How do I get a durable power of attorney?

Getting a durable power of attorney will require the principal to find someone that they can trust to handle their assets if they should not be able to handle it themselves. This means that the person(s) selected should be trustworthy fully capable to make decisions and handle the affairs of the principal.

Can a durable power of attorney be appointed as an executor?

Since a will becomes effective after death, the individual assigned as the executor of the will takes over. The same individual can be appointed as a durable power of attorney and executor, if desired. Both types of POA grant similar authority.

What is a durable power of attorney for parents?

As a Durable POA, your legal agency remains intact until your parents pass away, or unless they revoke your power. This means that as their agent, you’ll still be able to make important decisions if or when they become unable to do so themselves. Does a Power of Attorney Have to be Filed with the Court?

What is a power of attorney and do I need one?

Rather, your Power of Attorney is a document you include with your other estate planning documents. You’ll want to keep this safe and secured, such as through your password-protected estate planning platform.

How do I upload documents to PenFed?

If you are: A Member: Log in to PenFed Online. ... Select the most appropriate Category and Document Type. ... Click Upload Files to select your file.If you want to upload more documents, click:Read the disclosure and click the checkbox to acknowledge it.Click the reCAPTCHA checkbox.Click Submit.

Does PenFed have safe deposit boxes?

Safe Deposit Box Pen Air Safe Deposit Boxes can be leased on an annual basis and lease fees are automatically deducted from member Savings Accounts in one payment every year. Boxes are subject to availability. Access your box anytime the lobby is open.

Who can join PenFed?

PenFed membership is open to everyone, including you.

Is PenFed FDIC insured?

Is PenFed FDIC Insured? Your deposits at PenFed are federally insured by the NCUA (National Credit Union Administration). NCUA insurance is the equivalent of FDIC (Federal Deposit Insurance Corporation) insurance.

Which bank has cheapest safe deposit box?

Annual cost of safe deposit boxes by bank and size3" x 5"3" x 10"Bank of America$75$150Chase$50$90Wells Fargo$80$125US Bank$63$1123 more rows•May 5, 2022

Does BMO have safety deposit boxes?

We understand how important it is to keep your valuables safe. To help you do that, BMO Bank of Montreal full-service branches offer safety deposit boxes for important documents such as your passport and landing documents, and valuables such as jewelry, family heirlooms or other precious items.

Is PenFed better than Navy Federal?

Is PenFed better than Navy Federal? They both have excellent customer service and have great programs and products. NFCU is more generous with credit limits. PENFED has lower rates.

Is PenFed easy to get approved?

PenFed requires a minimum credit score of 650. While this score can help you qualify, it won't get you the most favorable terms. We recommend a score of 720 to receive the lowest interest rates and largest loan amounts.

Is PenFed a military bank?

SERVING OUR MILITARY HEROES Since 2001, the PenFed Foundation has provided more than $38.5 million in financial support to more than 140,000 military families.

Are banks safer than credit unions?

Why are credit unions safer than banks? Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks. The National Credit Union Administration is a US government agency that regulates and supervises credit unions.

Is PenFed part of the Pentagon?

PenFed Credit Union was formed in 1935. It is formally known as the Pentagon Federal Credit Union, and its headquarters are in McLean, Va. Originally, membership was limited to those with ties to the military or the federal government. Now that this credit union has an open charter, anyone may join.

What states does PenFed service?

We serve members in all 50 states and the District of Columbia, as well as in Guam, Puerto Rico, and Okinawa.

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

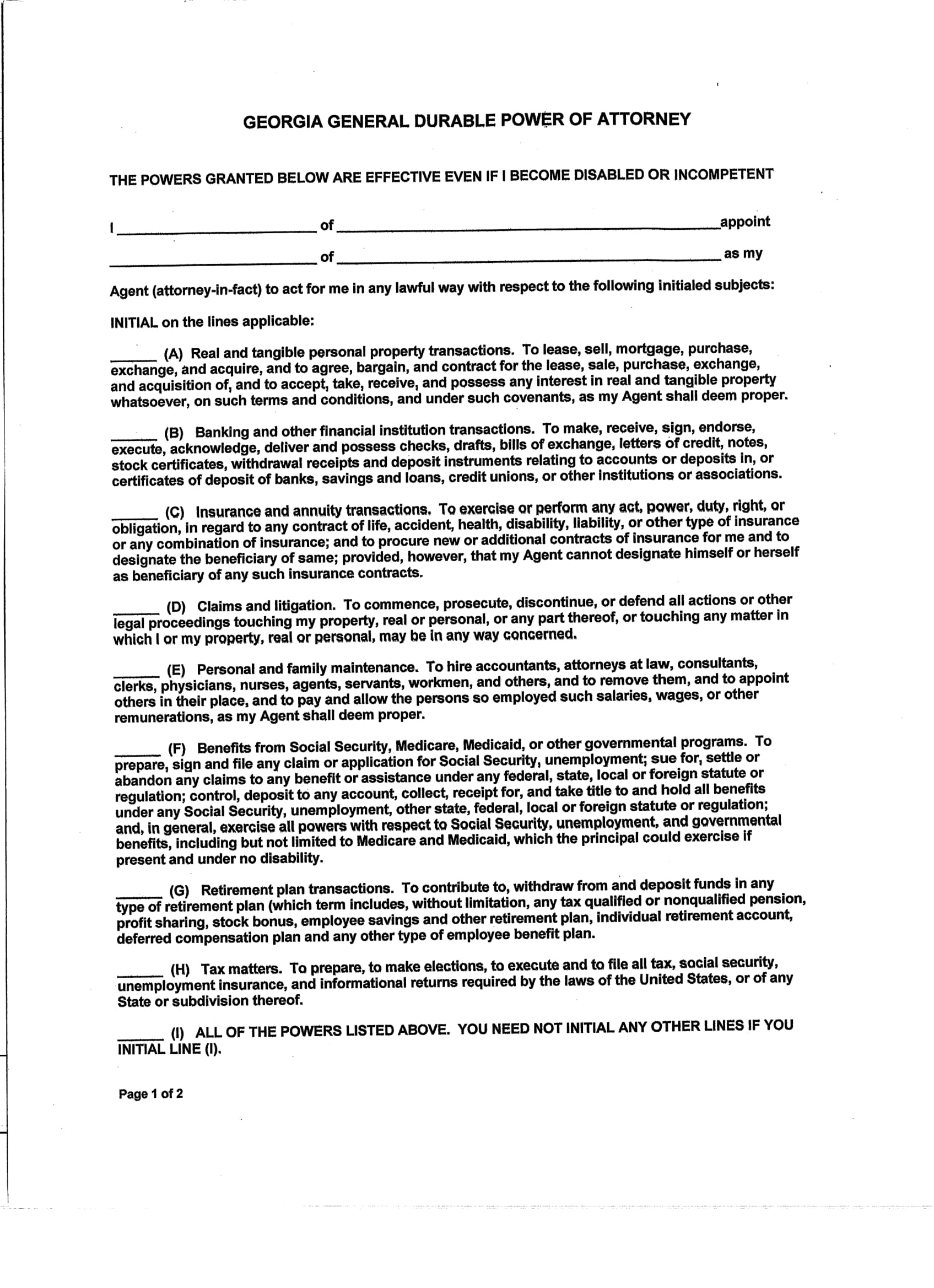

What is durable power of attorney?

In short, a general durable power of attorney is about your ability to have your property, legal affairs, business dealings and financial matters handled effectively, conveniently and quickly in the event of difficult or unforeseen personal circumstances.

What should a power of attorney consider?

A properly prepared and implemented power of attorney should consider and reduce potential risks to the individual and their family. Of course, appointing the "right" person as an agent is key. Characteristics such as trustworthiness, honesty, aptitude, experience and loyalty are important to consider. However, the manner in which ...

What is a life circumstance power of attorney?

Life circumstances may place an individual in a position (or location) where they are unable to make or execute key business, personal, legal or financial decisions for themselves and a power of attorney should squarely addresses such circumstances.

Can a power of attorney be broad?

A power of attorney can be prepared in such a way so as to be as narrow or as broad as you would like. For example, an individual could sign a power of attorney granting to someone else authority to manage one particular piece of property for a limited period of time.

Is it wise to exclude powers from a power of attorney?

For example, it may be wise to exclude certain more "sensitive" powers from a power of attorney (such as the ability to revise estate planning or beneficiary designations).

Is a non-durable power of attorney always preferable?

There are some instances in which someone might prepare a non-durable power of attorney ( which would terminate when the person giving the authority loses mental competence) but in the context of estate planning, it is almost always preferable to have a "durable" power of attorney.

What does a financial durable power of attorney do?

It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.

What is the Texas estate code for a power of attorney?

The agent's authority has been terminated under Texas Estates Code 751.132 and the power of attorney does not provide for a replacement; or. A guardian is appointed for the principal.

What is incapacitated power of attorney in Texas?

According to Section 751.00201 of the Texas Estates Code, a person is considered to be "incapacitated" for the purposes of a durable power of attorney if a doctor's examination finds that they are not able to manage their own finances.

Why do people need a durable power of attorney?

Many families assign a durable power of attorney to protect elderly or cognitively impaired loved ones. A durable power of attorney can extend authorization to all pertinent areas of one's life, including medical and financial decisions, after an individual is unable to act on their own behalf.

What happens to a durable power of attorney after death?

Since a will becomes effective after death, the individual assigned as the executor of the will takes over. The same individual can be appointed as a durable power of attorney and executor, if desired.

What is the difference between a durable power of attorney and a power of attorney?

The key difference is when they can be used. A typical power of attorney ends if the individual granting power of attorney becomes incapacita ted, while a durable power of attorney will stay in place. As such, a durable power of attorney is more appropriate for handling important end-of-life decisions.

What is a medical power of attorney?

A medical power of attorney is a type of durable power of attorney. This distinction gives an individual the right to make medical and health care-related decisions on your behalf after you lose the ability to do so for yourself. Advanced directive vs. durable power of attorney.

What is a POA?

A power of attorney (POA) is a legal document authorizing an individual to handle specific matters, such as health and financial decisions, on the behalf of another. If the POA is deemed durable, the POA remains in effect if the person granting the authorization becomes incapacitated. Durable powers of attorney are set in motion to protect people ...

Can a power of attorney make medical decisions?

In comparison, a durable power of attorney only allows another individual to make medical decisions on your behalf when you become mentally incapacitated. This applies to both end-of-life decisions and regular medical decisions, including prescription refills and doctor appointments.

Does a trustee have the right to manage other property?

The trustee does not have the right or power to manage any other property or assets. With a financial durable power of attorney, an individual of your selection handles your financial and asset decisions should you become incapable of doing so yourself.

What does DPOA stand for in a power of attorney?

If you’re appointed as the agent through a Durable Power of Attorney (DPOA), you’ll be given legal authority to act on your parents’ behalf. You’ll have agency to care for them even if they become suddenly incapacitated, until the day they pass away.

What is POA in estate planning?

A POA is a powerful estate planning tool, and there are a few different categories of powers, used in difference scenarios. Two types to consider are General Power of Attorney and Durable Power of Attorney. They’re equally important in the legal authority field, but there’s one key difference between them.

What is the difference between a POA and a DPOA?

The key differentiation between DPOA vs POA is simple: incapacitation. As a General POA, your agency ends the moment your parents become incapacitated. This means that if they suddenly become unable to make decisions for themselves, you will no longer be able to make important decisions for them.

What is a GPOA?

A General Power of Attorney (GPOA) is a similar legal document that allows your parents to appoint you as their agent. As a GPOA, your duties will end if your parents ever became incapacitated.

Do you have to file a POA with the court system?

Generally, a POA does not have to be filed with the court system. Rather, your Power of Attorney is a document you include with your other estate planning documents. You’ll want to keep this safe and secured, such as through your password-protected estate planning platform.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

How many copies of POA form are needed?

Successor Agent (optional) – Elect to have in case the agent is not available. Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present.

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

What powers does the principal have in real estate?

Financial Powers. The principal may grant the following standard financial powers to the agent in accordance with Section 301 (page 68): Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items;

What do you need to do after a form is completed?

After the form has been completed the principal will need to figure out the signing requirements in their State to finalize the document. In addition, the principal will need to gather the agent (s) as they will be required to sign the form in front of either the two (2) witnesses or notary public.

What is an agent certification?

An agent certification is an optional form that lets an agent acknowledged their designation by the principal. The agent must sign in the presence of a notary public ( Section 302 – Page 74 ):

What is an attorney in fact statement?

(25) Attorney-in-Fact Declaration. The Agent who will be granted the principal powers you approved according to the conditions you set will have an acceptance statement to tend to. The printed name of the Attorney-in-Fact must be included in this statement.

What Is Power of Attorney

A power of attorney is a document that grants legal authority to one person, known as the agent or “attorney in fact,” to act on behalf of another, the principal, when they are unable to do so themselves.1 While the word attorney might make one assume these responsibilities are reserved for lawyers, the agent can actually be any person the principal trusts enough to make decisions in their best interest or as directed, ranging from financial to healthcare matters.2.

When to Use a General (Financial) POA

Let’s use a hypothetical to outline one example of how and when a general power of attorney can be useful:

When to Use a Durable (Financial) POA

Under the same hypothetical situation, how or when would a durable power of attorney be necessary?

Popular Posts:

- 1. how to report a claim to state attorney general mass

- 2. attorney who handle ticket in galveston county

- 3. where to deduct the legal fees paid to attorney in the bp oil spill

- 4. what do i need when i sign power of attorney

- 5. how to qualify for pro bono attorney

- 6. how many cases do the district attorney office see in one day juvenile court utah

- 7. where to report a forged attorney signature in nj

- 8. defense attorney for murder is who

- 9. why gifts under power of attorney

- 10. not important when getting a disk for litigation support to an attorney