What are the benefits of a durable power of attorney?

What Are the Advantages & Disadvantages of Giving Someone Your Power of Attorney?

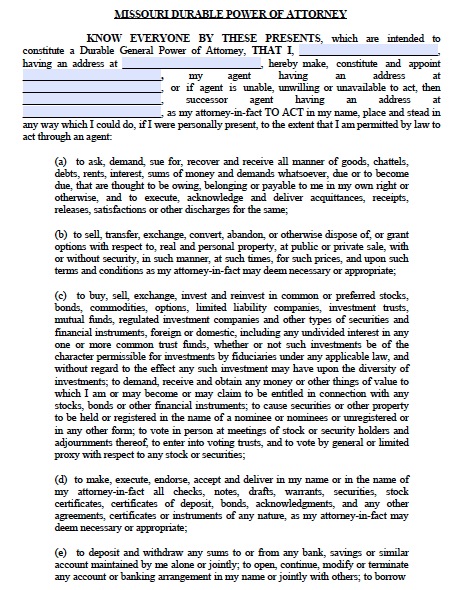

- Powers. You may grant your agent the authority to handle your business, banking, real estate, insurance, investment, pension and gift transactions.

- Advantages. A power of attorney is an easy way to have another person handle legal or financial matters for you when you are away or otherwise unable to handle them ...

- Disadvantages. ...

What is meant by a durable power of attorney?

A durable power of attorney means that you have designated someone as your agent, and your grant of authority to that agent will continue to stay in effect even when you are incapacitated. Understanding how a power of attorney works and what it means is very important for making advanced plans to secure your future.

Is it necessary to have a durable power of attorney?

There are many reasons to establish a healthcare durable power of attorney. If you have recently been diagnosed with an illness that may lead to an inability to make decisions for yourself (such as dementia or a brain tumor), then appointing a power of attorney is necessary to avoid a court-appointed guardian. Thank you for subscribing!

What does durable mean in a durable power of attorney?

“Durable” means that the power of attorney is valid through incapacity; the Agent can continue to act when the Principal is not mentally competent. A person is mentally incompetent if they are unable to make informed decisions, e.g., they are in a coma or suffering from Alzheimer’s disease.

What does it mean to be someone's financial POA?

A financial power of attorney is a legal document that lets you appoint someone to manage your finances and property for you. These tasks could include paying bills, making bank deposits, collecting your insurance benefits, and more.

What does durable mean on a POA?

A durable power of attorney refers to a power of attorney which typically remains in effect until the death of the principal or until the document is revoked.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

Can a family member override a power of attorney?

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian.

What is the difference between durable and non durable POA?

With a non-durable POA, your agent's authority ends as soon as you become incapacitated. If you have a durable POA, your agent can continue to make decisions for you even after you become unable to make them yourself.

Do I need a power of attorney if I have a will?

A will protects your beneficiaries' interests after you've died, but a Lasting Power of Attorney protects your own interests while you're still alive – up to the point where you die. The moment you die, the power of attorney ceases and your will becomes relevant instead. There's no overlap.

Can I do power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What does durable mean in legal terms?

Durable means for a determinable period with a reasonable certainty that the use, possession, or claim with respect to the property or improvements will continue for that period.

What are the 3 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.

How is a health care power of attorney different than a durable power of attorney quizlet?

A health care proxy (also known as a durable power of attorney for health care, medical power of attorney or appointment of a healthcare agent) is a document that lets you to appoint another person (a proxy or agent) to express your wishes and make health care decisions for you if you can not speak for yourself.

What does the Durable power of attorney for Healthcare enable the health care agent to do?

A Durable Power of Attorney for Health Care is a document that lets you name someone else to make decisions about your health care in case you are not able to make those decisions yourself. It gives that person (called your agent) instructions about the kinds of medical treatment you want.

When A Financial Power of Attorney Takes Effect

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of atto...

Making A Financial Power of Attorney

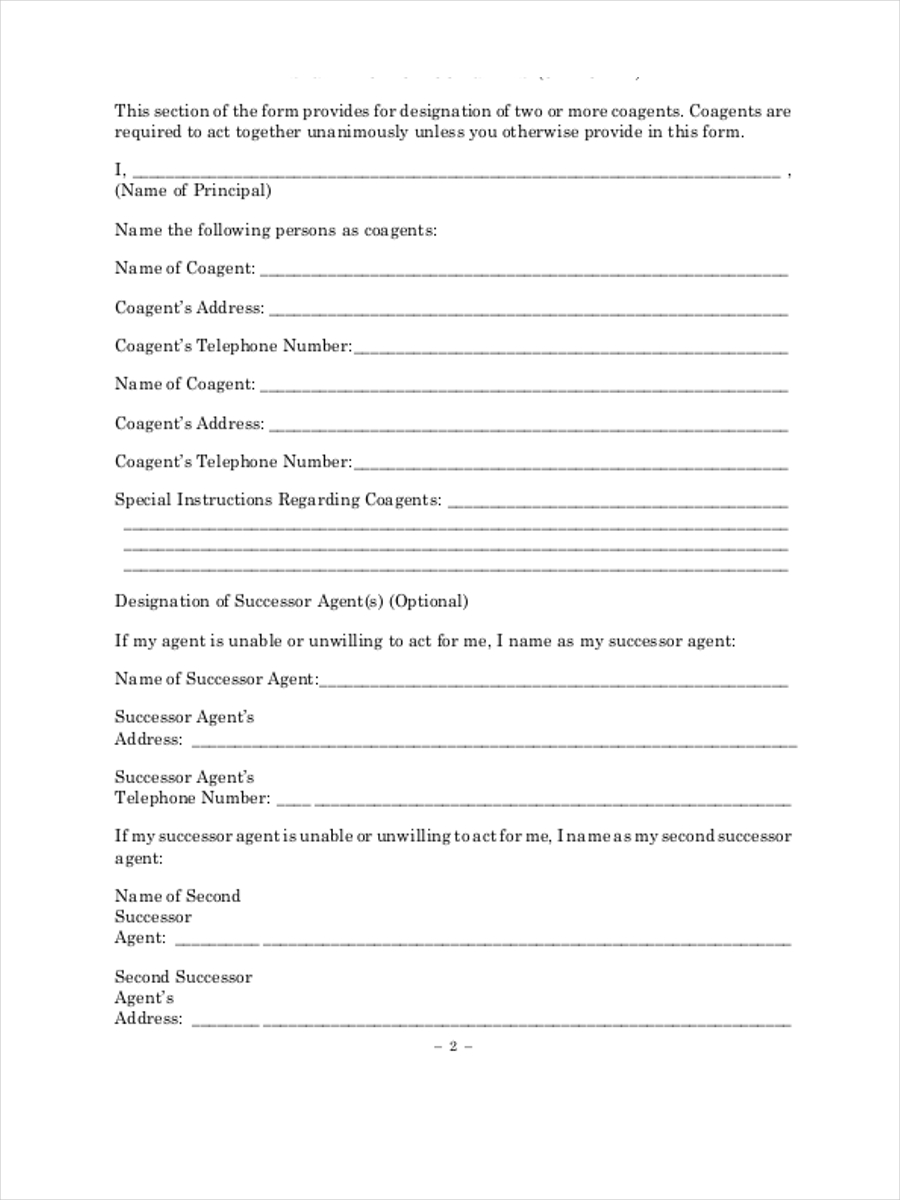

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages...

When A Financial Power of Attorney Ends

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your de...

When Does My Agent’s Durable Financial Power of Attorney End?

Durable financial powers of attorney are not permanent. Your agent cannot continue to manage all aspects of your financial affairs after you have passed away. As soon as you die, your powers of attorney go away. In other cases, if your appointed financial agent is your spouse, a divorce can also end a durable financial power of attorney. Make sure you stay on top of these powers as the circumstances in your life change.

What Can an Estate Planning Lawyer Do to Assist Me?

We can assist you in setting up a power of attorney that best suits your preferences. Call Thomas-Walters, PLLC today at (919) 424-8277 to schedule a free consultation.

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

When does a power of attorney expire?

An ordinary power of attorney expires if you become mentally incompetent, while a durable power of attorney includes special wording that makes it effective even if that happens.

Who can override a power of attorney?

The question of who can override a power of attorney for a loved one is more difficult. If you believe someone is abusing their position as power of attorney, you may be able to take legal action to have them removed. An attorney with experience in both estate planning and elder law can help.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

Why is a durable power of attorney important?

This is why the Durable Financial Power of Attorney is one of the most important resources and decisions to make in your estate planning. It is the legal document that addresses the combination of your decision-making capacity and the management of your financial affairs. Confused about why you should have one and the differences between other ...

What is a financial power of attorney?

A financial power of attorney is simply a legal document in which you (the “principal”) authorize someone else (an “agent” or “attorney-in-fact”) to make financial decisions for you or to act for you in financial matters.

What are the responsibilities of a financial power of attorney?

Unless you indicate otherwise, the responsibilities of an agent of a durable financial power of attorney are limited to financial matters. Your financial agent cannot make medical or health care decisions for you.

Why is a power of attorney called a springing power of attorney?

This is known as a “springing” power of attorney because the authority to act for your “springs” into effect upon the happening of a particular event —in this case, your incapacity.

How to act as a power of attorney?

Act in your best interest. Maintain appropriate financial records. Maintain impartiality and avoid conflicts of interest. Avoid the mixing, or commingling, of assets. Keep in mind that a power of attorney is a private agreement between the principal and the agent.

When does a power of attorney end?

A power of attorney terminates when you are no longer incapacitated or when you die. Therefore, if you want the agent of your power of attorney to continue to have financial authority over your estate after you die, you must also name your agent as the executor of your estate.

When you create a power of attorney, should you review it?

When you do create a power of attorney, you should regularly review it to assess whether you continue to need it in its existing form. If your circumstances have changed, you’ll likely want to amend it, revoke it to designate a new agent, or create a new power of attorney.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a POA in estate planning?

Understanding Power of Attorney is key to setting up an Estate Plan that has all your bases covered. Having a Financial Power of Attorney (POA) in place ensures you’re establishing a way for your affairs to be managed when it matters most - when you can’t do it yourself.

What is a living will?

A Living Will states your final wishes for end-of-life medical care. It appoints someone to ensure your declaration about life-saving measures (whether you want them, don’t want them or have specific ideas about how extensive they should be) are respected.

Is a durable power of attorney the same as a living will?

A Durable Power of Attorney and a Living Will are similar in nature but have distinct differences. When you’re talking about POA in this sense, you are talking about Medical Power of Attorney (not financial). The main difference between the two follows.

Do you need a POA?

Determine need. Do you actually need a Financial POA? If you’re married and have joint assets, this may not always be necessary right now. Likewise, if you have a Living Trust holding your assets, and you’ve appointed a Trustee to act on your behalf, a Financial POA may not be a great need at this time. That said, a Durable Financial POA can still be a good idea, and they can be the same person as your Trustee.

Is it natural to choose a POA?

From the trust aspect, it probably seems natural to select a family member who is close to you. But sometimes the POA you choose actually isn’t the person closest to you, as emotions can become a factor and the responsibilities could be burdensome. At the end of the day, as long as you’re placing a person you trust in the role, you'll be more confident in your decision.

Does POA last after death?

Two last points - note that some states will automatically see a Financial POA as “Durable,” meaning it lasts even if you’re suddenly incompetent. Also, the role dissolves upon your death unless you’ve written in specific language noting otherwise elsewhere in your Estate Plan (such as your POA could then become Trustee of your Trust or Executor of your Will).

What is a durable power of attorney?

A power of attorney (POA) is a legal document authorizing an individual to handle specific matters, such as health and financial decisions, on the behalf of another. If the POA is deemed durable, the POA remains in effect if the person granting the authorization becomes incapacitated.

What is the difference between a durable power of attorney and a power of attorney?

The key difference is when they can be used. A typical power of attorney ends if the individual granting power of attorney becomes incapacita ted, while a durable power of attorney will stay in place. As such, a durable power of attorney is more appropriate for handling important end-of-life decisions.

What happens to a durable power of attorney after death?

Since a will becomes effective after death, the individual assigned as the executor of the will takes over. The same individual can be appointed as a durable power of attorney and executor, if desired.

Why do people need durable powers of attorney?

Durable powers of attorney are set in motion to protect people in case of a medical emergency or other situations where an individual is incapable of making a sound decision or choice. Many families assign a durable power of attorney to protect elderly or cognitively impaired loved ones.

What is a living will?

A living will is also called a health care/medical or instruction directive. This document concerns your desires for medical choices and treatment if you’re unable to cognitively make sound decisions because of an illness or impairment. This can include your preferences for resuscitation and breathing tubes.

Can you revoke a power of attorney?

If you need to revoke durable power of attorney on behalf of a loved one, you should discuss your options with an attorney. If an individual is abusing their rights as power of attorney, there may be legal solutions.

Can a power of attorney make medical decisions?

In comparison, a durable power of attorney only allows another individual to make medical decisions on your behalf when you become mentally incapacitated. This applies to both end-of-life decisions and regular medical decisions, including prescription refills and doctor appointments.

What Is Power of Attorney

A power of attorney is a document that grants legal authority to one person, known as the agent or “attorney in fact,” to act on behalf of another, the principal, when they are unable to do so themselves.1 While the word attorney might make one assume these responsibilities are reserved for lawyers, the agent can actually be any person the principal trusts enough to make decisions in their best interest or as directed, ranging from financial to healthcare matters.2.

When to Use a General (Financial) POA

Let’s use a hypothetical to outline one example of how and when a general power of attorney can be useful:

When to Use a Durable (Financial) POA

Under the same hypothetical situation, how or when would a durable power of attorney be necessary?

What is a Durable Power of Attorney (DPOA)?

A durable power of attorney (DPOA) is the designation of allowing an agent to handle financial responsibility even if the principal becomes incapacitated. The financial responsibilities may be broad or limited.

What is a power of attorney?

“Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.

How many copies of POA form are needed?

Successor Agent (optional) – Elect to have in case the agent is not available. Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present.

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

How many states have adopted the Uniform Power of Attorney Act?

The following 28 States have adopted the Uniform Power of Attorney Act:

What powers does the principal have in real estate?

Financial Powers. The principal may grant the following standard financial powers to the agent in accordance with Section 301 (page 68): Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items;

What is the meaning of "to cooperate with any agent that has the power to make health care decisions for the principal"?

To cooperate with any agent that has the power to make health care decisions for the principal; and; In preserving the principal’s estate plan to the extent known by the agent , such as: Maintaining the value of the principal’s property; Upkeeping with the principal’s obligations for maintenance;

Popular Posts:

- 1. what office is clyde collins attorney jacksonville fl

- 2. how do i file for a power of attorney for health

- 3. when an attorney calls regarding a car accident

- 4. who is a good parole attorney in georgia

- 5. what kind of attorney do i need for a tenant

- 6. what are the responsibility and liability of a health power of attorney?

- 7. what is the degree of an attorney

- 8. what is a licensed field attorney

- 9. what is it like being an attorney for landlords

- 10. who does trump support in florida attorney general race