What is the difference between will and power of attorney?

What does it mean to give someone your power of attorney?

What three decisions Cannot be made by a legal power of attorney?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

Is a Power of Attorney the same as a Living Will?

Keep in mind that a Healthcare Power of Attorney is not necessarily the same thing as a Living Will. Some states allow certain preferences to be included in a Living Will, such as whether or not you’d want to be on life support.

What is a financial power of attorney?

A Financial Power of Attorney designates an agent the authority to make financial decisions and act on your behalf should you not be able to. This type of POA can be broad or very specific. It’s another title for General POA, and could typically grant all the same actions listed above.

Do you have to prove incapacitation to get a power of attorney?

The biggest issue is proof. Since this type of Power of Attorney only goes into effect after you’re incapacitated, there could easily be (and often is) a necessity to prove incapacitation. This sometimes even requires a court order, which can be a lengthy process during a very time-sensitive period.

Can you have more than one power of attorney?

Yes, you can appoint more than one Power of Attorney. If you designate more than one person, be sure to clearly note how you want them to act. You can specify if they must act jointly or if they can act independently. If you only choose one POA, you should consider having a backup designation.

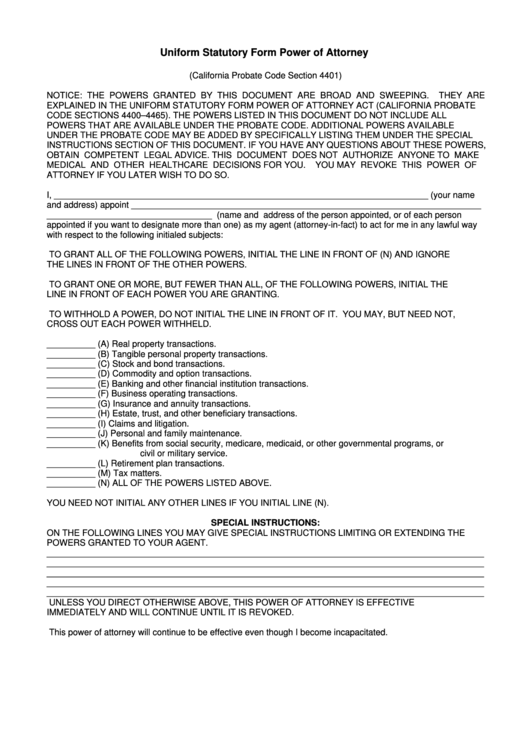

When was the Uniform Power of Attorney Act created?

The Uniform Power of Attorney Act (UPOAA) was created by the Uniform Law Commission in 2006 to establish universal rules for POAs across the states. The law states what powers are included by default, versus which need to be stated outright.

What is a POA?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

What is a fiduciary POA?

The person you appoint as your Power of Attorney is known as a fiduciary – someone who is responsible for managing the affairs of another. Depending on the type of POA that’s in effect, the powers your agent can exercise could have a wide range of authority. At the most basic level, your POA will act on your behalf if you become unable to do so ...

What is a power of attorney?

Power of attorney is a written legal document that allows an agent or attorney-in-fact to take financial and legal actions for you.

Is a power of attorney part of an estate plan?

Often, designating general power of attorney is part of a larger estate plan, so if you're visiting a lawyer to draft a will, trust or guardianship documents, you can roll this into the conversation.

How to set up a power of attorney?

To get started, follow these basic guidelines for designating power of attorney: 1 How to set up power of attorney. 2 Consider durable power of attorney. 3 Limited vs. general power of attorney. 4 Immediately effective vs. springing power of attorney. 5 Power of attorney for health care.

Can a power of attorney be used as a proxy?

Generally, power of attorney applies to legal and financial matters, but a separate document can also allow a proxy to make health care decisions for you if you are incapacitated. The rules for designating power of attorney vary from state to state, so it's important to know your own state's laws. Here's what to know about power ...

When does a power of attorney go into effect?

A springing power of attorney goes into effect in a predetermined situation, such as after the principal becomes incapacitated. Typically, the legal document will specify the circumstances under which the power takes effect. An immediately effective or nonspringing power of attorney is in place once the paperwork is signed.

Can you have a durable power of attorney if you are incapacitated?

That's where durable power of attorney comes in. A durable power of attorney continues after the individual is incapacitated .

What happens to a durable power of attorney?

That's where durable power of attorney comes in. A durable power of attorney continues after the individual is incapacitated. So if you are unable to make financial or medical decisions on your own after an accident or illness, the document will remain in effect.

Can you designate a power of attorney?

But really, you can designate your power of attorney anytime you want. You simply need to have an attorney draw up the paperwork. You also can specify when the duties of the power of attorney begin to take effect.

What is a power of attorney?

Regardless of the name, a power of attorney is someone you choose to make health and medical decisions for you if you're unable to make them for yourself. 1. For most people, having this person in place to make medical decisions when they are no longer able to do so can bring peace of mind. Some people choose to designate a power ...

Can a power of attorney agree with everything you want?

While your power of attorney may not agree with everything you want, they have to be willing to follow through even though they disagree. If you feel pressured to change your opinions, then that is a sign that this person would not make a good representative for you.

How to choose a power of attorney?

When choosing your power of attorney, talk to the person you are considering. Be sure that they feel they could serve in this capacity. Encourage the person to be honest.

Do you need a lawyer to do a proxy?

To assign a healthcare proxy, you'll fill out a document in a hospital setting and just need two witnesses to complete it—you do not need a lawyer for this purpose. A power of attorney, however, is a more formal document that can have medical as well as legal and financial implications.

What is a durable financial power of attorney?

The durable financial power of attorney is simply a way to allow someone else to manage your finances in the event that you become incapacitated and are unable to make those decisions yourself. …. More precisely, it grants someone legal authority to act on your behalf for financial issues. A financial agent can….

When was the Power of Attorney Act created?

Uniform POA Act. Twenty-five states have adopted the Uniform Power of Attorney Act. Created in 2006 by the Uniform Law Commission, this law aims to create universal default rules for POA contracts across states. It determines which powers are included in the document by default, and which must be explicitly addressed in order to be bestowed on an ...

What is a POA?

A power of attorney (POA) is a legal document in which (you) called the Principal, designates another person, called the Agent or an attorney-in fact to act on your behalf to make decisions in specified matters or in all matters. A power of attorney is in effect only as long as the principal is alive and it can only be enacted by a principal who is mentally competent. You may think that once an attorney-in-fact has be appointed you lose control of any decision making and how your assets are used. This is not true… a POA only steps in if you are no longer mentally capable of running your own affairs.

Can an agent change POA?

Change or transfer POA to someone else. An agent has the right to decline their appointment at any time. However, unless the principal named a co-agent or alternate agent in the same POA document or is still competent to appoint someone else to act on their behalf, an agent cannot choose who takes over their duties.

Can an agent choose who takes over the POA?

However, unless the principal named a co-agent or alternate agent in the same POA document or is still competent to appoint someone else to act on their behalf, an agent cannot choose who takes over their duties.

Can a POA pay bills?

When creating a power of attorney you can be as specific as you like. You can say the financial POA can only pay bills, buy and sell stocks and bonds, manage real estate or any individual affair you would like to include.

Can you do a POA before incapacitation?

Incapacitation can happen at any time of your life but senior citizens should consider doing a POA before physical deterioration or mental incapacity. A POA completed in time ensures that your personal affairs are attended to when you no longer have the ability to manage them on your own.

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

What is a power of attorney?

A power of attorney is a legal document or contract that allows you to officially designate someone as your agent. Your agent, also known as an attorney-in-fact, can handle financial and legal matters on your behalf in the event that you become physically or mentally incapacitated. Because your agent can handle a wide variety ...

What are the different types of powers of attorney?

There are three types of power of attorney: durable, conventional and springing. The durable power of attorney contract gives your designated agent the right to handle business and financial matters like stock portfolios, bank accounts and real estate agreements on your behalf. It becomes effective as soon as you, the principal, sign the form and remains effective throughout your lifetime unless you revoke it. Conventional powers of attorney become effective as soon as they are signed and filed with the courts. The drawback to this type is that it becomes ineffective should you become incapacitated, the very reason that many people designate someone to handle their legal affairs. Springing powers of attorney only become effective after you become incapacitated and usually last throughout a life event such as a coma. You can revoke a power of attorney at any time.#N#Read More: Types of Power of Attorney for Elderly Family Members

What is an attorney in fact?

Your agent, also known as an attorney-in- fact, can handle financial and legal matters on your behalf in the event that you become physically or mentally incapacitated. Because your agent can handle a wide variety of personal matters on your behalf including handling banking and credit issues, it is important that you choose ...

Why is it important to choose the best person to file a power of attorney?

Because your agent can handle a wide variety of personal matters on your behalf including handling banking and credit issues, it is important that you choose the best person when you file your power of attorney forms.

When does a power of attorney become effective?

Conventional powers of attorney become effective as soon as they are signed and filed with the courts.

Can you use a springing powers of attorney after you are incapacitated?

The drawback to this type is that it becomes ineffective should you become incapacitated, the very reason that many people designate someone to handle their legal affairs. Springing powers of attorney only become effective after you become incapacitated and usually last throughout a life event such as a coma. ...

Can you revoke a power of attorney at any time?

Springing powers of attorney only become effective after you become incapacitated and usually last throughout a life event such as a coma. You can revoke a power of attorney at any time. Read More: Types of Power of Attorney for Elderly Family Members.

What is a power of attorney?

In a power of attorney, you name someone as your attorney-in-fact (or agent) to make financial decisions for you. The power gives your agent control over any assets held in your name alone. If a bank account is owned in your name alone, your attorney-in-fact will have access to it.

Is a power of attorney important?

People tend to focus their energies on their wills and trusts, naming someone to serve as their power of attorney at the last minute. This is an important decision and not one that should be taken lightly.

What is the power of a bank account?

The power gives your agent control over any assets held in your name alone. If a bank account is owned in your name alone, your attorney-in-fact will have access to it. If you have transferred an asset to your trust, your trustee will have control of the asset. Consider your options.

When is a durable power of attorney effective?

A durable power of attorney is effective when you sign it and survives your incapacity. A springing power of attorney springs into effect when you are incapacitated. A springing power of attorney seems more attractive to most people, but it is actually harder to use.

Is a springing power of attorney harder to use?

A springing power of attorney seems more attractive to most people, but it is actually harder to use. Your agent will need to convince the bank that you are incapacitated and, even though the document spells out how to do that, your local bank branch often does not want to make that determination.

Can a power of attorney change bank account?

Depending on the language of the power of attorney, your agent may be able to change the ownership of your bank accounts or change your beneficiary designations. This is a common scenario in second marriages.

What to do if your named agent dies before you?

Name an alternate. If your named agent dies before you or is incapacitated, you want to have a back-up who can act. Also, consider nominating a guardian and conservator in your power of attorney in case one is needed down the road. Read the document. This seems obvious, but clients often do not read their documents.

Can you choose who to execute a power of attorney?

If you execute a power of attorney, you can choose the person you prefer and there is no delay between the time you need someone to handle your affairs and the time they can do so. Each state has its own power of attorney form. The document must be signed and notarized in most states to be valid.

Can you have a will and a power of attorney together?

It is almost always recommended that you create a will and power of attorney together. The power of attorney provides protection during your lifetime, while the will provides protection after your death. Together they provide an ongoing umbrella of protection for your assets.

What happens if you don't have a power of attorney?

If you do not have a power of attorney, a court proceeding is necessary to prove you are mentally incompetent and have a guardian appointed. If you execute a power of attorney, you can choose the person you prefer and there is no delay between the time you need someone to handle your affairs and the time they can do so.

What is a durable power of attorney?

This type is applicable from the date it is executed. If you sign it today, your son can manage your bank account tomorrow without any further authorization.

What is a last will and testament?

A last will and testament is a document that allows you to decide who will inherit your assets after you die. As the testator, you select who your heirs will be and what they each will receive. You also name an executor, who will be responsible for distributing your assets in accordance with your wishes. A last will can also be used ...

What is the purpose of a last will?

You also name an executor, who will be responsible for distributing your assets in accordance with your wishes. A last will can also be used to name a guardian for your minor child. Last wills must be signed in front of witnesses.

What is a POA?

A power of attorney (POA) is a legal document that authorizes someone else (called the attorney in fact) to make business, legal, and financial decisions on your behalf. If you become unable to manage your own affairs, the person you choose will be able to do it for you. Your attorney in fact will be able to pay your bills, ...

Can I Delegate My Power of Attorney Duties to Another Person?

I have come across this question a lot about whether an agent under a power of attorney can delegate his or her powers to someone else. The agent, often an older son or daughter, was selected by the principal to carry out the duties in the power of attorney.

About the Author: Robert Wells

Attorney Robert M. Wells is the principal attorney of The Law Office of Robert M. Wells, which is currently based in Vallejo, California which provides high quality legal services for Business, Estate Planning, Landlord, and Real Estate related matters. The Law Office of Robert M.

Popular Posts:

- 1. how to become an ediscovery attorney

- 2. how old is david o denton attorney

- 3. how do i get apower of attorney in ny

- 4. why did my attorney request a change of judge?

- 5. who is us attorney district of nj

- 6. how to get power of attorney in virginia for a minor

- 7. what games included in phoenix wright ace attorney trilogy

- 8. what happens when you ignore the epa and states attorney

- 9. attorney disclosing who their clients are?

- 10. how to appeal case in upshur county texas without attorney