A durable power of attorney generally gives your agent the ability to make decisions about your financial, legal, business, as well as health care matters. It’s called durable because it remains valid even after you become indisposed. A medical power of attorney only gives your agent control over all your medical decisions.

How to supersede a medical power of attorney?

Oct 08, 2020 · A durable power of attorney is the most common document of its kind, and the coverage afforded by the form is sweeping. It allows the agent to make financial, business and legal decisions on behalf of a principal, and the durability aspect extends the agent’s powers to during an event of incapacitation.

How do you obtain medical durable power of attorney?

A durable power of attorney generally gives your agent the ability to make decisions about your financial, legal, business, as well as health care matters. It’s called durable because it remains valid even after you become indisposed. A medical power of attorney only gives your agent control over all your medical decisions.

What does durable mean in a durable power of attorney?

Feb 20, 2019 · The durable power of an attorney simply means that the documents you sign stay in effect if you become unable to handle things on your own and are unable to make any decisions for yourself. Regular powers of attorney that aren’t labeled as durable will automatically end when the person who makes the decisions loses mental capacity.

Is it necessary to have a durable power of attorney?

Nov 24, 2017 · There are two main types of power of attorney; a durable power of attorney for finances and a medical power of attorney. The durable power of attorney. By granting someone durable power of attorney, you are essentially giving him or her decision-making power over your financial, legal and business interests. The “durable” part refers to the fact that this type …

What is the most powerful power of attorney?

A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

What does Durable power of attorney mean in medical terms?

Durable power of attorney for health care is a legal document that gives another person the authority to make a medical decision for an individual. The person named to represent the individual is referred to as an agent or attorney-in-fact.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

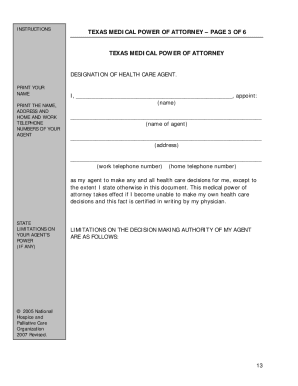

Who makes medical decisions if there is no power of attorney Texas?

Provides that if an individual is incompetent or unable to communicate his or her own medical decisions and no guardian or representative with Medical Power of Attorney has been appointed, then medical decisions may be made by the attending physician with the cooperation of one of the following people: the patient's ...

What does it mean to have a durable power of attorney?

The durable power of an attorney simply means that the documents you sign stay in effect if you become unable to handle things on your own and are unable to make any decisions for yourself. Regular powers of attorney that aren’t labeled as durable will automatically end when the person who makes the decisions loses mental capacity.

What does a power of attorney do?

With the power of an attorney, the person whom you choose will then be legally permitted to take care of your needs and your important life decisions. For example, this person will take care of paying your bills, directing your medical care, and managing all your finances.

Do you need separate documents for medical care?

You are going to need separate documents for medical care and for your finances. This needs to happen in order to make things easier for your agent and for other people who will be helping.

What is a health care power of attorney?

A health care power of attorney, on the other hand, is similar to a durable power of attorney for finances in that it grants someone else decision-making power over your affairs. However, as the name indicates, this type of power of attorney grants someone else the power to make important decisions ...

What are the two types of power of attorney?

There are two main types of power of attorney; a durable power of attorney for finances and a medical power of attorney.

What happens if you don't have a power of attorney?

If you become unable to make decisions on your own behalf without giving someone power of attorney, your loved ones will not be able to make important decisions regarding finances, business interests and so on.

Why do we need powers of attorney?

Giving those you trust powers of attorney can help ease your own concerns about aging and your future, but it can also help your loved ones avoid unnecessary trouble during what may already be an emotional and stressful time.

What is a power of attorney?

A power of attorney is a document that one party (the principal) uses to appoint another party as their agent. The agent gets the power to make medical or financial decisions on behalf of the principal. There are a few different POA types: Solve My Problem. Get Started.

What is a medical POA?

Medical Power of Attorney. A medical POA is also known as a health care proxy. This document grants an agent the power to make health care and end-of-life decisions on behalf of the principal. Those decisions can refer to surgeries, drugs, treatment options, and similar.

What is a POA?

A general POA permits an agent to act on behalf of the principal in any and all matters in accordance with state law. The agent can make decisions regarding financial and health care matters.

What is durable POA?

A durable POA enables an agent to act in the principal’s stead in legal and financial matters. The document has to specify the exact powers it will grant. Generally, an agent can: Deal with different legal matters. Handle businesses.

How to create a POA?

If you want to create it, you’ll need to follow the steps below: Decide who your agent is going to be. Download or buy a POA form. Define the powers granted. Sign the document before a notary to give it legal weight (in some states, powers of attorney don’t need to be notarized, but it’s highly recommended)

What is a power of attorney?

A power of attorney is a legal document through which you, as the principal, name someone to have the authority to make decisions and take actions on your behalf. This person is called your agent or attorney-in-fact. Note that the person you name does not have to be an attorney. A durable power of attorney, sometimes called a DPOA for short, ...

How long does a durable power of attorney last?

A durable power of attorney generally remains in effect until the principal revokes the powers or dies, but can also be terminated if a court finds the document invalid or revokes the agent's authority, or if the principal gets divorced and the spouse was the agent.

What is a durable power of attorney?

A durable power of attorney can be for medical use or financial use, depending on what it is intended to cover. In this case “durable” just means that the terms of the POA will still be valid after the person is incapacitated or otherwise unable to make decisions on their own behalf.

What is a durable medical POA?

As an estate planning document, a durable medical POA is essential because it enables you to name an agent that is responsible for making medical decisions on your behalf. The agent may be anyone you wish: 1 Partner 2 Sibling 3 Friends 4 Anyone

Why is a POA important?

As an estate planning document, a durable medical POA is essential because it enables you to name an agent that is responsible for making medical decisions on your behalf. The agent may be anyone you wish: The document lasts until it is revoked or you're able to make decisions on your own again.

What is a POA?

A durable medical power of attorney ( POA) is one of the most important documents in your estate plan. This important health care directive allows you, when of sound mind, to appoint someone that will make your medical decisions on your behalf if you're incapacitated or unable to make decisions on your own.

What are the different types of power of attorney?

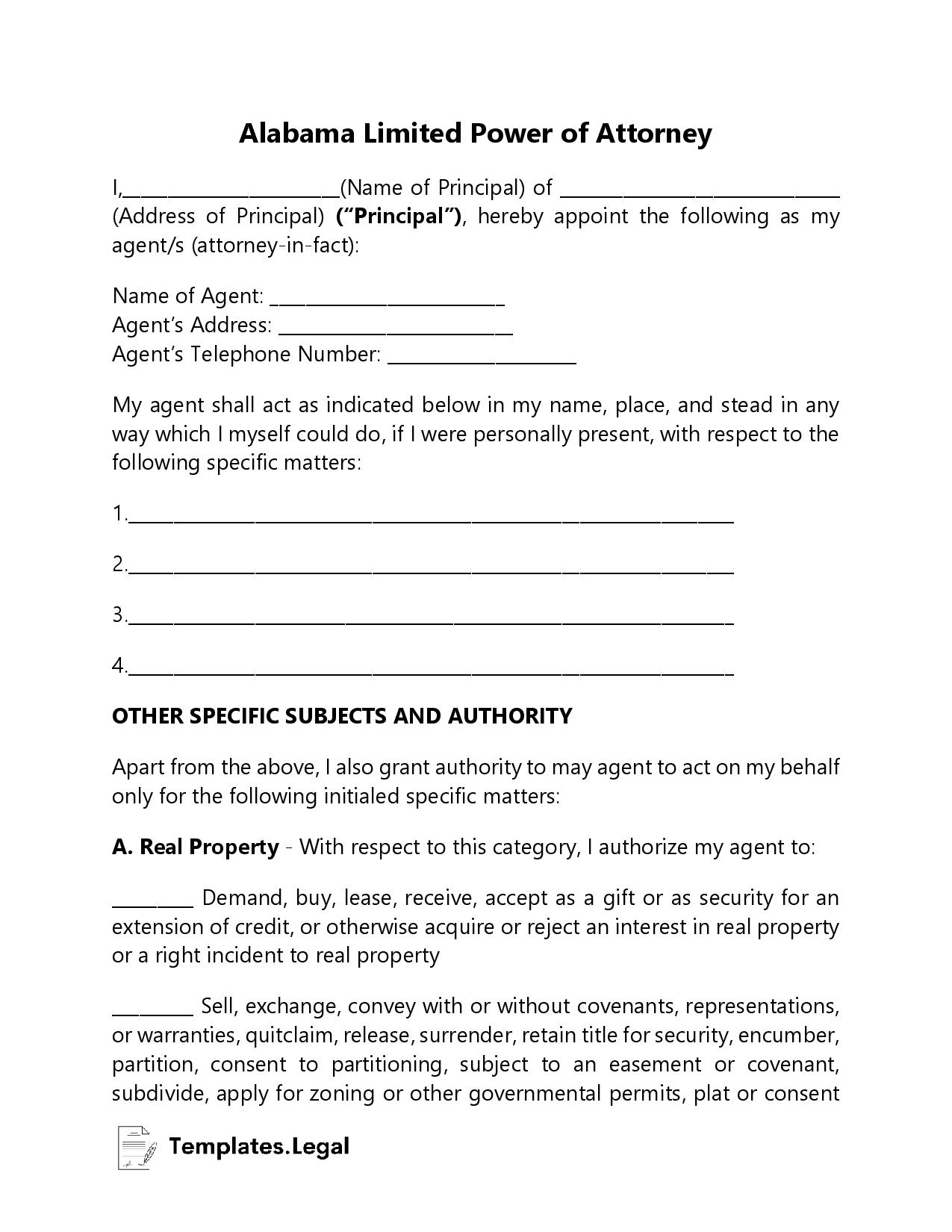

In general, however, the different types of power of attorney can be classified into one of the following categories: - Durable Power of Attorney. - Medical Power of Attorney. - General Power of Attorney. - Limited (Special) Power of Attorney.

What is a medical POA?

A medical POA is a directive that is dictated to the exact wants of the person having the directive drafted. When drafted, the medical POA can have: Each state is allowed to have its own set of rules for this health care directive, and it may need to be: Technically, you don't need an attorney to help you draft a basic medical power of attorney, ...

What happens if you don't have a POA?

If you don't have a medical POA, the court will often appoint someone to act on your behalf. This is referred to as “guardianship.”. Here is a video that discusses the differences between a POA and guardianship. When you don't have a health care directive in place, doctors will continue to do everything in their power to save your life.

What is a power of attorney?

In general, a power of attorney is a document authorizing an individual to make decisions on behalf of another person. The person who gives the authority is called the principal, and the person who has the authority to act for the principal is called the agent, or the attorney-in-fact. You can designate both a financial power ...

What is a financial power of attorney?

A financial power of attorney permits someone you have designated (your agent, or attorney-in-fact) to oversee your finances. Typically, it is used so the person can step in and pay your bills or handle other financial or real estate matters. It can be a designation for a financial professional acting on your behalf, or you may use it to designate a trusted friend or family member to handle matters if or when you cannot physically or mentally do so yourself. In some cases it may also be used for isolated, one-off situations where it is not convenient for you to be present, such as a real estate closing in another city.

Why is it important to review a power of attorney?

Review the Document Periodically: Because it may be hard to predict when you will need a power of attorney, the document may be created decades before it will be used. For this reason, it is important to review the document periodically.

When does a power of attorney go into effect?

The medical power of attorney will only go into effect when you do not have the capacity to make decisions for yourself regarding medical treatment.

Who is Hanna Rubin?

Hanna Rubin is the director of registrations for the NY State Attorney General’s charity bureau with 20+ years of experience as an executive editor. Anthony Battle is a financial planning expert, entrepreneur, dedicated life long learner and a recovering Wall Street professional.

Do you need a power of attorney for a living trust?

Likewise, if an individual has a living trust that appoints a person to act as a trustee, then a power of attorney may not be necessary. Identify an Agent: One adult will be named the agent in a power of attorney. An attorney, a faith leader, or a family counselor can all help facilitate this decision-making process.

Do you need to notarize a power of attorney?

Notarize the Power of Attorney: Once a power of attorney is written, it generally needs to be notarized. A verbal agreement is not recognized as a legal power of attorney, nor is a casually written letter or note. Once a power of attorney is written and notarized, keep a copy safely stored.

Popular Posts:

- 1. attorney who is friends with opposing party

- 2. living trust: why an attorney over legal zoom?

- 3. how does an attorney register for efiling in the federal system

- 4. why did harvey birdman attorney at law get cancelled

- 5. who is power of attorney when you have no relatives

- 6. what does power of attorney for finances mean

- 7. who is attorney mary l. smith

- 8. what to do with power of attorney when someone is incapacited

- 9. how much do you pay an attorney

- 10. if i show up to court with no attorney present what happens