What is the form for power of attorney?

Sep 23, 2021 · Log in to your online MyFTB account to view, edit, or revoke your POA Declaration (s). Call us at 1-800-852-5711 and reference the associated Declaration ID number. Send us a completed FTB 3520 RVK, Power of Attorney Declaration Revocation.

What is the tax form for power of attorney?

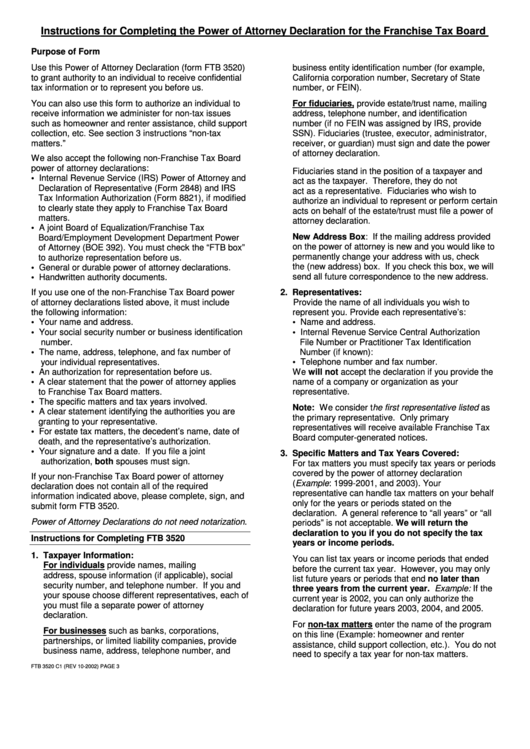

Jan 13, 2020 · Tax Professional: Power of Attorney (POA) Declaration - Submit Form 3520 (PIT or BE) The POA declaration is a legal document that allows your client to authorize a specific individual(s) to receive confidential information and represent them in all matters before the Franchise Tax Board (FTB). The preferred method to submit a POA declaration is through MyFTB.

What is the power of attorney form?

FTB 3520 PIT Individual or Fiduciary Power of Attorney Declaration. 8551213FTB 3520-PIT 2021 Side 1. (If a joint tax return is filed, each spouse/Registered Domestic (Estate or Trust - FEIN required) Partner (RDP) must complete their own POA Declaration) IndividualFiduciary. Individual (first name, middle initial, last name, suffix) or name of estate or trust FEIN Phone SSN or ITIN …

How to get power of attorney?

Franchise Tax Board Business Entity or Group Nonresident Power of Attorney Declaration CALIFORNIA FORM 3520-BE Use this legal document to authorize a specific individual(s) to receive confidential information and represent you in all matters before the Franchise Tax Board (FTB). Part I – Business Entity Information. Check only one box below.

How do I submit a POA to the FTB?

- Choose the correct form. ...

- Fill out the form correctly. ...

- Sign the form. ...

- Provide supporting documentation, if necessary, such as: ...

- Submit the form. ...

- After you submit.

What is form 100W California?

Where do I file a 3520?

What is a POA for FTB?

What is Form 100X?

What is a 109 tax form?

What is the difference between Form 3520 and 3520-A?

Form 3520 “Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts” and Form 3520-A “Annual Information Return of Foreign Trust With a U.S. Owner.” Both forms involve Foreign Trust Reporting.

Do I need a CAF number for POA?

Who files Form 3520?

You're only required to file this form if you received: A gift of more than $100,000 from a foreign person or estate. A gift of more than $15,601 from a foreign partnership or corporation.

Does power of attorney need to be notarized in California?

How do I get power of attorney for elderly parent in California?

- Talk to Your Parent. Your parent must be mentally competent to make his or her own decisions. ...

- Gather the paperwork. ...

- Fill out the paperwork (Do not sign yet!) ...

- Meet with a Notary to Sign. ...

- File the Form Appropriately.

How do I get power of attorney in CA?

3. Sign the form

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following:

5. Submit the form

Online through MyFTB#N#11#N#. In the services menu, select File a Power of Attorney.

6. After you submit

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer.

What is the FTB 3520-PIT form?

Use form FTB 3520-PIT to authorize an individual to represent you in any matter before FTB, and to request, receive and inspect your confidential tax information. Information that FTB may release includes, but is not limited to estimated payments, notices, account history or compliance status. FTB may release information by phone, in person, in writing, or online via MyFTB.

Do you need a FEIN for a POA?

A FEIN is required for estates or trusts and an SSN is required for deceased individuals. If this POA Declaration is for a grantor trust and the IRS did not provide a FEIN, provide the individual’s SSN.

What is a fiduciary in tax?

A fiduciary stands in the position of an individual and acts as the individual, not as a representative. To authorize an individual to receive confidential tax information on behalf of the individual, estate, or trust, the fiduciary must file form FTB 3520-PIT, and include supporting documents establishing the fiduciary’s authority, such as a certificate of trustee (as provided by Probate Code section 15603), court order, governing instrument, or letters issued by a court (as provided by Probate Code sections 2310 or 8405). If federal Form 56, Notice Concerning Fiduciary Relationship, is required to be filed with the IRS, attach a copy to form FTB 3520-PIT, with supporting documents.

Important Information

Beginning January 1, 2019, our online submission process and our Power of Attorney (POA) Declaration form allow you to request full online account access for your tax professional at the time of submission. See Part V, Request or Retain MyFTB Full Online Account Access for Tax Professional (s).

General Information

To file a POA Declaration use the online submission in MyFTB for faster processing. However, the following paper forms are available for taxpayers without online access:

Specific Line Instructions

To ensure form FTB 3520-BE is processed accurately, it is important that all requested information is included when available.

What is POA declaration?

The POA declaration is a legal document that allows your client to authorize a specific individual(s) to receive confidential information and represent them in all matters before the Franchise Tax Board (FTB). The preferred method to submit a POA declaration is through MyFTB. If you need specific information on how to complete the POA declaration, ...

How many years after a POA declaration can you declare?

specific years or income periods to be covered by this POA declaration. You may designate current, past, or future years that end no later than five years after the POA declaration is signed.

What is the Enter Representative Information page?

Enter Representative Information page allows you to enter the new representative’s name, ID number(s), and contact information. You can save this representative to your Associates List to use on future POA declarations.

Important Information

- Our online submission process and our Power of Attorney (POA) Declaration form allow you to request full online account access for your tax professional at the time of submission. See Part V, Request or Retain MyFTB Full Online Account Access for Tax Professional(s). 1. For purpose of these instructions, a tax professional is a representative that has a professional identification nu…

General Information

- To file a POA Declaration, use the online submission in MyFTB for faster processing. However, the following paper forms are available for individuals without online access: 1. Form FTB 3520-PIT,Individual or Fiduciary Power of Attorney Declaration, authorizes an individual to represent and receive confidential information on all matters before FTB for an individual, estate, or trust. 2. Fo…

A. Purpose

- Use form FTB 3520-PIT to authorize an individual to represent you in any matter before FTB, and to request, receive and inspect your confidential tax information. Information that FTB may release includes, but is not limited to estimated payments, notices, account history or compliance status. FTB may release information by phone, in person, in wri...

B. General Authorizations

- The representative(s) listed in Side 1, Part II, Representative(s) and on Side 4 of form FTB 3520-PIT, will be authorized as attorney(s)-in-fact to: 1. Talk to FTB agents about your account. 2. Receive and inspect your confidential information. 3. Represent you in all matters before FTB. 4. Request information we receive from the Internal Revenue Service (IRS). If additional authorizati…

C. Duration

- Generally, a POA Declaration will remain in effect until any of the following occurs: 1. The expiration, which is generally six yearsfrom the date the POA Declaration is signed. 2. A POA Declaration Revocation is filed. 3. The POA relationship is revoked online in MyFTB. Important: Submitting this form FTB 3520-PIT will not revoke any previously submitted POA Declarations wi…

D. Where to File

- Use one of the following methods to file form FTB 3520-PIT: 1. For faster processing, submit electronically. Go to ftb.ca.gov, log in to MyFTB, and select File a Power of Attorney. For more information, go to ftb.ca.gov/poa3. 2. Mail form FTB 3520-PIT separately from the tax return(s) or other correspondence to the following address: Mail 1. POA/TIA Unit Franchise Tax Board PO Bo…

E. Revocations

- Individuals, estates, or trusts: It is your responsibility to revoke your POA Declaration when you are no longer working with a representative. Representatives: If you no longer represent a taxpayer, it is your responsibility to revoke a POA Declaration to ensure you do not receive confidential information you are not entitled to access. To revoke a POA Declaration, get form FTB 3520-RVK…

F. Fiduciary

- A fiduciary stands in the position of an individual and acts as the individual, not as a representative. To authorize an individual to receive confidential tax information on behalf of the individual, estate, or trust, the fiduciary must file form FTB 3520-PIT, and include supporting documents establishing the fiduciary’s authority, such as a certificate of trustee (as provided by …

G. Representative Notices

- We do not mail copies of most notices to POA representatives. POA representatives who provide a valid email address on the POA Declaration will receive electronic notifications each time we send a notice to one of their clients. Representatives with a MyFTB account, who do not provide an email address, will be able to view the notices for their clients. However, the representative wi…

H. Termination

- When an individual dies and a death certificate is filed with us, or we are otherwise notified of their death, we will revoke the POA Declaration on file. A new POA Declaration may be established for the legal representative of the decedent and/or their estate. The legal representative of the decedent or their estate, as established under the Probate Code, has authority to act on behalf o…

Important Information

General Information

A. Purpose

B. General Authorizations

C. Duration

D. Where to File

- Use one of the following methods to file form FTB 3520-BE: 1. For faster processing, submit electronically. Go to ftb.ca.gov, log in to MyFTB, and select File a Power of Attorney. For more information, go to ftb.ca.gov/poa3. 2. Mail form FTB 3520-BE separately from the tax return(s) or other correspondence to the following address: Mail 1. POA/TIA ...

E. Revocations

F. Representative Notices

Specific Line Instructions

Popular Posts:

- 1. who is the settlor of a trust your attorney?

- 2. what verbiage to use in durable power of attorney

- 3. what is the client attorney information release form

- 4. why would attorney no longer represent

- 5. who signs ny attorney general resignations

- 6. when an attorney signs a pleading or motion, she is telling the court that ...

- 7. how to find out if an attorney is disbarred

- 8. where does the virginia attorney general stand on guns

- 9. where do i find attorney for bad perimedics

- 10. when was sc attorney mike hostello kidnapped