What to Do With the Signed Document Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf. So, if you want your attorney-in-fact to start using the document right away, give the original document to the attorney-in-fact.

Can a power of attorney be signed by an attorney-in-fact?

Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf. So, if you want your attorney-in-fact to start using the document right away, give the original document to the attorney-in-fact. If you named more than one attorney-in-fact, give the original document to one of them.

What do I do after I Complete my durable power of attorney?

When you've completed your durable power of attorney for finances, you have just a few more things to do. Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf.

What is a power of attorney and how does it work?

A power of attorney is a legal document. This document permits the person that creates it to appoint a trustworthy individual to act on their behalf. The person that creates the document is the principal while the appointee is the power of attorney agent.

Can a power of attorney be used to step down?

Or, if your power of attorney won't be used right away, keep the form with your power of attorney document so your attorney-in-fact will have easy access to it later. Your attorney-in-fact can use the Resignation of Attorney-in-Fact form to step down from the job.

How do I activate my power of attorney in Wisconsin?

Most Power of Attorney for Health Care documents provide that the document becomes “activated” when two physicians or one physician and one psychologist personally examine the principal and then sign a statement certifying that the principal is incapacitated.

Does a power of attorney need to be recorded in North Carolina?

When a power of attorney is used to transfer land or to do business on behalf of a person who has become incapacitated, it must be recorded. As a general rule, however, a power of attorney does not need to be recorded in North Carolina in order to be effective.

Does a power of attorney need to be recorded in Florida?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

Does a power of attorney need to be recorded in Georgia?

Does a Power of Attorney Need to be Recorded in Georgia? A POA should be notarized and witnessed by two adults, and the principal should keep the form in a safe place unless the authority needs to be used immediately. However, there is no need to record it in public records.

How do you activate a power of attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.

How do I prove I have power of attorney?

How do I prove I have power of attorney?One way of proving that you have a lasting power of attorney is by presenting a certified copy of the LPA. ... You can also use a normal photocopy if the donor countersigns it while they still have the capacity.More items...•

How long does a power of attorney last in Florida?

But as a general rule, a durable power of attorney does not have a fixed expiration date. Of course, as the principal, you are free to set an expiration date if that suits your particular needs. More commonly, if you want to terminate an agent's authority under a power of attorney, you are free to do so at any time.

Does a lasting power of attorney have to be registered?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

How does power of attorney work in Florida?

A power of attorney must be signed by the principal, by two witnesses to the principal's signature, and a notary must acknowledge the principal's signature for the power of attorney to be properly executed and valid under Florida law.

How long does a power of attorney last in Georgia?

Let's be clear: there is no Georgia statute that forces a power of attorney to have a set expiration date. There is no magical number of years that a power of attorney must have been written within in order to still be good. So, when you hear: “Your power of attorney is over five years old, we can't use it.”

Does power of attorney end at death in Georgia?

Under Georgia law, when the person passes away, the financial power of attorney immediately ends. When the person passes away, the will of the deceased or Georgia law for intestacy (which is a situation where there is no will) would then take over.

How do I transfer power of attorney in Georgia?

Steps for Making a Financial Power of Attorney in GeorgiaCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Clerk of the Superior Court.More items...

How do I file a power of attorney in North Carolina?

Steps for Making a Financial Power of Attorney in North CarolinaCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Land Records Office.More items...

Does North Carolina recognize out of state power of attorney?

ANSWER: The short answer to your question is “yes.” NC law provides that a power of attorney executed in a state other than North Carolina is valid in North Carolina, provided that when it was signed its execution complied with the law of the other state.

Can a family member override a power of attorney?

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian.

What is a durable power of attorney in North Carolina?

A North Carolina durable power of attorney form allows a person named as “agent” to act and manage the person's own property and financial matters, while retaining the right to care for the person's health and safety by being able to make decisions in their behalf if the person is incompetent to do so.

Uzzell S Branson IV

Oooh, that's a tricky question. You see, there are many types of powers of attorney, and they exist for many different purposes. The basic rule is that whoever is going to be using the power of attorney should have it when he or she needs it. Often, business partners will get powers of attorney for one another so that one...

L Christopher Arvin

Why are you doing this? This is only 1 of many estate planning documents - WHY ARE YOU PRINTING OUT 1 DOCUMENT FROM THE INTERNET (?????????????) and not as part of a set of docs from an attorney?

Robin Mashal

Disclaimer: The materials provided below are informational and should not be relied upon as legal advice. I am not clear based on your description why you are signing a power of attorney. Is this a durable power of attorney for health care purposes?

Do you need to record a power of attorney?

In some cases, it may be necessary to record the power of attorney for instance, if it is used to sell real estate. However, you do not need to record the power of attorney in order to make it generally valid.

Can a power of attorney be filed anywhere?

The form need not be filed anywhere. You should lodge a copy of a health care power of attorney with your doctor. If you have real property that could be impacted by the power of attorney you should record the financial power of attorney in the county where the property is located. Report Abuse.

Do you file a durable power of attorney?

The originals of the Durable Power of Attorney stay in your possession. You do not file them anywhere. You can record them with a county recorder if you intend on affecting a specific piece of property; typically though, if you are selling a piece of real property for another person, for whom you hold the durable power, then title and escrow is going to want to see the original and maybe record it for you when they transfer title to a new buyer, to show the chain of title and you have the power to transfer the title.

When to bring a power of attorney?

Always bring your power of attorney document with you when you transact business on someone else’s behalf and make sure the people you do business with know that you are acting under a power of attorney.

Why do people sign powers of attorney?

People also commonly sign health care powers of attorney to give someone else the authority to make medical decisions if they are unable to do so. Powers of attorney have other uses as well.

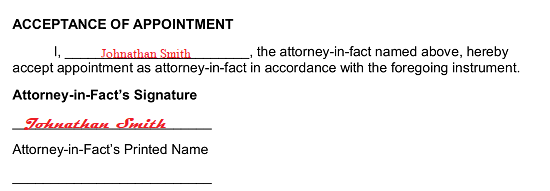

What does it mean when you sign a document as an attorney in fact?

When you sign a document as someone’s attorney-in-fact, your signature needs to make it clear that you—not they—are signing the document and that you are acting under the authority of a power of attorney. To understand how this works, let’s suppose your name is Jill Jones and you have power of attorney to act for your friend, Sam Smith.

What is a power of attorney?

A power of attorney is a legal document that gives someone the authority to sign documents and conduct transactions on another person’s behalf. A person who holds a power of attorney is sometimes called an attorney-in-fact.

What happens if you sign a document in your own name without a power of attorney?

If you sign a document in your own name without indicating that you are acting under a power of attorney, you could be held personally responsible for the transaction. If you sign only the principal’s name, you could face criminal or civil penalties for fraud or forgery.

What is a person who holds a power of attorney called?

A person who holds a power of attorney is sometimes called an attorney-in-fact. Many people sign a financial power of attorney, known as a durable power of attorney, to give a friend or family member the power to conduct financial transactions for them if they become incapacitated. People also commonly sign health care powers ...

What happens if you sign only the principal's name?

If you sign only the principal’s name, you could face criminal or civil penalties for fraud or forgery. A power of attorney can be invaluable if you need to manage the affairs of an ailing relative or sign documents on behalf of someone who is unavailable. If you act as attorney-in-fact for someone, make sure you understand your authority ...

What to do if you are unsure of the meaning of a power of attorney?

If you are at all unsure of the meaning or consequences of signing the document, consult with an attorney to clarify everything first. The attorney will ensure that the document you sign is legally binding and that it conveys all of the powers you want it to, but nothing more. As with any document, the person that is signing and granting power of attorney must have the mental capacity to do so and must know what they are signing, or the document will not be valid.

Why is a power of attorney important?

A power of attorney is especially important in the event of incapacitation. Someone is considered legally incapacitated when their decision-making skills are either temporarily or permanently impaired due to injury, illness, or a disability.

Do I Need a Lawyer for Help with a Power of Attorney?

You should definitely consider contacting a local estate planning attorney to assist in the drafting of your power of attorney. An experienced attorney at law will be able to ensure that the document is enforceable and your rights are protected.

What is a power of attorney for health care?

Health Care: A health care power of attorney authorizes the agent to make medical decisions on behalf of the principal in the event that the principal is unconscious, or not mentally competent to make their own medical decisions.

What is an example of a power of attorney?

An example would be if someone develops dementia as they age or is unconscious after having been in a car accident. If a valid power of attorney exists prior to the principal’s incapacitation, then the agent has full authority to make decisions on the principal’s behalf, to the extent they were granted in the power of attorney document.

What to do if you are unsure of the meaning of a document?

If you are at all unsure of the meaning or consequences of signing the document, consult with an attorney to clarify everything first. The attorney will ensure that the document you sign is legally binding and that it conveys all of the powers you want it to, but nothing more. As with any document, the person that is signing and granting power ...

Can a power of attorney be used after a principal's incapacitation?

Important to note is that in order for a power of attorney to remain valid after a principal’s incapacitation, it must be a durable power of attorney. To create a durable power of attorney, specific language confirming that to be the principal’s intent must be included in the document.

Why do you need a power of attorney?

Another important reason to use power of attorney is to prepare for situations when you may not be able to act on your own behalf due to absence or incapacity. Such a disability may be temporary, for example, due to travel, accident, or illness, or it may be permanent.

Why is a power of attorney important?

A power of attorney allows you to choose who will act for you and defines his or her authority and its limits, if any.

Who Should Be Your Agent?

You may wish to choose a family member to act on your behalf. Many people name their spouses or one or more children. In naming more than one person to act as agent at the same time, be alert to the possibility that all may not be available to act when needed, or they may not agree. The designation of co-agents should indicate whether you wish to have the majority act in the absence of full availability and agreement. Regardless of whether you name co-agents, you should always name one or more successor agents to address the possibility that the person you name as agent may be unavailable or unable to act when the time comes.

How The Agent Should Sign?

Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas. If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions. This is especially important if you take actions that directly or indirectly benefit you personally.

What Kinds of Powers Should I Give My Agent?

In addition to managing your day-to-day financial affairs, your attorney-in-fact can take steps to implement your estate plan. Although an agent cannot revise your will on your behalf, some jurisdictions permit an attorney-in-fact to create or amend trusts for you during your lifetime, or to transfer your assets to trusts you created. Even without amending your will or creating trusts, an agent can affect the outcome of how your assets are distributed by changing the ownership (title) to assets. It is prudent to include in the power of attorney a clear statement of whether you wish your agent to have these powers.

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

What to do if you are called upon to take action as someone's agent?

If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions.

What happens to a power of attorney when you die?

Power of attorney dies with you. Once you pass away, the document is no longer valid and your will then controls what happens to your assets. Fund your revocable trust. If you fund your revocable trust during your lifetime, you may not need to use your power of attorney although you should still have one just in case.

What is a power of attorney?

In a power of attorney, you name someone as your attorney-in-fact (or agent) to make financial decisions for you. The power gives your agent control over any assets held in your name alone. If a bank account is owned in your name alone, your attorney-in-fact will have access to it.

How effective is a durable power of attorney?

Consider your options. There are two types of powers of attorney. A durable power of attorney is effective when you sign it and survives your incapacity. A springing power of attorney springs into effect when you are incapacitated. A springing power of attorney seems more attractive to most people, but it is actually harder to use. Your agent will need to convince the bank that you are incapacitated and, even though the document spells out how to do that, your local bank branch often does not want to make that determination. Translation: your lawyer often needs to get involved. For that reason, most attorneys advise you to execute a durable power of attorney. The attorney will often hold the original power of attorney until it is needed as an extra protection.

What happens if you transfer an asset to a trust?

If you have transferred an asset to your trust, your trustee will have control of the asset. Consider your options. There are two types of powers of attorney. A durable power of attorney is effective when you sign it and survives your incapacity.

What to do if your named agent dies before you?

Name an alternate. If your named agent dies before you or is incapacitated, you want to have a back-up who can act. Also, consider nominating a guardian and conservator in your power of attorney in case one is needed down the road. Read the document. This seems obvious, but clients often do not read their documents.

Can a financial agent access your funds?

The unfortunate answer is “yes. ”. Since he will have access to your financial accounts, he can access your funds and use them for his own benefit. The agent does have a fiduciary duty to use the assets only for your benefit or as you direct in the document.

Can a power of attorney change bank account?

Depending on the language of the power of attorney, your agent may be able to change the ownership of your bank accounts or change your beneficiary designations. This is a common scenario in second marriages.

What to Do with The Signed Document

- Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf. So, if you want your attorney-in-fact to start using the document right away, give the original document to the attorney-in-fact. If you named more than one attorney-in-fact, give the original document to one of them. Between them, ...

Making and Distributing Copies

- If you wish, you can give copies of your durable power to the people your attorney-in-fact will need to deal with—in banks or government offices, for example. If the durable power is in their records, it may eliminate hassles for your attorney-in-fact later because they will be familiar with the document and expecting your attorney-in-fact to take action under it. If your power of attorney w…

Keeping Your Document Up to Date

- If you make a power of attorney that your attorney-in-fact won't use unless and until you become incapacitated, it's a good idea to revoke it and create a new one every five to seven years, especially if your

What to Do with The Additional Documents

- Your power of attorney prints out with several additional documents. Here is a quick summary of these documents and what you should do with them.

Popular Posts:

- 1. how long does an attorney have to present their case before the u.s. supreme court?

- 2. how much to pay attorney in florida for probate

- 3. how to obtain power of attorney over someone incompetent

- 4. fool for a client when you act as your own attorney

- 5. who is conner guzman defense attorney in butte county

- 6. how power of attorney can open llc

- 7. what happens if attorney does not do his job

- 8. laws prohibiting attorney representation where conflicts exist

- 9. how to find a defective and dangerous products attorney in phoenix

- 10. what can the overseerers board do to an attorney who not giving a client his trust funds