Does form 706-a need to be signed?

Jan 01, 2019 · Form 706-A must be signed. The taxpayer (or person filing on his or her behalf) must verify and sign the declaration on page 1 under penalties of perjury. The taxpayer may use Form 2848, Power of Attorney and Declaration of Representative, to authorize another person to act for him or her before the IRS.

How long does an executor have to file Form 706?

Dec 21, 2021 · Form 706 must be filed on behalf of a deceased U.S. citizen or resident whose gross estate, adjusted taxable gifts, and specific exemptions exceed $11.7 million in 2021 ($12.06 million in 2022).

Is the election on Form 706 irrevocable?

Mar 02, 2022 · You must file Form 706 to report mesi estivi and/ GST tax within 9 months after the date of the decedent’s death. If you are unable to file Form 706 by the coppia date, you may receive an extension of time to file. ... ( behalf of the decedent under a power of attorney) for which risposta negativa Forms 709 were filed. Include the value of ...

What happens if I forgot to file Form 706?

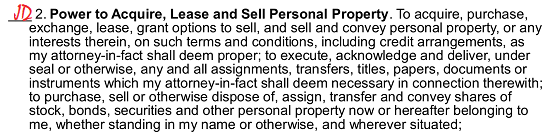

Power of Attorney (POA) is your legal permission for another adult to act on your behalf. The permission can be granted for a specific, limited purpose and period of time or for much broader purposes (such as handling all of your financial affairs) and an unquantified period of time (such as until your death).

What is reported on Form 706 Schedule F?

Schedule F – Miscellaneous Property. This is the catchall schedule for all property not reported on any other schedule. A list of the assets to be reported on this schedule is provided in the instructions for Schedule F, page 20 of Form 706.

What is reported on Form 706 Schedule E?

If you are required to file Form 706, you must complete Schedule E and file it with the return if the decedent owned any joint property at the time of death, whether or not the decedent's interest is includible in the gross estate.

What do I attach to Form 706?

Schedule A—Real Estate. ... Schedule B—Stocks and Bonds. ... Schedule C—Mortgages, Notes, and Cash. ... Schedule D—Insurance on the Decedent's Life (attach Form(s) 712) ... Schedule E—Jointly Owned Property (attach Form(s) 712 for life insurance) ... Schedule F—Other Miscellaneous Property (attach Form(s) 712 for life insurance)More items...

When Should Form 8971 be filed?

Generally, Form 8971 and Schedule A must be filed within 30 days of filing the estate tax return or the due date of the estate tax return [IRC section 6035(a)(3)(A)(i-ii)]. This reporting requirement can prove difficult for executors because some beneficiaries may not be known by the return due date.Jun 6, 2018

What is the difference between 706 and 1041?

Form 1041 is used to report income taxes for both trusts and estates (not to be confused with Form 706, used when filing an estate tax return).

What funeral expenses are deductible on form 706?

Tax-deductible funeral expensesEmbalming or cremation.Casket or urn.Burial plot and burial (internment)Green burial services.Tombstone, gravestone or other grave markers.Funeral home facility costs and director fees.Funeral service arrangement costs, including floral and catering services.More items...•Mar 25, 2022

Do you have to report inheritance money to IRS?

No, but your mother may be required to report this transaction to the IRS as a taxable gift. Generally, the transfer of any property or interest in property for less than adequate and full consideration is a gift.Nov 4, 2021

What does IRS Code 706 mean?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.Feb 8, 2022

Who Must File 706?

If the decedent is a U.S. citizen or resident and decedent's death occurred in 2016, an estate tax return (Form 706) must be filed if the gross estate of the decedent, increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the ...Feb 10, 2022

What gets reported 8971?

Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after July 2015. This form, along with a copy of every Schedule A, is used to report values to the IRS.Feb 8, 2022

Do IRAS get reported on form 8971?

10. Do you have to report cash and cash equivalents on Form 8971? No. There are four types of assets that are excluded on the form: cash, IRD, certain tangible personal property and property that is sold, exchanged, or otherwise disposed of in a transaction in which capital gain or loss is recognized.Mar 31, 2016

What assets are reported on form 8971?

Property reported on Form 8971 includes all property in the gross estate for federal estate tax purposes with four exceptions: Cash, other than coins or paper bills with numismatic value; Income in respect of a decedent; Items of tangible personal property for which an appraisal is not required, ex.Aug 16, 2016

What is a 706A?

Form 706-A must be signed. The taxpayer (or person filing on his or her behalf) must verify and sign the declaration on page 1 under penalties of perjury. The taxpayer may use Form 2848, Power of Attorney and Declaration of Representative, to authorize another person to act for him or her before the IRS.

When computing the amounts to enter on Form 706-A, use the same values and estate tax that the executor

When computing the amounts to enter on Form 706-A, use the same values and estate tax that the executor reported on the Form 706 filed for the decedent. However, if the IRS has completed the audit of the estate tax return, use the agreed values and tax rather than the reported values and tax.

What is recapture tax?

The recapture tax is limited to the tax savings attributable to the property actually disposed of (or for which qualified use ceased) rather than to the tax savings attributable to all the specially valued property received by the heir.

How to allow IRS to discuss tax return?

If you want to allow the IRS to discuss the tax return with the paid preparer who signed it, check the "Yes" box in the signature area of the return. This authorization applies only to the individual whose signature appears in the Paid Preparer Use Only section of the return. It does not apply to the firm, if any, shown in that section. If the "Yes" box is checked, you are authorizing the IRS to call the paid preparer to answer any questions that may arise during the processing of its return. You are also authorizing the paid preparer to:

Is a disposition of an interest in property to a family member of the qualified heir taxable?

A disposition of an interest in property to a family member of the qualified heir is a taxable event that must be reported on Form 706-A. If the transferee enters into an agreement to be personally liable for any additional tax under section 2032A (c), the disposition is nontaxable and you should enter it on Schedule C.

What is special value property?

The term "specially valued property" means farm or closely held business property that the executor elected to value at actual use rather than fair market value (FMV) (defined on page 3). The executor makes the election on Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, filed for the decedent. Specially valued property refers to the qualified real property described in section 2032A and includes qualified real property owned indirectly, such as interests in certain partnerships, corporations, and trusts as described in section 2032A.

Can a qualified heir increase the basis of a specially valued property?

A qualified heir may elect to increase the basis of specially valued property when a taxable event (as defined earlier) occurs. If this election is made, the basis of the property shall increase to the excess of the FMV amount on the decedent's date of death (or alternate valuation date, if applicable) over the value amount determined under section 2032A. Once the election is made, it is irrevocable.

Who must file Form 706?

Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $11,700,000 for decedents who died in 2021, and $11,580,000 for 2020; or 2 .

What is a 706?

Form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to Chapter 11 of the Internal Revenue Code (IRC), and to calculate the generation-skipping transfer tax (GSTT) imposed by Chapter 13 of the IRC.

What is generation-skipping transfer tax?

A generation-skipping transfer tax (GST) is a transfer of money or property, either as an inheritance or a gift, to someone who is two or more generations below the grantor. The person who receives the inheritance or gift is called the “skip person.”.

How long does it take to file a 706?

Where to Mail Form 706. You must file a paper Form 706 to report estate or GSTT within nine months of the date of the decedent’s death . 3 If you can’t file Form 706 by the due date, you can apply for an automatic six-month extension using Form 4768, Application for Extension of Time to File a Return and/or Pay U.S.

Who is Jean Folger?

Jean Folger has 15+ years of experience as a financial writer covering real estate, investing, active trading, the economy, and retirement planning. She is the co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004.

When was the 706 revision date?

All references to the U.S. Form 706 are to the form with a revision date of July 1999. This form and instructions are available at mass.gov/dor. All estates are required to submit a completed U.S. Form 706 with a revision date of July 1999 in addition to the Massachusetts Form M-706.

What is the estate tax?

The IRS, and many states, impose an estate tax on the transfer of cash and property between a decedent and their beneficiaries. These taxes generally only apply to estates over a certain size threshold, generally several million dollars, and therefore only affects the largest few percent of estates in the United States.

Popular Posts:

- 1. how to make appointment with the colorado state attorney

- 2. what happens when investigators foward a case to attorney general in dc

- 3. why wont my attorney help me with auto accident claim

- 4. what attorney is representing.kavanaugh

- 5. when challenging constitutionality of statute must serve attorney general

- 6. who is the attorney on days of our lives

- 7. what is the role of an attorney in the common law system

- 8. why use a real estate attorney the fund

- 9. how would i file for child custody without an attorney

- 10. who is the attorney general that is going to jail for lies to the fbi