Massachusetts Office of the Attorney General Division of Public Charities SHORT FORM PC To be filed annually by all non-profit charitable organizations conducting business in the Commonwealth.

Who must file a form PC in Massachusetts?

A. Who Must File a Form PC? Every public charity organized or operating in Massachusetts or soliciting funds in Massachusetts must file a Form PC with the Non-Profit Organizations/Public Charities Division (the “Division”), except organizations that hold property for religious purposes or certain federally chartered organizations.

Who needs to file a form PC?

A. Who Must File a Form PC? Every public charity organized or operating in Massachusetts or soliciting funds in Massachusetts must file a Form PC, except organizations which hold property for religious purposes or certain federally chartered organizations. The Form PC, including attachments, becomes a public record and is open to public inspection.

Where can I contact the Attorney General of Massachusetts?

Form PC. Check all items attached (if applicable) Schedule A-1 Schedule A-2. Schedule RO Probate Account. Copy of IRS Return Audited Financial Statements/Review. Filing Fee or Printout of Electronic Payment Confirmation Amended Articles/ By-Laws. Electronic Payment Confirmation #: Schedule VCO. Rev. 03/2020. Attach printout of electronic payment confirmation.

What is the form PC for nonprofit organizations in Massachusetts?

In order to process a proposed dissolution, all public charities that are required to report to the AGO must submit the following: 1) A completed Form PC-F; 2) an officer's certificate of the authorization of the dissolution by the charity's board of directors or members, and either.

Who Must File Massachusetts form PC?

As outlined in the AGO's Form PC Instructions, all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements.

What is ma PC?

The Metropolitan Area Planning Council (MAPC) is the regional planning agency serving the people who live and work in the 101 cities and towns of Metropolitan Boston. Established in 1963, MAPC is a public agency created under Massachusetts General Law Chapter 40B Section 24.

Do churches have to file annual reports in Massachusetts?

Secretary of State oversees all corporations in Massachusetts (as well as LLCs, limited partnerships, etc.). Nonprofits that are incorporated fall within the Secretary's purview. All nonprofit corporations must file an Annual Report on or before November 1st of each year. …. Except churches & religious organizations.Feb 19, 2016

Are non profits tax exempt in Massachusetts?

Most nonprofits are 501(c)(3) organizations, which means they are formed for religious, charitable, scientific, literary, or educational purposes and are eligible for federal and state tax exemptions. To create a 501(c)(3) tax-exempt organization, first you need to form a Massachusetts nonprofit corporation.

Can Massachusetts nonprofit PC form be amended?

A non-profit corporation may amend its articles of organization by a vote of two thirds of its members legally qualified to vote at a meeting called for the purpose of amending its articles. M.G.L.A. c180 § 7; 950 CMR § 106.09.

How do I file an article of organization in Massachusetts?

Step 1: Get Your Certificate of Organization Forms. You can download and mail in your Massachusetts Certificate of Organization, OR you can file online. ... Step 2: Fill Out the Certificate of Organization. ... Step 3: File the Certificate of Organization.Mar 4, 2022

How do I register a church in Massachusetts?

How to Start a Nonprofit in MassachusettsName Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.More items...

Can a PC be a non profit?

PC is a professional corporation formed and controlled by a Section 501(c)(3) public charity (Parent). PC's sole shareholder is an individual employed and selected by Parent....Exempt Organization Tax Services• Terence Kennedy(216) 583-1504• Kathy Pitts, Southeast Region – Birmingham(205) 254-16089 more rows•Mar 1, 2019

How many board members are required for a nonprofit in Massachusetts?

threeA 501(c)(3) eligible nonprofit board of directors in Massachusetts MUST: Have a minimum of three unrelated board members. Elect the following members: president (that must serve as a director as well), treasurer, and clerk.Aug 27, 2021

What is the legal structure of a 501c3?

A 501(c)(3) organization is a nonprofit organization that acts as a community chest, corporation, foundation or fund. A nonprofit organization gains 501(c)(3) status by filing Form 1023 with the Internal Revenue Service. Gaining 501(c)(3) status means the nonprofit organization will be federally tax-exempt.

Forms for Initial Registration

All public charities doing business in the Commonwealth of Massachusetts must register with the Non-Profits/Public Charities Division and, thereafter, file annual financial reports with the AGO. Upon registration, the AGO will assign the public charity an Attorney General Account Number (AG Number).

Form PC

The form PC is filed by annually by all nonprofit charitable organizations conducting business in the Commonwealth of Massachusetts.

Form PC-F and Instructions

In order to process a proposed dissolution, all public charities that are required to report to the AGO must submit the following:

Form PC-IF

Please see the Attorney General's page on Donor-Restricted Gifts for more information on form PC-IF.

Professional Fundraiser Forms

All professional fundraiser forms can be found on the Attorney General's Office Professional Fundraiser Guide.

Charitable Organization Complaint Form

The Non-Profit Organizations/Public Charities Division has jurisdiction to investigate complaints that involve:

How to contact the state of Massachusetts for tax exemption?

Once you have received a determination of federal tax exempt status in a letter from the IRS, contact the Massachusetts Department of Revenue at (617) 887-6367 to inquire about obtaining exemption from certain state taxes.

How long does it take to register a foreign corporation in Massachusetts?

A foreign corporation must register with the Corporations Division of the Office of the Secretary of the Commonwealth within 10 days of commencing business in Massachusetts. Registration with the Corporations Division entails filing a certificate of legal existence or good standing issued by the Secretary of State of the state in which ...

What charitable organizations are exempt from filing with the AGO?

The two categories of charitable organizations exempted by statute from registering and filing with the AGO are: The Red Cross and certain veterans organizations ; and. Certain religious organizations.

What to do when a charity stops doing business in Massachusetts?

When the charity stops doing business in Massachusetts, it should notify the AGO in writing of its date of withdrawal. The charity will have to file a final Form PC to account for activity through that withdrawal date. If the charity wishes to begin soliciting funds or engaging in charitable work in the Commonwealth at any point in the future, it should contact the Division first to discuss re-activation procedures.

Do you need a certificate of solicitation in Massachusetts?

If the organization intends to solicit funds from the public, it must first obtain a Certificate for Solicitation from the Division, unless exempted from this requirement by statute (see Overview of Solicitation ). Other Massachusetts state agencies and federal agencies such as the IRS may require additional filings from charitable organizations.

What is PC F?

What is the Form PC-F? The Form PC-F is required for all dissolving public charities that are required to file annual reports to the AGO. A filing fee, 990, 990-EZ, or 990-PF and a financial review or audit, are not required for a Form PC-F.

What happens if you don't submit all of your financial documents for a dissolution?

Failure to submit all of three of these documents will result in a delay of processing the dissolution. Reminder: a public charity not required to register and submit annual reports, such as a church or those exempt by statute, should include a financial report for its last three years of activity.

What is an officer's certificate?

The officer's certificate should specify the receiving entity or entities and articulate whether the assets and/or property are to be used for the organization's general purpose or are restricted to ensure that the assets and property are used in conformance with the dissolving organization's original mission.

Can a charity be dissolved in Massachusetts?

A public charity organized as a corporation in the Commonwealth of Massachusetts may only dissolve under the requirements of M.G. L. c. 180, §11A. As you prepare to dissolve this charitable entity, please ensure that it is in compliance with its reporting to the Non-Profit Organizations/Public Charities of the Attorney General's Office ("AGO") for the last four years. If you do not know whether the organization is in compliance, please contact the AGO at (617)727-2200 ext. 2101 and address any outstanding reporting issues.

What form do I need to file for a charitable campaign?

Professional solicitors and commercial co-venturers are required to register charitable campaigns by filing the Form 10A (solicitors) or Form 10B (co-venturers), and to submit annual financial reports for each campaign (Form 11A or 11B).

What is the AGO filing?

The AGO's Public Charities Annual Filing website allows you to search for and access the annual reports of public charities filed with the AGO , as well as documents filed by professional fundraisers You may search by name, Attorney General registration number, or FEIN #.

What is the AGO in Massachusetts?

These organizations operate solely for the benefit of the public, and the Attorney General's Office (AGO) is responsible for protecting the public's interest in their activities. The Non-Profit Organizations/Public ...

Can you search for a fundraiser on the annual filing website?

These forms are now available to the public via the annual filing document search website, searchable by charity.The annual filing document search website does not currently allow users to search for a specific fundraiser by name.

Popular Posts:

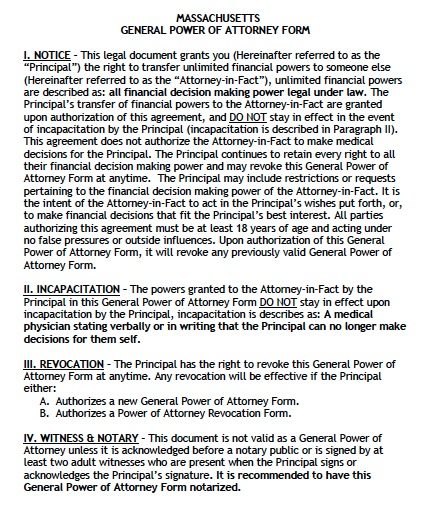

- 1. what happens when a company violates a power of attorney

- 2. who is the best divorce attorney in westchester county ny

- 3. what happrns when an attorney general is impeached

- 4. attorney client privilege when attorney is dead

- 5. how do i get power of attorney in india

- 6. how can next of kin get power of attorney if on life support

- 7. recvied a letter from attorney asking to validate debt what to do

- 8. was an attorney who was drafting a new constitution for myanmar assinated?

- 9. lawyers who deal with power of attorney

- 10. what power of attorney is needed to do real estate in india