How to Get DPOA (5 steps)

- Download the Form. Most States have a statutory form that is required to be completed in order to be accepted. ...

- Select the Financial Powers. After downloading the principal will be required to select the powers they deem necessary to give in the chance they lose consciousness.

- Effective Immediately or Upon Disability. The principal will have to decide if the form will be effective immediately or if it will be effective upon the disability ...

- Prepare the Form for Signature. After the form has been completed the principal will need to figure out the signing requirements in their State to finalize the ...

- Storing the Form. After the form has been legally authorized, the principal should keep it in a safe place with more than one (1) person knowing the ...

- Decide who you want to be your financial agent. ...

- Decide which financial decisions you want your agent to be able to make.

- Get a durable financial power of attorney form. ...

- Complete the form, and sign and witness it according to the laws in your state.

How can I become a financial power of attorney?

You can look after someone's affairs in one of the following ways:

- with a letter or a third party mandate to deal with a bank, building society or other financial account – see Bank and building society accounts

- as an agent or appointee to deal with someone's welfare benefits or tax credits – see Welfare benefits and tax credits

- with a power of attorney. ...

How long does it take to become a power of attorney?

Have a think. How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Can you go to a bank for power of attorney?

Many banks have their own power of attorney forms that their account holders must complete and sign before the bank will acknowledge the power of attorney privileges of an agent. Some banks will require the account holder and the agent to appear in person together to complete the power of attorney form, while others may permit the account holder to complete the form off-site as long as it is notarized.

How do you obtain power of attorney over another person?

- Right to information. Your parent doesn't have to tell you whom he or she chose as the agent. ...

- Access to the parent. An agent under a financial power of attorney should not have the right to bar a sibling from seeing their parent. ...

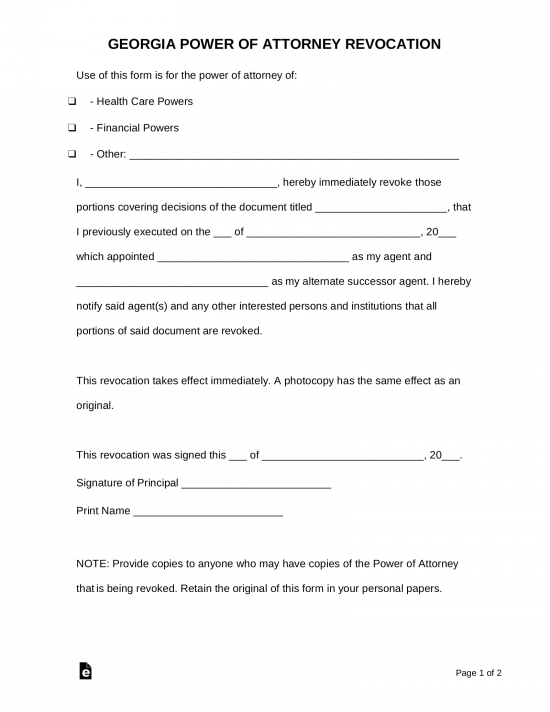

- Revoking a power of attorney. ...

- Removing an agent under power of attorney. ...

- The power of attorney ends at death. ...

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a POA in estate planning?

Understanding Power of Attorney is key to setting up an Estate Plan that has all your bases covered. Having a Financial Power of Attorney (POA) in place ensures you’re establishing a way for your affairs to be managed when it matters most - when you can’t do it yourself.

Does POA last after death?

Two last points - note that some states will automatically see a Financial POA as “Durable,” meaning it lasts even if you’re suddenly incompetent. Also, the role dissolves upon your death unless you’ve written in specific language noting otherwise elsewhere in your Estate Plan (such as your POA could then become Trustee of your Trust or Executor of your Will).

What is a living will?

A Living Will states your final wishes for end-of-life medical care. It appoints someone to ensure your declaration about life-saving measures (whether you want them, don’t want them or have specific ideas about how extensive they should be) are respected.

Is a durable power of attorney the same as a living will?

A Durable Power of Attorney and a Living Will are similar in nature but have distinct differences. When you’re talking about POA in this sense, you are talking about Medical Power of Attorney (not financial). The main difference between the two follows.

Do you need a POA?

Determine need. Do you actually need a Financial POA? If you’re married and have joint assets, this may not always be necessary right now. Likewise, if you have a Living Trust holding your assets, and you’ve appointed a Trustee to act on your behalf, a Financial POA may not be a great need at this time. That said, a Durable Financial POA can still be a good idea, and they can be the same person as your Trustee.

Is it natural to choose a POA?

From the trust aspect, it probably seems natural to select a family member who is close to you. But sometimes the POA you choose actually isn’t the person closest to you, as emotions can become a factor and the responsibilities could be burdensome. At the end of the day, as long as you’re placing a person you trust in the role, you'll be more confident in your decision.

How to get guardianship if you have no power of attorney?

Pursue legal guardianship if you cannot obtain power of attorney. If the person is already mentally incapacitated and did not grant power of attorney in a living will, it may be necessary to get conservatorship or adult guardianship. In most regards, the authority held by a guardian is similar to (but more limited than) those held by someone with power of attorney. A guardian is still accountable to the court, and must provide regular reports of transactions. To become a guardian of someone, a court must deem the principal to be “legally incompetent." In other words, they are judged to be unable to meet their own basic needs. If you believe someone you known meets the criteria for incompetence, you may petition the court to be named guardian.

What is an ordinary power of attorney?

An ordinary or general power of attorney is comprehensive. It gives the agent all the powers, rights, and responsibilities that the person granting POA has. A person can use an ordinary power of attorney if s/he is not incapacitated but needs help in some areas. An ordinary power of attorney usually ends with the death or incapacitation of the person granting POA.

Why is notarizing a power of attorney important?

Notarizing the power of attorney document reduces the chance that it will be contested by an outside party.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

What happens when you file a guardianship petition?

Once you file the petition, the court will schedule a hearing. At the hearing, the proposed guardian must establish the incompetence of the proposed ward (the principal) and that no suitable alternatives to guardianship are feasible.

When does a springing power of attorney go into effect?

A springing power of attorney does not go into effect until a specified qualification is met. Typically, power of attorney is granted following the incapacitation of the principal.

What is a nondurable power of attorney?

A nondurable financial power of attorney could be used if you want someone to handle a financial decision when you’re not physically able , like if you are leaving the country, but need someone to sign some papers to complete a business transaction while you are away. If you get into an accident that leaves you in a coma, the power of attorney would end and the agent could no longer make decisions on your behalf. Some states allow for springing POA , which take effect only after you become incapacitated.

Can an attorney in fact transfer property into a trust?

An attorney-in-fact can transfer property into a living trust that you’ve already created, but their powers are limited beyond that. A trust is a separate entity that holds assets on your behalf. It has its own set of rules about who receives the assets and how they are used. You cannot grant your agent the ability to change its terms or use the money in the trust through a financial power of attorney. The trustee is the only person who can manage the trust — this strict measure regarding trust property is one reason why a trust can be a useful tool for managing your assets.

Overview of a Financial Power of Attorney

A financial power of attorney is a legal instrument that allows you the ability to grant authority to another person to tend to your financial affairs. There are two types of financial powers of attorney. There is a nondurable financial power of attorney and a durable financial power of attorney.

Financial Power of Attorney When You Are Not Incapacitated

As mentioned a moment ago, a nondurable financial power of attorney is one that is put into effect and remains in place until you lose your capacity to make decisions yourself. You can also terminate this type of financial power of attorney in a number of ways, including placing a specific termination date in the instrument itself.

Financial Power of Attorney When You Are Incapacitated

Another type of financial power of attorney is one that takes effect if you are no longer capable of dealing with these matters because of a physical or mental disability or limitation. This type of instrument technically or legally is known as a durable financial power of attorney.

How to Obtain a Financial Power of Attorney

You’ve three primary options through which you can obtain a financial power of attorney in California and the United States. First, you theoretically can draft a financial power of attorney on your own. Unless you’ve at least some legal or appropriate financial background, taking this step can prove a risky exercise.

Popular Posts:

- 1. where can i get a blank automotive power of attorney form free

- 2. who plays the attorney general in billions season 3

- 3. what type of attorney do i need to sue walmart

- 4. why you need an attorney if children divorce

- 5. what power of attorney do i need for pharmacy issues

- 6. what is attorney personal misconduct

- 7. how much did you pay for a coop attorney

- 8. penalty for government attorney who commits a crime

- 9. attorney general when conducting invesitgations

- 10. what would be the perfect ace attorney villain