How do you create a durable power of attorney?

Subscribe to DoNotPay and learn everything you need to know about how a power of attorney works in New York state. What Is a Durable Power of Attorney in NY? A power of attorney (POA) is a document that allows an agent to make decisions on behalf of the principal. A durable power of attorney stays in effect even if the principal is physically or mentally ill or until either the …

Does power of attorney need to be notarized in NY?

Sep 16, 2020 · A power of attorney (or POA) is a legal document that gives one person (known as the "agent") the authority to act for another person (known as the "principal"). Typically you use a POA if you can't be present to take care of a financial matter, or you want someone to be able to take care of your finances in the event you become incapacitated. A POA can also be executed …

How to enforce durable power of attorney?

Dec 28, 2020 · A New York durable power of attorney form is a document that grants someone (the “agent”) the legal authority to act and make decisions for another person (the “principal”) in the state of New York. Unlike a regular non-durable power of attorney (POA), a durable power of attorney (DPOA) stays in effect even if the principal becomes incapacitated and legally can’t …

Who can notarized a durable power of attorney?

Durable Power of Attorney— New York This form should be used only by residents of New York who wish to grant or modify the power of a third party (your agent or “Attorney-in-Fact”) to act on your behalf on one or more Fidelity accounts. Do NOT use this form for any custodial, business, defined benefit,

What can I do with a durable power of attorney?

It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

Does a power of attorney have to be recorded in New York?

SHOULD MY NEW YORK DURABLE POWER OF ATTORNEY BE RECORDED AT THE COUNTY CLERK'S OFFICE? It is usually unnecessary to record the power of attorney. Only if a deed or other document is being recorded with the agent's signatures.

Does power of attorney need to be notarized in New York?

In New York, you must notarize the POA and also have it witnessed by two people who are not named in the POA as agents. The notary public can serve as a witness, so you might need to find only one more witness.

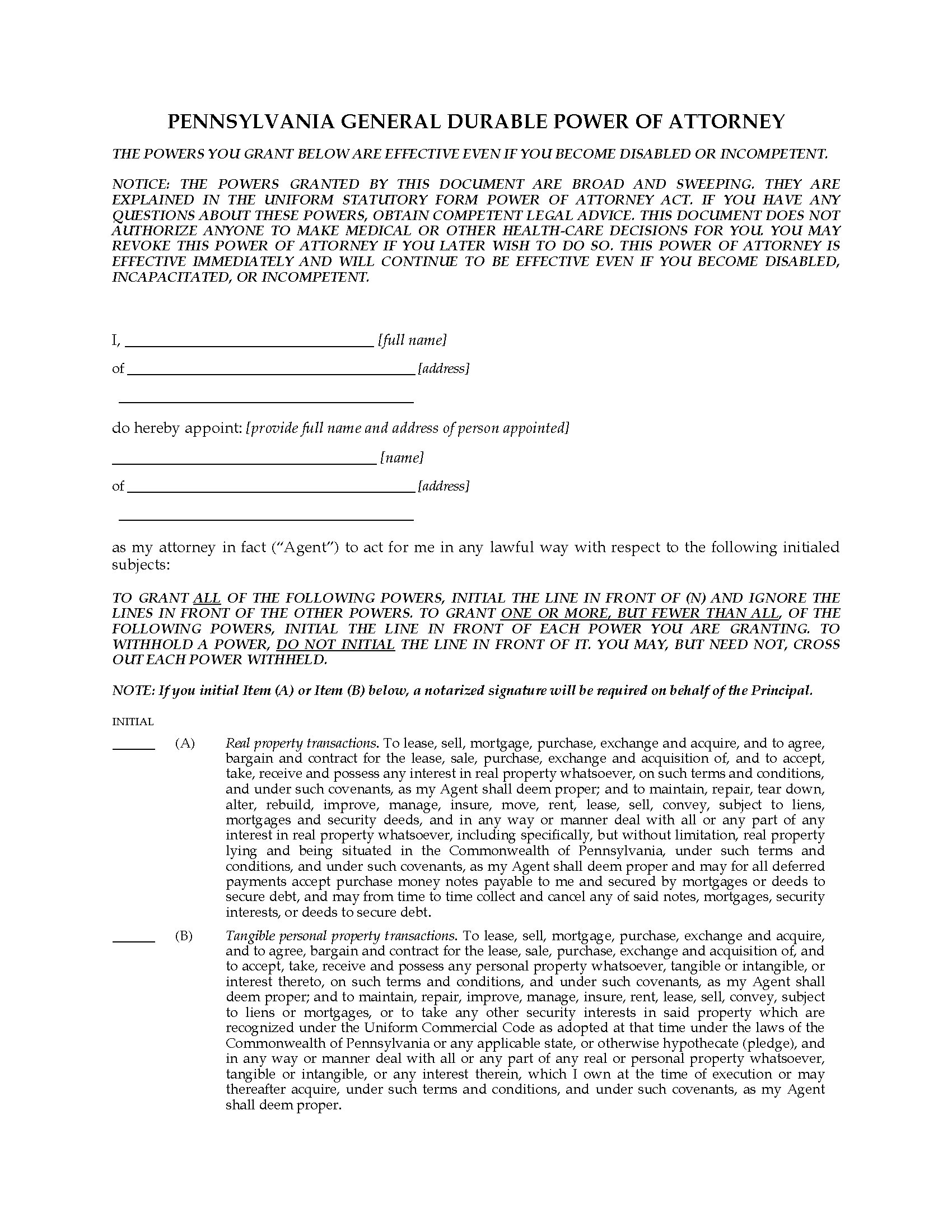

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

Do you need a lawyer to get a Power of Attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Who can witness for Power of Attorney?

Here are the rules on who can witness a lasting power of attorney this time:The witness must be over 18.The same witness can watch all attorneys and replacements sign.Attorneys and replacements can all witness each other signing.The certificate provider could also be a witness.

How much does a Power of Attorney cost in New York?

How much does a Power of Attorney cost in NY? The cost of finding and hiring a lawyer to create a Power of Attorney could be between $200 and $500.

Can I do Power of Attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

How do I get Power of Attorney for elderly parent in NY?

How to Get a POA for Elderly Parents in Good HealthTalk it through with your parent(s) At this point, you should have a better idea of what type of power of attorney would suit your situation. ... Consult with a lawyer. The laws governing powers of attorney vary from state to state. ... Document your rights. ... Execute the document.

What is the difference between a PoA and a durable PoA?

Note that the person you name does not have to be an attorney. A durable power of attorney, sometimes called a DPOA for short, means there is language within the legal document providing that this power extends to your agent even in the event you become incapacitated and unable to make decisions for yourself.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Jan 13, 2022

What is a durable power of attorney in New York?

A New York durable statutory power of attorney allows a person to hand over powers to their finances to someone else and remains valid during their lifetime. The person giving power (“principal”) can choose to give limited or broad powers to their selected individual (“agent”). The term “durable” is in reference to the form remaining valid ...

What is a power of attorney?

“Power of attorney” means a written document, other than a document referred to in section Gen. Oblig. Law § 1501C of this title, by which a principal with capacity designates an agent to act on his or her behalf and includes both a statutory short form power of attorney and a non-statutory power of attorney (Gen.

What is a durable power of attorney?

A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable.

What is a POA in New York?

The New York legislature has established standardized forms specifying power of attorney (POA) requirements in New York relating to financial matters and to medical issues.Thanks to their efforts, the process of obtaining a POA in New York is relatively easy.

What is a POA?

Power of Attorney 101. A power of attorney (or POA) is a legal document that gives one person (known as the "agent") the authority to act for another person (known as the "principal"). Typically you use a POA if you can't be present to take care of a financial matter, or you want someone to be able to take care of your finances in ...

When does a POA become effective?

Also, traditionally, a POA became effective immediately upon being property signed by the principal. A POA that does not become effective unless and until the principal becomes incapacitated is known as a "springing" power of attorney (which by its nature is also durable).

What is a living trust in New York?

A living trust in New York allows you to place your asset into a trust but still use them during your lifetime. Your beneficiaries inherit them after your death. A revocable living trust (sometimes known as an inter vivos trust) provides many advantages that may make it a desirable part of your estate planning process.

What is a durable power of attorney in New York?

A New York durable power of attorney form is a document that grants someone (the “agent”) the legal authority to act and make decisions for another person (the “principal”) in the state of New York. Unlike a regular non-durable power of attorney (POA), a durable power of attorney ...

What does the principal need to mark on the form?

The principal needs to mark on the form which areas of their life they want to give the agent legal power over. This can be general authority (e.g., operation of a business) or specific authority (e.g., make a loan). They can also write specific instructions about which actions the agent can perform on their behalf.

What is the meaning of "you" in a form?

In Sections 1–5 and 8 of this form, “You,” “you,” and “your” refer to the account owner . In Sections 6 and 7 of this form, “You,” “you,” and “your” refer to the Attorney-in-Fact. In Section 9, “you” refers

Who completes Section 6 and 7?

Sections 6 and 7 must be completed by the Attorney-in-Fact. In this Section 6, “You,” “you,” and “your” refer to the Attorney-in-Fact. Individuals who are being paid for their investment management of the account(s) are not permitted.

Can you name someone as a beneficiary on a 529?

Name others as beneficiaries Add, change, or remove beneficiaries (in accordance with specific account rules) and 529 College Savings Plan successor participants, provided that this does not grant the Attorney-in-Fact the authority to name him/ herself as a beneficiary.

Make a durable POA in New York so someone can help you with your financial matters if you ever become incapacitated

Make a durable POA in New York so someone can help you with your financial matters if you ever become incapacitated.

What Types of Power of Attorneys Are Available in New York?

You can make several different types of POAs.

What Are the Legal Requirements of a Financial POA in New York?

For your POA to be valid in New York, it must meet certain requirements.

Steps for Making a Financial Power of Attorney in New York

New York offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your POA. However, statutory forms are often full of legalese, and it's not always apparent how to fill them out.

Who Can Be Named an Agent in New York?

Legally speaking, you can name any competent adult to serve as your agent. But you'll want to take into account certain practical considerations, such as the person's trustworthiness and geographical location. For more on choosing agents, see What Is a Power of Attorney.

When Does My Durable Financial POA Take Effect?

In New York, unless you've explicitly stated otherwise in the document, your durable financial power of attorney takes effect as soon as you've signed it before witnesses and a notary public.

When Does My Financial Power of Attorney End?

Any power of attorney automatically ends at your death. It also ends if:

Everything you need to know about a power of attorney in New York in 2021

As we said in the beginning, planning for the future is not just about wills and trusts. Proper estate planning can solve many problems in the future. And, for this, it is ideal to have a power of attorney and an agent who can, eventually, execute it. But don’t worry, as we will explain in detail what to do and how.

What is an agent when we talk about power of attorney?

As we said a few lines before, the agent is the person who will appoint the principal. The agent will make medical or other decisions, as well as carry out specific procedures or actions that will be stipulated in the power of attorney.

Is a power of attorney the same as a guardianship?

A power of attorney is a signed document in which a person, the principal, grants power of attorney to a designated agent for the purpose of performing an action or making certain decisions. You should know that a power of attorney is not the same as a guardianship.

Why hire our New York power of attorney experts?

As the saying goes, it is better to be safe than sorry. A properly drafted and executed power of attorney can be the solution to many current and future problems. First of all, it can give you peace of mind as to what will happen to your property and assets if something happens to you or you become incapacitated.

What is the POA form?

Elimination of the Statutory Gift Rider: In general, the POA form is an intricate document made up of two distinct parts, the POA Statutory Short Form and the SGR. Currently, the SGR Form is a separate optional form used if the principal desires to authorize the agent to make gifts of the principal’s assets.

Is a POA valid?

The new legislation creates a presumption that a POA form is valid and permits courts to award damages. Allowing damages will apply only to unreasonable denial to accept an agent’s authority under a statutory short form POA that substantially complies with the statute.

What is a power of attorney?

The power of Attorney gives legal authority to another person (called an Agent or Attorney-in-Fact) to make property, financial and other legal decisions for the Principal. A Principal can give an Agent broad legal authority, or very limited authority. The Power of Attorney is frequently used to help in the event of a Principal's illness ...

What is a springing power of attorney?

A "Springing" Power of Attorney becomes effective at a future time. That is, it "springs up" upon the happenings of a specific event chosen by the Power of Attorney. Often that event is the illness or disability of the Principal. The "Springing" Power of Attorney will frequently provide that the Principal's physician will determine whether ...

Is a power of attorney good?

Powers of Attorney are only as good as the Agents who are appointed. Appointing a trustworthy person as an Agent is critical. Without a trustworthy Agent, a Power of Attorney becomes a dangerous legal instrument, and a threat to the Principal's best interests.

Popular Posts:

- 1. what is real estate attorney review process nj

- 2. where to get help in tampa to get a free attorney

- 3. what monroe attorney in monroe la died today

- 4. how much does it cost to hire a attorney for chapter 13bankruptcy?

- 5. what type of bills go to the ohio attorney general

- 6. how to file a complaint with the district attorney

- 7. which of the following is true? a competent person of any age may be given attorney in fact

- 8. how to get a power of attorney in california

- 9. how to write a request for power of attorney for phone account

- 10. how long can you serve as city attorney