Full Answer

How do I record a legal trust deposit?

Feb 19, 2016 · April 6, 2021. by Devon. To exercise attorney competence in the management of client trust accounting, a basic understanding of the double entry accounting system is helpful. In a double entry accounting system, every transaction is entered into the company’s books twice: once as a credit in one account, and once as a debit in another account.

How do I document attorney funds in a trust account?

Dec 21, 2017 · Step by step: Lawyers’ trust accounting in QuickBooks Online. 1. Set up the trust/retainer account. Begin by creating a liability account to track the amount of the retainer you received from your client. You ... 2. Set up a trust liability bank account in …

How do I manage client trust accounting as an attorney?

A lawyer shall maintain and preserve complete records of trust account funds, all deposits and disbursements, and other trust property and shall preserve those records for at least 6 years after the date of termination of the representation. Electronic records shall be backed up by an appropriate storage device. The

What are the requirements of trust accounting?

Apr 08, 2015 · At its most basic level, Trust Accounting is simply bookkeeping of trust accounts in accordance with state requirements. These requirements vary from state to state, but they have a few rules in common. Namely, there is to be no comingling of client funds with the lawyer or law firm’s funds, and maintaining accurate records is a must.

How do I set up an attorney trust in QuickBooks?

1:056:37How To Set Up Trust Accounting in QBO Advanced (WIthout LeanLaw ...YouTubeStart of suggested clipEnd of suggested clipAccount with the detail type of trust account liabilities. We'll name it for the client sampleMoreAccount with the detail type of trust account liabilities. We'll name it for the client sample client and then the key thing is making it a sub account under the funds held in trust liability.

Which accounting type can be used for trust fund record keeping?

Form RE 4525 is used to record trust fund account deposits and disbursements pertaining to each property managed for others.

How do you do a trust in accounting?

Trust accounting rules: Know what they are?No comingling or mixing funds. ... Maintain a separate ledger. ... Verify trust accounts regularly. ... If you haven't earned it, don't touch it. ... Don't rob Peter to pay Paul. ... Create checks and balances. ... Follow state bar and government regulations. ... No collecting interest.Jul 5, 2018

How do you manage a client trust account?

The Do's and Don'ts of Legal Trust Account ManagementDO understand which funds go where. ... DO have a separation between trust and operating accounts. ... DO track individual ledgers. ... DON'T commingle funds. ... DON'T overdraft ledgers. ... DO maintain evergreen retainers.More items...

How do you record a trust fund?

0:544:30How to Record Trust Transactions - YouTubeYouTubeStart of suggested clipEnd of suggested clipAccount from the drop-down box and then select new transaction on the top right in this newMoreAccount from the drop-down box and then select new transaction on the top right in this new transaction window type in the amount that you are depositing into your clients trust account in the amount.

What are three trust records examples?

Trust documents and records that should be maintained include: • a record of money received for or on behalf of any other person; • trust receipt books register; • duplicates of every completed trust account deposit form; • trust account journals; • trust ledgers; • trust cheque books' register; • records of trust ...

What is the final accounting of a trust?

Trust accounting is a detailed record that includes information about all income and expenses related to a trust. It includes items like taxes paid, disbursements, gains and losses, and expenses paid to advisors who helped manage the trust over time.Aug 9, 2021

What is a trust accountant?

Trust Accountants are responsible for overseeing trust accounts and ensuring that all accounting processes related to trusts are completed in accordance with statutory requirements.

Do trusts have financial statements?

As a financial entity, a trust needs to keep track of its investment income and distributions on its financial statements. The trustee must keep accurate records as taxes are due each year on trust income over $600, and the beneficiaries must be aware of their trust's status at all times.

How long keep trust accounting records?

7 years“The formal records of a trust (agendas and minutes and formal reports to the trustees etc) must be kept for the lifetime of the trust [per the Trusts Act] , and financial records must be kept for 7 years per IRD requirements – though many trusts archive these also.Jan 4, 2022

Why do attorneys keep two separate types of bank accounts?

Always keep law firm operating accounts separate from client funds accounts so that there is never any appearance of noncompliance with the rules. The easiest way to achieve this goal is with trust accounts that are integrated into case management software.Sep 12, 2018

How do client trust accounts work?

What is a client trust account? According to the ABA, “Standard rules and common practice dictate that lawyers use a client trust account (CTA) to hold funds paid by the client upfront as an advance on fees and expenses before the work is done and prior to the client's approval of billing.Mar 9, 2021

How to track retainer?

1. Set up the trust/retainer account. Begin by creating a liability account to track the amount of the retainer you received from your client. You must first decide whether you are using a seperate account for each client matter or whether one trust account will be used for multiple clients.

How to check if you have Track Expenses and Items by Customer?

You’ll also need to check that you have Track Expenses and Items by Customer enabled: Click the Gear Menu. Select Account and Settings (or Company Settings). Select the Expenses tab. If Track expenses and items by customer is not checked, click on it and then place a check mark in the box next to it.

How to add retainer to sales receipt?

Most businesses would receive the retainer through a sales receipt: Click on the “+” icon.#N#Select Sales Receipt.#N#Select your client .#N#Add the retainer or deposit item you set up earlier to your Sales Receipt and set its Rate or Amount to equal the amount of money you’re receiving for this retainer or deposit.#N#Use the Deposit To dropdown to select a bank account. If you created a separate trust liability bank account, select that account now.#N#Otherwise, select your general trust account.#N#Save the Sales Receipt.#N#In addition to adding this money to the chosen bank account, this also increases the amount in your liability account. This shows that the money isn’t truly yours yet and avoids treating it as income until later.

Can you enter a retainer amount greater than the invoice total?

You cannot enter a retainer amount greater than the invoice total as an invoice can have a zero total, but not a negative one. Click Save and Close. This decreases the amount in your liability account and applies the credit to your customer’s invoice, which turns it into income. The money is now yours.

How long do you keep records of a trust?

lawyer shall maintain and preserve complete records of trust account funds, all deposits and disbursements, and other trust property and shall preserve those records for at least 6 years after the date of termination of the representation. Electronic records shall be backed up by an appropriate storage device. The office of lawyer regulation shall publish guidelines for trust account recordkeeping.

What are blank forms?

BLANK FORMS: The blank forms can be printed and used for manual record keeping or maintained in the Word document by inserting dates, amounts, payees, deposit sources, client matters and purposes of disbursements. The running balances must be calculated by the lawyer or law firm and entered in both formats of the record (the handwritten format as well as the electronic format). If the records are created electronically in Word, be sure to back up the documents and print a hard copy on a monthly basis.

What is the role of an attorney in a trust account?

The three most common scenarios in which an attorney will be responsible for a trust account are: For funds received at the start of representation, In connection with payment from a settlement, or. When the attorney acts as a fiduciary agent on behalf of a client or a client’s estate.

What are the requirements for trust accounting?

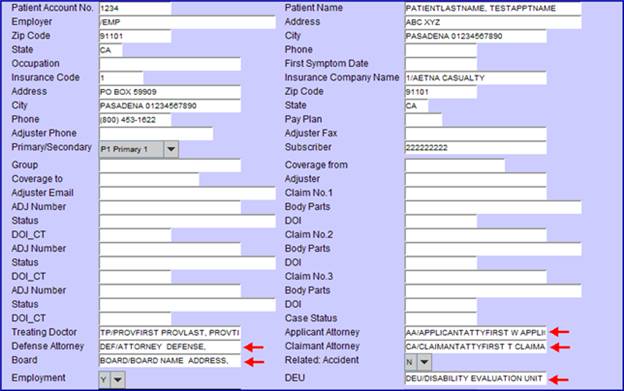

Trust Accounting has some very specific recordkeeping requirements, which are used to maintain accurate information for both the attorney and the client. Trust Accounting requires: 1 Tracking of all deposits and disbursements made through the account. 2 A detailed ledger that notes every monetary transaction for each particular client. 3 An account journal for each account, tracking each transaction through the account. 4 Monthly reconciliation of the account.

What is trust accounting?

At its most basic level, Trust Accounting is simply bookkeeping of trust accounts in accordance with state requirements. These requirements vary from state to state, but they have a few rules in common. Namely, there is to be no comingling of client funds with the lawyer or law firm’s funds, and maintaining accurate records is a must.

What is unearned income in a trust?

These include: Settlement Funds such as those obtained through a Personal Injury case or a Real Estate transaction. Unearned Income refers to monies paid to the lawyer or law firm before services have been rendered.

What are some examples of unearned income?

Fees, Cost Advances, and Retainers are all examples of unearned income. Advances for Costs are similar to unearned income, except they are to be used specifically for costs associated with managing the case. Judgment Funds, similar to settlement funds, are awarded by the court.

Can personal funds go into a trust account?

This goes against the most important principle of Trust Accounting – no comingling of funds. Personal funds should never be put into a client’s trust account. Personal includes funds used by the law firm itself. Nothing should go into the trust account unless it is provided by or to be paid to the client.

Can a lawyer use a trust account to manage payroll?

The trust account should only have money that the client provided specifically for designated purposes. Payroll. Lawyers should never use a client trust account to manage payroll. Again, going back to the no comingling of funds rule, there should never be a reason for a law firm’s payroll function to access a client trust.

What is the common mistake lawyers make when they open a new trust account and transfer funds from an existing account?

A common mistake lawyers make when they open a new trust account and transfer funds from an existing account is that they fail to deposit the amount sufficient to open or service the account.

What is a trust account?

The whole idea of the trust account is to identify who you are paying, why you are paying, and whose money you are paying with. It does not come up very often, but no cash shall be withdrawn from a trust account or fiduciary account by means of a debit card.

What is a bank directive?

The bank directive instructs the bank to report you to the Executive Director of the State Bar when any item is presented for payment against insufficient funds. Not only is it important to have a copy of the directive on file in your office, it is important to know where it is. “Let me see a copy of your Bank Directive”, is one of the first things the auditor will say when paying a visit to your firm.

How to avoid being reported to the state bar?

To avoid being reported to the State Bar, it is important to stay in communication with your clients, and follow their directions in a reasonable period of time. Any reasonable person would be suspicious if their request to deliver property being held is unnecessarily delayed without explanation.

Who must disclose the location of a safe deposit box?

The lawyer shall disclose the location of the property to the client or other person for whom it is held. Any safe deposit box or other place of safekeeping shall be located in this state, unless the lawyer has been otherwise authorized in writing by the client or other person for whom it is held.

Can you print a trust activity on a client statement?

If your accounting (billing) software provides the option to print the trust activity on the client statement, you should use that option to provide the client with a detailed statement showing how and when you used their funds.

Can you print a deposit report?

It is possible, and recommended that you print a detailed deposit report at the time of deposit showing the front and back image of the deposited items. Keep in mind the ‘source of funds’ is not the bank it is drawn on, it is the person or entity providing the funds.

LegalFuel: The Practice Resource Center of The Florida Bar

Then, check out the materials and forms on LegalFuel: The Practice Resource Center website. This webpage addresses the creation of trust accounts, management, and applicable rules:

Reconcile Your Trust Account

After your Trust Account has been opened for one month, you need to make it a habit to reconcile your Trust Account. And then reconcile your Trust Account every month thereafter. Check out the Practice Resource Institute for templates, spreadsheets, and helpful information to make trust reconciliation fast and simple.

Maintain a Trustworthy Trust Account

Last, but certainly not least, check out this video about Maintaining a Trustworthy Trust Account.

Popular Posts:

- 1. what you have to do to become a somebody's power of attorney

- 2. how much should an attorney charge for nyc traffic ticket

- 3. how to write a letter power of attorney in two languages

- 4. what is durable power attorney means in virginia

- 5. how long for attorney to keep client file

- 6. who is the kingman city attorney

- 7. who is governor rick scotts attorney

- 8. what is it called when an attorney councils someone tp break the law?

- 9. what happens if attorney general barr is held in contempt of congress?

- 10. how much is texas attorney genearl paxton paid