If you have not been appointed as third-party designee or if you are required to perform acts beyond a third-party designation, you must be authorized as a taxpayer’s representative on Form IL-2848, Power of Attorney. To submit Form IL-2848 or Form IL-56 for immediate processing send your completed and signed form by email or fax.

Full Answer

Where can I find power of attorney form in Illinois?

In the event you do not want to use the Illinois statutory form provided here, any document you complete must be executed by you, designate an agent who is over 18 years of age and not prohibited from serving as your agent, and state the agent's powers, but it need not be witnessed or conform in any other respect to the statutory health care power.

How do you obtain power of attorney in Illinois?

The Illinois tax power of attorney is a limited power of attorney form that is filed with the Illinois Department of Revenue along with an individual’s tax filings. The document provides the taxpayer with the ability to formally select an accountant or other representative (referred to in the form as the attorney-in-fact) to act on their behalf.

How to get power of attorney in Illinois?

Aug 02, 2021 · An Illinois Power of Attorney for Health Care has been created by the Illinois legislature. This form must be signed by the principal and one witness. It does not need to be notarized. Like the financial form, this form includes detailed instructions, including an explanation of the types of persons who may not serve as a witness.

How to complete the power of attorney form?

administrative hearing or proceeding before the Illinois Independent Tax Tribunal, Form IL-2848 must be filed with IDOR listing the POA. The POA must be an attorney to act for a taxpayer at an administrative hearing or other preliminary proceedings, including status calls and pretrial. This form also may be required in order to have a POA act

Does a power of attorney need to be notarized in Illinois?

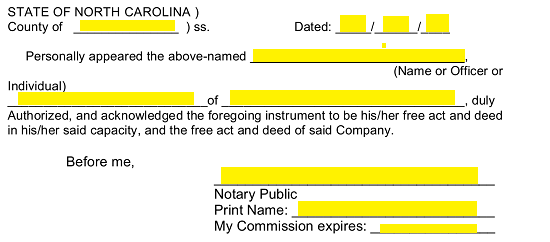

The person you give the power of attorney to is the agent and you are the principal. The agent is usually a spouse, a close friend, or a trusted relative. The document does not have to be notarized. ... Once the power of attorney is signed, make multiple copies.Jul 28, 2021

How do I get power of attorney in Illinois?

The basic requirements for a power of attorney in Illinois for financial matters are that it must:Designate the agent and the agent's powers.Be properly signed (executed) by the principal.Be signed by at least one witness to the principal's signature.More items...

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

What is form IL-2848 A?

In general, Form IL-2848, Power of Attorney, should be filed to authorize a Power of Attorney (POA) to perform certain acts with the Illinois Department of Revenue (IDOR) on behalf of the taxpayer.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How long does it take to register a power of attorney?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Jan 13, 2022

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

What is a 941 form?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.Nov 24, 2021

How do I get a caf?

You can get a CAF number by submitting Form 2848 or 8821 and writing “None” in the space designated for the CAF number. The IRS will send you a CAF number within a few weeks.

What is an Enrolled Agent IRS?

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee.Apr 6, 2021

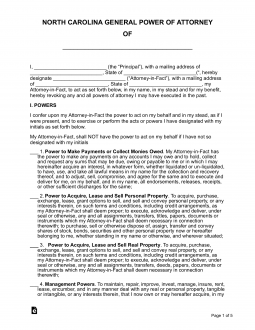

Durable Power of Attorney Illinois Form – Adobe PDF

The Illinois durable power of attorney form enables the principal (individual creating the form) to assign an agent to oversee their finances and make decisions on their behalf. Because the form is durable, the agent will be able to operate even when the principal is unable to make decisions for herself (as determined by a licensed physician).

General Power of Attorney Illinois Form – Adobe PDF

The Illinois general power of attorney is a document that transfers authority to an agent to act on behalf of the principal (individual creating the document) so long as the principal can make decisions for themselves.

Limited Power of Attorney Illinois Form – Adobe PDF

The Illinois limited power of attorney form provides a resident with the opportunity to transfer limited financial powers to another individual (referred to as an attorney-in-fact or agent). The selected representative will be able to act on behalf of the resident for the completion of a singular, agreed upon act.

Medical Power of Attorney Illinois Form – Adobe PDF

The Illinois medical power of attorney form enables an individual to designate someone as their health care agent. This agent will be able to make health care related decisions on behalf of the individual when they have lost the ability to communicate their wishes.

How old do you have to be to get a power of attorney in Illinois?

The basic requirements for a power of attorney in Illinois for financial matters are that it must: For both financial and healthcare POAs, agents and witnesses must be at least 18 years of age. There are limitations as to who may be a witness.

What is a POA in Illinois?

Let's look at the state of Illinois requirements for granting Power of Attorney. A legal document called a power of attorney ( or POA) can assure that your financial and healthcare matters are taken care of in the event you can't be present to sign documents, or if you become incapacitated.

What is a POA in financial terms?

A financial POA giving the agent broad powers to represent the principal in just about any matter is called a "general" POA. A "limited" or "special" POA is one that limits the agent's authority in some way, such as limiting it to a single transaction, a certain type of transaction, or to a limited amount of time.

When does a POA end?

Traditionally, a POA ended if the principal became mentally incapacitated, and became effective as soon as it was signed. Under Illinois law, you can have a POA that continues in effect after incapacity (called a "durable" POA) or one that does not go into effect unless the principal becomes incapacitated (called a "springing" POA).

Who can execute Form IL-2848?

You must be the taxpayer or have fiduciary authority to execute Form IL-2848. If the taxpayer is a minor child, then a parent or legal guardian may execute Form

Can you list a single year on a tax return?

You must list tax years or periods on the line provided. You can list a single year or period or a range of years or periods, or you can list “All” years or periods.

What is a short form power of attorney in Illinois?

Illinois Statutory Short Form Power of Attorney for Health Care. The State of Illinois recognizes the right of adults to control all aspects of his or her personal care and medical treatment, including the right to decline medical treatment or to direct that it be withdrawn, even if death ensues.

What is a report form for a ward?

A report form detailing the ward’s condition, living arrangement, and services provided should be filed annually with the court. The form may be attached to the most recent care plan.

What is an advance directive?

Advance Directives. Declaration For Mental Health Treatment. An adult of sound mind may put into writing his or her preferences regarding future mental health treatment. The preferences may include consent or refusal of mental health treatment and may be stated on the forms provided.

What is successor guardianship?

Successor Guardianship. A petition and order are provided to assist in naming a successor guardian upon the death, resignation or removal of a guardian. Death of a Ward. Guardianship terminates upon death of the ward. A petition to notify the court of the ward’s death and close the guardianship case is attached.

Can you refer to a statute without consulting?

Any statutes, references to case law, or other references to the law should not be relied upon without first consulting with a skilled attorney who is knowledgeable in the particular area of law.

Popular Posts:

- 1. how to end a retainer attorney

- 2. how do to resume in word 2013 attend trial with attorney

- 3. why is the attorney general of texas opposed to lifting bands on gay marriage? quzlet

- 4. what its really like to be an attorney uw

- 5. how many district attorney are there in the us

- 6. who is illinois dupage county attorney general

- 7. what does it mean when it says attorney bar of the highest court

- 8. how to cite the final report from the states attorney

- 9. why should you have an attorney through naturalization process

- 10. what happens to power of attorney upon death