The New York minor power of attorney form is a document that parents can use to authorize a third party to temporarily have parental rights over their child. This type of arrangement is usually used during a period of a parent’s absence due to work, military deployment, illness, or education.

How do you apply for power of attorney in NYC?

Use Form POA-1, Power of Attorney, when you want to give one or more individuals the authority to obligate or bind you, or appear on your behalf. You may only appoint individuals (not a firm) to represent you. Note: Authorizing someone to represent you …

Does power of attorney need to be notarized in NY?

Nov 05, 2021 · You can still complete Form POA-1 using our web application. Just print and sign the form and send it directly to the Tax Department by fax (preferred) or mail, but not both. If you still want to use the paper form. Continue to paper Form POA-1, Power of Attorney. See Form POA-1: additional information for detailed instructions.

How to create a power of attorney?

Jun 18, 2021 · "POWER OF ATTORNEY NEW YORK STATUTORY SHORT FORM (a) CAUTION TO THE PRINCIPAL: Your Power of Attorney is an important document. As the "principal," you give the person whom you choose (your "agent") authority to spend your money and sell or dispose of your property during your lifetime without telling you. You do not lose your

How to create power of attorney forms?

The Requirements for a Power of Attorney The NY State DMV will accept a power of attorney only if it meets all of the following requirements the POA must contain the date the POA was issued the name and address of the agent the name, address and signature of the principal the POA must be notarized (an embossed seal is not required)

When should you consider power of attorney?

Putting in place a power of attorney can give you peace of mind that someone you trust is in charge of your affairs. If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future.

What is a power of attorney form used for?

A power of attorney, or POA, is a legal document that lets you grant another person the authority to make financial and/or medical decisions on your behalf. This person is called your agent, proxy, or attorney-in-fact.May 7, 2021

Does a power of attorney need to be recorded in NY?

SHOULD MY NEW YORK DURABLE POWER OF ATTORNEY BE RECORDED AT THE COUNTY CLERK'S OFFICE? It is usually unnecessary to record the power of attorney. Only if a deed or other document is being recorded with the agent's signatures. ... Filing a document in the County Clerk's office makes it a public document.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

How much does a power of attorney cost in NY?

How much does a Power of Attorney cost in NY? The cost of finding and hiring a lawyer to create a Power of Attorney could be between $200 and $500.

How does power of attorney work in NY?

In New York, you can use a statutory POA to give your agent authority to handle your financial and business matters. For example, you can give your agent the power to pay your bills, file your taxes, sell your real estate property, and more. This type of POA is often called a financial power of attorney.Oct 22, 2021

Who can witness a power of attorney in New York?

The new law requires that powers of attorney now be witnessed by two persons who are not named in the instrument as agents or as permissible recipients of gifts thereunder. It should be noted that the person who takes the acknowledgement may also serve as a witness, which may simplify the execution.May 4, 2021

What you can file

The table below may contain content too wide for the screen. To view all of its content, please use the scrollbar at the bottom of the table, or scroll the table itself if using a touch device.

How to submit

You can complete Form POA-1 using our web application, accessible from your Online Services account. If you don’t have an Online Services account— create one! Once you have an account, you’ll need to:

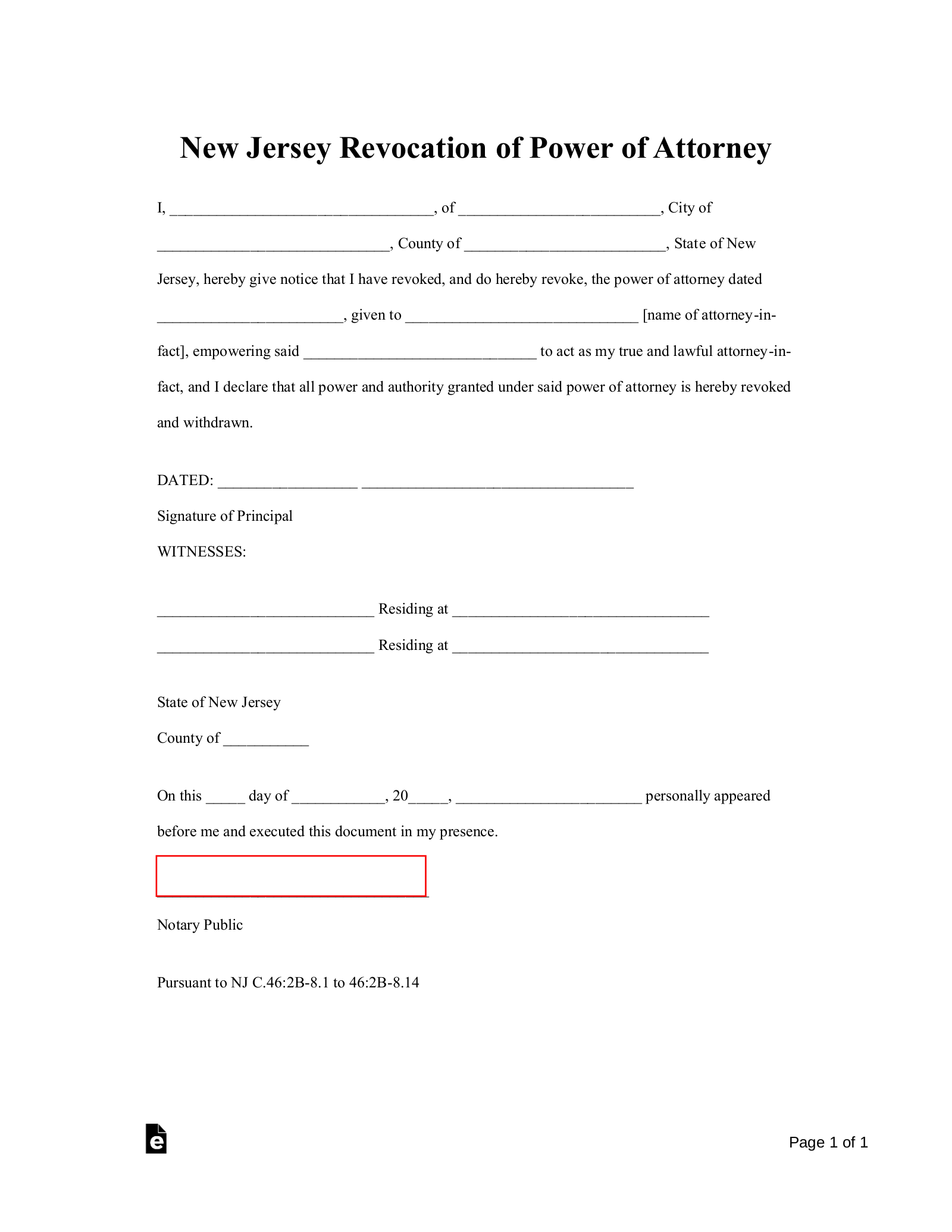

How to revoke a power of attorney or withdraw from representation

Before you revoke a power of attorney (POA) or your representative withdraws, you should know the following information.

What is a 5-1513 power of attorney?

As the "principal," you give the person whom you choose (your "agent") authority to spend your money and sell or dispose of your property during your lifetime without telling you .

Can a successor agent sign at the same time?

It is not required that the principal and the SUCCESSOR agent (s), if any, sign at the same time, nor that multiple SUCCESSOR agents sign at the same time. Furthermore, successor agents can not use this power of attorney unless the agent (s) designated above is/are unable or unwilling to serve.

Can you revoke a power of attorney?

You can revoke or terminate your Power of Attorney at any time for any reason as long as you are of sound mind. If you are no longer of sound mind, a court can remove an agent for acting improperly. Your agent cannot make health care decisions for you. You may execute a "Health Care Proxy" to do this.

What is a power of attorney for a DMV?

A power of attorney for DMV transactions normally authorizes the agent to do the following transactions for the principal. buy, sell or register a vehicle. record liens. apply for a duplicate title certificate. The DMV does not provide a power of attorney form. You do not need a POA to register a vehicle for someone else if you can show ...

What is a secure power of attorney?

A secure power of attorney is printed with security features and used for mileage disclosure purposes in the transfer of ownership of a motor vehicle. A seller can use a secure POA to authorize the buyer to complete the odometer disclosure statement on the title certificate when

What is a POA?

A power of attorney (POA) is a document that authorizes a person, partnership or corporation (the agent) to make business transactions in the name of another person, partnership or corporation (the principal). A power of attorney for DMV transactions normally authorizes the agent to do the following transactions for ...

What is a power of attorney in New York?

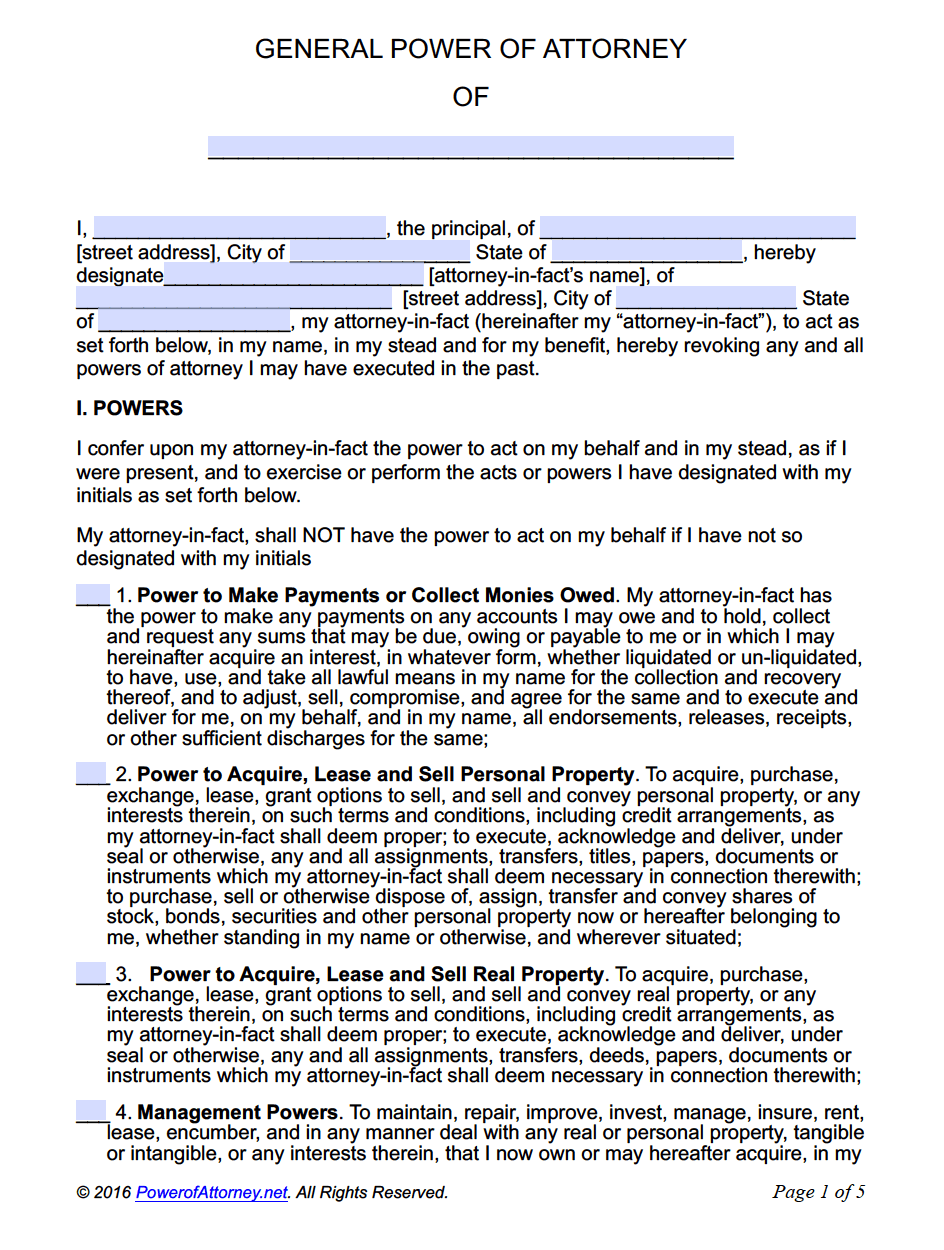

A New York general power of attorney form enables a principal to name a representative (“agent” or “attorney-in-fact”) for the management of their financial affairs.

What is a NYS POA-1?

The New York tax power of attorney form, also known as Form POA-1, allows the principal to appoint someone to handle their tax matters with the New York Department of Taxation and Finance. Most likely, the appointed individual will be a certified accountant, attorney, or some other type of tax professional.

What is a minor power of attorney?

The New York minor power of attorney form is a document that parents can use to authorize a third party to temporarily have parental rights over their child. This type of arrangement is usually used during a period of a parent’s absence due to work, military deployment, illness, or education. The designated attorney-in-fact will be able to make decisions regarding the child’s education, health care,…

What is a power of attorney?

The power of Attorney gives legal authority to another person (called an Agent or Attorney-in-Fact) to make property, financial and other legal decisions for the Principal. A Principal can give an Agent broad legal authority, or very limited authority. The Power of Attorney is frequently used to help in the event of a Principal's illness ...

What is a springing power of attorney?

A "Springing" Power of Attorney becomes effective at a future time. That is, it "springs up" upon the happenings of a specific event chosen by the Power of Attorney. Often that event is the illness or disability of the Principal. The "Springing" Power of Attorney will frequently provide that the Principal's physician will determine whether ...

Is a power of attorney good?

Powers of Attorney are only as good as the Agents who are appointed. Appointing a trustworthy person as an Agent is critical. Without a trustworthy Agent, a Power of Attorney becomes a dangerous legal instrument, and a threat to the Principal's best interests.

What is a durable power of attorney in New York?

A New York durable statutory power of attorney allows a person to hand over powers to their finances to someone else and remains valid during their lifetime. The person giving power (“principal”) can choose to give limited or broad powers to their selected individual (“agent”). The term “durable” is in reference to the form remaining valid ...

What is a power of attorney?

“Power of attorney” means a written document, other than a document referred to in section Gen. Oblig. Law § 1501C of this title, by which a principal with capacity designates an agent to act on his or her behalf and includes both a statutory short form power of attorney and a non-statutory power of attorney (Gen.

Popular Posts:

- 1. what does power of attorney mean uk

- 2. who is the chicago attorney general

- 3. who is andre brendler associate court attorney

- 4. how many u.s. attorneys report and are serviced by u.s. attorney general

- 5. which country do the ace attorney games take place in

- 6. how to write a letter to district attorney civil case template

- 7. how long doesit take an attorney to draw up disability paperwork?

- 8. who was attorney in corrine erstad missing child lawsuit

- 9. how to calculate california attorney lien amount

- 10. how strong is confidence attorney walk-in consulation