You should file for power of attorney when you want to authorize an individual to be able to represent you before the IRS. There are two main reasons to file for a power of attorney which are listed below. Representation: If you want someone to represent you at a meeting with the IRS. This person will handle dealings on your behalf

Full Answer

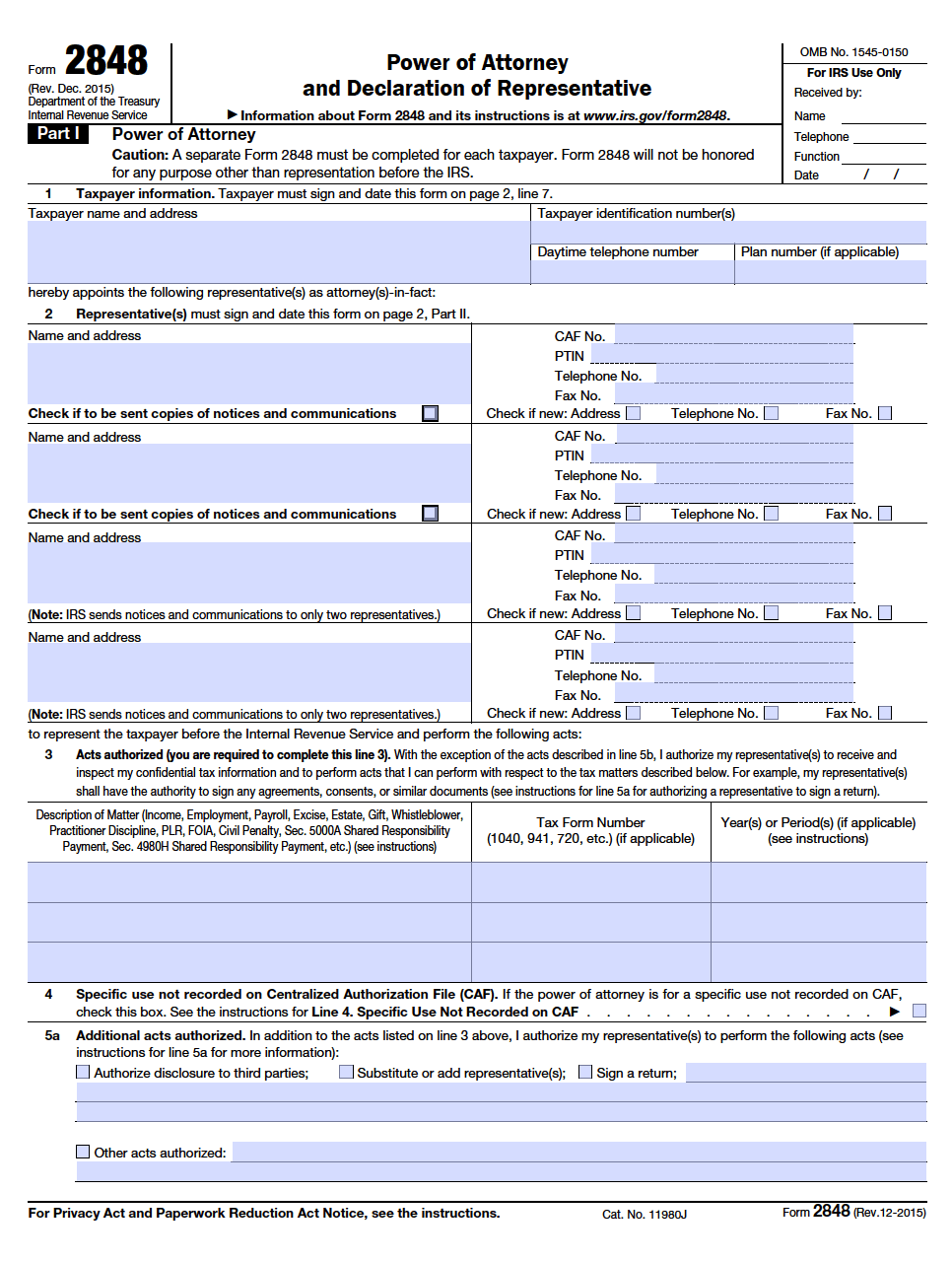

Does IRS accept power of attorney?

Jul 18, 2021 · Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney. With Power of Attorney, the authorized person can: Represent, advocate, negotiate and sign on your behalf,

What does IRS power of attorney mean?

Internal Revenue Service Publication 947 (Rev. February 2018) Cat. No. 13392P Practice Before the IRS and Power of Attorney ... When Is a Power of Attorney Not Required?....11 How Do I Fill Out Form 2848?.....11 What Happens to the Power of Attorney When

What is the tax form for power of attorney?

Apr 05, 2021 · The substitute form must contain all of the information required on the IRS Form. Your representative must also attach a Form 2848 (without your signature) for IRS tracking purposes. How to End a Power of Attorney. If your original power of attorney is limited in scope and time, it will automatically terminate once the stated purpose is completed.

Do you need IRS power of attorney?

You should file for power of attorney when you want to authorize an individual to be able to represent you before the IRS. There are two main reasons to file for a power of attorney which are listed below. Representation: If you want someone to represent you at a meeting with the IRS. This person will handle dealings on your behalf

Does the IRS recognize power of attorney?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

How long does it take for IRS to process POA?

To reduce processing time, the IRS added resources from multiple sites other than the three CAF units to assist in processing. During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

Who must sign the IRS Form 2848?

tax professionalThe taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.Jan 25, 2021

How does the IRS sign as power of attorney?

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.Jan 24, 2022

Is IRS backlogged 2021?

35 million returnsThe IRS has its own internal watchdog, the National Taxpayer Advocate. In her annual report to Congress this month, the advocate, Erin Collins, said that in 2021, the agency had a backlog of some 35 million returns that required manual processing.Jan 24, 2022

Does the IRS accept durable power of attorney?

The IRS will accept a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. But, the authorized agent will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.Jan 19, 2016

How long does it take for IRS to process form 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.Jan 26, 2021

What is the difference between form 2848 and 8821?

Whereas Form 2848 allows a power of attorney to represent a taxpayer before the IRS, Form 8821: Tax Information Authorization empowers someone to receive and inspect your confidential information without representing you to the IRS.

What is an 8821 form?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

How do I get a CAF number from the IRS?

If you are a tax professional and cannot remember your CAF number, you may call the Practitioner Priority Service, otherwise known as PPS. PPS may be reached at 866-860-4259. A PPS assistor will initiate the process to help you retrieve your CAF number once you provide your authenticating information.Feb 4, 2022

Can I sign my mom's tax return?

To sign a return for a parent who no longer is competent, you'll need to be your parent's power of attorney or court-appointed conservator or guardian. Even if you have either of these designations, you can't simply sign your parent's return. You must file a Form 2848 along with your parent's Form 1040.

Can a POA sign a W9?

Although only an authorized corporate officer can sign some tax forms, a W9 form is not one of them.

Popular Posts:

- 1. how long does the district attorney have to file charges

- 2. how to make motorcycle injury claim without attorney

- 3. right to an attorney when was created

- 4. how to file to get fees back from an attorney in pa

- 5. how many attorney general opinioins have been issues to governor burgum

- 6. how do i sign with power of attorney

- 7. what to do if attorney withdraws from my bankruptcy case week prior to trial

- 8. who is david boente as new attorney general, where does he stand?

- 9. what to do when doing a power of attorney

- 10. how to obtain power of attorney in nj