Form 706 must be filed by the executor of the estate of every U.S. citizen or resident:

- Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $11.7 million for decedents who died in 2021 ($12.06 million in 2022), or 2

- Whose executor elects to transfer the “deceased spousal unused exclusion” (DSUE) amount to the surviving spouse, regardless of the size of the decedent’s gross estate. 5 2

Full Answer

Who must file Form 706?

That’s why we created a Form 706 example. All estates that exceed the exemption amount must file form 706. In addition, there are 11 states that have an estate tax as well. Therefore, I’ve decided to go step by step through Form 706 to create the definitive guide of everything you need to know.

Is the election on Form 706 irrevocable?

The election is irrevocable. If you file a Form 706 in which you do not make this election, you may not file an amended return to make the election unless you file the amended return on or before the due date for filing the original Form 706.

Can a power of attorney represent you before the IRS?

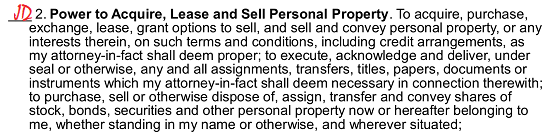

You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney. With Power of Attorney, the authorized person can: Receive copies of IRS notices and communications if you choose.

What is an exhibit to a Form 706?

Copies of tax returns filed with Form 706 must be identified as exhibits to the Form 706. The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by chapter 11 of the Internal Revenue Code. This tax is levied on the entire taxable estate and not just on the share received by a particular beneficiary.

Who is a resident on Form 706?

What to do if you receive a notice about penalties after filing a 706?

How long does it take to transfer a 706 to a spouse?

How long after filing Form 706 to get a closing letter?

How long does it take to file a 706?

What is the purpose of a 706?

What is Section 6651?

See 4 more

About this website

What is reported on form 706?

More In Forms and Instructions The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

What is reported on form 706 Schedule F?

Real estate that is part of a sole proprietorship should be shown on Schedule F. Real estate that is included in the gross estate under sections 2035, 2036, 2037, or 2038 should be shown on Schedule G.

What is reported on form 706 Schedule C?

List on Schedule C: Mortgages and notes payable to the decedent at the time of death. Cash the decedent had at the date of death.

What is reported on form 706 Schedule E?

If you are required to file Form 706, you must complete Schedule E and file it with the return if the decedent owned any joint property at the time of death, whether or not the decedent's interest is includible in the gross estate.

What should be attached to Form 706?

You must attach the death certificate to the return. If the decedent was a citizen or resident of the United States and died testate (leaving a valid will), attach a certified copy of the will to the return. If you cannot obtain a certified copy, attach a copy of the will and an explanation of why it is not certified.

Do all estates have to file Form 706?

If the decedent is a U.S. citizen or resident and decedent's death occurred in 2016, an estate tax return (Form 706) must be filed if the gross estate of the decedent, increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the ...

What expenses can be deducted on Form 706?

General.Funeral expenses.Executors' commissions.Attorney fees.Interest expense.Miscellaneous expenses.

Who must file federal Form 706?

Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $11.7 million for decedents who died in 2021 ($12.06 million in 2022), or 2.

What is the difference between Form 706 and Form 709?

Form 709 vs Form 706 Form 706 is filed by the executor of an estate on behalf of a deceased person to calculate estate tax owed, while the latter is filed by you to report gifts exceeding the annual exclusion.

Can Form 706 be filed electronically?

At this time, it is not possible to e-file Forms 706, 706-NA, and 709 (and several related, separately filed forms). It would be in the interest of both taxpayers and the Internal Revenue Service to extend electronic filing to these forms.

Are IRAS included on Form 706?

Is the amount in a traditional IRA includable in the preparation of Form 706? No separate line is provided for it. IRA's under section 408(a)(ROTH)are excluded, but instructions for traditional IRA's are vague.

What is a qualified joint interest on 706?

(2) Qualified joint interest defined For purposes of paragraph (1), the term “qualified joint interest” means any interest in property held by the decedent and the decedent's spouse as— (A) tenants by the entirety, or (B) joint tenants with right of survivorship, but only if the decedent and the spouse of the decedent ...

What assets are included on Form 706?

This includes (a) cash, investments, retirement assets, tax-exempt assets, business assets, real and personal property; (b) probate, as well as jointly-held assets; (c) non-taxable assets exempt from taxation under the marital or charitable deductions; (d) life insurance and annuities, as well as special interests and ...

What expenses can be deducted on Form 706?

General.Funeral expenses.Executors' commissions.Attorney fees.Interest expense.Miscellaneous expenses.

What funeral expenses are deductible on Form 706?

If the estate was reimbursed for any of the funeral costs, you must deduct the reimbursement from your total expenses before claiming them on Form 706. This includes government payments such as Social Security or Veterans Affairs death benefits. Such reimbursements are not eligible for a deduction.

Is an IRA included on a 706?

Is the amount in a traditional IRA includable in the preparation of Form 706? No separate line is provided for it.

Instructions for Form 706 (Rev. September 2022)

Instructions for Form 706 (Rev. September 2022) ... -13-

Where to report IRA assets on Estate Tax Form 706?

Deceased (died in late 2020) held stocks, ETF's, and mutual funds in his traditional and Roth IRA's. Outside of annual RMD's (although he did not take RMD in 2020), there was no annuity set-up with his IRA's. What is the proper schedule within Form 706 to report these assets? The IRS form instructions do not contain this information, and I've seen conflicting information about using Schedule F ...

On form 706, on which schedule do you report IRA's that are… - JustAnswer

On form 706, on which schedule do you report IRA's that are not annuities? Thought I was - Answered by a verified Tax Professional

I am filling out a Form 706 only to take advantage of the… - JustAnswer

I would like some clarification of some things in Form 706. 1. Is a Marital Deduction in Schedule M something like a joint Bank Account where 50% is part of the gross estate of the decedent but it automatically passes to the surviving spouse and similarly for a house that is jointly owned. These amounts will eventually be deducted from the Gross Estate to result in the tentative taxable estate.

Who receives a copy of Form 2848?

By default, the first representative listed on Form 2848 will receive copies of notices and communications from the IRS. To change this behavior, select the desired recipient (s) from the Send copies of notices to representatives for Form 2848 drop-down list.

How to stop Ultratax from sending IRS notices?

To prevent UltraTax CS from sending copies of IRS notices to the appointee on Form 8821, mark the Send no notices to Form 8821 appointee checkbox. If this field is marked, UltraTax CS automatically clears checkbox 5a on Form 8821. This field is used to complete Form 8821, line 5b and is not applicable to Form 2848.

How to authorize a power of attorney?

Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

When is oral authorization revoked?

Unless you state otherwise, the oral authorization is automatically revoked once the conversation has ended.

Do you have to meet your tax obligations when you authorize someone to represent you?

You still must meet your tax obligations when you authorize someone to represent you.

Who can authorize oral disclosure?

You can authorize your tax preparer, a friend, a family member, or any other person you choose to receive oral disclosure during a conversation with the IRS.

Do you need a signature for a power of attorney?

Power of Attorney must be authorized with your signature. Here’s how to do it:

Do you have an estate plan?

Form 706 for an estate tax return is an often misunderstood form. That’s why we created a Form 706 example.

Form 706, Part 1, Page 1 – Decedent & Executor

Take a look at the screenshot. This section is for some basic information regarding:

Form 706, Part 4, Pages 2 & 3 – General Information

This section requests a variety of information. Special items to note when completing Part 4 are:

Schedule A, Page 5 – Real Estate

Schedule A is used to report the value of all real estate, including foreign real estate, which is part of the gross estate (§2031). The full value of the real estate is reported and there is no reduction for homestead, dower, or curtsey.

Schedule A-1, Pages 6 thru 9 – Section 2032A Valuation

The requirements under §2032A for special valuation have been discussed earlier. Some special items to note are:

Schedule B, Page 10 – Stocks and Bonds

Schedule B is used to report the value of all stocks and bonds included in the gross estate. In doing so, some special items include:

Schedule C, Page 11 – Mortgages, Notes, and Cash

Schedule C is used to report cash and all items owed to the decedent at the time of death. Mortgages and notes are valued based on their unpaid principal plus accrued interest unless special circumstances (e.g., below-market in-10-13 terest rate or insolvency of the debtor) permit a lower valuation.

When should a power of attorney be considered?

A power of attorney should be considered when planning for long-term care. There are different types of POAs that fall under either a general power of attorney or limited power of attorney . A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state.

What Is Power of Attorney?

Power of attorney (POA) is a legal authorization that gives a designated person, termed the agent or attorney-in-fact, the power to act for another person, known as the principal. The agent may be given broad or limited authority to make decisions about the principal's property, finances, investments, or medical care.

How can I revoke power of attorney I have given to somebody?

Power of attorney can be terminated if you expressly revoke it. It may also have a set termination date or duration of time for which it is in force. If you become mentally incapacitated it will also cease unless it is a durable power of attorney. If you die, all powers of attorney cease.

Why do parents need POAs?

Ask parents to create POAs for the sake of everyone in the family—including the children and grandchildren— who may be harmed by the complications and costs that result if a parent is incapacitated without a durable POA in place to manage the parent’s affairs.

How long does a power of attorney last?

Many variations of power of attorney forms exist. Some POAs are short-lived; others are meant to last until death. Decide what powers you wish to grant and prepare a POA specific to that desire. The POA must also satisfy the requirements of your state. To find a form that will be accepted by a court of law in the state in which you live, perform an internet search, check with an office supply store or ask a local estate planning professional to help you. The best option is to use an attorney.

How long is a limited power of attorney good for?

A limited power of attorney may be in effect for a specific period. For example, if the principal will be out of the country for two years, the authorization might be effective only for that period.

What is limited POA?

For example, the limited POA may explicitly state that the agent is only allowed to manage the principal's retirement accounts. A limited POA may also be in effect for a specific period of time (e.g., if the principal will be out of the country for, say, two years).

What is a power of attorney?

A power of attorney is a written authorization by which a person, or principal, authorizes another person, the agent, to act on her behalf. A financial power of attorney allows the agent to manage the principal's financial affairs, such as bank accounts, investments, bill payment and business affairs, as designated in the power of attorney.

What happens if a power of attorney is not limited?

If the powers are not limited, the person holding the power of attorney may engage in whatever financial transactions the principal may engage in, including opening and closing accounts and making investments. The power of attorney may take effect immediately upon signing by the principal or contain provisions making it a "springing" power ...

What is the fiduciary duty of an agent?

To fulfill that fiduciary duty, the agent must keep careful records of all transactions conducted on the principal's behalf and keep the principal's funds strictly separate from his own personal or business funds.

When does a power of attorney take effect?

The power of attorney may take effect immediately upon signing by the principal or contain provisions making it a "springing" power of attorney, in which the power of attorney does not become effective until a specified date or until certain future events occur.

Who can petition a court to review your actions as an agent?

The principal, her spouse or guardian, heirs, beneficiaries or government agency charged with protecting her welfare, may petition a court to review your actions as agent and seek compensation for your failure to appropriately carry out your fiduciary duties.

Can you refuse a power of attorney appointment?

Appointment under a power of attorney is voluntary and you may refuse the appointment . The principal may terminate the power of attorney at any time. Depending on the terms of the power of attorney document, the agent may be compensated for his time and out-of-pocket expenses; these should be carefully documented and must be reasonable and appropriate for the work performed.

Who is a resident on Form 706?

File Form 706 for the estates of decedents who were either U.S. citizens or U.S. residents at the time of death. For estate tax purposes, a resident is someone who had a domicile in the United States at the time of death. A person acquires a domicile by living in a place for even a brief period of time, as long as the person had no intention of moving from that place.

What to do if you receive a notice about penalties after filing a 706?

If you receive a notice about penalties after you file Form 706, send an explanation and we will determine if you meet reasonable cause criteria. Do not attach an explanation when you file Form 706. Explanations attached to the return at the time of filing will not be considered.

How long does it take to transfer a 706 to a spouse?

An executor can only elect to transfer the DSUE amount to the surviving spouse if the Form 706 is filed timely; that is, within 9 months of the decedent's date of death or, if you have received an extension of time to file, before the 6-month extension period ends.

How long after filing Form 706 to get a closing letter?

To allow time for processing, please wait at least 9 months after filing Form 706 to request a closing letter. Instead of an estate tax closing letter, the executor of the estate may request an account transcript, which reflects transactions including the acceptance of Form 706 and the completion of an examination.

How long does it take to file a 706?

Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due date (including extensions) of Form 706 or the date of filing Form 706 if the return is filed late. The basis of certain assets when sold or otherwise disposed of must be consistent with the basis (estate tax value) of the asset when it was received by the beneficiary. To satisfy the consistent basis reporting requirements, the estate must file Form 8971, Information Regarding Beneficiaries Acquiring Property From a Decedent. See Form 8971 and its instructions for more information.

What is the purpose of a 706?

Purpose of Form. The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by chapter 11 of the Internal Revenue Code. This tax is levied on the entire taxable estate and not just on the share received by a particular beneficiary.

What is Section 6651?

Section 6651 provides for penalties for both late filing and for late payment unless there is reasonable-cause for the delay. The law also provides for penalties for willful attempts to evade payment of tax. The late filing penalty will not be imposed if the taxpayer can show that the failure to file a timely return is due to reasonable-cause.

Popular Posts:

- 1. what does lateral attorney mean

- 2. what nute gingridge said about new attorney geneeal

- 3. how to request a new attorney in pennsylvania

- 4. what candidates are running for attorney general in tucson

- 5. how much do assistant attorney generals make in ri

- 6. who has standing to raise misleading statements by an attorney in advertising

- 7. what do we do if living will completely contradicts power of attorney

- 8. how to write settlement check to attorney

- 9. how to sign check with power of attorney

- 10. what do you do with your case if your attorney dies