How to Write a Power of Attorney Letter.

- 1. Note down each special power you want to assign. A power of attorney can be very precise. Thus, it’s important to indicate the transactions, ...

- 2. Make a notation next to each springing power of attorney.

- 3. Indicate an expiration date.

- 4. Delegate a successor agent.

- 5. Finalize your document.

- Your name, address, and signature as the principal.

- The name, address, and signature of your Agent.

- The activities and properties under the Agent's authority.

- The start and termination dates of the Agent's powers.

- Any compensation you will give to the Agent.

How do you write up a power of attorney?

Follow the steps below to write a professional power of attorney letter: 1. Note down each special power you want to assign. A power of attorney can be very precise. Thus, it’s important to indicate the transactions, accounts, and properties that will be handled by your agent. Each power can be as specific or as broad as you want it to be. 2.

Can I write my own power of attorney letter?

Get your hands on a personalized power of attorney letter by following these steps: Log in to your DoNotPay account; Locate the Power of Attorney tool; Answer our chatbot’s questions to help us select the type of POA you need; We will immediately draft a power of attorney letter and two notices—one for you and the other for your agent.

How do I create a power of attorney?

Step I: Generate a draft. Start by generating a draft of the letter you want to send out to the person to whom you delegate the powers. The draft ought to contain a list of the special powers you intend to bequeath to a third party. This list ought to …

How do you fill out a power of attorney paper?

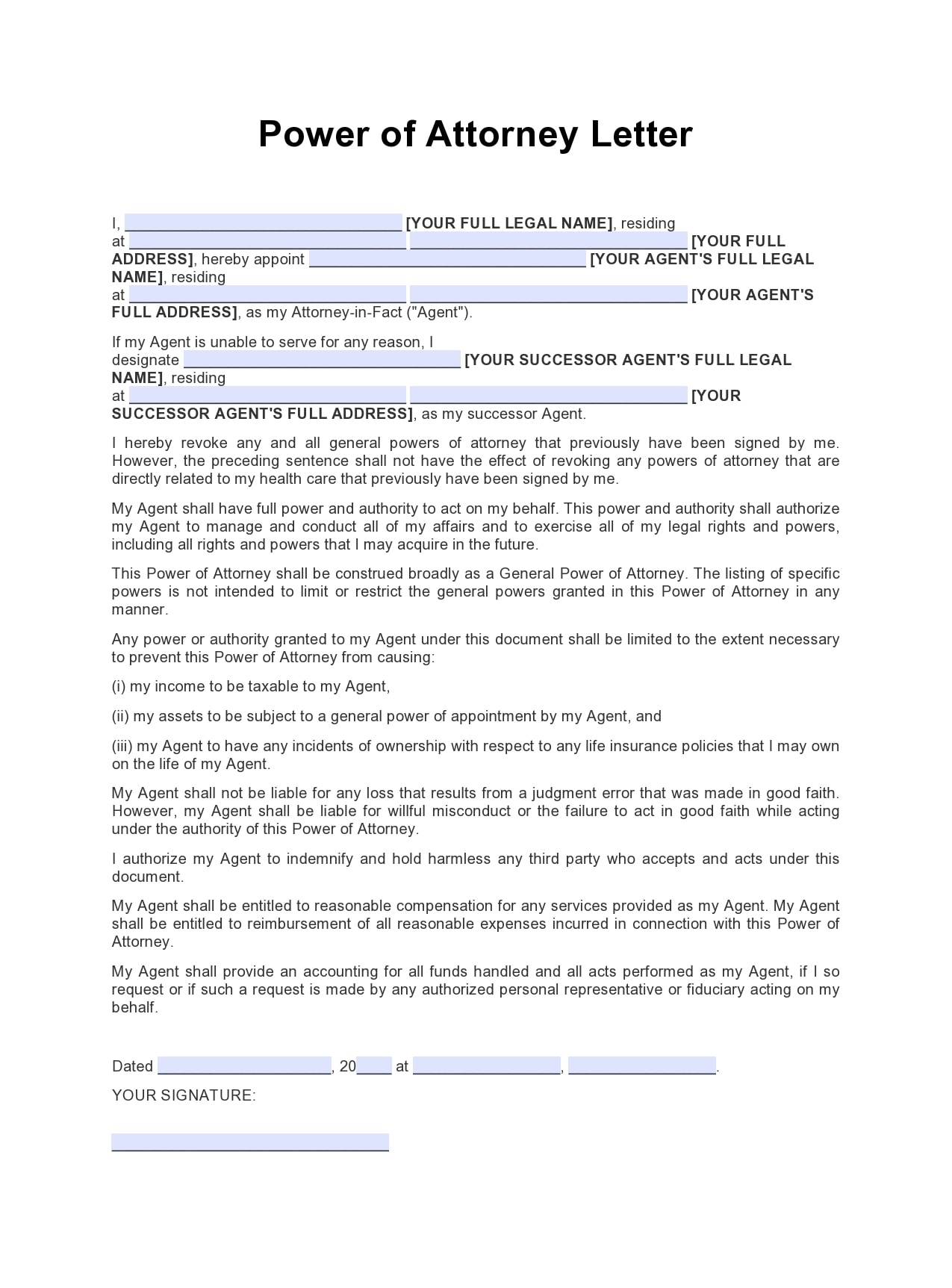

Apr 28, 2022 · Sample Power Of Attorney Letter. I, Name of Principal, who currently resides at Address of Principal am of sound mind, do hereby name Name of Agent who currently resides at Address of Agent as my lawful and true attorney in fact, to act in my name and place to do and perform the following on my behalf.

What is a letter of power?

How do you describe power of attorney?

How do you draw a power of attorney?

- Understand How a POA Works in California. ...

- Choose your agent. ...

- Choose the powers you want your agent to have. ...

- Select witnesses. ...

- Fill out your form and make sure it complies with California law. ...

- Sign your financial power of attorney.

What three decisions Cannot be made by a legal power of attorney?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

What do you put in power of attorney?

- The name, age, address and occupation of the person who makes the Power of Attorney, the Principal.

- The person to whom the power is granted, the Attorney.

- The reason for granting the power of Attorney which should be legally valid.

Can you write your own general power of attorney?

What is the best power of attorney to have?

Can a power of attorney be written?

Some states allow oral powers of attorney, but it is best to have them in written form. Most states follow the Uniform Power of Attorney Act, which outlines the powers that the principal can give to the agent.

What is a power of attorney?

Powers of attorney are one of the most powerful legal documents. Giving powers over important decisions away is not something you should brush aside. Before writing a power of attorney, you should consider the following: Power of attorney laws and forms can vary from one U.S. state to another.

Is a power of attorney a necessity?

Different situations in life can cause a person to delegate someone to take care of their personal and financial affairs. When that happens, writing a power of attorney document is a necessity. What should you do if you don’t have experience in these matters or money for legal assistance?

What is POA in legal terms?

A POA stands for a power of attorney—a legal document used to transfer power over certain decisions from one person to another. Solve My Problem. Get Started. A power of attorney is created between two parties—the principal and attorney-in-fact.

Can a principal use a power of attorney?

Contrary to the common opinion, people don’t use powers of attorney only when they’re mentally or physically incapable of making the decisions on their own. You can use a power of attorney ...

What are the different types of power of attorney?

state to another. There are different power of attorney types, and the main ones include: General POA. Durable POA. Limited POA.

Does POA end at death?

POA ceases at death. Powers of attorney are revocable and amendable, provided you are capable of making legal decisions on your own. Some states allow oral powers of attorney, but it is best to have them in written form.

What Is a Power of Attorney Letter?

It is an official letter that confers the power to make far-reaching decisions and act on the behalf of another person in line with the terms that are stipulated in the letter.

How to Write

Start by generating a draft of the letter you want to send out to the person to whom you delegate the powers. The draft ought to contain a list of the special powers you intend to bequeath to a third party. This list ought to be explicit and detailed to avoid any doubts.

Types of Power of Attorney

Lasts longer and mainly comes in force when you are completely incapacitated such as when in a coma. This type is only applicable if you are completely incapable of making decisions on your own.

Does a Power of Attorney Need to be notarized?

YES, it has to be notarized. The notary public is the one to do this. It is only after it has been notarized that it is deemed legally binding. The rules and regulations differ per state. That means you have to check out your state laws to find out about the rules.

Does Power of Attorney Expire?

The ‘power of attorney’ is a very serious document that should never be handled recklessly. You need to treat it with the seriousness it requires to prevent the issues and problems that potentially arise with use. Reading in between the prescriptions we have stipulated above is a sure way of achieving this end.

Who signs a power of attorney?

To be legal, the power of attorney letter must be signed by the principal, witnesses, a notary public or other official according to the laws of the state where the POA is written. The principal should not sign the document until they are in the presence of a notary public. A POA could also be created for a specific transaction such as selling ...

Can a principal sign a power of attorney?

The principal should not sign the document until they are in the presence of a notary public. A POA could also be created for a specific transaction such as selling a business, and cancelled when that transaction is completed. Here is a sample power of attorney letter. It may be kept by a lawyer, if the principal had legal help writing it.

What is POA in 2021?

Power of attorney (POA) means a person, called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves. This can only legally be done if the principal has the requisite mental capacity to grant this power ...

What is a POA?

Power of attorney (POA) means a person , called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves.

Can a guardian revoke a POA?

Recommend a guardian for a minor child. Even if a principal grants an agent the power of attorney over their affairs, they are still responsible for their affairs, and can revoke the POA at any time.

Why do you need a POA?

The main reasons it is recommended to designate a POA are: If property is owned by more than one person. If bank accounts have more than one name. If brokerage accounts have more than one name. If the principal is single and going on a trip. If the principal will have major surgery.

What happens to property when a person dies?

If a person dies, his or her property and money will be transferred to the benefactors of the will. However, if they become incapacitated, the joint owner will have very limited authority over the share of the joint property or account unless they have power of attorney.

What is a power of attorney?

A power of attorney is an official document that bestows the power to make decisions and act on behalf of another person in accordance with the terms written in the letter. Typically, the person granted such a power is the “Agent.”. The activities that the Agent will undertake may include property dealings, monetary transactions, signing checks, ...

What are the elements of a power of attorney?

Generally, the main elements in an example of power of attorney letter include: Your name, address, and signature as the principal. The name, address, and signature of your Agent. The activities and properties under the Agent’s authority. The start and termination dates of the Agent’s powers.

Can an agent act on your behalf?

The Agent can’t act on your behalf legally regarding a springing power until the condition or event occurs. This type of power doesn’t have to include a clause for this power but without it, then your letter becomes enforceable after you affix your signature. Choose your Agent and a Successor Agent.

How to finalize a letter?

After you have gathered all the information you need, you can now finalize your letter. Use non-ambiguous, clear language when outlining the details in the document. Include in your letter your complete name, the complete name of your Agent, and the complete name of your Successor Agent.

What to consider when choosing an agent?

When choosing your agent, the most important qualities to consider are trust and accountability. Just make sure that your Agent is always available, especially in times of duress, and will execute your wishes faithfully. It’s also recommended to list more than a single Agent in your letter.

What are the qualities of an agent?

This is the person who makes decisions on your behalf. When choosing your agent, the most important qualities to consider are trust and accountability. Just make sure that your Agent is always available, especially in times of duress, and will execute your wishes faithfully.

Who signs a power of attorney?

To be legal, the power of attorney letter must be signed by the principal, witnesses, a notary public or other official according to the laws of the state where the POA is written. The principal should not sign the document until they are in the presence of a notary public.

What is a POA letter?

Power of attorney (POA) means a person, called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves.

What is a POA?

Power of attorney (POA) means a person, called the principal, chooses someone whom they trust, called the agent, to handle their affairs and make decisions if they are not in a position to do so themselves. This can only legally be done if the principal has the requisite mental capacity to grant this power ...

Can a principal revoke a POA?

Even if a principal grants an agent the power of attorney over their affairs, they are still responsible for their affairs, and can revoke the POA at any time. The main reasons it is recommended to designate a POA are: If property is owned by more than one person. If bank accounts have more than one name.

Can a POA be cancelled?

A POA could also be created for a specific transaction such as selling a business, and cancelled when that transaction is completed. Here is a sample power of attorney letter. It may be kept by a lawyer, if the principal had legal help writing it. Otherwise it should be sent by certified mail.

What happens to property when a person dies?

If a person dies, his or her property and money will be transferred to the benefactors of the will. However, if they become incapacitated, the joint owner will have very limited authority over the share of the joint property or account unless they have power of attorney. Three Types of Power of Attorney. .

How to designate a power of attorney?

There are a lot of reasons to designate a power of attorney, and among the reasons are the following: 1 If bank accounts have two or more names 2 If a property is owned by two or more persons 3 If brokerage accounts have two or more names 4 If the principal is single and is out of town 5 If the principal is having or will be having a major surgery

What is a power of attorney?

A power of attorney is a legal document signed by a principal and is usually a notarized document allowing a person to appoint another person to take control of his affairs or make decisions on his behalf should you become unable to effectively do so in accordance with the terms of the document.

Can a principal revoke a power of attorney?

Although the principal grants the power of attorney over their affairs to an agent, they can still be held responsible for their affairs, and they can revoke the power of attorney at any time.

Is a springing power of attorney durable?

The springing power of attorney can be durable or non-durable. It can also encompass any number of affairs that the principal wants to assign to his or her trusted agent. It becomes immediately effective at a future time when a specific events occur.

What are the different types of power of attorney?

They are as follows: non-durable power of attorney, durable power of attorney, special or limited power of attorney, medical power of attorney, and springing power of attorney. You may also like reference letter examples.

What is a letter of authorization?

A letter of authorization is a written confirmation that gives another person the right, rank, authority, or ability to act on your behalf to enter into a contract, take action, spend a certain amount, delegate his or her responsibilities and duties, and do other matters you want them to look into.

Why do you need a power of attorney authorization letter?

A power of attorney authorization letter is essential whenever you need someone to act on your behalf to complete tasks that you are unable to do due to certain valid reasons.

When is a power of attorney needed?

A power of attorney is necessary when bank accounts, properties, and brokerage accounts have two or more names, and when the principal is incapacitated or is unable to act due to valid reasons. There are five primary forms of power of attorney, and you can choose any depending on your current needs.

What is authorization letter?

An authorization letter is a written endorsement that gives another person the right, authority, mandate, or capacity to act on your behalf to enter into a contract, spend a certain amount, take action, delegate his or her responsibilities, and do other matters you want them to look into.

What can an agent do?

Some of the activities an agent can undertake to include monetary transactions, property dealings, and even signing cheques. When the agent acts in the place of the original person, his activities are binding legally to the original person. Advertisements.

What is a letter of authority?

A letter of authority authorizes someone to act on someone’s behalf for a given specific purpose. The assignee of the letter of authority should cancel the letter upon completion of the tasks assigned. On the other hand, the power of attorney authorization letter gives the assignee powers to act over a wide range of transactions.

Why do you need a power of attorney?

There are quite a several reasons to designate a power of attorney, and among the reasons are the following: In instances where bank accounts have two or more names. If brokerage accounts have two or more names. In situations where the principal is single and is out of town. If the principal is having or is scheduled to have major surgery.

Can a principal revoke a power of attorney?

While the principal grants a power of attorney over their dealings to an agent, they can still be held accountable for their dealings. They can revoke the power of any attorney at any specific time. If the owner of the property dies, the money, shares, and property are transferable to the benefactors of the will.

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

What is a power of attorney in Washington?

Create Document. A power of attorney form used by an individual (“principal”) to appoint someone else to handle their affairs (“agent” or “attorney-in-fact”). The agent is able to handle financial, medical, guardianship, or tax-related matters during the principal’s lifetime. If the form is durable, ...

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is banking banking?

Banking – To be able to deposit or withdraw funds in addition to conducting any type of financial transaction that the principal could also do themselves. Upon initials being placed on this line, the agent will have the full capacity to

Popular Posts:

- 1. who is the best elder law litigation estate attorney in richmond va

- 2. courts in texas where you have to be a practicing attorney

- 3. how much is a court appointed attorney for ivc

- 4. when was the us attorney general created

- 5. what is the address for mr bitterman attorney in new brunswick nj

- 6. what does it mean when an attorney withdraws as the council of record

- 7. where to turn when your attorney does not do their job

- 8. california attorney general consumer complaints how to reply

- 9. when should i see a bankruptcy attorney

- 10. which department is the attorney general in