Record the power of attorney with the county clerk office where the home is located — depending on your state or county requirements. Make authenticated copies of the document for safekeeping.

Full Answer

Where can you get durable power of attorney?

Jun 30, 2021 · A power of attorney is a legal document that allows someone (the principal) to give another person (the agent) the legal power to make decisions on the principal's behalf. An agent is sometimes called an attorney-in-fact or a health care proxy when the power of attorney concerns health care.

How do you make a power of attorney?

Feb 11, 2022 · Updated February 15, 2022. A power of attorney form allows an individual (principal) to appoint an agent (attorney-in-fact) to make decisions and handle affairs on their behalf. An agent can handle a wide range of matters including: financial, medical, guardianship, or tax-related duties depending on the powers given.

How to create a power of attorney?

“Power of attorney” (POA) is a flexible legal tool that grants permission for someone to act on another’s behalf on a temporary or permanent basis. In real estate, this can be an incredibly useful option for all sorts of situations, like if you had to sell your house but couldn’t be there due to a job relocation or deployment.

What does it cost to get a power of attorney?

Sep 11, 2018 · A power of attorney is an important document that sometimes shows up in real estate transactions. It can allow someone else to act in your place to purchase, sell, finance or refinance a home.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How do you obtain power of attorney?

Here are the basic steps to help a parent or loved one make their power of attorney, and name you as their agent:Help the grantor decide which type of POA to create. ... Decide on a durable or non-durable POA. ... Discuss what authority the grantor wants to give the agent. ... Get the correct power of attorney form.More items...•Jun 14, 2021

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How long does a power of attorney take?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

Can power of attorney sell property?

Provided there are no restrictions within the lasting power of attorney (LPA) or enduring power of attorney (EPA) you can usually do the following: Sell property (at market value) Buy property. Maintain and repair their home.

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

Why is it important to review power of attorney?

When writing the power of attorney, it’s important to review any State laws to ensure that all codes and rules are being followed. For example, some States have a maximum time limit on real estate power of attorney documents while others only allow a durable provision to be included in their statutory form.

What is a power of attorney?

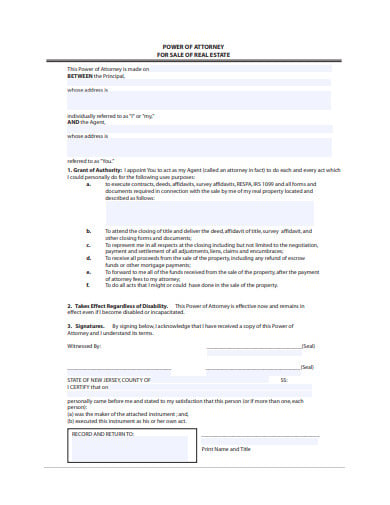

A real estate power of attorney form, also known as “limited power of attorney”, is a document that allows a landlord to delegate leasing, selling, or managing powers to someone else. This is often used by homeowners or business owners when their attorney is designated to handle a real estate closing on their behalf when signing all necessary ...

Who has the power of attorney to evict tenants?

The owner of an apartment complex gives real estate power of attorney to their son. The son will have the right to sign leases, evict tenants, and perform maintenance on the property. Although, all rents collected must go to the owner unless a separate agreement is made.

Can a power of attorney be durable?

In most cases, a real estate power of attorney is not durable, meaning, it does not terminate if the principal becomes mentally incapacitated. If the principal is seeking to have this option, although not required in most States, a durable power of attorney form should be completed.

What is the first paragraph of a delegation?

The initial paragraph of this delegation paperwork will serve as a declaration identifying the Principal and his or her Attorney-in-Fact. The individual who intends to authorize an Agent to represent him or her in matters of real estate or the Principal must have his or her “Full Name” displayed on the first blank space while his or her “Street Address,” city, and state should be presented on the three empty lines that follow.

Who is the agent in fact?

Agent (“Attor ney-in-Fact”) which may be anyone that the Principal chooses; 2nd Agent in case the original agent is not available to act; Real Estate Power of Attorney Document; Notary Public; and/or. Two (2) Witnesses.

What is assignment of authority?

Assignment Of Authority” has been set to enable the Principal to name the decisions and actions that he or she authorizes the Attorney-in-Fact to undertake on his or her behalf. This will be accomplished with the Principal’ s review and direct permissions. The real estate powers available to the Attorney-in-Fact will be summarized across four paragraph descriptions – each with attached to a blank space and check box. The Principal must initial and check the paragraph he or she wishes applied to the Attorney-in-Fact’s abilities of representation. Any paragraph without these items or missing information will not be applied to the principal powers being designated here. At least one and as many as all of these paragraphs may be within the scope of principal powers assigned through this document.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

What is a power of attorney?

In the United States, a Power of Attorney enables a person to legally make medical, financial, and certain personal decisions (such as recommending a guardian) for another person. You may need to grant someone power of attorney if you are incapable of handling all or part of your affairs for a period of time.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

When does a durable power of attorney go into effect?

It often will not go into effect until the person who grants the power of attorney becomes incapacitated.

Can an agent be incapacitated?

An agent should be in good health and not likely to become incapacitated. Otherwise, s/he may not be able to carry out decisions on the principal's behalf. Consider whether you may wish to assign different agents for financial and medical decisions. Power of attorney is a huge responsibility.

Is a power of attorney void?

If the power of attorney purports to transfer a power that cannot be transferred under the law, that part of the power of attorney is void. For instance, even if the principal and the agent agree, the agent cannot write or execute a will for the principal. Any such will is not valid.

Do you need to notarize a power of attorney?

Have the power of attorney document notarized. Some states require the agent and the principal to sign the power of attorney document in front of a notary. Even if your state does not require notarization, notarization eliminates any doubt regarding the validity of the principal's signature.

What is a power of attorney in Washington?

Create Document. A power of attorney form used by an individual (“principal”) to appoint someone else to handle their affairs (“agent” or “attorney-in-fact”). The agent is able to handle financial, medical, guardianship, or tax-related matters during the principal’s lifetime. If the form is durable, ...

What is a Durable Power of Attorney?

View and read the Types of Power of Attorney in order to get a better understanding of which form (s) are best. The most common is the Durable Power of Attorney for financial purposes and allows someone else to handle any monetary or business-related matter to the principal’s benefit.

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

What is banking banking?

Banking – To be able to deposit or withdraw funds in addition to conducting any type of financial transaction that the principal could also do themselves. Upon initials being placed on this line, the agent will have the full capacity to

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

How to get a power of attorney?

How to get power of attorney if you need it 1 Understand the obligations of being an agent in a POA arrangement. 2 Evaluate that the principal has the capacity to sign a power of attorney agreement. 3 Discuss the issue with the financial institutions (mortgage holders) and physicians (whenever there may be questions about capacity). 4 Hire an attorney or contact a legal website like Legal Zoom, online on-demand legal services with a 100% satisfaction guarantee on all their filings. 5 Be supportive. Giving up control of a real estate transaction can be a hard adjustment for an elder family member. 6 Ask a lot of questions and make sure you understand the obligations for all parties under the document. 7 Make sure that the document outlines actions with as much detail as possible to avoid any gray areas that can be misinterpreted. 8 Get the final document notarized or witnessed — depending on your state’s requirements if they haven’t enacted the Uniform Power of Attorney act of 2006. 9 Record the power of attorney with the county clerk office where the home is located — depending on your state or county requirements. 10 Make authenticated copies of the document for safekeeping. 11 Always present yourself correctly as someone’s agent.

What is a POA in real estate?

“Power of attorney” (POA) is a flexible legal tool that grants permission for someone to act on another’s behalf on a temporary or permanent basis. In real estate, this can be an incredibly useful option for all sorts of situations, like if you had to sell your house but couldn’t be there due to a job relocation or deployment.

Can a power of attorney be used to sell real estate?

In certain states, like California, “General or durable power of attorney cannot be used to sell real estate ” says Glen Henderson a top-selling real estate agent in San Diego who also specializes in probate sales.

Why is a power of attorney important?

Because it’s limited in both time and scope, it’s a great tool when you want to give someone a very specific responsibility. A medical power of attorney gives an agent (often a family member) authority over someone’s medical care once a doctor determines they are unable to make decisions on their own.

What is an agent in fact?

The agent or attorney-in-fact is the person who receives the power of attorney to act on someone else’s behalf. The agent will have a fiduciary responsibility to always act in the best interest of the principal for as long as the power of attorney is valid. A fiduciary, according to the Consumer Financial Protection Bureau (CFPB), ...

How many people have a will?

According to a 2019 Report from Merrill Lynch and Age Wave, only 45% of Americans have a will, and just 18% have the recommended estate planning essentials: a will, a healthcare directive, and a durable power of attorney.

Can you be on the principal side of a POA?

Whether you anticipate that you’ll be on the principal or agent side of a POA agreement, you should be familiar with the different types of power of attorney, their uses and limitations, as well as any restrictions around when to set one up so that it’s ready when you need it. Otherwise, you or your loved ones could be leaving your assets — like the house — at risk.

Why do you need a POA?

A POA is a very powerful document that can make buying or refinancing a home possible when you can’t be there yourself to handle all the legalities.

What is a POA?

What is a power of attorney (POA)? A power of attorney is an important document that sometimes shows up in real estate transactions. It can allow someone else to act in your place to purchase, sell, finance or refinance a home. “A power of attorney,” says the Florida Bar Association, “is a legal document delegating authority from one person ...

How long is a mortgage lock?

You’re buying a home. You have a 45-day mortgage rate lock. The deadline looms. You are out-of-town for a business meeting. With a power of attorney, your spouse can close for you.

Can you sell a property with a power of attorney?

You bought a property with several people. It’s now time to sell. Only one owner lives near the property. With a power of attorney from each investor, one owner can sell the property.

Why do third parties refuse to honor powers of attorney?

Some third parties refuse to honor powers of attorney because they believe they are protecting the principal from possible unscrupulous conduct. If your power of attorney is refused, talk with your attorney.”.

Can a principal sign a power of attorney?

Not so. Principals must have the “capacity” to sign legal documents. Generally, this means that someone under age 18 cannot create a power of attorney. In addition, the person creating a POA must legally have the mental capacity to manage their own affairs effectively.

What is an agent in a business?

In turn, an “agent” is someone with a “fiduciary” obligation. The term “fiduciary” means a lot of responsibility. An agent must be loyal to the principal, fully account for all money, act with care, maintain confidences, follow instructions, and deal honestly and fairly.

What is a POA in real estate?

A Power of Attorney (POA) is a legal document executed by a Principal (buyer or seller) that designates an agent, referred to in this document as the Attorney in fact, to sign on their behalf. In the State of Maryland, it is suggested that you use a statutory POA form when such a power is needed.

Can a principal be without the original deed?

At closing, the original must be presented to the closing agent, a copy is unacceptable. It will be recorded in the land records along with the deed or the deed of trust, depending on how it was used. This means the Principal will be without the original for several months. It will not be available to the Principal for the period needed for the county to record it and then return it to the closing agent. Be sure the Principle understands this.

What is POA power?

By giving someone the power to sign on their behalf, the Principal is giving the attorney-in-fact power to make decisions for them. When signing a POA, the Principal’s signature must be notarized at the time and place it is signed. A local notary in any state of the U.S. is acceptable. If signed in a foreign country, ...

Can POA be notarized?

This means a visit to the US embassy or a consulate. If the Principal is in the military, the POA can be notarized by a military officer. If a foreign, local notary is used, you must have the local notary certified by a judge of the highest court in the jurisdiction where the notary is located. This may require local assistance.

The Ins and Outs of a Power of Attorney for Someone in Jail

A power of attorney (POA) is a document in which the principal hands over legal power to the agent to act on their behalf, for example, in case the principal is mentally or physically incapacitated.

How To Create a POA for an Incarcerated Person

When creating a POA, it is important to seek legal advice. In case there’s a mistake in the document, the POA will be rejected immediately. Due to their special position, incarcerated principals will have to work closely with their lawyer or future power of attorney holder to transfer their decision-making authority successfully.

What Power of Attorney Is the Best for an Incarcerated Person?

It is important to understand the different types of powers of attorney, especially when choosing one for an incarcerated person. All of these documents have their advantages and disadvantages, and the choice will depend on the principal’s unique needs and circumstances.

Draft a Power of Attorney Document in a Flash Using DoNotPay

Don’t waste more of your time and money on expensive lawyers and online templates! DoNotPay can help you draft your power of attorney document within minutes. All you need to do is follow these instructions:

DoNotPay Makes All Issues Go Away in Several Clicks

Using DoNotPay comes with plenty of advantages, the main one being that you can resolve just about anything in a matter of clicks. It doesn’t get any easier than that!

Get Rid of Paperwork With Your AI-Driven Assistant

Even though paperwork belongs in the past, we have to keep dealing with it almost daily. To avoid this annoyance, you can just use DoNotPay!

Popular Posts:

- 1. when purchasing a home in ga, does a attorney need to be present

- 2. how old is chauvin's attorney

- 3. how do i get power of attorney in virginia

- 4. what do you need to get a lemon law attorney

- 5. what is the frcp for attorney client privilege

- 6. how to sign title with power of attorney for dealership idaho

- 7. why attorney can be put in jail or dangerous

- 8. what does being power of attorney entail for a reenager

- 9. where to take a completed power of attorney form

- 10. how to revoke power of attorney in sc