Full Answer

How to obtain power of attorney?

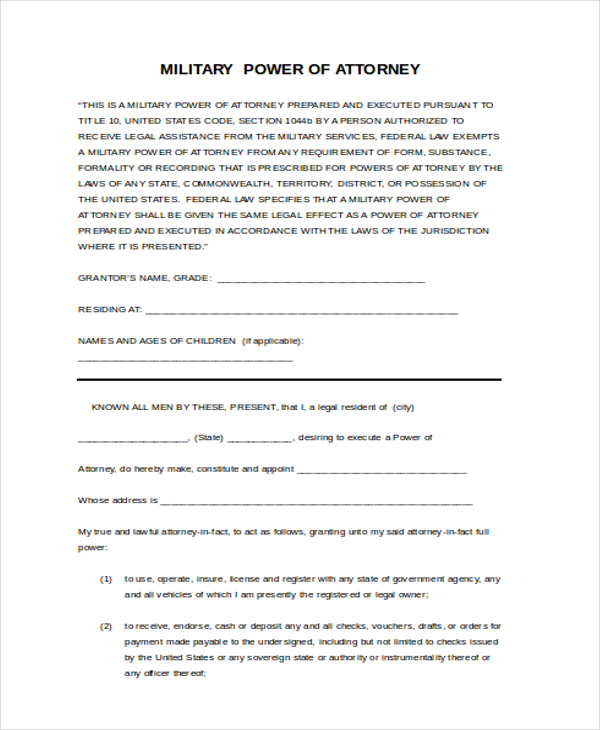

May 02, 2018 · formality or recording that is prescribed for powers of attorney under the laws of a state, the District of Columbia, or a territory, commonwealth, or possession of the United States. Federal law specifies that this power of attorney shall be given the same legal effect as a power of attorney prepared and executed in accordance the with the laws

What is a general power of attorney form in Louisiana?

Feb 24, 2022 · You get power of attorney by having someone willingly and knowingly grant it to you in a signed legal document. He or she must be able to sufficiently comprehend what a POA document represents, understand the effects of signing it, …

How do I appoint a power of attorney for my parent?

Jul 19, 2012 · To get power of attorney, start by determining what type of power of attorney is needed, such as medical, financial, general, immediate, or limited. Different types of power of attorney require different documents, and to get the documents you'll need, you can either contact a trusts and estates attorney or download forms from the internet.

Where can I keep a power of attorney document?

1) Choose the right person (s). …. 2) Talk to an attorney. …. 3) Choose what kind of power of attorney is best suited to your needs. …. 4) Decide on the details. …. 5) Fill out the power of attorney form. …. 6) Sign your power of attorney form in front of a notary or witness.

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

What is a power of attorney?

In the United States, a Power of Attorney enables a person to legally make medical, financial, and certain personal decisions (such as recommending a guardian) for another person. You may need to grant someone power of attorney if you are incapable of handling all or part of your affairs for a period of time.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

When does a durable power of attorney go into effect?

It often will not go into effect until the person who grants the power of attorney becomes incapacitated.

Is a power of attorney void?

If the power of attorney purports to transfer a power that cannot be transferred under the law, that part of the power of attorney is void. For instance, even if the principal and the agent agree, the agent cannot write or execute a will for the principal. Any such will is not valid.

Do you need to notarize a power of attorney?

Have the power of attorney document notarized. Some states require the agent and the principal to sign the power of attorney document in front of a notary. Even if your state does not require notarization, notarization eliminates any doubt regarding the validity of the principal's signature.

Can you charge someone for acting as a power of attorney?

You are not allowed to charge for acting as power of attorney on behalf of someone else. The only charges you can make are on food, lodging, and travel for performing your duties.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

What is an advance directive?

An advance directive, referred to as a “living will” or “medical power of attorney”, lets someone else handle health care decisions on someone else’s behalf and in-line with their wishes. These powers include: Everyday medical decision-making; End-of-life decisions; Donation of organs;

How many witnesses do you need to be a notary public?

In most cases, a Notary Public will need to be used or Two (2) Witnesses.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

What is a power of attorney?

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters.

Who is the principal of a power of attorney?

The "principal" is the person who creates a Power of Attorney document, and they give authority to another adult who is called an "attorney-in-fact.". The attorney-in-fact does NOT have to be a lawyer and CANNOT act as an attorney for the principal.

Can a court order a conservatorship?

The courts generally are not involved with Powers of Attorney, however, if someone becomes incapacitated or is unable to make their own decisions ( e.g., in a coma, mentally incompetent, etc.) and needs another adult to make decisions for them, the court may get involved to order a legal Guardianship or Conservatorship for the incapacitated person. ...

Marty Burbank

One thing that I want to make clear is that a diagnosis of dementia or Alzheimer's does NOT equal incapacity. It will Hower lead to incapacity. A person under the law is (presumed to have capacity (even with dementia) This is a place we're a lot of people waste a lot of resources because of bad advice...

James Charles Shields

If mother has sufficient capacity, she may execute POA appointing you as her agent.

Holland Ilene McBurns

You will likely need a guardianship if she is unwilling or unable (due to the dementia) to voluntarily sign a POA. It would be helpful if she would sign the POA so that you could avoid a guardianship. Guardianships are complex, lengthy and expensive actions. These are typically actions to be avoided.

Alan Leigh Armstrong

How far down the path is she? Does she still have capacity? If you think so, have her physician complete the Judicial Council form entitled "Capacity Declaration" include the dementia add on page.

Edna Carroll Straus

No, you gave to go to court to get a dementia guardianship. Hire probate attorney.

What is a minor power of attorney in Louisiana?

The Louisiana minor power of attorney form is a document that allows a parent to temporarily grant powers to another individual to act as the child’s guardian. In Louisiana, the more common term for a minor power of attorney is a “provisional custody by mandate.”.

What is a limited financial power of attorney?

The Lousiana limited financial power of attorney is a legal document that allows a person to be able to handle specific actions on behalf of someone else. The person being represented is known as the “Principal” and the person doing performing the representation the “Agent” or “Attorney in Fact”. The “limited” nature of ...

What is a medical power of attorney?

A medical power of attorney names a surrogate to act on your behalf regarding medical decisions if you aren’t capable of doing making them for yourself.

What is a POA?

The Basics of a Power of Attorney. A POA isn’t obtained by someone. It’s given to someone by you, the maker or principal. It’s a document that gives another person, your agent, the authority to act on your behalf in financial and legal matters. The POA can grant limited authority to your agent, such as signing checks from your bank account ...

How long does a POA last?

A POA can become void after a specified amount of time or remain in effect until your death. You can revoke a POA at any time, as long as you’re mentally competent. If you choose to revoke the POA, you must send a notice to all interested parties, such as your bank, mortgage holder and attorney. As the principal, you decide what acts you want ...

Who is Sandra King?

Sandra King uses her life experience as a small business owner, single parent, community volunteer and obsessive traveler to write about a variety of topics . She holds degrees in communication and psychology and has earned certificates in medical writing, business management and landscape gardening.

Can a POA be void?

Private individuals can use it as well for similar purposes. This POA is automatically void if you, the principal, become incapacitated. Durable POA: Grants your agent broad authority to act in your best interests, but differs from the nondurable POA in that it continues even after you become disabled or incapacitated.

What is a durable POA?

You can use a durable POA to grant an adult child or other trustworthy person authority over financial and legal concerns if you become incapacitated. Health care POA: Grants an agent the power to make decisions regarding your medical care when you can no longer make those decisions yourself.

Does South Carolina have a POA?

South Carolina does not have a statutory POA, but does require that a durable POA clearly state that the agent’s authority will not be revoked if the principal becomes disabled of incapacitated. Power of Attorney forms are available on numerous websites, including SC.gov. Once you’ve obtained the form, be sure to fill out each section carefully ...

Popular Posts:

- 1. attorney mikey joseph when they see us

- 2. what is the difference between a mediator and a divorce attorney

- 3. what type of attorney works on the housing issues

- 4. what legal way can i help dementia parents that didnt set up power of attorney

- 5. who are the tulsa county assistant attorney

- 6. kansas why car lot forcing to sign power of attorney

- 7. attorney talk: what does "prepared without opinion" mean?

- 8. how do i send a letter of inquiry to nj attorney general grewal

- 9. attorney who specializes in compensation claims near the dallel, or

- 10. how can a defense attorney defend the indefensible