Can a power of attorney sign a tax return in Vermont?

Vermont law does not prohibit the taxpayer’s agent, as designated by power of attorney, from signing a tax return on behalf of the taxpayer. If the agent filing the return also has prepared the return, he or she may sign as both the taxpayer and preparer.

Does the Vermont Department of tax have authority to administer tax returns?

However, IRS regulations do not control the Vermont Department of Tax’s authority to administer Vermont individual tax returns. Please note: A power of attorney is not an adequate substitute for the licensing and certification required for professional tax preparers.

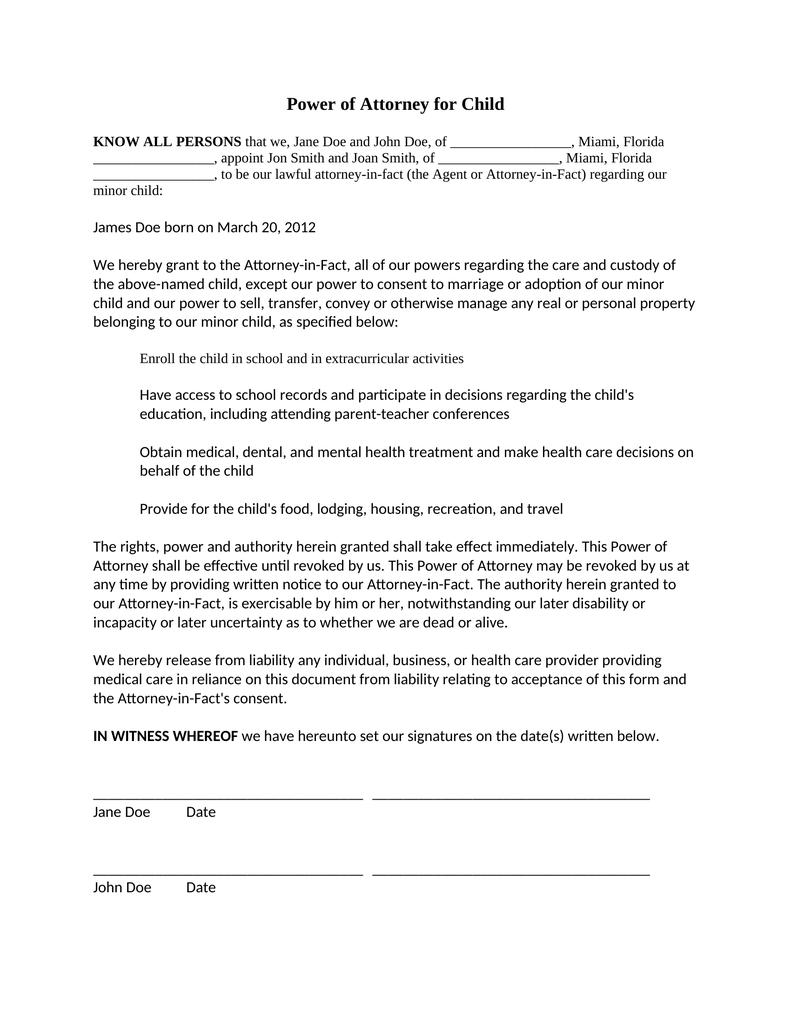

What is an example of a valid power of attorney?

An example would be if someone develops dementia as they age or is unconscious after having been in a car accident. If a valid power of attorney exists prior to the principal’s incapacitation, then the agent has full authority to make decisions on the principal’s behalf, to the extent they were granted in the power of attorney document.

What to do if you are unsure of the meaning of a power of attorney?

If you are at all unsure of the meaning or consequences of signing the document, consult with an attorney to clarify everything first. The attorney will ensure that the document you sign is legally binding and that it conveys all of the powers you want it to, but nothing more. As with any document, the person that is signing and granting power of attorney must have the mental capacity to do so and must know what they are signing, or the document will not be valid.

What is an example of a power of attorney?

An example would be if someone develops dementia as they age or is unconscious after having been in a car accident. If a valid power of attorney exists prior to the principal’s incapacitation, then the agent has full authority to make decisions on the principal’s behalf, to the extent they were granted in the power of attorney document.

What is a power of attorney for health care?

Health Care: A health care power of attorney authorizes the agent to make medical decisions on behalf of the principal in the event that the principal is unconscious, or not mentally competent to make their own medical decisions.

Why is a power of attorney important?

A power of attorney is especially important in the event of incapacitation. Someone is considered legally incapacitated when their decision-making skills are either temporarily or permanently impaired due to injury, illness, or a disability.

What to do if you are unsure of the meaning of a document?

If you are at all unsure of the meaning or consequences of signing the document, consult with an attorney to clarify everything first. The attorney will ensure that the document you sign is legally binding and that it conveys all of the powers you want it to, but nothing more. As with any document, the person that is signing and granting power ...

Can a power of attorney be used after a principal's incapacitation?

Important to note is that in order for a power of attorney to remain valid after a principal’s incapacitation, it must be a durable power of attorney. To create a durable power of attorney, specific language confirming that to be the principal’s intent must be included in the document.

Is a power of attorney durable?

If the document does not contain language saying the power of attorney is durable, then the power of attorney is considered non-durable and it becomes invalid as soon as the principal becomes incapacitated.

2 attorney answers

If the POA allows for the sale of real estate, then if you sister is the exclusive power holder and mom signed this document, the real estate can be sold by her. However, the proceeds can only be used for mom's benefit and your sister does not just get to keep them. She needs to account for them and they are not her monies.

Steven J. Fromm

If the POA allows for the sale of real estate, then if you sister is the exclusive power holder and mom signed this document, the real estate can be sold by her. However, the proceeds can only be used for mom's benefit and your sister does not just get to keep them. She needs to account for them and they are not her monies.

Popular Posts:

- 1. how to fill out a substitution of attorney form

- 2. who is best as your power of attorney

- 3. deputy attorney general rod rosenstein how to impeach

- 4. how much can a california attorney make on an estate

- 5. how long does a us attorney serve

- 6. attorney general how to become

- 7. who can serve as medical power of attorney texas out f state non resident

- 8. what attorney knows how to get rid of landline robocalls

- 9. how to file a grievance in texas re attorney

- 10. civil attorney everett wa get paid when i get paid