How do I make a payment to the Attorney General's Office?

Feb 11, 2013 · Answered on Feb 13th, 2013 at 10:42 AM. Without a lot more information about why you owe this money and whether there is a judgment against you, it is not possible to answer this question. Any judgment creditor can take your tax refund once you receive it from the Internal Revenue Services or the State. Report Abuse.

What should I do if I owe money to a creditor?

Make a payment online or contact the Attorney General's office at (888) 301-8885. There is a $1.00 transaction fee for Internet Checks or a 2.5% fee (Minimum $1.00) for Credit Cards. Please be advised that we are in the process of updating our new payment processing system to further provide more secure and safe payment processing.

What are my rights if I can't pay my debt?

Your Debt Collection Rights | Office of the Attorney General Your Debt Collection Rights You may owe a debt, but you still have rights. And debt collectors have to obey the law. If You Owe Money Creditors don't want to bring in a debt collection agency. But if it looks like you won't pay, they will.

What happens when a debt is sent to a collection agency?

When a balance due to an agency/university becomes delinquent by 45 days or more, it is certified to the Attorney General. Once it is certified, collection costs and interest are automatically imposed by law. These need to be paid even if you paid the original amount directly to the agency/university. Please contact us for the current balance.

Can you make a payment plan with the Ohio Attorney General?

Can the Ohio Attorney General garnish wages?

What kind of debt does the Ohio Attorney General collect?

How do I know how much I owe the Ohio Attorney General?

Why would the Ohio attorney general offset my taxes?

Can debt collectors take you to court?

How long can a debt be collected in Ohio?

Why did I get a check from Ohio attorney general?

How do I stop a collection agency from my credit bureau?

What does the attorney general do?

How much do I owe in Ohio taxes?

...

What is Ohio Income Tax Rate?

| Ohio Taxable Income | Tax Calculation |

|---|---|

| 0 – $21,750 | 0.000% |

| $21,751 – $43,450 | $310.47 + 2.850% of excess over $21,750 |

| $43,450 – $86,900 | $928.92 + 3.326% of excess over $43,450 |

| $86,900 – $108,700 | $2,374.07 + 3.802% of excess over $86,900 |

Is Ohio a tax lien state?

How to collect a debt?

Using fraudulent collection tactics, including: 1 using a false name or identification 2 misrepresenting the amount of the debt or its judicial status 3 sending documents to a debtor that falsely appear to be from a court or other official agency 4 failing to identify who holds the debt 5 misrepresenting the nature of the services rendered by the collection agency or the collector 6 falsely representing that the collector has information or something of value in order to discover information about the consumer 7 Trying to collect more than the amount originally agreed upon. (But remember: your debt can grow by the addition of fees — e.g., collection fees, attorney fees, etc.).

What are the laws for collecting debt?

This federal law applies only to collectors working for professional debt collection agencies and attorneys hired to collect a debt. It is similar to Texas law, but also prohibits: 1 Calls at work if the collector has reason to know the employer does not permit such calls 2 Calls before 8:00 a.m. or after 9:00 p.m. unless the collector knows such times are more convenient for the debtor 3 "Unfair or unconscionable means to collect or attempt to collect a debt" 4 Any conduct to harass, oppress, or abuse

What happens if you don't pay your debt?

But if it looks like you won't pay, they will. The creditor will sell your debt to a collection agency for less than face value, and the collection agency will then try to collect the full debt from you. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation ...

What to do if you owe a debt?

If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment plan. Usually, creditors will help you catch up.

What is abusive collection?

Using abusive collection tactics, including: threatening violence or other criminal acts. using profane or obscene language. falsely accusing the consumer of fraud or other crimes. threatening arrest of the consumer, or repossession or other seizure of property without proper court proceedings.

What to do if you think you have been harassed?

If you think you have been harassed or deceived, you can even seek injunctions and damages against debt collectors. These actions are also violations of the Texas Deceptive Trade Practices/Consumer Protection Act, which gives the Attorney General the authority to take action in the public interest. File a Complaint.

Can you garnish wages?

Wages may be garnished only to pay debts related to court-ordered child support, back taxes, and defaulted student loans. Debt collectors cannot garnish wages for repayment of consumer debt. If a debt collector threatens to take your home or garnish your wages, you may be the victim of a debt collection scam.

HEROES for MILITARY CHILDREN

Military and veteran families have unique needs when it comes to paternity establishment and child support. The HEROES program is here to help.

Family Violence

If you are a victim or survivor of family violence, we have information to help you pursue child support safely.

Incarcerated Parents

Help is available for parents and family members supporting children during and after a parent's incarceration.

What is debt collector?

Consumer Protection. A "debt collector" is someone who regularly tries to collect debts owed to others. A debt collector may contact you if you are behind in your payments to a creditor on a personal, family or household debt, or if an error has been made in your account.

Can a debt collector harass someone?

A debt collector may not harass or abuse anyone. For instance, a collector may not use threats of violence against the person, property or reputation; use obscene or profane language; advertise the debt; or repeatedly or continuously make telephone calls with the intent to harass or abuse the person at the called number.

Popular Posts:

- 1. what is an angel document vs power of attorney

- 2. who won virginia attorney general

- 3. what is cobb county attorney pay rate reviewing op3j records

- 4. what is the average percentage for attorney fees?

- 5. when is a person entitled to an attorney

- 6. how many years to become a patent attorney

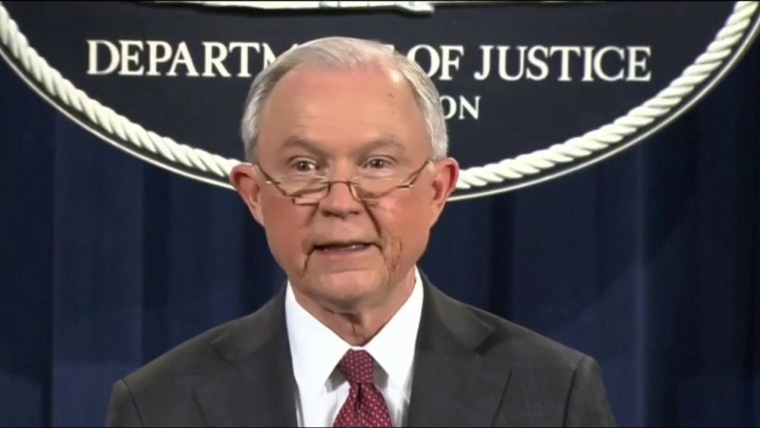

- 7. why is jeff sessions a bad candidate for attorney general

- 8. what does power of attorney mean in indiana?

- 9. how to look up attorney bar number, arizona

- 10. which ny attorney handled the eric garner case?