables an adult to authorize someone to make decisions for them when they can no longer manage on their own. The representative can make decisions relating to health care and personal care matters.

What is Bloom Group?

In Vancouver, the Bloom Group is an agency that provides this service for incapable people, including homeless individuals. The federal government has more information. They also explain when a form of pension trusteeship is available for a veteran’s pension.

Does the public guardian charge a fee?

The Public Guardian does charge a fee for its services. They should be contacted for more information.

What is it called when an adult is mentally incapable of managing their own affairs?

A committeeship . If an adult is mentally incapable of managing their own affairs, someone can be appointed to manage the adult's affairs on their behalf. This is referred to as committeeship. A committee must apply to court to be appointed under this law. Dial-A-Law has more on committeeship.

Can an older adult be a trustee of a pension?

If an older adult's financial situation is not complicated (for example, there are no significant assets and their only income is federal pension monies), a pension trusteeship with the income security programs in Ottawa could be sufficient. This option is more formally known as a third-party administrator of pension funds.

What is a power of attorney?

A power of attorney gives someone you trust the power to make decisions for you if you’re not able to make them. On the form to apply, you’re known as the ‘donor’. The person you’ve chosen to act for you is called your ‘attorney’.

What is an example of an attorney acting independently?

Typically, you choose certain decisions that all attorneys must agree on. For example, buying or selling property, or managing investments. For anything else, you let them act independently.

What does "jointly and severally" mean?

In a lasting power of attorney, ‘jointly and severally’ means that your attorneys can make decisions together or act by themselves if they need to. So, one or two attorneys could potentially take care of everything, with the others able to check what they’re doing and chip in every now and again. Or they can do everything together.

Why do you need a power of attorney?

Doing so allows them to handle real estate matters on your behalf. Creating a power of attorney provides valuable peace of mind. It can also help ensure your loved ones have an easier time handling your financial affairs if they need to do so.

How to create a POA?

1. Determine who should serve as your agent. When you create a POA, you name at least one agent who can act on your behalf under the document's authority. If you draft it for estate planning purposes, they will likely have broad authority to do almost anything you could do from a financial standpoint.

What is POA in estate planning?

It is a common tool used for estate planning, although its uses are not limited to the estate planning context. When creating this type of legal documentation, you are considered the principal, and the person you grant powers to is called your agent (or attorney-in-fact). To be valid, your POA must meet your state's legal requirements, ...

Popular Posts:

- 1. to which triumphant does the attorney geneneral lie

- 2. when do you file a motion for attorney fees

- 3. who has authority of ther is no medical power of attorney

- 4. who played sharon lawrence's assist distric attorney in nypd

- 5. originally, one's right to an attorney was only provided in what kind of case? quizlet

- 6. how do you get power of attorney immediately in pa

- 7. colorado power of attorney where to send tax

- 8. how long to wait for attorney to call back

- 9. when do you need a substitution of attorney

- 10. what is the difference between a durable power of attorney and a medical power of attorney