Many people sign a financial power of attorney, known as a durable power of attorney, to give a friend or family member the power to conduct financial transactions for them if they become incapacitated. People also commonly sign health care powers of attorney to give someone else the authority to make medical decisions if they are unable to do so.

How do you make a power of attorney durable?

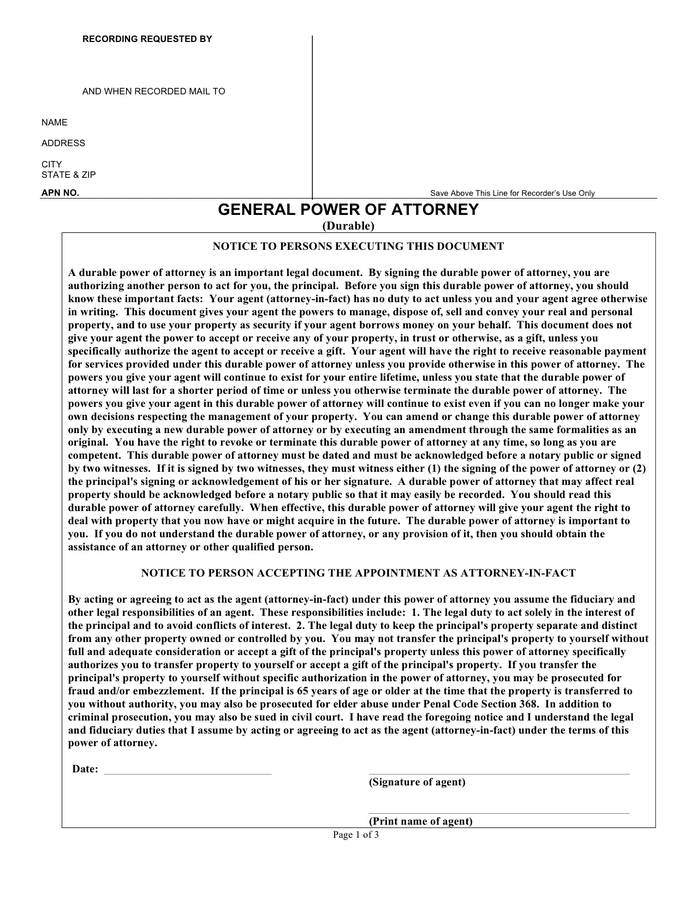

Jan 27, 2022 · A durable power of attorney gives your agent the right to make decisions and take the actions specified for the long term. Even if you are mentally incapacitated or deemed unfit to make decisions for yourself, your agent can still act on your behalf.

Can a power of attorney sign documents on behalf of someone?

That’s where a durable power of attorney can help. It serves to give an appointed third party permission to make decisions for you if you’re unable to do it for yourself. A durable power of attorney can prevent many potentially unpleasant situations from happening—including having a judge declare you incompetent in court and handing the control over your affairs to a social …

What is a durable healthcare power of attorney?

May 02, 2022 · A person who holds a power of attorney is sometimes called an attorney-in-fact. Many people sign a financial power of attorney, known as a durable power of attorney, to give a friend or family member the power to conduct financial transactions for them if they become incapacitated. People also commonly sign health care powers of attorney to give someone …

What is a power of attorney form?

The wording of the durable power of attorney restricts or creates the ability for the agent named to act on the principal’s behalf. The legal validity of the durable power of attorney is usually construed by a third party, such as a financial institution, bank, investment company, or court. The third-party will be looking for verification of the identity of the person who signed the document …

What does durable mean in power of attorney?

What is the advantage to executing a durable power of attorney?

How do you endorse a check with power of attorney?

You can sign the person's name first, then follow it with "by [your name] under POA." Or, you can sign your own name first, then identify yourself as "attorney-in-fact for [the person's name for whom you are attorney-in-fact.]Dec 12, 2018

What three decisions Cannot be made by a legal power of attorney?

What are the disadvantages of a durable power of attorney?

You will not have direct control over your agent's actions because he or she will have the authority to enter into transactions for you, without you being present.Jul 7, 2014

What do you put when signing on behalf of someone?

Can I deposit a check with my dad's name on it?

Does bank of America accept power of attorney?

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

What is a durable power of attorney?

A durable power of attorney is one of the most important legal documents you’ll ever have to create. You don’t want to risk omitting a crucial section—any mistake can have considerable consequences for your future health, finances, or property management.

Why do we need a power of attorney?

That’s why creating a power of attorney is crucial. It ensures your health, finances, and many other aspects of your life will be taken care of according to your wishes.

What is a POA?

A power of attorney (POA) is a legal document that authorizes an individual to perform different actions on another person’s behalf, including: Solve My Problem. Get Started.

Can you revoke a power of attorney?

A durable power of attorney can be broad or limit the agent’s powers to specific acts. If you suspect a person is abusing their authority as your agent, you can revoke the power of attorney at any time—as long as you’re mentally competent.

Can a power of attorney be terminated?

In some cases, the court can terminate a durable power of attorney. That can happen when, for example, the principal and agent get divorced and fail to update their documents. Also, some states consider any power of attorney durable unless the contract specifies otherwise.

Does a power of attorney need to be notarized?

Get the document notarized. In most states, any power of attorney needs to be notarized to be considered legally valid.

Do you have to record a POA?

While recording the POA is not a legal requirement in all states, it’s standard practice among real estate planners. File the document. Some states require the signers to file specific durable powers of attorney with the court or government office to make them legally valid.

What is a power of attorney?

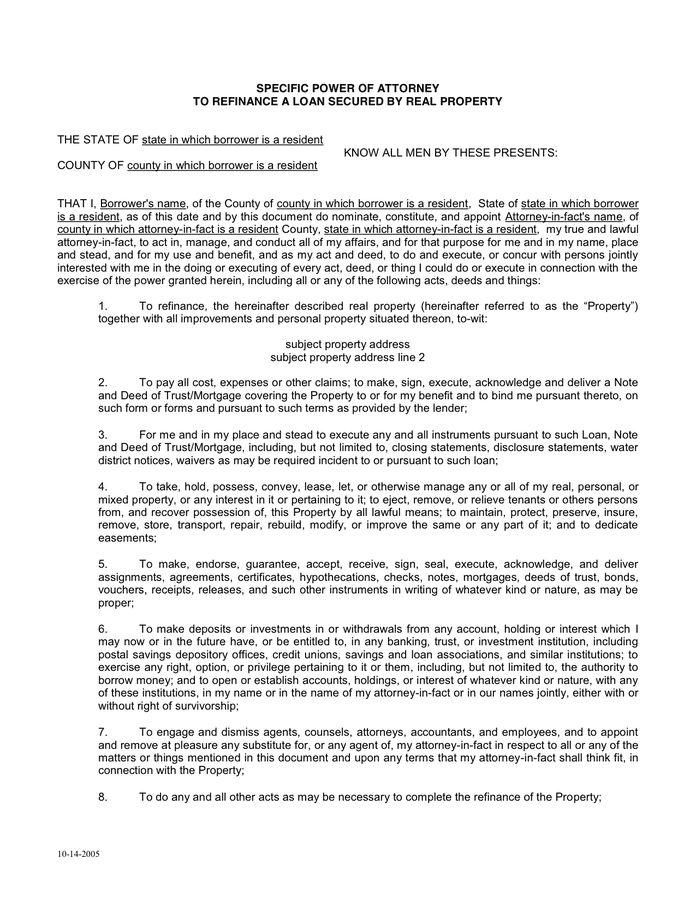

A power of attorney is a legal document that gives someone the authority to sign documents and conduct transactions on another person’s behalf. A person who holds a power of attorney is sometimes called an attorney-in-fact.

Who is responsible for managing a power of attorney?

A person who acts under a power of attorney is a fiduciary . A fiduciary is someone who is responsible for managing some or all of another person’s affairs. The fiduciary has a duty to act prudently and in a way that is fair to the person whose affairs he or she is managing.

What is an attorney in fact?

Duties of an Attorney-in-Fact. A person who acts under a power of attorney is a fiduciary. A fiduciary is someone who is responsible for managing some or all of another person’s affairs. The fiduciary has a duty to act prudently and in a way that is fair to the person whose affairs he or she is managing. An attorney-in-fact who violates those ...

Who is Jane Haskins?

Jane Haskins is a freelance writer who practiced law for 20 years. Jane has litigated a wide variety of business dispute….

What is Durable Power of Attorney?

The wording of the durable power of attorney restricts or creates the ability for the agent named to act on the principal’s behalf. The legal validity of the durable power of attorney is usually construed by a third party, such as a financial institution, bank, investment company, or court.

What is a third party verification?

The third-party will be looking for verification of the identity of the person who signed the document and for verification of the identity of the person named as the agent. This can become problematic if the agent has changed names due to marriage, divorce, or legal name change. Once the parties are identified, ...

What is a springing power of attorney?

With a springing power of attorney, the authority to act on your behalf only kicks in after a doctor certifies that you’re incapacitated. (One drawback to keep in mind: That extra step can sometimes create delays.)

What happens if you are unable to manage your own affairs?

So if you are unable to manage your own affairs for any reason—for example, you’re unconscious in the hospital, or you develop severe dementia—your agent can step in and pay your bills or file your taxes, deposit checks in your bank account, manage your investments, handle insurance issues, and make many other important decisions. ...

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

Who is Mollie Moric?

Mollie Moric is a staff writer at Legal Templates. She translates complex legal concepts into easy to understand articles that empower readers in their legal pursuits. Her legal advice and analysis...

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a convicted felon have a power of attorney in Texas?

Can a Convicted Felon Have Power of Attorney? Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they want to serve as their power of attorney.

Do you need a power of attorney to act on your behalf?

Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf. So, if you want your attorney-in-fact to start using the document right away, give the original document to the attorney-in-fact. If you named more than one attorney-in-fact, give the original document to one of them.

Can you give copies of durable power?

If you wish, you can give copies of your durable power to the people your attorney-in-fact will need to deal with —in banks or government offices, for example. If the durable power is in their records, it may eliminate hassles for your attorney-in-fact later because they will be familiar with the document and expecting your attorney-in-fact to take action under it.

Can you use a power of attorney if you are incapacitated?

If your power of attorney won't be used unless and until you become incapacitated , however, it may seem premature to contact people and institutions about a document that may never go into effect. It's up to you. Be sure to keep a list of everyone to whom you give a copy.

What is a Durable Power of Attorney?

When you create and sign a Durable Power of Attorney, you give another person legal authority to act on your behalf. This person may also be called an agent or as an attorney-in-fact. Here is a list of those financial decisions you may give to your agent. You may choose which ones this agent can perform or you may give the agent permission ...

What happens to a durable power of attorney after death?

The Durable Power of Attorney ends with your passing. Your agent cannot handle any of your affairs after your death. These affairs are conducted by your trustee or the administrator/executor of your estate. You can appoint your agent to be this administrator/executor. Your Durable Power of Attorney also ends if: ...

What is a POA?

One of the easiest documents to provide is the Durable Power of Attorney (POA). This document is also referred to as a Financial Power of Attorney. This document enables your finances and business decisions to be managed effectively and efficiently should you be unable to communicate your directives or you have become incapacitated.

What is the job of a real estate agent?

Handle all types of real estate and other property transactions. Collect your government benefits, including Social Security and Medicare. File and pay your federal and state taxes. Conduct your financial transactions with banks and other financial institutions. Handle your investment portfolio and retirement plans.

Can a power of attorney be used after death?

The Durable Power of Attorney ends with your passing. Your agent cannot handle any of your affairs after your death. These affairs are conducted by your trustee or the administrator/executor of your estate.

Who is Leonard Steinberg?

Leonard Steinberg is the principal of Steinberg Enterprises, LLC and is a United States federally licensed Enrolled Agent with an extensive tax practice. Mr. Steinberg is also a Certified Management Consultant (CMC).

Popular Posts:

- 1. what happens when a fire marshall makes a referral to the state attorney office

- 2. what pocs meand in attorney firm audit

- 3. how would you target facebook ads for a criminal attorney

- 4. mastagni lawfirm what percentage do attorney get

- 5. how much is an attorney for us citizenship

- 6. who was the attorney in loving

- 7. when does a financial power of attorney end

- 8. my attorney has had my settlement check for over 1 month, what is taking so long

- 9. how to file a case with right to sue letter without an attorney

- 10. how to enswer an attorney who has not done a good job