Form 2848: Power of Attorney and Declaration of Representative is an Internal Revenue Service (IRS) document that authorizes an individual or organization to represent a taxpayer by appearing before the IRS—at an audit, for example. 1 Federal law requires the IRS to keep confidential all of the information that you supply on your tax return.

Full Answer

What is form 2848 power of attorney declaration of representative?

D-2848 Power of Attorney and Declaration of Representation Fill-in Version MyTax.DC.gov Visit the District’s new online tax portal to view and pay your taxes.

What is IRS Form 2848?

D-2848 Page 2 Taxpayer’s SSN or FEIN Taxpayer’s Name Retention/revocation of prior power(s) of attorney By filing this power of attorney form, you automatically revoke all earlier power(s) of attorney on file with the Office of Tax and Revenue for the same tax matters and years or periods covered by this document.

Can a PoA be prepared on an outdated version of form 2848?

Feb 10, 2021 · Form 2848: Power of Attorney and Declaration of Representative is used to authorize an individual to appear before the IRS to represent a taxpayer. Education General

How to authorize an individual to represent you before the IRS?

D-2848 Power of Attorney and Declaration of Representation Personal Information Your first name, M.I., Last name for individual or Business name for business Spouse first name, M.I., Last name for individual Your SSN or EIN for business Spouse’s SSN Your daytime phone number Home address (number and street) or business address Apartment number

What is a power of attorney and Declaration of Representative?

Form 2848: Power of Attorney and Declaration of Representative is an Internal Revenue Service (IRS) document that authorizes an individual or organization to represent a taxpayer by appearing before the IRS—at an audit, for example.

What is a 2848 form used for?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.Mar 8, 2021

Who can file form 2848?

When do you need Form 2848?Attorneys.CPAs.Enrolled agents.Enrolled actuaries.Unenrolled return preparers (only if they prepared the tax return in question)Corporate officers or full-time employees (for business tax matters)Enrolled retirement plan agents (for retirement plan tax matters)More items...•Jan 18, 2022

How many years can a 2848 cover?

Under “Years or Periods,” be specific. Do not write “all years.” Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.Nov 8, 2021

Do you need a lawyer to get a power of attorney?

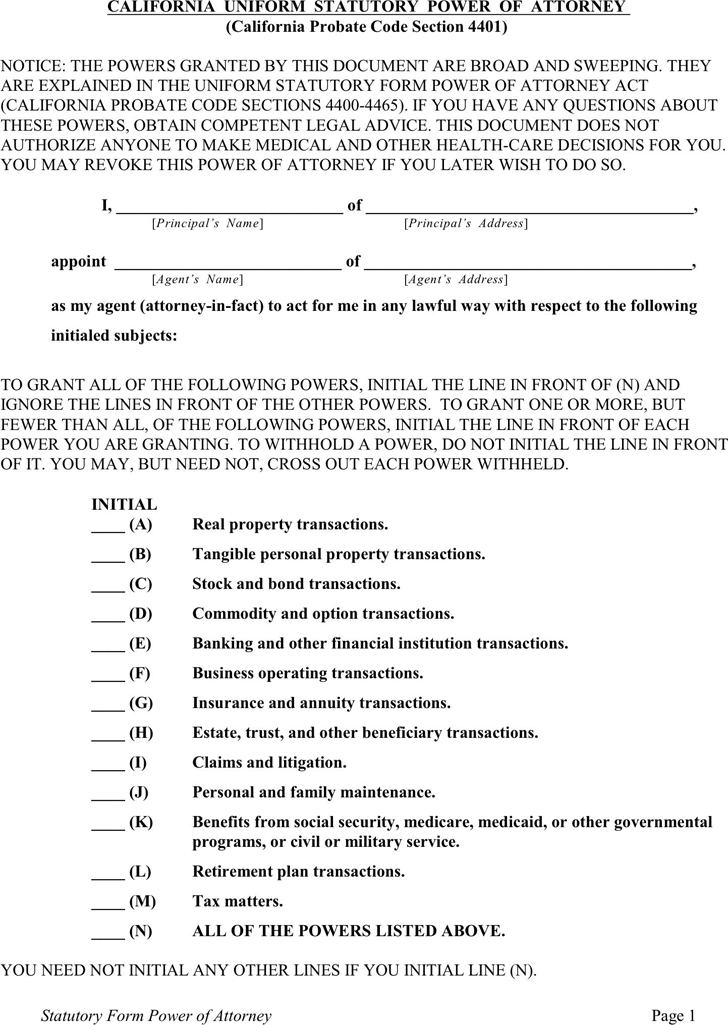

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How do I fill out a power of attorney form 2848?

0:352:24Learn How to Fill the Form 2848 Power of Attorney and ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe name and address followed by the CAF. Number telephone number and fax number the form 2848.MoreThe name and address followed by the CAF. Number telephone number and fax number the form 2848. Allows the taxpayer to elect the scope of the power of attorney granted.

Can 2848 be signed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

What is the difference between form 8821 and 2848?

Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.Jan 25, 2021

How long does it take the IRS to process a power of attorney?

During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

Does IRS recognize POA?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

What is a CAF number on form 2848?

The Centralized Authorization File (CAF) number is a 9-digit number assigned to individuals based on the filing of Form 2848, Power of Attorney and Declaration of Representative.

Can a POA file taxes?

The representative named in a POA cannot sign an income tax return unless: The signature is permitted under the Internal Revenue Code and the related regulations (see Regs. Sec.Apr 1, 2016

What is a 2848 form?

IRS Form 2848 authorizes individuals or organizations to represent a taxpayer when appearing before the IRS. Authorized representatives, include attorneys, CPAs, and enrolled agents. Signing Form 2848 and authorizing someone to represent you does not relieve a taxpayer of any tax liability.

What is 8821 power of attorney?

Whereas Form 2848 allows a power of attorney to represent a taxpayer before the IRS, Form 8821: Tax Information Authorization empowers someone to receive and inspect your confidential information without representing you to the IRS. 9 In other words, you may use Form 8821 when you want someone merely to see your tax information—as when you're applying for a mortgage and need to share your tax information with your lender.

Who can represent a taxpayer?

Authorized individuals or organizations include attorneys or law firms, CPAs, and enrolled agents. These agents can fully represent taxpayers to the IRS. 6 . The IRS also allows individuals who are related to the taxpayer, such as family members or fiduciaries, to act as third-party representatives.

What is a 2848 form?

Form 2848 is processed by an IRS computer , which treats spaces, dashes, and similar notations as characters. The date of the taxpayer's signature must be no later than the date of the representative's signature. This is a sensitive issue with the IRS, and it will not process a POA if a practitioner's signature is dated prior to the taxpayer's.

What is a POA?

The power of attorney (POA) is the written authorization for an individual to receive confidential information from the IRS and to perform certain actions on behalf of a taxpayer. If the authorization is not limited, the individual can generally perform all acts that a taxpayer can perform except negotiating a check.

Popular Posts:

- 1. who pays probate attorney fees

- 2. how to make ace attorney videos

- 3. how to file a motion without an attorney in virginia

- 4. how much does a ssi attorney charge

- 5. what to do and how does power of attorney work

- 6. what to do if your identity is stolen attorney general

- 7. how do you know if your attorney sucks

- 8. what is a wrongful death attorney

- 9. how much does it cost to charge a musician attorney?

- 10. how do states attorney hand sexual assault prosecution