Full Answer

What is the difference between power of attorney and affidavit?

A third party is authorized by Florida law to require the agent to sign an affidavit (a sworn or an affirmed written statement), stating that the agent is validly exercising the authority under the power of attorney. If the agent wants to use the power of attorney, the agent may need to sign the affidavit if so requested by the third party.

What is a third party power of attorney in Florida?

An affidavit executed by the attorney in fact must state where the principal is domiciled, that the principal is not deceased, and that there has been no revocation, partial or complete termination by adjudication of incapacity or by the occurrence of an event referenced in the durable power of attorney, or suspension by initiation of proceedings to determine incapacity or to appoint a …

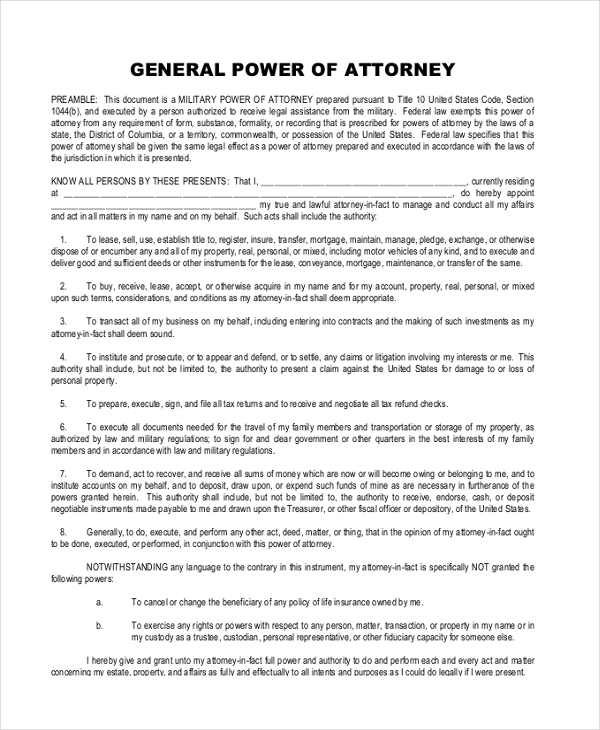

What is a general power of attorney in Florida?

Sep 26, 2017 · An affidavit is a sworn statement made by a person who swears under oath that the statement is true. When you make an affidavit, you affirm that your statement is true and do so under penalty of perjury, just as if you made the statement in court under sworn testimony. Perjury is a crime.

Can a third party sign an affidavit of power of attorney?

Feb 10, 2020 · Potential Problems with Powers of Attorney. As with most legal documents, there are some potential problems when executing a Florida power of attorney.. With that in mind, it’s a good idea to consult an estate planning attorney with experience in Florida’s POA laws before appointing an agent or accepting an appointment. While there are forms available online, they …

Is a POA an agent?

A power of attorney gives one or more persons the power to act on your behalf as your agent. ... The person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact." With a valid power of attorney, your agent can take any action permitted in the document.

Does Florida power of attorney need to be notarized?

According to Section 709.2105, in order for the power of attorney to be valid, you must sign the Florida power of attorney in the physical presence of two (2) witnesses and must be acknowledged by a notary. You must all sign in the presence of each other when executing the power of attorney.

What formalities does Florida require for execution of a power of attorney?

A power of attorney must be signed by the principal and by two witnesses to the principal's signature, and a notary must acknowledge the principal's signature for the power of attorney to be properly executed and valid under Florida law.

Who has power of attorney after death if there is no will?

What Happens After Death of the Principal? Upon the death of the principal, the power of attorney is no longer valid and instead the will is executed. Instead of the agent, now the executor of the will is responsible for carrying out the demands of the principal through the will.Jun 25, 2021

Has Florida adopted the Uniform Power of Attorney Act?

On October 1, 2011, Florida adopted its version of the Uniform Power of Attorney Act (2006).Jul 3, 2018

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Can a family member be a witness on a power of attorney in Florida?

A: Yes, family members can witness a power of attorney.Nov 14, 2019

What does a power of attorney allow you to do?

Power of Attorney (POA) is all about giving the right to act on your behalf to a trusted friend or family member. A Power of Attorney allows the holder of the POA to take clearly defined actions and decisions on behalf of the donor in this case.

Can a spouse make medical decisions without a power of attorney in Florida?

If there is no power of attorney or health care surrogate designation signed, then you can rely on the Florida Health Care Proxy statute. Spouses are, by law, allowed to make medical decisions for their spouses when they're incapacitated and no other documentation exists.

Does next of kin override power of attorney?

No. The term next of kin is in common use but a next of kin has no legal powers, rights or responsibilities.

Can a family member override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

Can a power of attorney transfer money to themselves?

Can a Power of Attorney Transfer Money to Themselves? No — not without good reason and express authorization. While power of attorney documents can allow for such transfers, generally speaking, a person with power of attorney is restricted from giving money to themselves.Jun 26, 2019

Popular Posts:

- 1. how to find a tort attorney

- 2. attorney of record post divorce how long

- 3. where can i get free forms for durable ppower of attorney

- 4. how to add attorney in efile

- 5. an attorney explains why hillary wasn't prosecuted

- 6. who is ohio attorney general

- 7. raymond burr western attorney who gets shot

- 8. who is the boss of the county attorney

- 9. who is paying for chauvin attorney

- 10. when does the new illinois state's attorney go into effect