Does durable power of attorney cover health care matters?

When it comes to granting someone as the health care power of attorney, that person is responsible for making important medical decisions on your behalf if you were to ever become incapacitated. From blood transfusions to medications, and what life-saving measures you would like taken on your behalf, your health care power of attorney is responsible for communicating …

What is the purpose of a durable power of attorney?

What does durable mean in a durable power of attorney?

How to enforce durable power of attorney?

May 02, 2022 · When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. Durable …

What is the difference between power of attorney and power of health?

What does Durable power of attorney mean in medical terms?

What is the difference between a living will and a durable power of attorney for healthcare quizlet?

What is the advantage of creating a durable power of attorney for healthcare decisions?

What three decisions Cannot be made by a legal power of attorney?

What is the best power of attorney to have?

Why might a person choose a living will over a durable power of attorney?

Can power of attorney override will?

What are the 3 types of advance directives?

- Common Law Advance Care Directives which are recognised by the common law (decisions made by judges in the courts) and generally must be followed. ...

- Statutory Advance Care Directives which are governed by State and Territory legislation.

What are the disadvantages of a durable power of attorney?

You will not have direct control over your agent's actions because he or she will have the authority to enter into transactions for you, without you being present.Jul 7, 2014

What are the disadvantages of being power of attorney?

- A Power of Attorney Could Leave You Vulnerable to Abuse. ...

- If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ...

- A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.

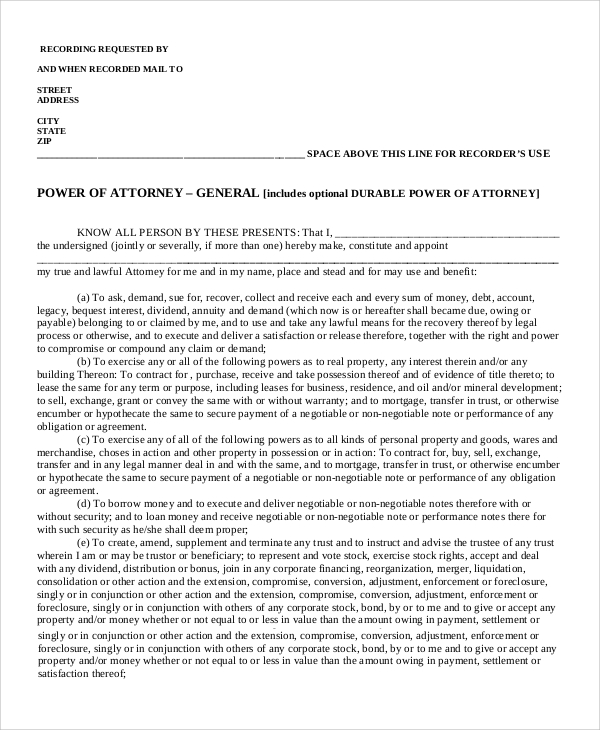

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

What Is A Power of Attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitate...

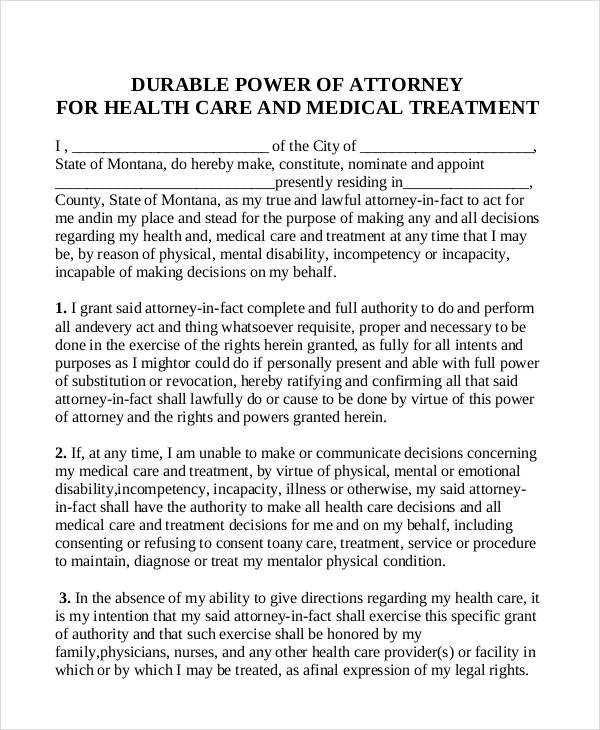

Medical Power of Attorney

A medical power of attorney is one type of health care directive -- that is, a document that set out your wishes for health care if you are ever to...

Financial Power of Attorney

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf....

What is a power of attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.

What happens if you don't have a durable power of attorney?

If you haven't made durable powers of attorney and something happens to you, your loved ones may have to go to court to get the authority to handle your affairs. To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances.

Can a power of attorney prevent accidents?

While medical and financial powers of attorney can't prevent accidents or keep you young, they can certainly make life easier for you and your family if times get tough.

How many separate documents do you need for a power of attorney?

To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances. Fortunately, powers of attorney usually aren't difficult to prepare.

What does a health care agent do?

Your health care agent will work with doctors and other health care providers to make sure you get the kind of medical care you wish to receive. When arranging your care, your agent is legally bound to follow your treatment preferences to the extent that he or she knows about them.

What is a financial power of attorney?

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf. Some financial powers of attorney are very simple and used for single transactions, such as closing a real estate deal.

Why do you need separate documents for your health insurance?

Making separate documents will keep life simpler for your agent and others. For example, your health care documents are likely to be full of personal details, and perhaps feelings, that your financial broker doesn't need to know. Likewise, your health care professionals don't need to be burdened with the details of your finances.

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What is the purpose of a durable POA?

The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you're no longer capable of making decisions.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What Is the Difference Between Durable and Medical Power of Attorney?

If you are looking to appoint someone to make decisions on your behalf, it is imperative to know what a power of attorney and a health care directive is. The basic difference between a durable and medical power of attorney lies in the amount of control it gives the appointed person over you.

Who Can This Power Be Transferred To?

You are allowed to appoint one or more people to act as your power of attorney. In most cases, it would be:

How To Create a Power of Attorney Document on Your Own

If you decide to create a living will or medical power of attorney on your own, you will need to fill out a living will or an advanced directive form. You will be required to include the following information in your form:

Having Trouble Crafting a Medical Power of Attorney Document? DoNotPay Can Help

Creating a living will can be expensive, regardless of whether you hire a lawyer or do it yourself. DoNotPay offers a solution that can save you a lot of time, money, and effort in drafting a power of attorney document. All you have to do is:

Fight Corporate Greed With DoNotPay

Greedy companies may take advantage of your time and money, but you shouldn’t take it lying down. DoNotPay is here to help you get what you’re owed and protect yourself!

Strapped for Cash? Earn Some Money With the Help of Our App!

You may need help paying your bills, getting what you’re owed, or earning some extra money. Whatever the case, DoNotPay is your go-to.

What is a Power of Attorney?

A power of attorney is a legal contract that grants someone the authority to act on someone else’s behalf. The elected person will be able to make important decisions regarding your assets, wealth, mortgages, loans, trade deals, and healthcare.

How to Elect a Power of Attorney for Healthcare

If you are wondering how to get power of attorney then you will have to find someone who will willingly and knowingly sign the document of the power of attorney and take on the responsibilities. To find the right person, consider the following things.

Why Elect a Power of Attorney for Healthcare?

Simply put, you should select a power of attorney to help you live a long and healthy life.

Cost of Keeping a Power Of Attorney

You will be glad to hear that the cost of a power of attorney is nothing! The only thing you need to pay for is the document where everything will be written and finalized with your, the attorney’s, and the lawyer’s signature. You need to notarize the paper which is around $50.

Final Thoughts

Accidents can happen at any time. It is in your best interest to have someone legally by your side to help you make important health care decisions so you can live a healthy life. A power of attorney is a useful option and should be someone you trust and has medical experience if possible. The process is simple and, best of all, virtually free!

Why is a durable power of attorney different from a power of attorney?

While similar, a durable power of attorney is different because it is a much more formal estate planning document. Most of the time, a durable power of attorney is in case you become ill or incapacitated and can no longer manage your own finances.

Can a power of attorney make a health care decision?

In almost all cases, a power of attorney does not give someone the authority to make health care decisions for you. Instead, advanced health care directives, also known as appointing a health care proxy, perform this kind of function. Essentially, health care directives empower a trusted person to make medical decisions on your behalf.

What is a power of attorney?

In simple terms, a power of attorney allows a person to grant another person the power to make decisions on one’s behalf. This type of power of attorney can be used for general purposes or for a specific purpose.

Can a power of attorney be canceled?

In most cases, people can choose anyone to act on their behalf, and the power of attorney designation can be canceled at any time by either party. This type of power of attorney may also contain a clause specifying when and under what conditions a limited power of attorney will end.

Does a power of attorney give someone authority to make health care decisions?

How Health Care Directives Differ. In almost all cases, a power of attorney does not give someone the authority to make health care decisions for you. Instead, advanced health care directives, also known as appointing a health care proxy, perform this kind of function.

What is a health care directive?

Essentially, health care directives empower a trusted person to make medical decisions on your behalf. The document does not cover financial decisions, which is why this legal tool is different from a power of attorney.

Can a physician act as a proxy?

Some states will allow the subject’s physician to act as a health care proxy, while other states believe this represents a conflict of interest and will not allow the practice. These designations show why everyone can benefit from estate planning, no matter the size of your estate.

What is durable power of attorney?

A durable power of attorney is the most common document of its kind, and the coverage afforded by the form is sweeping. It allows the agent to make financial, business and legal decisions on behalf of a principal, and the durability aspect extends the agent’s powers to during an event of incapacitation.

What does it mean if you don't have a POA?

The absence of a durable and/or medical POA can mean that family members will not be able to access accounts to pay for healthcare, taxes, insurance, utilities, and other important matters, and they won’t have clear instructions as to how to care for you if you should be faced with incapacitation.

Can you have both powers in estate planning?

Both. While situations may vary from person to person, estate planning and emergency preparation involves having both powers assigned so that you’re covered financially and medically. When an individual becomes incapacitated, bills and other responsibilities don’t get put on pause.

What is a living will?

Living Will – usually paired with a medical power of attorney. If this form isn’t included, you’ll want to create one as it puts your medical wishes into writing. Last Will and Testament – designates who gets what upon your passing.

What is the difference between an agent and a principal?

Principal – the person handing over decision-making powers. Agent – the chosen individual to manage affairs, usually someone the principal deeply trusts , such as a close family member (also called an “attorney in fact”) Incapacitation – when the principal is no longer able to make decisions for themselves .

Popular Posts:

- 1. who is the male attorney for dr ford

- 2. who determines who the closing attorney is the buyer or seller

- 3. family law how long does attorney have to file order

- 4. how much should a power of attorney cost?

- 5. who is your medical power of attorney if you're unconscious

- 6. who can notarize a power of attorney in washington state

- 7. why you should have an attorney for real estate purchase or sale

- 8. what attorney was involved with palo alto buena vista mobile home park

- 9. how much an attorney charge for bankrupcies

- 10. attorney who handles wills and estates