Where do legal fees go on 1099 for 2020? It explains that attorney’s fees of more than $600 made during the course of a trade or business must be reported in box 1 of Form 1099-NEC. However, gross proceeds of $600 or more paid to attorneys must still be reported in box 10 of Form 1099-MISC.

Full Answer

Do all attorneys get 1099?

Dec 10, 2020 · Where do legal fees go on 1099 for 2020? It explains that attorney’s fees of more than $600 made during the course of a trade or business must be reported in box 1 of Form 1099-NEC. However, gross proceeds of $600 or more paid to attorneys must still be reported in box 10 of Form 1099-MISC.

Do legal fees need 1099?

must report attorneys' fees (in box 1 of Form 1099-NEC) or gross proceeds (in box 10 of Form 1099-MISC), as described earlier, to corporations that provide legal services. Taxpayer identification numbers (TINs). To report payments to an attorney on Form 1099-MISC, you must obtain the attorney's TIN. You may use Form W-9 to obtain the attorney's TIN.

Do law firms get 1099?

Form 1099-NEC. Prior to 2020, Form 1099-MISC was used to report nonemployee compensation. The reporting requirement was moved to the new Form 1099-NEC. Attorney legal fees, commissions, and other compensation for services performed over $600 paid to the legal representatives must be reported in Box 1 of Form 1099-NEC.

Do attorneys need 1099s?

Dec 22, 2020 · December 21, 2020 02:45 PM. I want to make sure you're able to post the attorney fees to your 1099 report. As per the IRS instructions, gross proceeds paid to an attorney are reported in Box 10 of the 1099-MISC. However, there are exceptions where legal fees must be reported in the 1099-NEC form.

Where do legal fees go on 1099 for 2020?

Attorney fees paid in the course of your trade or business for services an attorney renders to you are reported in box 1 of Form 1099-NEC. Gross proceeds paid to an attorney in connection with legal services, but not for the attorney's services, are reported in box 10 of Form 1099-MISC.Jan 5, 2021

Where do I put attorney fees on a 1099?

Attorneys' fees of $600 or more paid in the course of your trade or business are reportable in box 1 of Form 1099-NEC, under section 6041A(a)(1).Jan 31, 2022

Do attorneys Receive 1099-NEC or 1099-Misc?

If your business paid an attorney or a law firm $600 or more for services related to your business, then you will need to complete and file a Form 1099-NEC. Under IRS guidance, the term “attorney" includes a law firm or any other legal services provider on behalf of your business or trade.

What 1099 form do I use for legal fees?

Therefore, you must report attorneys' fees (in box 1 of Form 1099-NEC) or gross proceeds (in box 10 of Form 1099-MISC), as described earlier, to corporations that provide legal services.Dec 12, 2019

How do I report 1099 NEC to IRS?

The nonemployee compensation reported in Box 1 of Form 1099-NEC is generally reported as self-employment income and likely subject self-employment tax. Payments to individuals that are not reportable on the 1099-NEC form, would typically be reported on Form 1099-MISC.Jan 21, 2022

Where do I send 1099 NEC to IRS?

E-file 1099-NEC Today! Even lower than paper filing cost. If your legal residence or principal place of business is outside the United States, file with the Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714.Nov 9, 2021

Do I need to send my attorney a 1099?

A business has to provide an attorney or law firm a 1099 if the business pays that attorney more than $600 for legal services in the same calendar year. ... It does not matter how the attorney structures their business – if you paid them more than $600 in the calendar year, you should provide a 1099-NEC.

Are legal settlements reported on 1099?

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

What happens if I use 1099-MISC instead of 1099 NEC?

The 1099-NEC is now used to report independent contractor income. But the 1099-MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney. Although the 1099-MISC is still in use, contractor payments made in 2020 and beyond will be reported on the form 1099-NEC.Dec 9, 2021

How do I fill out a 1099 NEC for a contractor?

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees. ... Form 1099-MISC. ... Payer's name, address, and phone number. ... Payer's TIN. ... Recipient's TIN. ... Recipient's name. ... Street address. ... City, state, and ZIP.More items...•Feb 11, 2021

How do I file 1099 NEC?

Form 1099-NEC can be filed online or by mail. A version of the form is downloadable and a fillable online PDF format is available on the IRS website. You can complete the form using IRS Free File or a tax filing software.Nov 12, 2021

How do I file a 1099 NEC electronically?

How to efile 1099 NEC form:Sign up on our website for free.Fill in the payer, payee information. Fill in the 1099 NEC form which is in the electronic format.Submit the completed 1099 NEC form to the IRS and that's it.

What does it mean to have an X in your TIN?

You may enter an “X” in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN. If you mark this box, the IRS will not send you any further notices about this account.

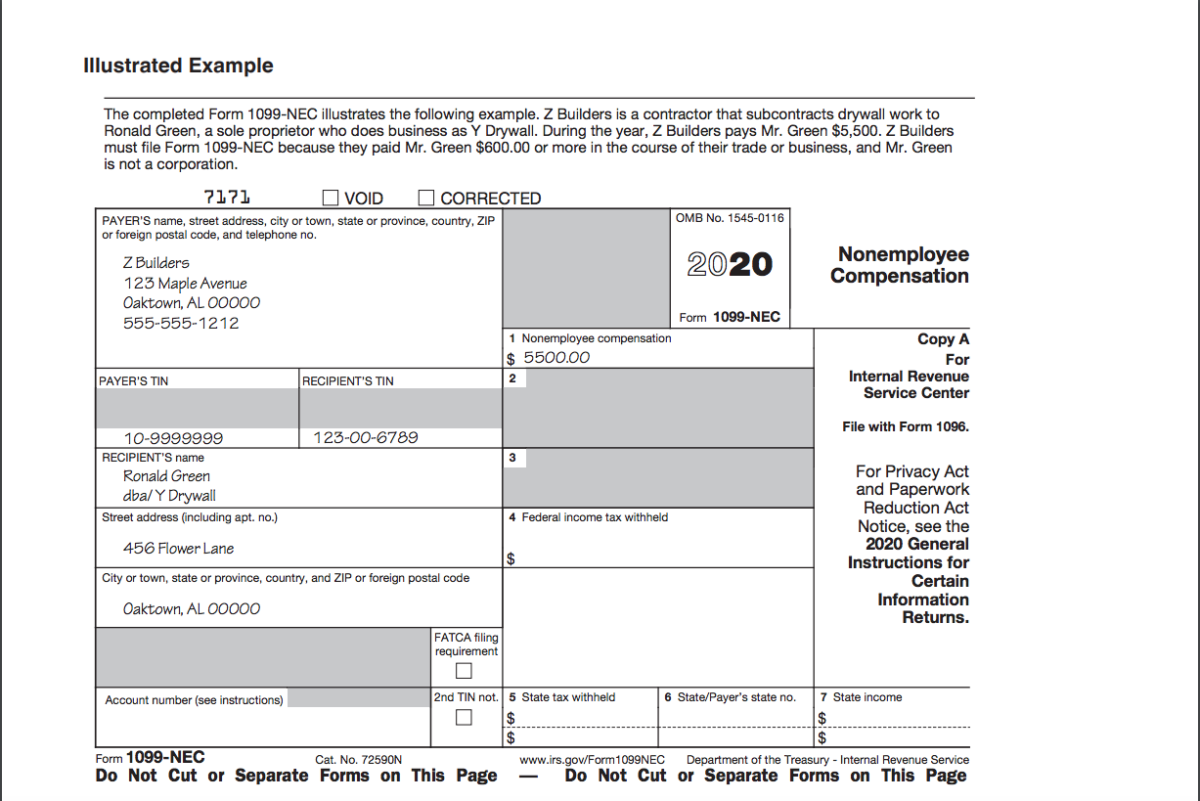

Who is Z Builders?

Z Builders is a contractor that subcontracts drywall work to Ronald Green, a sole proprietor who does business as Y Drywall. During the year, Z Builders pays Mr. Green $5,500. Z Builders

Do I need to report 1099-NEC?

Some payments do not have to be reported on Form 1099-NEC, although they may be taxable to the recipient. Payments for which a Form 1099-NEC is not required include all of the following.

What is excess golden parachute?

Enter any excess golden parachute payments. An excess parachute payment is the amount over the base amount (the average annual compensation for services includible in the individual's gross income over the most recent 5 tax years).

Do I need an account number for 1099?

The account number is required if you have multiple accounts for a recipient for whom you are filing more than one Form 1099-NEC. See part L in the 2021 General Instructions for Certain Information Returns.

What is the form 8596-A?

CAUTIONand Form 8596-A, Quarterly Transmittal of Information Returns for Federal Contracts, if a contracted amount for personal services is more than $25,000. See Rev. Rul. 2003-66, which is on page 1115 of Internal Revenue

What is a caution box?

CAUTIONbox alerts IRS scanning equipment to ignore the form and proceed to the next one. Your correction will not be entered into IRS records if you check the VOID box.

Why do lawyers send 1099s?

Copies go to state tax authorities, which are useful in collecting state tax revenues. Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out. Lawyers make good audit subjects because they often handle client funds. They also tend to have significant income.

Who must file a 1099?

Lawyers must issue Forms 1099 to expert witnesses, jury consultants , investigators, and even co-counsel where services are performed and the payment is $600 or more. A notable exception from the normal $600 rule is payments to corporations.

Do 1099s match Social Security?

IRS Forms 1099 match income and Social Security numbers. [1] . Most people pay attention to these forms at tax time, but lawyers and clients alike should pay attention to them the rest of the year as well. Failing to report a Form 1099 is guaranteed to give you an IRS tax notice to pay up. These little forms are a major source ...

Do attorneys have to report 1099?

The tax code requires companies making payments to attorneys to report the payments to the IRS on a Form 1099. Each person engaged in business and making a payment of $600 or more for services must report it on a Form 1099. The rule is cumulative, so whereas one payment of $500 would not trigger the rule, two payments of $500 to a single payee ...

Do you need a 1099 for slip and fall?

Given that such payments for compensatory damages are generally tax-free to the injured person, no Form 1099 is required.

Do lawyers have to issue 1099s?

Lawyers are not always required to issue Forms 1099, especially to clients. Nevertheless, the IRS is unlikely to criticize anyone for issuing more of the ubiquitous little forms. In fact, in the IRS’s view, the more Forms 1099 the better.

How to file 1099 NEC?

More specifically, a Form 1099-NEC is used when: 1 You have a payee who is not your employee; 2 The services paid for relate your business or trade; 3 The recipient of the payments is an individual, partnership, corporation, or estate; and 4 You must issue forms 1099 if the payments equal $600 or more for the course of your trade in the calendar year.

Is a $600 payment to a professional service provider exempt from 1099?

However, $600 payments made to professional service providers—including attorneys and law firms-- are not exempted, thus reportable on the 1099-NEC in Box 1.

What is a 1099 NEC?

You should use the Form 1099-NEC to report non-employee compensation, such as independent contractor compensation. Non-employee compensation includes fees, commissions, benefits, prizes and awards, and other forms of payment, as identified by the IRS. Any payment payable to a 1099 lawyer is reported even if all the client’s money is used ...

How much is a 1099 penalty?

For example, if you are more than 30 days past the due date for filing your 1099-NEC with the IRS in a calendar year, you will be fined $50 per form. If you file your tax return or after August 1, 2020, you will be fined $270 per form.

Who is the recipient of a 1099?

The recipient of the payments is an individual, partnership, corporation, or estate; and. You must issue forms 1099 if the payments equal $600 or more for the course of your trade in the calendar year. To use IRS Form 1099-NEC, you must satisfy all four of these conditions above.

What box is non-employee compensation on 1099?

By reporting non-employee compensation in Box 1 of the 1099-NEC, the IRS is tipped off that the recipient of those fees reported may be a self-employed individual, thus subject to self-employment tax in addition to federal and/or state income tax. Self-employed individuals pay 100% of self-employment tax, where W-2 employees pay half, ...

What is the tax rate for self employment?

The total self-employment rate is currently 15.3%, comprising 12.4% for Social Security tax and 2.9% for Medicare tax. For the 2020 tax year, Social Security tax only applies to your first $137,700 of compensation, where there is no limit for Medicare tax.

Why is it important to file the correct form?

It is important to file the correct form because filing the wrong form could result in a penalty for not issuing the correct form to the recipient as well as a separate penalty for each form filed past the form due date, once the correct form is filed.

When are 1099-NEC due?

Form 1099-NEC and Form 1099-MISC are due to the IRS on different dates. Form 1099-NEC is due by February 1, 2021, while Form 1099-MISC is due by March 1, 2021. However, both forms must be sent to recipients by February 1, 2021.

What are the penalties for not filing 1099?

Failure to file required Forms 1099-NEC subjects the taxpayer to penalties that can quickly prove significant. For taxpayers with gross receipts of $5,000,000 per annum or less, the penalty in 2020 is: 1 $50 per 1099, if you file within 30 days of due date with a maximum penalty of $194,000; 2 $110 per 1099, if you file more than 30 days after the due date but by August 1, with a maximum penalty of $556,500; and 3 $270 per 1099, if you file after August 1, with a maximum penalty of $1,113,000.

What are professional services fees?

Professional service fees, such as fees to accountants, architects, contractors, engineers, entertainers, and expert witnesses are included, as are fees paid by one professional to another, such as fee-splitting or referral fees.

When is the 1099-NEC due?

Forms 1099-NEC must be filed with the IRS by January 31 following the reporting year (although the 2020 Form 1099-NEC is due on February 1, 2021 because January 31 falls on a weekend).

When was the Path Act enacted?

This reflects the accelerated timing of employee and non-employee compensation required as a result of the Protecting Americans from Tax Hikes Act of 2015 (the PATH Act), enacted on December 15, 2015, by a month.

What Is Form 1099-Nec?

Who Needs to File A 1099-Nec?

- If your business paid an attorney or a law firm $600 or more for services related to your business, then you will need to complete and file a Form 1099-NEC. Under IRS guidance, the term “attorney" includes a law firm or any other legal services provider on behalf of your business or trade. Remember, that 1099-NECs is for services that contribute to your business, not your personal af…

How to Complete and File A 1099-Nec?

- Before you enter information into your 1099s and calendar the deadlines below, send a Form W-9to each vendor, including your business attorney or law firm. You want to confirm that you have the right information on each vendor, such as formal business names, addresses, and tax identification numbers. By having the correct information for subsequent tax forms, such as For…

What Happens If You Don’T File A 1099-Nec?

- So, what happens if I forget to file a Form 1099-NEC or 1099-MISC with the IRS? Or what if I forget to send a copy to the attorney? Aren't they just informational returns? In general, the IRS does not like to be ignored. If they say something is due, it’s due. However, most penalties for non-intentional failures to file timely are small. Your liability is based on how many days late you are i…

What Is Form 1099-Nec?

How Should Payments to Attorneys Be Reported?

- Payments to attorneys of $600 or more will be reported on either Form 1099-MISC or Form 1099-NEC according to the following rules: 1. Attorney fees paid in the course of your trade or business for services an attorney renders to you are reported in box 1 of Form 1099-NEC. 2. Gross proceeds paid to an attorney in connection with legal services, but not for the attorney’s services…

When Are Form 1099-Nec and Form 1099-Misc Due?

- Form 1099-NEC and Form 1099-MISC are due to the IRS on different dates. Form 1099-NEC is due by February 1, 2021, while Form 1099-MISC is due by March 1, 2021. However, both forms must be sent to recipients by February 1, 2021.

Need Help?

- Do you have other questions about issuing these forms, concerns about meeting the filing deadline, or a special circumstance that is difficult to navigate? P&N professionals are ready to assist! Contact usfor help working through your tax challenges.

Popular Posts:

- 1. attorney who understands direct marketing and federal requirements nyc

- 2. what does outside attorney fees mean

- 3. how soon to get traffic court attorney

- 4. when the assistance of an attorney is mandatory

- 5. why the attorney general may so much more money than the lieutenant governor

- 6. who was the other female attorney in erin brockovich

- 7. how much for asset agreement attorney

- 8. how to get a cheap attorney

- 9. what branch of government are state attorney generals in

- 10. when does power of attorney start in florida