Can a power of attorney transfer money to themselves UK?

Can a power of attorney transfer money to themselves Ontario?

What does POA mean on a bank account?

Can I withdraw money if I have power of attorney?

What three decisions Cannot be made by a legal power of attorney?

What are the limitations of power of attorney?

At any moment, the POA cannot delegate authority to another Agent. After the Principal's death, the POA is no longer able to make legal or financial decisions, and the Executor of the Estate assumes control.Oct 21, 2021

What can I do with power of attorney?

Can POA change beneficiary?

What is financial power of attorney?

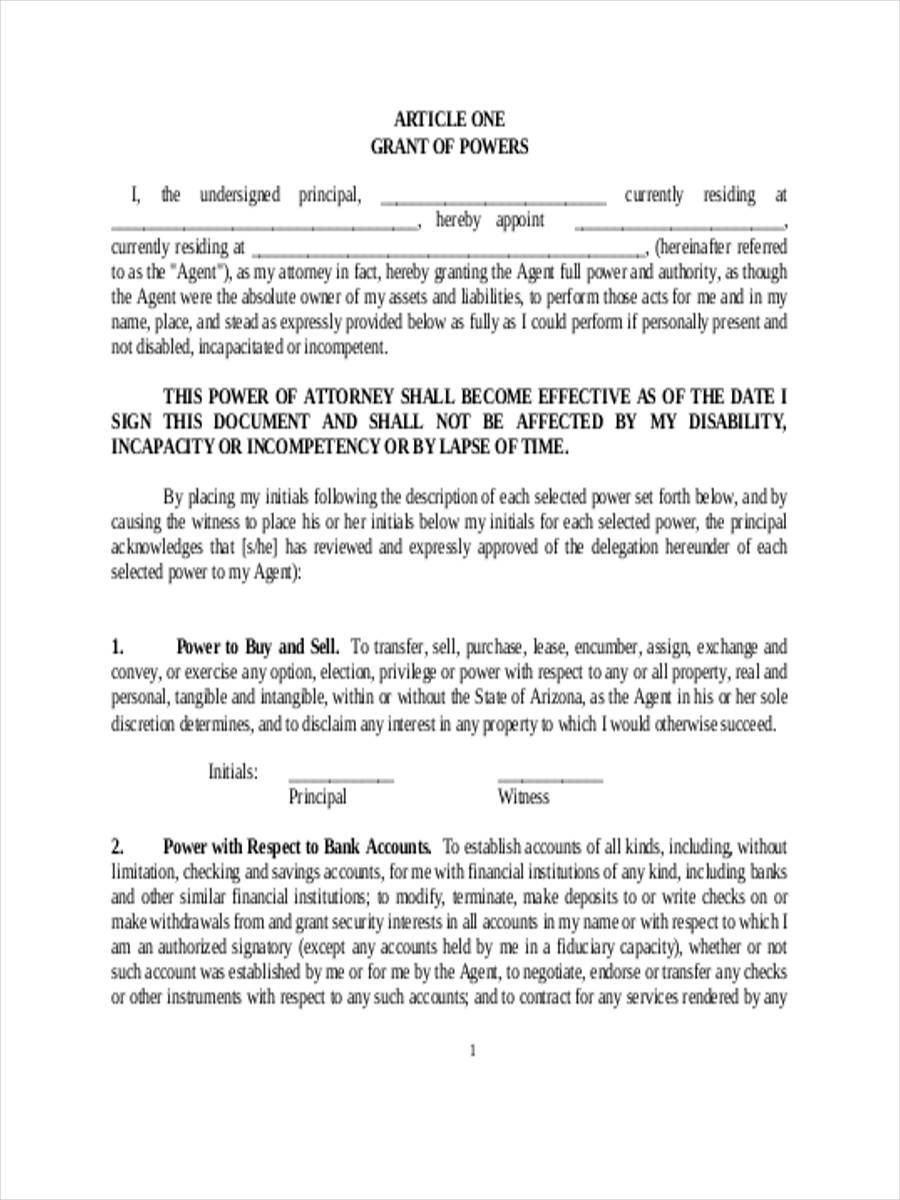

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

What happens to your agent if you revoke your authority?

The authority also ends if you revoke it, a court invalidates it, your agent is no longer able to serve and you have not appointed an alternative or successor agent, or (in some states), if your agent is your spouse and you get divorced.

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

When does a POA end?

The authority conferred by a POA always ends upon the death of the principal. The authority also ends if the principal becomes incapacitated, unless the power of attorney states that the authority continues. If the authority continues after incapacity, it is called a durable power of attorney (or DPOA). In cases of incapacity, a DPOA will avoid ...

When does a POA become effective?

When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated. This is done when someone can’t be present ...

Can you sign a POA before a notary?

Therefore, you may end up with more than one financial POA form. Generally, a financial power of attorney must be signed before a notary public. Especially if the sale or purchase of real estate is involved, it may also need to be signed before witnesses. In a few states, the agent is also required to sign to accept the position of agent.

Why don't power of attorney forms include powers?

Many power of attorney forms don't include these powers because they are dangerous if given to the wrong person. If not exercised with care and good judgment, these powers can deplete your property and ruin your estate plan. But if you trust your agent without reservation and want your agent to have as many options for taking care of you as possible, these powers can be very useful.

What can you give your financial power of attorney?

When you make a financial power of attorney, you can give your agent a lot of authority or very little. Basic forms often list various types of property, requiring you to check or initial each one to give your agent that authority. That list might look something like this: Real property. Tangible personal property.

What powers of attorney are there?

Basic powers of attorney usually don't include the authority to: 1 Make gifts from your property 2 Create or amend trusts 3 Change beneficiary designations on life insurance and retirement accounts 4 Delegate the agent's powers to another person

Why is it important to vary your agent's duties away from the statutory requirements?

For example, the default duty to keep detailed records isn't always needed. This duty can become a huge burden because it forces the agent to keep track of every receipt and document.

What does it mean when your agent gets more of your estate than you intended?

Your agent may get property you never wanted to give to him or her. This might mean your agent gets more of your estate than you intended, and others less.

How to make your agent a joint owner?

Making Your Agent Joint Owner of Your Bank Account. The most common task for agents is writing checks and paying bills from your bank account. To do this, you'll have to add your agent's name to the account. That's when you might mistakenly add your agent as a joint owner.

What is the best approach to grant general authority over all types of property?

The best approach is to grant general authority over all types of property, even property you don't currently own. It's best for your agent to have the authority, even if they never use it. Exception: Do not grant any powers to your agent that make you uncomfortable.

How to revocate a power of attorney?

If the eventuality the Power of Attorney has been given to the agent, an institution, or has already been recorded, you should execute immediately a revocation of the Power of Attorney that is witnessed and acknowledged in the same manner as the first Power of Attorney. Then; just as you distributed the Power of Attorney initially, you will need to furnish a copy of the Revocation to the banks, brokerage firm, or any other financial institution, and anyone else that may have a copy of the original Power of Attorney form that they know the Power of Attorney is no longer valid.

What to do if your agent is abusing your powers?

If you are suspicious that your agent is abusing their powers, revoke the Power of Attorney immediately .

Can an unscrupulous agent get back my money?

If you happen to have an unscrupulous agent, it can be very challenging to get back funds or property taken by the agent, because the agent usually has no money left to return as they have used it all for their benefit. The person acting as your Power of Attorney has the power to sell your property, or mortgage it.

Do you have to pay a filing fee for an accounting?

A filing fee will need to be paid by you and you may need to possibly pay the agent for the cost of preparing the accounting documentation. Next, the court will hold a hearing at which time you can challenge the any or all of the information given in the detailed accounting.

Can a power of attorney be used to sell property?

Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse the power by spending your money or taking your money without your knowledge or worse without your permission. Because the agent can use the Power of Attorney to access your bank account and sell your property, it is prudent that you not give your Power of Attorney to anyone you do not trust. If you happen to have an unscrupulous agent, it can be very challenging to get back funds or property taken by the agent, because the agent usually has no money left to return as they have used it all for their benefit. The person acting as your Power of Attorney has the power to sell your property, or mortgage it. It cannot be stressed enough that you chose your Power of Attorney very wisely.

What happens if you don't have a power of attorney?

If you don't, in most states, it will automatically end if you later become incapacitated. Or, you can specify that the power of attorney does not go into effect unless a doctor certifies that you have become incapacitated. This is called a "springing" durable power of attorney. It allows you to keep control over your affairs unless ...

When does a financial power of attorney end?

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of attorney for each other in case something happens to one of them -- or for when one spouse is out of town.) You should specify that you want your power of attorney to be "durable." If you don't, in most states, it will automatically end if you later become incapacitated.

What is a durable power of attorney?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

Where do you sign a power of attorney?

You must sign the document in front of a notary public. In some states, witnesses must also watch you sign. If your agent will have authority to deal with your real estate, you must put a copy of the document on file at the local land records office. (In two states, North and South Carolina, you must record your power of attorney at the land records office for it to be durable.)

What do you do with your money?

buy, sell, maintain, pay taxes on, and mortgage real estate and other property. collect Social Security, Medicare, or other government benefits. invest your money in stocks, bonds, and mutual funds. handle transactions with banks and other financial institutions. buy and sell insurance policies and annuities for you.

Can you revoke a power of attorney?

As long as you are mentally competent, you can revoke a durable power of attorney at any time. You get a divorce. In a handful of states, if your spouse is your agent and you divorce, your ex-spouse's authority is automatically terminated. In other states, if you want to end your ex-spouse's authority, you have to revoke your existing power ...

Can you give your power of attorney to someone after you die?

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your death, such as paying your debts, making funeral or burial arrangements, or transferring your property to the people who inherit it. If you want your agent to have authority to wind up your affairs after your death, use a will to name that person as your executor.

What is the legal action for a POA?

If the person who created the POA is still alive, then typically a guardianship or conservatorship proceeding is needed to appoint a proper decision-maker.

What happens when someone grants POA to another person?

When someone grants POA to another individual, it gives great power but also great responsibility. Unfortunately, some people who are granted the power of a POA are dishonest and may sometimes take advantage of the power for their own selfish interests.

Why do people need a POA?

A person appoints a power of attorney (POA) to make decisions for himself or herself – usually a spouse, parent, or adult child — for a variety of reasons. Most commonly, people create POA’s to be prepared if tragedy strikes, such as a car accident, or the mental decline that often comes along with aging. Without a proper POA in place, a family of someone with dementia or Alzheimer’s disease, for example, would need to go to court to obtain guardianship or conservatorship to be able to protect and make decisions for the person no longer able to do so.

Can you get conservatorship if you have a POA?

Just because a POA is already in place does not mean you cannot obtain guardianship or conservatorship. The probate court is there to protect vulnerable adults, as well as those who have passed away, and judges do remove legal authority from POAs who act improperly.

Can a POA be used as an executor?

Even when the person who abused a POA in turns becomes the executor, a breach of fiduciary duty claim can still be filed against that person, if properly asserted in probate court.

Can a power of attorney in Michigan handle a POA case?

While many lawyers say they can handle cases of this nature, this area of law is very specialized. Working with a good attorney who really knows, and has handled, cases involving POA abuse and fiduciary duty breaches can make the difference between winning and losing.

Can a breach of fiduciary duty be filed against a POA?

Even when the person who abused a POA in turns becomes the executor, a breach of fiduciary duty claim can still be filed against that person, if properly asserted in probate court.

Popular Posts:

- 1. a notary who is not also a licensed attorney may:

- 2. how to contact the attorney general jeff sessions

- 3. how to pick attorney for physician contract review

- 4. how do you change power of attorney from one person to another

- 5. what is a claims attorney

- 6. why would a seller need an attorney to sell land

- 7. how to find family law attorney for simplified dissolution of marriage

- 8. how to list a new attorney on a business card

- 9. who is prosecuting attorney chippewa co mi

- 10. in the state of md, how can one tell if a power of attorney is legitimate