Section 751.131 of the Texas Estates Code states that a durable power of attorney lasts until:

- The principal dies;

- The principal revokes the power of attorney;

- The conditions of termination specified in the power of attorney have been fulfilled;

- The agent's authority has been terminated under Texas Estates Code 751.132 and the power of attorney does not provide for a replacement; or

- A guardian is appointed for the principal.

How to get a durable power of attorney?

A durable power of attorney document grants those powers until the person ... e-signatures are often not valid), and you’ll want to be sure to get it right. Setting up power of attorney is an important part of estate planning, especially for senior ...

How to enforce durable power of attorney?

Understanding and Using Powers of Attorney

- About the Power of Attorney. A Durable Power of Attorney may be the most important of all legal documents. ...

- Powers and Duties of an Attorney-in-Fact. What can I do as an Attorney-in-Fact? ...

- Using the Power of Attorney. ...

- Financial Management and the Liability of an Attorney-in-Fact. ...

- Relationship of Power of Attorney to Other Legal Devices. ...

Is it necessary to file a durable power of attorney?

Thus, it is advisable that Durable Powers of Attorney be filed with the county clerk in case the original is lost or destroyed and the maker has become too ill to sign a valid replacement.

What makes a power of attorney "durable"?

With a Durable POA, even if the unthinkable happens, your POA could potentially:

- Act in any manner on your behalf

- Sign legal documents as necessary

- Advise on healthcare decisions

- Make personal financial decisions for you

- Make financial decisions for your business

Do you have to file a durable power of attorney in Texas?

In order for this power of attorney to be valid it must be notarized, but it doesn't need to be signed by any witnesses like a will does. You do not need to file a power of attorney at the courthouse unless you want your agent to be able to act on your behalf in regards to a real estate transaction.

What is the difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

Does a power of attorney have to be notarized in Texas?

We often hear the question, “does the power of attorney need to be notarized in Texas?” The answer is yes; the document and any changes to it should be formally notarized. Once these steps are completed, power of attorney is validly granted.

What is different about durable power of attorney?

A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Do you need a witness for a durable power of attorney in Texas?

The durable power of attorney does not need to be signed by any witnesses. It is not necessary to file the durable power of attorney unless the agent uses it with respect to a real property transaction.

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

Do you need witnesses for POA in Texas?

If you're making a financial POA, sign your document in the presence of a notary public. If you're making a medical POA, sign your POA in front of a notary public or in front of two competent adult witnesses.

Can two siblings have power of attorney?

Generally speaking, while it is good to include your spouse or siblings, consider the fact that they may not be around or have the inclination to sort out your wishes when the time comes. If possible, include two attorneys as standard and a third as a back-up should one of the attorneys not be able to act.

Can a power of attorney transfer money to themselves?

Can a Power of Attorney Transfer Money to Themselves? No — not without good reason and express authorization. While power of attorney documents can allow for such transfers, generally speaking, a person with power of attorney is restricted from giving money to themselves.

Can power of attorney sell property?

A person given power of attorney over a property cannot sell the asset unless there is a specific provision giving him the power, the Supreme Court has held in a judgment.

What is a power of attorney in Texas?

A “power of attorney” is a written document that authorizes someone (referred to as the agent) to make decisions or take actions on someone else's (known as the principal ) behalf. In Texas, there are several kinds of powers of attorney that will grant the agent the right to accomplish different things on the principal's behalf.

Why do I need a power of attorney?

Why would I need one? General powers of attorney are used to allow someone to act for you in a wide variety of matters. For example, general powers of attorney are often used in business dealings to allow an employee to enter into contracts, sell property, spend money, and take other actions on behalf of their client.

Can a power of attorney be used for end of life?

Because general powers of attorney terminate when someone is incapacitated, they are not ideal for end-of-life planning or medical directives. Medical powers of attorney and durable powers of attorney (ones that last after or begin upon the incapacitation of the principal) are better alternatives for these situations.

What is a durable power of attorney in Texas?

What does that mean? A Power of Attorney document gives a person you name – the agent – the power to act as you in financial and legal matters.

When is a power of attorney effective?

More often, Power of Attorney is effective in the case of incapacity or disability, meaning that if you were to become unable to handle your finances, your agent would take over.

Why do you need a power of attorney?

Make sure your lawyer helps you draft a Power of Attorney document to protect your family and assets in case the worst happens.

Do you need a power of attorney for a living trust?

If you are establishing a living trust instead of a will as part of your estate planning, you may not need Power of Attorney, as most trusts are set up to automatically transfer power of assets to a beneficiary or trustee. Talk to your lawyer to make sure.

Does a durable power of attorney cover medical decisions?

Statutory Durable Power of Attorney does not cover medical decisions. To give someone the power to make medical decisions on your behalf if you were unable to, you need several other documents: Medical Power of Attorney, a HPPA Privacy Release and, even better, a Living Will.

What Is Power of Attorney?

A power of attorney (or a “POA” for short) is a legal document that gives one person, usually called the “agent,” the legal authority to make certain types of decisions for another person, usually called the “principal.” Some people use a power of attorney to allow an agent to manage real estate, handle financial affairs, or run a business on their behalf for a period of time, often during a disability or near the end of life.

General vs. Limited Power

A general legal power of attorney in Texas allows the agent to complete a variety of transactions on behalf of the principal, essentially to enter into and complete nearly any business that the principal could themselves do.

How to Gain Power of Attorney in Texas

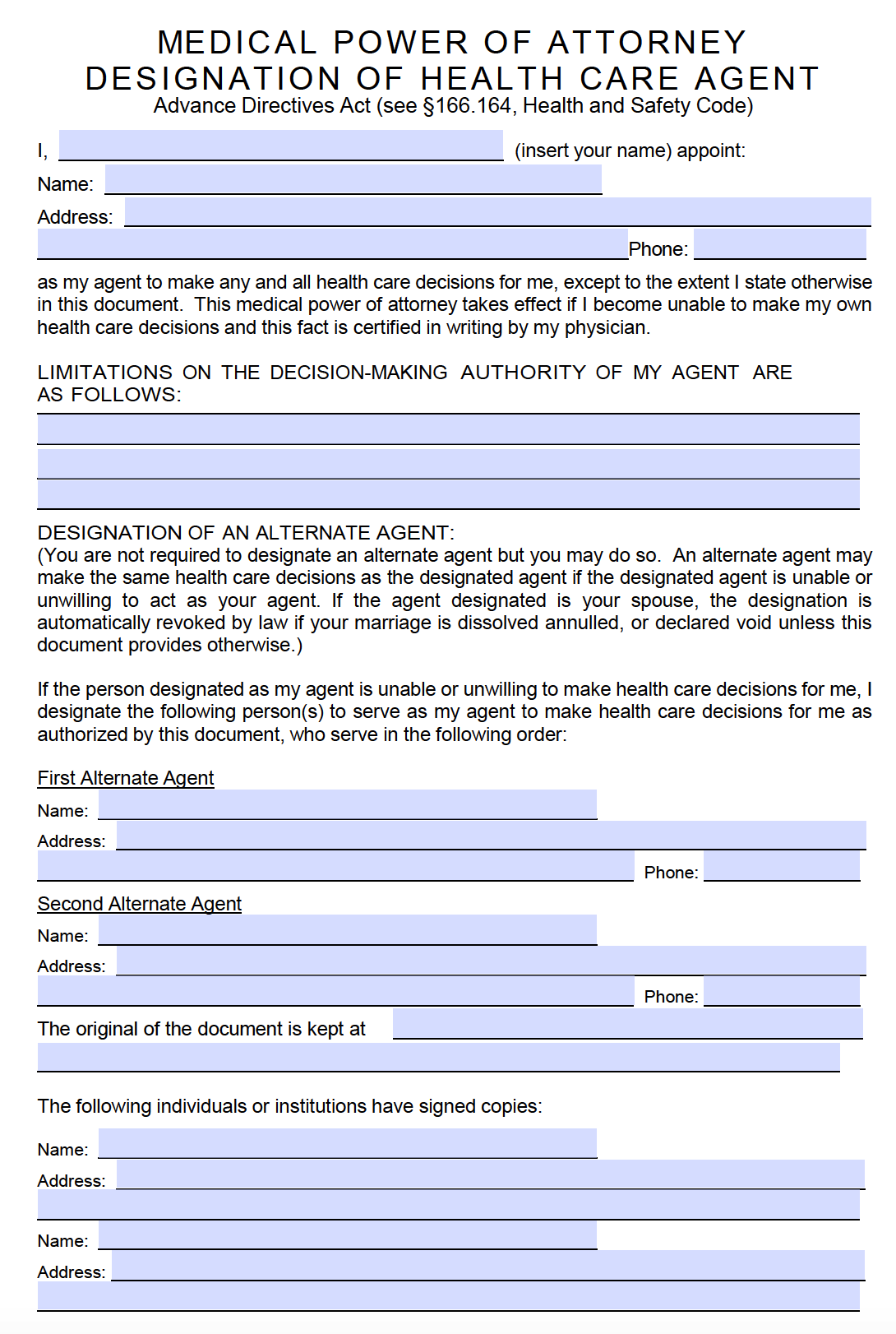

How do you get power of attorney in Texas? How to get power of attorney and how to get medical power of attorney in Texas follow the same procedures. Texas Power of Attorney requirements are based on what roles and responsibilities are assigned in the document.

Contact The Law Offices of Kretzer & Volderbing P.C. Today

When you are trying to figure out how to utilize or understand Power of Attorney in Texas, you will need lawyers with specific experience in this area of law and who have the right knowledge and resources to help you.

What Types of Power of Attorneys Are Available in Texas?

You can make several different types of POAs. In particular, many estate plans include two POAs that are effective even if you become incapacitated: a financial POA, which allows someone to handle your financial or business matters, and a medical POA , which allows someone to make health care decisions on your behalf.

Steps for Making a Financial Power of Attorney in Texas

Texas offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your POA. However, statutory forms are often full of legalese, and it's not always apparent how to fill them out.

Who Can Be Named an Agent in Texas?

Legally speaking, you can name any competent adult to serve as your agent. But you'll want to take into account certain practical considerations, such as the person's trustworthiness and geographical location. For more on choosing agents, see What Is a Power of Attorney.

When Does My Durable Financial POA Take Effect?

In Texas, your durable financial power of attorney will typically state whether it takes effect immediately or upon your incapacitation. If it doesn't specify, the POA will take effect immediately by default.

When Does My Financial Power of Attorney End?

Any power of attorney automatically ends at your death. It also ends if:

Instructions

This form is for designating an agent who is empowered to take certain actions regarding your property. It does not authorize anyone to make medical and other healthcare decisions for you.

Purpose

This form is for designating an agent who is empowered to take certain actions regarding your property. It does not authorize anyone to make medical and other healthcare decisions for you.

What is Durable Power of Attorney Act?

In addition, the Durable Power of Attorney Act (Subtitle P, Title 2, Estates Code) requires you to: (1) maintain records of each action taken or decision made on behalf of the principal; (2) maintain all records until delivered to the principal, released by the principal, or discharged by a court; and. (3) if requested by the principal, provide ...

Is a power of attorney valid?

A power of attorney is valid with respect to meeting the requirements for a statutory durable power of attorney regardless of the fact that: (1) one or more of the categories of optional powers listed in the form prescribed by Section 752.051are not initialed; or. (2) the form includes specific limitations on, or additions to, ...

What is a Durable Power of Attorney?

A durable power of attorney is a document that will allow you to appoint someone you trust to engage in specified business, financial and legal transactions on your behalf. It is called “durable” because it does not terminate if you become incapacitated.

When Does it go Into Effect?

Powers of attorney can become effective immediately or can spring into effect when you become incapacitated. In the case of a springing durable power of attorney, you can define the disability that would cause the durable power of attorney to take effect.

The Problem with a Springing Power of Attorney

Because durable powers of attorney are so powerful, clients are often concerned about the risks of granting their agent the power to act immediately. I generally recommend that my clients grant their agents the power to act immediately for the following reasons:

Tips for Minimizing Abuse

The best way to minimize the risk for abuse is to choose your agent wisely. The person you select as your power of attorney should be someone who you trust implicitly to do what is in your best interest. Remember that your agent could cause more damage when you lack capacity than when you are capable of managing your own financial affairs.

Popular Posts:

- 1. who are the candidates for county attorney for sheridan counrty,wyo

- 2. is attorney who is board member a witness in litigation

- 3. who was elected attorney general of virginia

- 4. why would a diversion be denied by the prosecuting attorney in johnson co., ks.

- 5. what should an attorney do if his client admits to forgery?

- 6. who is the current attorney general of the u.s. and what is his/her tasks?

- 7. why cops wouldn't make an arrest and let states attorney decide

- 8. how long must an attorney in nc keep a file

- 9. attorney who know about landing airplane helicopter on your own property

- 10. what the difference a lawyer and an attorney