What is the difference between IRS Form 8821 and 2848?

Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.Jan 25, 2021

Does the IRS require a power of attorney?

For the most part, taxpayers need an IRS Power of Attorney under two circumstances: If you want someone else to represent you during a meeting with the IRS and handle the tax situation on your behalf. If you want someone else to prepare a written response to the IRS, or fill out documents on your behalf.

What is IRS individual POA?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

What is a third party authorization with the IRS?

The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. There are different types of third party authorizations: Power of Attorney - Allow someone to represent you in tax matters before the IRS.Jul 18, 2021

How long does it take IRS to process power of attorney?

To reduce processing time, the IRS added resources from multiple sites other than the three CAF units to assist in processing. During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

How do I submit power of attorney to IRS?

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.Jan 24, 2022

Can I call the IRS on behalf of someone else?

If you're calling for someone else, you'll need the person there with you to speak with the IRS. Or, he or she can authorize you to make the call with Form 8821.

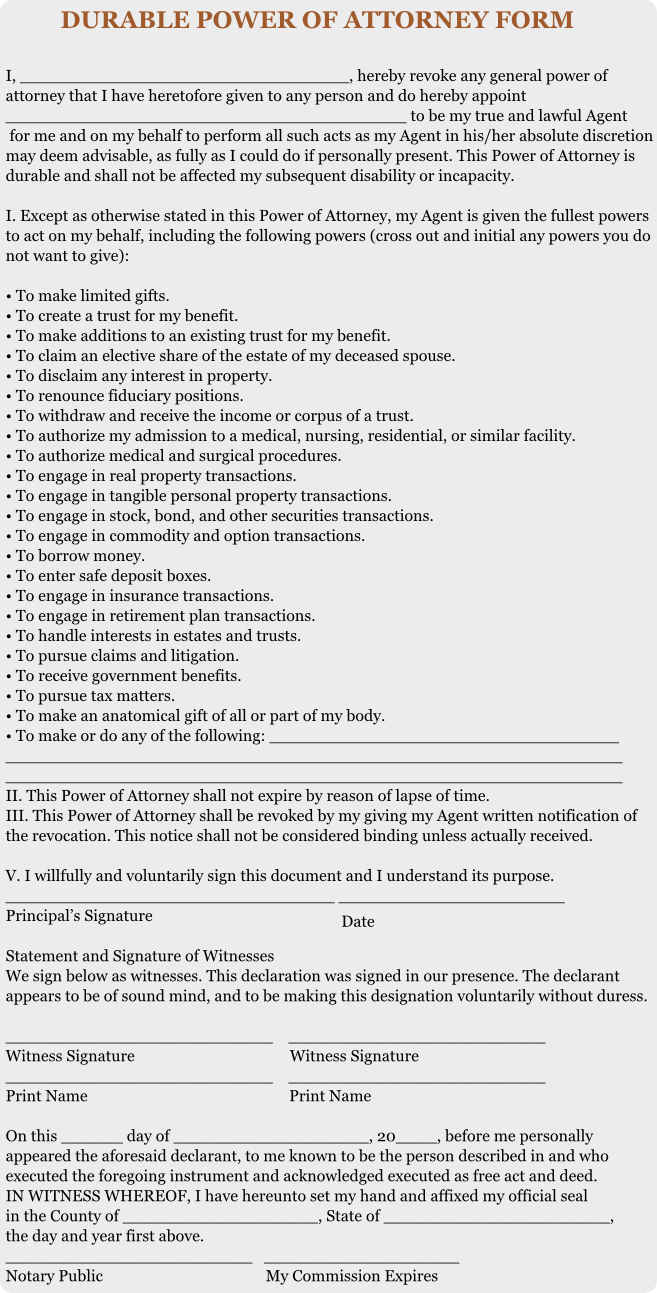

Does the IRS accept durable power of attorney?

The IRS will accept a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. But, the authorized agent will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.Jan 19, 2016

How do I get an IRS CAF number?

Centralized Authorization File Number You can get a CAF number by submitting Form 2848 or 8821 and writing “None” in the space designated for the CAF number. The IRS will send you a CAF number within a few weeks.

Will allow someone else to discuss this return with the IRS?

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person ...Jan 24, 2022

Who can talk to IRS on my behalf?

You can let the IRS discuss your tax return information with a third party, like a friend or family member. You do this by marking the Third Party Designee checkbox of your return. This lets the IRS discuss your return with the person you designate, even if they're not a tax professional.

Who can be a third party designee on tax return?

Myth 4: “Only the paid preparer can act as the designee.” However, the form instructions have caused confusion about firm designees. According to Form 1040 instructions, “your preparer, a friend, a family member, or any other person you choose” can serve as a third-party designee for the tax year and tax return.Mar 11, 2014

What is a 2848 form?

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter (s) and tax year (s)/period (s) specified on the Form 2848.

What is CAF in tax?

The CAF allows IRS personnel who don't have access to the original power of attorney to determine whether you've authorized an individual to represent you. Joint filers must submit separate Forms 2848 to have the power of attorney recorded on the CAF.

What is a power of attorney?

Power of attorney gives them the most power, they can act on your behalf for tax matters. You can limit their power by just authorizing them access to your confidential tax information by filling out and filing the tax information authorization form.

What line do you check if you have a power of attorney?

Check the box listed on Line 4 if the IRS power of attorney is for a use that will not be named on the CAF. An IRS power of attorney will not be recorded if it does not relate to a specific period.

What is the second part of a power of attorney?

The second part of the IRS power of attorney is where your representative signs and dates, while also entering his designation – such as attorney, certified public accountant, enrolled agent, officer, family member, etc.

Who can represent you before the IRS?

Below is a list of individuals that can legally represent you before the IRS. Attorneys. CPAs. Enrolled agents. Lawyers. Enrolled retirement plan agents. Enrolled actuaries.

What is Form 2848?

IRS Form 2848 is used to file for IRS power of attorney. This form is used by the taxpayer to authorize an individual to represent them before the IRS. Although the process of filing for IRS power of attorney is rather simple, the steps that you take when completing Form 2848 are very important.

What does Form 2848 do?

Form 2848 gives the Internal Revenue Service confirmation that you have asked a tax professional to represent you. It also tells the IRS what tax matters you have asked for help with.

How do you fill out Form 2848?

Form 2848 asks for basic information such as your name and tax identification number. It also lists the specific acts you’re authorizing the representative to take on your behalf. The IRS website has instruction for Form 2848 here.

Can you use a different power of attorney form?

The IRS allows substitute power of attorney forms with strict requirements. A general power of attorney is not enough.

How to End a Power of Attorney

If your original power of attorney is limited in scope and time, it will automatically terminate once the stated purpose is completed. If you wish to change tax professionals or end it for a different reason, you may write “REVOKE” on a copy of the power of attorney form that you filed and mail or fax it to the IRS.

What is a power of attorney for IRS?

What is an IRS Power of Attorney? The IRS Power of Attorney, Form 2848, is the document required (well, sort-of, see below) in order to represent a taxpayer in front of the IRS. There are some common misconceptions about this form that we would like to lay to rest.

What is an unenrolled tax preparer?

Unenrolled Return Preparer – only in an audit and only where the tax return preparer prepared and signed the return that is being audited. Registered Tax Return Preparer - only in an audit and only where the tax return preparer prepared and signed the return that is being audited.

Do you need to notarize a power of attorney?

Not true. Not only are copies fine, the IRS power of attorney form, unlike a regular power of attorney, does not need to be notarized.

What is an enrolled agent?

Enrolled Agent – They have to take a test that covers basic information about IRS tax resolution before they can become an enrolled agent. Just make sure that the enrolled agent has actually handled a case like yours before hiring them.

Can a power of attorney sign a check?

The IRS Power of Attorney ONLY authorizes your attorney to represent you before the IRS. This does not authorize your attorney to sign deeds, sign checks, or anything else outside of dealings with the IRS.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

Who is Diana's representative on W-2?

Diana authorizes John to represent her in connection with her Forms 941 and W-2 for 2018. John is authorized to represent her in connection with the penalty for failure to file Forms W-2 that the revenue agent is proposing for 2018.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

Popular Posts:

- 1. how to explain power of attorney to a parent with dementia

- 2. when did loreta lynch become attorney general

- 3. what type of attorney handles promissory notes

- 4. can an international attorney who is denied a visa still enter the us during litigation?

- 5. atlanta attorney disability discrimination attorney who practice in fl

- 6. what made uendo lose consciousness ace attorney 6

- 7. what states can a non attorney own an attorney firm?

- 8. what the difference between a district attorney and a public defender

- 9. how to report against the texas attorney general child support

- 10. what is the difference between a private defender and a public attorney