Power of attorney

A power of attorney (POA) or letter of attorney is a written authorization to represent or act on another's behalf in private affairs, business, or some other legal matter, sometimes against the wishes of the other. The person authorizing the other to act is the principal, grantor, or donor (of t…

Full Answer

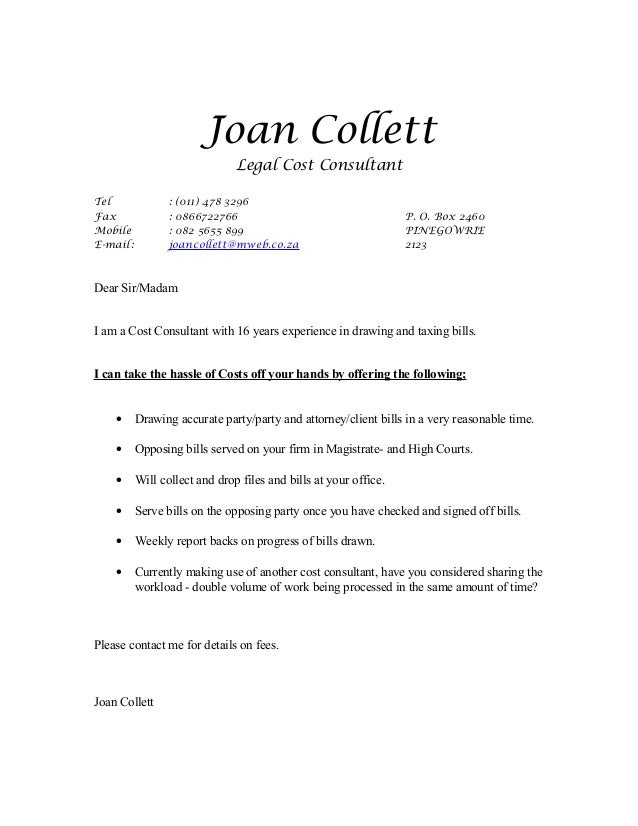

How to write a letter of attorney?

LETTER OF ATTORNEY, practice. A written instrument under seal, by which one or more persons, called the constituents, authorize one or more other persons called the attorneys, to do some lawful act by the latter, for or instead, and in the place of the former. 1 Moody, Cr. Cas. 52, 70.

What does letter of attorney mean?

letter of attorney noun [ C ] uk us plural letters of attorney LAW a legal document that gives someone the authority to act for someone else in business or financial matters See also power of attorney Want to learn more? Improve your vocabulary with English Vocabulary in Use from Cambridge. Learn the words you need to communicate with confidence.

How do you write a letter to an attorney?

An attorney letter of representation is a legal document that explaining that an attorney or law firm is now the acting legal representation for an individual, group, or business. It is used in any number of legal situations such as professional malpractice, car accidents, business lawsuits, family law issues like divorce or custody, and all types of personal injury cases.

How to write a power of attorney letter [10+ best examples]?

It is an official letter that confers the power to make far-reaching decisions and act on the behalf of another person in line with the terms that are stipulated in the letter. The person who receives the power is called the ‘agent.’. Some of the common activities that may be handled by the agent are monetary transactions, property dealings, and signing checks.

What is a letter from the attorney?

What Is an Attorney's Letter? An attorney's letter is a formal business letter sent by a certified public accountant (CPA) to a client's attorney. The attorney's letter verifies the information sent by the management of a company pertaining to pending litigation of the company.

Why would you get a letter from a lawyer?

Commonly used by businesses, demand letters are often sent to demand money owed or restitution, but they can also be used to demand specific actions. Having your attorney draft a demand letter can be a wise move because it gives the recipient a chance to rectify the situation without facing a lawsuit.

How do you respond to an attorney letter?

Responding to Correspondence Threatening Legal ActionLook carefully at the letter's contents. ... Check to see who sent the letter. ... Review the substance of the letter or email. ... Review the situation and the facts. ... Determine how best to proceed.More items...

Can you ignore a lawyers letter?

No, you should not ignore the letter. It is unlikely that the lawyer is going to be rejected by the company's failure to respond to a lawyer letter. Most likely, the company will either get a second letter – or a formal law suit.Dec 5, 2019

Do I have to respond to a lawyer letter?

It's always best to have an attorney respond, on your behalf, to a “lawyer letter,” or a phone call from a lawyer. If that's not an option for you, though, make sure that you send a typed, written response to the attorney (by e-mail or mail), and keep a copy for yourself.Sep 12, 2017

What happens if you ignore lawyers letters?

The fact that you ignored the demand letter will be used against you in court. The demand letter will likely end up as an exhibit to the court and jury in any subsequent litigation, and your response to the demand will be judged accordingly.Mar 24, 2019

How quickly should a lawyer respond?

A: The lawyer should be responsive to your questions within 24-48 hours after you left a message. If the lawyer is not responsive, perhaps he or she is on vacation and unable to return.Dec 28, 2019

What happens if no response to demand letter?

If you do not receive a response by the due date (i.e. the end date you included in your letter), you can contact the recipient to ensure the letter was received, send a second letter, or commence legal proceedings. If you're uncertain about what to do next, consider speaking with a lawyer.

What Is an Attorney's Letter?

An attorney's letter is a formal business letter sent by a certified public accountant (CPA) to a client's attorney. The attorney's letter verifies the information sent by the management of a company pertaining to pending litigation of the company.

Understanding an Attorney's Letter

The attorney's letter makes up a significant part of the financial audit process. When auditors are conducting a review of a company's financials, they need to take into consideration any litigation that may have a negative impact on the financials. Therefore, they need a full account of any pending lawsuits the company faces.

Accounting and Auditing Considerations

It is primarily management's responsibility to put in place procedures to account for any litigation, claims, and assessments against the company when preparing financial statements in compliance with generally accepted accounting principles (GAAP).

What Is a Power of Attorney Letter?

It is an official letter that confers the power to make far-reaching decisions and act on the behalf of another person in line with the terms that are stipulated in the letter.

How to Write

Start by generating a draft of the letter you want to send out to the person to whom you delegate the powers. The draft ought to contain a list of the special powers you intend to bequeath to a third party. This list ought to be explicit and detailed to avoid any doubts.

Types of Power of Attorney

Lasts longer and mainly comes in force when you are completely incapacitated such as when in a coma. This type is only applicable if you are completely incapable of making decisions on your own.

Does a Power of Attorney Need to be notarized?

YES, it has to be notarized. The notary public is the one to do this. It is only after it has been notarized that it is deemed legally binding. The rules and regulations differ per state. That means you have to check out your state laws to find out about the rules.

Does Power of Attorney Expire?

The ‘power of attorney’ is a very serious document that should never be handled recklessly. You need to treat it with the seriousness it requires to prevent the issues and problems that potentially arise with use. Reading in between the prescriptions we have stipulated above is a sure way of achieving this end.

What is a power of attorney?

Powers of attorney are one of the most powerful legal documents. Giving powers over important decisions away is not something you should brush aside. Before writing a power of attorney, you should consider the following: Power of attorney laws and forms can vary from one U.S. state to another.

What are the different types of power of attorney?

state to another. There are different power of attorney types, and the main ones include: General POA. Durable POA. Limited POA.

What is POA in legal terms?

A POA stands for a power of attorney—a legal document used to transfer power over certain decisions from one person to another. Solve My Problem. Get Started. A power of attorney is created between two parties—the principal and attorney-in-fact.

Where do I file a power of attorney?

File the document. Most powers of attorney are filed with a court or government office, but that can vary depending on your state’s laws and your POA type.

Can a principal use a power of attorney?

Contrary to the common opinion, people don’t use powers of attorney only when they’re mentally or physically incapable of making the decisions on their own. You can use a power of attorney ...

Can you delegate powers to an attorney in fact?

Not all powers can be delegated—you cannot authorize the attorney-in-fact to: Vote on your behalf. Make, change, or revoke your will. POA ceases at death. Powers of attorney are revocable and amendable, provided you are capable of making legal decisions on your own.

Can a power of attorney be written?

Some states allow oral powers of attorney, but it is best to have them in written form. Most states follow the Uniform Power of Attorney Act, which outlines the powers that the principal can give to the agent.

What is a power of attorney letter?

A general power of attorney letter grants the agent the same powers indicated in the durable form. The only difference is that it does not remain in effect if the principal becomes, for whatever reason, incapacitated or mentally disabled.

What is a special case power of attorney letter?

A special case power of attorney letter refers to a written authorization that grants a representative the right to act on behalf of the principal under specified circumstances. When preparing this document, you need to be very clear about the acts you wish to grant the agent. It is possible for you to make more than one special power of attorney to delegate different responsibilities to different individuals.

Why do we need a surrogate?

When this happens, you would need a surrogate to handle your personal affairs or make life-and-death decisions about your healthcare.

What is a springing power of attorney?

A springing power of attorney refers to a conditional power of attorney that will only come into effect if a certain set of conditions are met. This may be used in various situations, particularly when the principal is either disabled or mentally incompetent.

When to use a durable power of attorney?

A durable power of attorney is typically used when the principal becomes incapacitated and is unable to handle personal affairs on their own. This is often created for the purpose of financial management, giving your agent the authority to deal with real estate assets and other finances on your behalf.

Why do you have to revoke a power of attorney?

Perhaps you are unhappy with the way your agent has handled previous matters, or maybe you are no longer acquainted with the said individual. The revocation must include your name, a statement proving that you are of sound mind, and your wish to revoke this right. This is necessary to make the revocation legal and enforceable.

What happens if you fall into a coma?

If you get into an accident, fall into a coma, or become mentally incapable to make stern decisions for yourself, you need to have someone who can decide for you during these critical circumstances. Medical decisions can be difficult, and often overwhelming, to make. Thus, be sure to grant this authority to someone whom you can entrust your life with, such as a spouse, parent, sibling, or close friend.

What is the difference between a power of attorney and a letter of authority?

These two letters are very similar, but the main difference comes in the scope. A letter of authority authorizes someone to act on someone’s behalf for a given specific purpose. The assignee of the letter of authority should cancel the letter upon completion of the tasks assigned. On the other hand, the power of attorney authorization letter gives the assignee powers to act over a wide range of transactions.

Why do you need a power of attorney authorization letter?

A power of attorney authorization letter is essential whenever you need someone to act on your behalf to complete tasks that you are unable to do due to certain valid reasons.

What is authorization letter?

An authorization letter is a written endorsement that gives another person the right, authority, mandate, or capacity to act on your behalf to enter into a contract, spend a certain amount, take action, delegate his or her responsibilities, and do other matters you want them to look into.

Why do you need a power of attorney?

There are quite a several reasons to designate a power of attorney, and among the reasons are the following: In instances where bank accounts have two or more names. If brokerage accounts have two or more names. In situations where the principal is single and is out of town. If the principal is having or is scheduled to have major surgery.

What is an agent in a transaction?

Usually, the party being granted this authority is referred to as the ‘agent’. Some of the activities an agent can undertake to include monetary transactions, property dealings, and even signing cheques. When the agent acts in the place of the original person, his activities are binding legally to the original person.

When is a power of attorney needed?

A power of attorney is necessary when bank accounts, properties, and brokerage accounts have two or more names, and when the principal is incapacitated or is unable to act due to valid reasons. There are five primary forms of power of attorney, and you can choose any depending on your current needs.

What is a durable power of attorney?

A Durable Power of Attorney. It is used to grant another person the authority to make important decisions and take actions on your behalf. It is more encompassing compared to the non-durable power of attorney. The decisions that the authorized person may resolve include financial, business, and real estate affairs.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

What is a durable power of attorney?

You might also sign a durable power of attorney to prepare for the possibility that you may become mentally incompetent due to illness or injury. Specify in the power of attorney that it cannot go into effect ...

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

What is a fiduciary?

A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing. Someone who violates those duties can face criminal charges or can be held liable in a civil lawsuit.

What is a letter of protection?

A letter of protection is a letter sent by the attorney of an injured party to a medical provider agreeing to pay the medical expenses owed by the patient out of any future recovery whether by settlement or by trial and judgment. It is a contractual agreement that allows the injured person to get ...

What is a LOP letter?

A letter of protection (LOP) is a letter sent to a medical professional by a personal injury lawyer representing a person injured in a car accident, work injury, or fall. An LOP guarantees payment for medical treatment from a future lawsuit settlement or verdict award. In many cases hospitals or doctors will not accept the injured party’s medical ...

Who is Paul Cannon?

He is Board Certified in Personal Injury Trial Law by the Texas Board of Legal Specialization since 2005. He has earned recognition as a Super Lawyer by Thompson Reuters in 2017-2020, and as a Top 100 Trial Lawyer by the National Trial Lawyers Association 2017-2020. He is a Shareholder, trial lawyer and online marketing manager at Simmons and Fletcher, P.C. His legal writings have been published by the Texas Bar Journal, Business.com, Lawyer.com HG Legal Resources, Lawfirms.com, and others. He has been asked to give educational talks and media interviews regarding personal injury law issues.

Does auto insurance pay for medical bills?

Automobile liability insurance carriers, however, will not pay for your medical care as you go. They expect you to pay for the care, then submit all of the bills at once and they then may make you an offer to settle the case (or they may low ball you or simply tell you to go jump in a lake).

What happens when someone is hurt at work?

When someone is hurt at work, the injured person’s health insurance might point the finger at the employer’s worker’s compensation insurance. Financial liability for a fall injury might be redirected to the building or property owner’s insurance for example.

What is a medical contract?

It is a contractual agreement that allows the injured person to get the care they need effectively on credit with the creditor (the medical provider) agreeing to wait until the conclusion of the case to demand payment.

What is an example of personal injury?

For example: Assume you are in a wreck. You go to a medical facility for care. They submit the bill to your health insurance carrier who later refuses to pay the claim because it is for care rendered as the result of an automobile collision. You cannot afford the expensive bill. Your personal injury lawyer may be able to provide ...

What Is An Attorney's Letter?

Understanding An Attorney's Letter

- The attorney's letter makes up a significant part of the financial auditprocess. When auditors are conducting a review of a company's financials, they need to take into consideration any litigation that may have a negative impact on the financials. Therefore, they need a full account of any pending lawsuits the company faces. Auditors will request this letter for any audit and particularl…

Accounting and Auditing Considerations

- It is primarily management's responsibility to put in place procedures to account for any litigation, claims, and assessments against the company when preparing financial statements in compliance with generally accepted accounting principles(GAAP). In relation to litigation, claims, and assessments, the auditor needs to obtain information related to the matter. The informatio…

Popular Posts:

- 1. who was stephanie simpson's attorney charlotte nc

- 2. case where power of attorney is needed

- 3. how to take my attorney before the judge

- 4. the attorney general barr what religiong

- 5. how to manage finances of someone who can't sign a power of attorney

- 6. what happens if attorney looses the will

- 7. what are the requirements to grant another person power of attorney

- 8. what is the salary of attorney general?

- 9. bar association how to choose attorney

- 10. how to order martin county indiana prosecuting attorney badges