Some disadvantages of getting a power of attorney are that:

- the principal’s mental capacity at signing can be questioned

- some banks don’t accept a power of attorney

- incorrectly created POAs won’t give the agent the authority they need to make decisions

- the agent can abuse their powers if the instructions are too broad

- the principal could be a victim of elder abuse or fraud

- A Power of Attorney Could Leave You Vulnerable to Abuse. ...

- If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ...

- A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.

What are the pros and cons of a power of attorney?

Dec 28, 2021 · Some disadvantages of getting a power of attorney are that: the principal’s mental capacity at signing can be questioned some banks don’t accept a power of attorney incorrectly created POAs won’t give the agent the authority they need to make decisions the agent can abuse their powers if the ...

Why are limited durable power of attorney becoming more common?

Feb 05, 2015 · The durability allows the power of attorney to remain in effect even if you become incapacitated. The same basic disadvantage exists with regard to the handing over of power to another individual. However, in addition to this, there are some estate planning factors to take into consideration. You could create a durable financial power of attorney empowering …

What are the different kinds of power of attorney?

Oct 03, 2014 · When you grant your Agent broad powers it is known as a “General POA”. When the powers you grant are limited, it is referred to as a Limited POA or a Special POA. The disadvantages to a power of attorney will depend, to some extent, on the type of POA you create. If you execute a general POA, one of the biggest potential disadvantages is that your Agent has …

Can an agent of a power of attorney cause legal and financial chaos?

Jan 29, 2016 · Therefore, if your power of attorney does not comply the bank’s internal policies, your attorney-in-fact will likely have difficulty accessing your accounts and completing transactions. You must provide notice of revocation to all third-parties. Revoking a power of attorney, simply requires a written statement that the power or authority is being revoked. The …

What are the pros and cons of a power of attorney?

- Pro: Lower Cost. ...

- Pro: Convenience. ...

- Con: It Might Not Conform to State Law. ...

- Con: It Might Give Your Agent Too Much or Too Little Power. ...

- Con: It Might Be Too General. ...

- Con: It Could Expose You to Exploitation.

Is power of attorney a good idea?

What does giving someone the power of attorney mean?

What three decisions Cannot be made by a legal power of attorney?

Who makes decisions if no power of attorney?

How long can a power of attorney last?

Once an LPA has been validly executed, it will last indefinitely unless revoked by the donor, the attorney, the Court of Protection or by operation of law.May 25, 2021

What is the best power of attorney to have?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

What is a power of attorney?

A power of attorney is a legal document that you can use to give another person the ability to act on your behalf. It can be necessary to grant a power of attorney under some circumstances, but there is an inherent disadvantage that is readily self-evident. It can be disconcerting to allow someone else to act for you, ...

Can you be a trustee while you are alive?

As the grantor of the trust you can act as the trustee while you are alive and well . You would name a successor trustee to administer the trust after your passing. It would also be possible to empower the successor trustee to manage the trust in the event of your incapacitation.

Should you prepare for incapacity when creating an estate plan?

You should certainly take steps to prepare for possible incapacity when you are creating your estate plan, because many elders become unable to make sound decisions on their own at some point in time.

Who is Paul Kraft?

Paul Kraft is Co-Founder and the senior Principal of Frank & Kraft, one of the leading law firms in Indiana in the area of estate planning as well as business and tax planning.

What are the disadvantages of a power of attorney?

If you execute a general POA, one of the biggest potential disadvantages is that your Agent has the ability to devastate you financially. With a general POA your Agent can withdraw funds from all your financial and investment accounts, ...

What is a power of attorney?

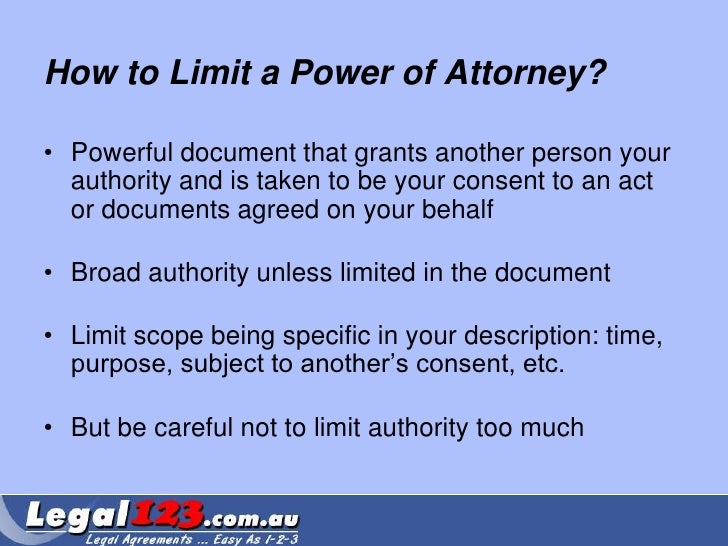

A power of attorney is a legal arrangement wherein you give someone (known as your “Agent”) the legal authority or power to act on your behalf. As the Principal, you have the ability to grant limited powers to your Agent or broad powers. When you grant your Agent broad powers it is known as a “General POA”.

What is a POA?

Powers of Attorney. At some point in your life you will likely be asked to execute a power of attorney, or POA, or you will contemplate the need for one. A POA can be an extremely useful legal tool when used appropriately and carefully.

What is a limited POA?

When you grant your Agent broad powers it is known as a “General POA”. When the powers you grant are limited, it is referred to as a Limited POA or a Special POA. The disadvantages to a power of attorney will depend, to some extent, ...

What is a general POA?

When you grant your Agent broad powers it is known as a “General POA”. When the powers you grant are limited, it is referred to as a Limited POA or a Special POA. The disadvantages to a power of attorney will depend, to some extent, on the type of POA you create.

What does "durable" mean in POA?

You can resolve this dilemma, however, by making your POA a “durable” POA. “Durable” simply means the POA survives the incapacity of the Principal. Finally, many states do not allow medical treatment decisions to be made by an Agent even if the Agent has a general power of attorney.

Can an agent make medical decisions?

Finally, many states do not allow medical treatment decisions to be made by an Agent even if the Agent has a general power of attorney. Instead, a very specific advanced directive must be executed giving an Agent the legal authority to make healthcare decisions for you.

What are the pros and cons of a power of attorney?

Power Of Attorney: The Pros And Cons 1 Establishing a power of attorney is inexpensive. 2 Your loved one can decide who should make decisions on his or her behalf. 3 Your loved one controls whether the agent has general or specific power. 4 The document can require the agent to become bonded or to give an account of his or her transactions.

Is a power of attorney cheap?

Establishing a power of attorney is inexpensive. Your loved one can decide who should make decisions on his or her behalf. Your loved one controls whether the agent has general or specific power. The document can require the agent to become bonded or to give an account of his or her transactions.

What is a durable power of attorney?

General Durable Power Of Attorney. This is the standard POA agreement for wills, estates, and finances. Agents can buy and sell property, pay bills, and conduct other financial business for the grantor. Durable means it remains binding should the grantor become incapacitated or pass away.

What is a durable POA?

Durable means it remains binding should the grantor become incapacitated or pass away.

What is a limited POA?

This is a simple, limited POA that allows the agent to make healthcare and medical decisions should the grantor become incapacitated and require guardianship. It’s essential to recognize that this type of POA carries an extremely low risk for the agent, and no agent will be held financially responsible for the medical bills of the grantor.

Can you give a spouse a POA?

Spouses are considered the first next of kin in the eyes of the law. As such, it is generally unwise to give a spouse POA over your affair s as it could adversely affect them financially and legally should they need to use that POA. Suppose you insist on making your spouse or close relative an agent of your POA. In that case, the recommendation is to use a limited durable power of attorney and not a general power of attorney.

Can a POA cause financial chaos?

Sometimes, either through willful intent or blissful ignorance, agents of a POA can cause legal and financial chaos. If the terms of the POA are too broad (as with a general durable POA), the agent can buy and sell property at a loss, mismanage a business into the ground, or even create the appearance of theft or embezzlement unintentionally.

What to do before signing a POA?

Before you sign anything as an agent in a POA, you want to make sure you clearly and thoroughly understand the rules, stipulations, and limitations of the agreement. Even unintentionally violating any of those rules can result in legal and financial liability for you even though you were acting as the grantor’s agent.

Popular Posts:

- 1. do you need an attorney when you sell your house

- 2. what is an ag order from the texas attorney general court

- 3. what power of attorney lets the agent manage medical insurance

- 4. who is running for nevada attorney general 2018?

- 5. does a general power of attorney expire when the person dies

- 6. where can i find a free l and i attorney in washington state

- 7. what different attorney and lawyer

- 8. who was chambliss attorney in 77

- 9. can lawyer allow person who suffered tbi yrs ago be power of attorney or handle lawsuit awards

- 10. county attorney asking my 12 year old daughters rapist for light sentence. what can i do?