Is a CPA the same thing as a tax attorney?

A tax attorney is a type of lawyer who specializes in tax law. These professionals are uniquely equipped to handle legal tax matters, such as settling back taxes, helping with unfiled returns, halting wage garnishment, undoing property liens and account levies, and coming up with compromises with the IRS.

Should I use a CPA or a tax attorney?

Apr 04, 2019 · If your business faces legal tax issues, you need to hire a tax attorney because they have a deeper understanding of the legalities in the U.S. tax system. Hire a tax attorney if you’re one of the unlucky 2.5% getting audited this year or if you’re dealing with any other tax controversies. Choose a tax lawyer when receiving notices of debt ...

Do you need a tax attorney or a CPA?

Jan 18, 2022 · Click to expand. Certified public accountants (CPAs) and tax attorneys are both uniquely qualified and trained professionals that can help you with taxes and financial decisions. Deciding which to hire depends upon your particular set of circumstances and the type of assistance you need.

What is the job description of a tax attorney?

Mar 18, 2021 · Even though both professionals can help you prepare tax documents and advise about tax liabilities, tax attorneys are legal professionals trained in tax law while CPAs are accountants with a high level of training and credentials …

What is the difference between a tax advisor and a CPA?

Can a CPA help you pay less taxes?

Can a CPA help with IRS problems?

Can a CPA go to tax court?

Is hiring a CPA worth it?

How much does CPA cost?

According to the National Society of Accountants (NSA) in their 2020-2021 survey report, the average hourly rate of CPAs for filing federal/state tax returns was $180, and $174 for other tax services.Feb 1, 2022

How much is a tax attorney?

Can a CPA negotiate with the IRS?

Can CPAs talk to IRS?

Are tax attorneys worth it?

Can a CPA represent you before the IRS?

What do tax lawyers do?

What is a Tax Lawyer?

A tax lawyer is a legal professional who graduated with a law degree and specialized in the very complicated world of tax law. A tax attorney must...

What is a CPA?

A CPA, or certified public accountant, does not have a law degree, but a five-year business degree. CPA programs require at least 150 hours of lear...

Tax Attorney vs CPA: When is a Tax Lawyer the Better Choice?

Trying to decide between hiring a tax attorney or a CPA? It depends on your business’s tax situation. Keep in mind that a tax attorney can do basic...

What is a Tax Lawyer?

A tax lawyer is a legal professional who graduated with a law degree and specialized in the very complicated world of tax law. A tax attorney must pass the bar in the state they wish to work just like any other lawyer. But what does a tax attorney do?

What is a CPA?

A CPA, or certified public accountant, does not have a law degree, but a five-year business degree. CPA programs require at least 150 hours of learning during those 5 years. They must also pass an extensive exam before graduating.

Tax Attorney vs CPA: When is a Tax Lawyer the Better Choice?

Trying to decide between hiring a tax attorney or a CPA? It depends on your business’s tax situation. Keep in mind that a tax attorney can do basically everything a CPA can do. But they also have the legal background and license to address court-based matters.

Hire a Great Tax Attorney to Help with Back Taxes and IRS Issues

Now you should better understand the key differences between a tax attorney vs CPA. They both offer helpful tax services for your business, but a tax attorney wields greater power when dealing with serious tax issues.

CPA training

Accountants, bookkeepers, and other tax preparers aren't required to undergo the same amount of training, education, or testing as a professional who is a certified public accountant (CPA). In order to be a CPA, individuals must complete 150 hours of college coursework, which is typically 30 hours more than most bachelor's degrees require.

Tax attorney training

To become a tax attorney, candidates must first obtain a four-year bachelor's degree, typically in math, accounting, or business. Then, they must pass the Law School Admission Test (LSAT) in order to be admitted into a law school. The LSAT measures skills in areas related to legal work, such as reasoning, analysis, and reading comprehension.

Tax attorney vs. CPA: Choosing who to hire

Whether you need to hire a CPA or a tax attorney depends upon your tax needs. You should most likely hire a CPA if you need help with the business and accounting side of taxes, such as:

Find the right fit

Whether you need a CPA or tax attorney to help with your particular situation, it's important to find the professional who will work best with you. For instance, when hiring a CPA, look for someone who works with clients in financial situations similar to yours, whether you're the beneficiary of a family trust or the owner of an LLC.

Be proactive

Whether you're thinking about hiring a CPA or a tax attorney, it's important to be proactive rather than waiting for problems to arise. You can often schedule a free consultation with a prospective CPA or tax attorney to discuss your needs and determine your next steps.

What's the difference between a tax attorney and a CPA?

Even though both professionals can help you prepare tax documents and advise about tax liabilities, tax attorneys are legal professionals trained in tax law while CPAs are accountants with a high level of training and credentials relevant to the financial aspects of tax reporting.

What is a tax attorney?

A tax attorney is a legal professional who is trained in tax law and court precedents regarding taxation. Before becoming a tax attorney, they must pass a state bar exam to practice law. Tax attorneys specialize in defending clients with taxation issues that require legal proceedings.

What is a CPA?

A CPA, or Certified Public Accountant, is responsible for a range of financial preparations for both individual and business clients, including tax statements. CPAs also act as financial advisors, assisting clients with decisions that affect their investment holdings and tax liabilities.

How do the roles of CPA and tax attorney differ?

Although tax attorneys and CPAs both work with issues related to taxes, the main functions of their jobs are very different. A tax attorney knows and understands tax laws and follows changing regulations to better serve clients. Most tax attorneys work for a legal firm, although they can offer their services independently.

What's the difference in education and training for a CPA vs. a tax accountant?

CPAs go to school for a four-year degree. Because each state has its own board governing accountancy, specific credit hour requirements will vary. CPAs typically earn an accounting degree with courses focused on accounting principles, business ethics and auditing.

What is the salary difference between a CPA and a tax attorney?

Although employment and educational experience affect earnings, the national average salary for a CPA is $80,442 per year. (For the most up-to-date salary information from Indeed, click on the salary link.) A CPA working for a large corporation may make significantly more annually.

When should you hire a tax attorney?

You may want to hire a tax attorney to act as a legal counsel and representative when you encounter the following situations:

The role of a tax attorney

Tax attorneys are lawyers who have gone through law school, passed their state’s bar exam and emphasize tax issues in their practice.

The role of a CPA

CPAs dedicate their education — which is extensive — to a broad range of accounting fields. From auditing and taxation to bookkeeping and business strategy, CPAs are one of the most versatile financial planners available.

The benefits of a dually-certified professional

While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes, the advantages of having a two-in-one professional are hard to overstate.

Being Audited

Legal representation helps you dialogue successfully with the IRS during and after an audit. An effective attorney can help settle the liability for less than you owe by making an offer in compromise, seeking a penalty abatement or requesting a payment plan.

Compromising with the IRS

Often the language used in tax situations and the complexity of IRS bureaucracies can make it difficult to know what to say and to whom. Providing a tax attorney with a power of attorney allows your legal representative to speak with the IRS on your behalf.

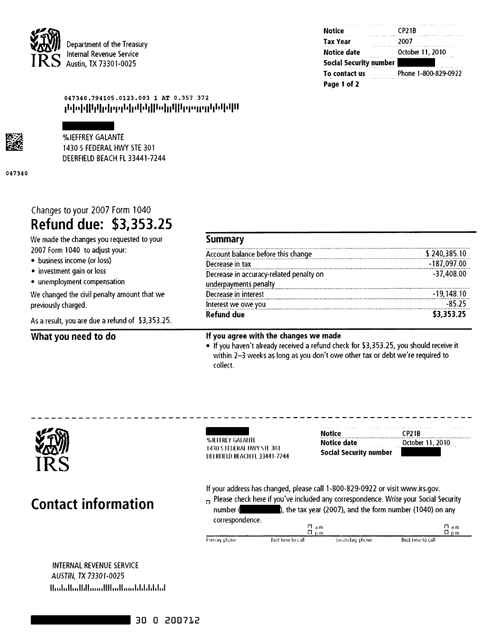

Received an IRS Notice or CP

The IRS sends notices, also known as CPs in IRS jargon, to inform taxpayers about hundreds of different matters, from an error on a return to tax bill reminders. Knowing how to proceed after receiving such a notice can be confusing and require the assistance of a qualified tax attorney.

Criminal Charges

Occasionally, the IRS is mandated to pursue criminal charges. In such cases, you need to hire a tax attorney. Tax evasion and tax fraud are the most common causes of criminal IRS investigations. To avoid or reduce prison sentences and hefty fines, consider hiring an attorney.

How Does a Tax Attorney Help?

A tax attorney serves as your advocate in dealings with the IRS. In addition to speaking and debating with the IRS on your behalf, a tax attorney is often able to dissuade the IRS from pursuing inappropriate lines of questioning.

When to work with an EA vs. CPA

EAs and CPAs are both knowledgeable, experienced professionals who are required to maintain high ethical standards. The primary difference between an EA vs CPA is that EAs specialize in taxation, and CPAs can specialize in taxation and more.

Working with an EA

If you need help with an IRS issue, such as a collection problem or an audit, then an EA might be your best bet. They’re adept at dealing with the IRS, and some EAs even worked as IRS agents before opening their own practices.

Working with a CPA

CPAs that specialize in tax preparation can help you identify the credits and deductions you qualify for to increase your refund and help lower your tax bill.

The Role of A Tax Attorney

The Role of A CPA

- CPAs dedicate their education — which is extensive — to a broad range of accounting fields. From auditing and taxation to bookkeeping and business strategy, CPAs are one of the most versatile financial planners available. Considered the most trusted advisor in their industry, CPAs are a great choice for year-round financial recordkeeping and tax preparation; however, their diverse s…

The Benefits of A Dually-Certified Professional

- While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes, the advantages of having a two-in-one professional are hard to overstate. Not only do dually-licensed Attorney-CPAs have the financial background to understand the intricate details …

Popular Posts:

- 1. what advantage does an attorney have if they are friends with judges

- 2. how do you fill out a dmv power of attorney?

- 3. finding a attorney hourly rate contingency plan which

- 4. how does an attorney handle ve at hearing video

- 5. which party should submit the substitution of attorney

- 6. what if i cant afford an attorney

- 7. how to investigate financial abuse of power of attorney

- 8. what the criminal defense attorney needs to know about immigration

- 9. attorney generals who became president

- 10. what is substitution of counsel and withdrawal of attorney in 10 year judgment