A person with power of attorney has the authority to manage limited benefits. A power of attorney can’t negotiate federal payments such as Social Security checks. So, if you need to handle affairs for someone unable to manage their benefits, you’ll need to apply for Representative Payee.

Full Answer

What is an Illinois Power of attorney for health care?

In Illinois, your power of attorney is durable by default (meaning it remains effective after your incapacitation) unless you explicitly state otherwise in the document. 2. Sign the POA in the Presence of a Notary Public. As mentioned, you can't simply sign the document and call it a day.

How do I create a power of attorney in Illinois?

Aug 02, 2021 · An Illinois Power of Attorney for Health Care has been created by the Illinois legislature. This form must be signed by the principal and one witness. It does not need to be notarized. Like the financial form, this form includes detailed instructions, including an explanation of the types of persons who may not serve as a witness.

Can a power of attorney negotiate Social Security benefits?

State of Illinois . Illinois Department of Public Health . Illinois Statutory Short Form . Power of Attorney for Health Care . NOTICE TO THE INDIVIDUAL SIGNING . THE POWER OF ATTORNEY FOR HEALTH CARE . No one can predict when a serious illness or accident might occur. When it does, you may need someone else to speak or make health ...

When does a power of attorney end in Illinois?

Health Care Power of Attorney for _____ Signed _____ Statutory ShortForm Powerof Attorney for Health Care - Effective JULY 30, 2021 . NOTICE TO THE INDIVIDUAL SIGNING THE POWER OF ATTORNEY FOR HEALTH CARE . No one can predict when a …

Does Social Security recognize a power of attorney?

No. The Social Security Administration does not recognize power of attorney as conferring authority to manage another person's benefits. Nor is it sufficient to have your name on your mother's bank account or be her authorized representative.

What does power of attorney mean in Illinois?

Posted on July 30, 2019. A power of attorney allows a person (known as a “principal”) to appoint a representative (or agent) to manage their property and affairs in the event they are no longer able to do so for themselves.Jul 30, 2019

How do I add POA to Social Security?

If you decide to appoint someone to help you with your case, you must tell us in writing. You can sign and submit a written statement appointing the person, or use our standard form SSA-1696, Appointment of Representative.

What is financial power of attorney Illinois?

If you want to ensure that your financial needs are met if you become incapacitated, you should have a financial power of attorney. A financial power of attorney allows you to choose someone to make decisions for you. If you do not have one, a court will decide who should care for you when you cannot care for yourself.Jan 25, 2022

What are the 3 types of power of attorney?

Here are examples of the types of Alberta POAs that you may need:Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ... General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ... Enduring Power of Attorney. ... Durable Power of Attorney.Feb 1, 2022

Can family members witness a power of attorney?

An attorney's signature must also be witnessed by someone aged 18 or older but can't be the donor. Attorney's can witness each other's signature, and your certificate provider can be a witness for the donor and attorneys.Aug 26, 2021

What can SSI be used for?

You can only use money in a dedicated account for the following expenses: Medical treatment and education or job skills training. Personal needs related to the child's disability — such as therapy and rehabilitation, special equipment, and housing modifications.

What is SSI vs SSDI?

The major difference is that SSI determination is based on age/disability and limited income and resources, whereas SSDI determination is based on disability and work credits. In addition, in most states, an SSI recipient will automatically qualify for health care coverage through Medicaid.

Why do I need a SSI payee?

We appoint a payee to receive the Social Security or SSI benefits for anyone who can't manage or direct the management of his or her benefits. . A payee's main duties are to use the benefits to pay for the current and future needs of the beneficiary, and properly save any benefits not needed to meet current needs.

Can power of attorney withdraw money?

Can a power of attorney borrow money? So, a property and financial Power of Attorney can give themselves money (with your best interests in mind). But you may be concerned about them borrowing money from you, or giving themselves a loan. The answer is a simple no.Jun 18, 2021

Does an Illinois power of attorney need to be notarized?

It does not need to be notarized. Like the financial form, this form includes detailed instructions, including an explanation of the types of persons who may not serve as a witness. This form may be found in the Illinois Compiled Statutes, Chapter 755, Article 45, Section 4-10.

How long does it take for power of attorney?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

How old do you have to be to get a power of attorney in Illinois?

The basic requirements for a power of attorney in Illinois for financial matters are that it must: For both financial and healthcare POAs, agents and witnesses must be at least 18 years of age. There are limitations as to who may be a witness.

What is a POA in Illinois?

Let's look at the state of Illinois requirements for granting Power of Attorney. A legal document called a power of attorney ( or POA) can assure that your financial and healthcare matters are taken care of in the event you can't be present to sign documents, or if you become incapacitated.

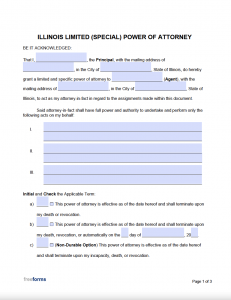

What is a POA in financial terms?

A financial POA giving the agent broad powers to represent the principal in just about any matter is called a "general" POA. A "limited" or "special" POA is one that limits the agent's authority in some way, such as limiting it to a single transaction, a certain type of transaction, or to a limited amount of time.

Do you need to notarize a financial form in Illinois?

It does not need to be notarized. Like the financial form, this form includes detailed instructions, including an explanation of the types of persons who may not serve as a witness. This form may be found in the Illinois Compiled Statutes, Chapter 755, Article 45, Section 4-10.

How to become a power of attorney for Medicare?

If you want to be the representative payee for someone on Social Security, go to the local office. At the Social Security office, submit a letter from the recipient’s doctor that states the need for a representative payee. Also, you’ll need to have proof of identity.

What is a durable power of attorney?

Durable Power of Attorney gives financial legal authority to an agent when the principal is either capable or incapable. Conventional Power of Attorney is granted to the agent when the principal is unfit.

When is a springing power of attorney granted?

Conventional Power of Attorney is granted to the agent when the principal is unfit. Springing Power of Attorney only occurs when the document is signed, and it stays in effect throughout the principal’s life. An attorney can notarize any documents in your state. Each state has different rules.

Is a power of attorney enough for Medicare?

Is Having a Standard Power of Attorney Enough for Medicare? Having a standard power of attorney isn’t enough when it comes to Medicare or Social Security. Standard power of attorney allows you to handle most of the finances; but, it doesn’t allow you to make health care choices.

Can a power of attorney negotiate Social Security?

A person with power of attorney has the authority to manage limited benefits. A power of attorney can’t negotiate federal payments such as Social Security checks. So, if you need to handle affairs for someone unable to manage their benefits, you’ll need to apply for Representative Payee.

Does Medicare recognize power of attorney?

Yes, Medicare recognizes power of attorney as legal authorization when someone else is acting on behalf of the beneficiary. Does a representative payee have limits? Unless you’re the guardian, you can’t sign a legal document for the beneficiary.

What is the grant of power for autopsy?

The above grant of power is intended to be as broad as possible so that your agent will have the authority to make any decision you could make to obtain or terminate any type of health care. If you wish to limit the scope of your agent's powers or prescribe special rules or limit the power to authorize autopsy or dispose of remains, you may do so specifically in this form.

Who can act as an agent for a health care agency?

Section 4-5. Limitation on health care agencies. Neither the attending physician nor any other health care provider may act as agent under a health care agency; however, a person who is not administering health care to the patient may act as health care agent for the patient even though the person is a physician or otherwise licensed, certified, authorized, or permitted by law to administer health care in the ordinary course of business or the practice of a profession.

What is a power of attorney?

Power of attorney is a legal process where one individual grants a third party the authority to transact certain business for that individual. It does not lessen the rights of the individual and does not usually grant the third party the right to manage the individual's assets.

What is the law regarding Social Security?

Social Security law and regulations require payees to use the payments they receive for the current needs of the beneficiary and in their best interests. While serving as a representative payee, we encourage you to go beyond just managing payments and be actively involved in the beneficiary’s life.

What is a beneficiary in Social Security?

A beneficiary is a person who receives Social Security and/or Supplemental Security Income (SSI) payments. Social Security and SSI are two different programs. we administer both. Who Needs a Representative Payee? The law requires most minor children and all legally incompetent adults to have payees.

What is a payee in social services?

A community based, nonprofit social service organization, bonded and licensed in the state in which it serves as payee, or. A state or local government agency responsible for income maintenance, social service, health care, or fiduciary duties, and. Regularly serves as a payee for at least five beneficiaries, and.

What is a representative payee?

A representative payee is a person or an organization. We appoint a payee to receive the Social Security or SSI benefits for anyone who can’t manage or direct the management of his or her benefits. . A payee’s main duties are to use the benefits to pay for the current and future needs of the beneficiary, and properly save any benefits not needed ...

What to do with money left after meeting the beneficiary's current needs?

Save any money left after meeting the beneficiary’s current needs in an interest bearing account or savings bonds for the beneficiary's future needs ; Report any changes or events which could affect the beneficiary's eligibility for payments; Keep records of all payments received and how you spent and saved them;

Is a power of attorney the same as a payee?

Being an authorized representative, having power of attorney, or a joint bank account with the beneficiary is not the same as being a payee. These arrangements do not give legal authority to negotiate and manage a beneficiary's Social Security and/or SSI benefits. In order to be a payee, you must apply for and be appointed by Social Security.

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

Who is a fiduciary under a power of attorney?

A person who acts under a power of attorney is a fiduciary. A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing.

Popular Posts:

- 1. how does california resident give power of attorney to texas resident

- 2. what is the disadvantage to hiring an attorney for a crash

- 3. former ohio lawyers who worked for the attorney general

- 4. who are dr.christine ford' attorney?

- 5. ginny, who is the outgoing district attorney, is going to work for our firm. grammer corrector

- 6. : why do the women go to so much trouble to hide the dead canary from the county attorney?

- 7. who does the chapter 11 attorney owe a duty to?

- 8. how to get district attorney to drop charges

- 9. what was the name of the movie with kim bassinger and uma thurman with righard gere at the attorney

- 10. what is the range of contingent attorney fees?