If you want to help a prisoner manage their financial affairs while they’re in prison, the prisoner will need to complete a Power of Attorney form. Once completed, this will give the named person permission to liaise with the relevant agencies (landlords, banks, creditors, etc.) on the prisoner's behalf.

Can I get a power of attorney for an incarcerated person?

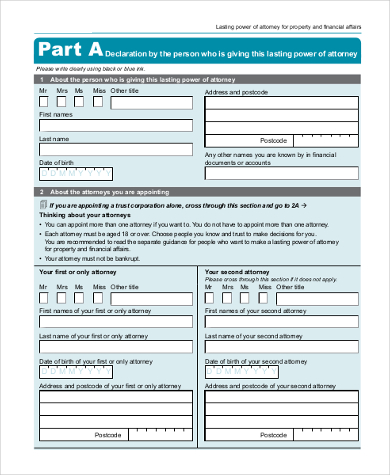

Ways To Create the Power of Attorney Document. There are three ways to create a POA for someone in jail: Do it yourself—If you want to prepare a power of attorney letter for an incarcerated person, check state laws and POA document samples to ensure that you meet legal requirements; Hire a lawyer—Consult a lawyer and ask them to make the document. Although it …

Who can grant a power of attorney to another?

Dec 10, 2018 · You cannot force someone to make a power of attorney. The principal must make the decision of his own free will. You can educate an incarcerated person about powers of attorney when you visit him, or you can send him information about powers of attorney to show the ways in which the legal document could help him and his family.

Do I need a financial power of attorney?

Nov 28, 2016 · A general poa, also knows as a financial poa, allows you to handle his business affairs. While you are not made responsible for his debts, you must act in his interests to avoid becoming liable to him. However, these types of poa's are not unusual if he has financial or other business issues he needs help with while he is in prison. Given that ...

What is a power of attorney for incapacitated person?

May 02, 2022 · Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial ...

Who gets the money if a beneficiary is incarcerated in Texas?

What does Durable power of attorney mean in Florida?

How do you get a power of attorney in GA?

What is power of attorney in Texas?

What three decisions Cannot be made by a legal power of attorney?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

Does power of attorney need to be notarized in Georgia?

Can you get power of attorney without consent?

How Long Does power of attorney take to get?

How do I get a financial power of attorney in Texas?

Does power of attorney need to be notarized?

Does power of attorney need to be notarized in Texas?

What is a power of attorney?

A power of attorney is a legal document by which a person gives someone else authority to make decisions on their behalf. If a friend or family member is incarcerated, a financial power of attorney would give you authority to manage his money and a parental power of attorney would allow you to make decisions about his children on his behalf.

What happens if a power of attorney is incorrectly done?

If a power of attorney is done incorrectly, it might be rejected by the institutions being asked to accept it by the agent wishing to act on behalf of the inmate, which will cause delays. Always seek appropriate advice when preparing legal documents. References.

Can a principal force a person to make a power of attorney?

Willing Principal. You cannot force someone to make a power of attorney. The principal must make the decision of his own free will. You can educate an incarcerated person about powers of attorney when you visit him, or you can send him information about powers of attorney to show the ways in which the legal document could help him and his family.

Do powers of attorney need to be signed by a notary?

Formalities. Most states require that powers of attorney be signed by the principal in the presence of witnesses or a notary. An incarcerated principal also must follow these rules. If the prisoner has an attorney, you can ask the attorney to prepare it or you can give her the document and ask her to arrange for signature.

What is financial power of attorney?

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

What happens to your agent if you revoke your authority?

The authority also ends if you revoke it, a court invalidates it, your agent is no longer able to serve and you have not appointed an alternative or successor agent, or (in some states), if your agent is your spouse and you get divorced.

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

When does a POA end?

The authority conferred by a POA always ends upon the death of the principal. The authority also ends if the principal becomes incapacitated, unless the power of attorney states that the authority continues. If the authority continues after incapacity, it is called a durable power of attorney (or DPOA). In cases of incapacity, a DPOA will avoid ...

How old do you have to be to be an agent?

The only legal requirements to be an agent are that the person be of sound mind and at least eighteen years of age.

When does a POA become effective?

When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated. This is done when someone can’t be present ...

Is the expert above legal advice?

The Expert above is not your attorney, and the response above is not legal advice. You should not read this response to propose specific action or address specific circumstances, but only to give you a sense of general principles of law that might affect the situation you describe.

Is JustAnswer a private forum?

DISCLAIMER: Answers from Experts on JustAnswer are not substitutes for the advice of an attorney. JustAnswer is a public forum and questions and responses are not private or confidential or protected by the attorney-client privilege. The Expert above is not your attorney, and the response above is not legal advice. You should not read this response to propose specific action or address specific circumstances, but only to give you a sense of general principles of law that might affect the situation you describe. Application of these general principles to particular circumstances must be done by a lawyer who has spoken with you in confidence, learned all relevant information, and explored various options. Before acting on these general principles, you should hire a lawyer licensed to practice law in the jurisdiction to which your question pertains.

When does a financial power of attorney go into effect?

A Financial Power of Attorney goes into effect whenever you appoint them. Often, language in the document will read as a safeguard to ensure someone is there to step in should you become incapacitated, but it could also be for a specific time period (for example, you will live abroad for 2 years, or you can’t make it to a signing for a real estate deal). As noted, Financial Power of Attorney extinguishes automatically upon your passing. At that point, the Executor of your Will or Trustee of your Trust would step in.

What is a general power of attorney?

General Power of Attorney is another form of POA that essentially accomplishes the same goal of ensuring a trusted, competent person can make decisions on your behalf should the time come. Powers to act can be very specific, or they can be pointedly broad.

What is a POA in estate planning?

Understanding Power of Attorney is key to setting up an Estate Plan that has all your bases covered. Having a Financial Power of Attorney (POA) in place ensures you’re establishing a way for your affairs to be managed when it matters most - when you can’t do it yourself.

Is a durable power of attorney the same as a living will?

A Durable Power of Attorney and a Living Will are similar in nature but have distinct differences. When you’re talking about POA in this sense, you are talking about Medical Power of Attorney (not financial). The main difference between the two follows.

Do you need a POA?

Determine need. Do you actually need a Financial POA? If you’re married and have joint assets, this may not always be necessary right now. Likewise, if you have a Living Trust holding your assets, and you’ve appointed a Trustee to act on your behalf, a Financial POA may not be a great need at this time. That said, a Durable Financial POA can still be a good idea, and they can be the same person as your Trustee.

Can a medical power of attorney make decisions?

Durable Medical Power of Attorney can make any and all healthcare-related decisions for you should you suddenly become unable to make them on your own.

Is it natural to choose a POA?

From the trust aspect, it probably seems natural to select a family member who is close to you. But sometimes the POA you choose actually isn’t the person closest to you, as emotions can become a factor and the responsibilities could be burdensome. At the end of the day, as long as you’re placing a person you trust in the role, you'll be more confident in your decision.

What is a power of attorney?

At its most basic, a power of attorney is a document that allows someone to act on another person’s behalf. The person allowing someone to manage their affairs is known as the principal, while the person acting on their behalf is the agent.

How to get a power of attorney for an elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your state and the scope of available powers. Talk to your parent so they understand why you want to take this step and the benefits and drawbacks of the action. Consult a lawyer who can help you draw up a document that details your parent’s rights and the agent’s responsibilities, whether that’s you or another person. Finally, execute the document by getting all parties to sign it and have it witnessed as required by state law.

How does a durable power of attorney work?

A durable power of attorney lasts after the principal’s incapacitation. What you can do with a durable POA is based on both the document and state laws. In some cases, you may only be able to manage the principal’s finances and will need a separate medical power of attorney to make health care decisions. These POAs are used when a person can no longer handle their affairs, and it can end in several ways. They can be revoked upon the principal’s death or when a guardian is appointed. The principal can revoke the POA if they’re no longer incapacitated. For example, if a person wakes from a coma, they can take back control of their finances. There may also be conditions in the document that, if fulfilled, end the POA. A durable power of attorney comes into effect on the day it’s signed unless otherwise specified.

Why do you need a power of attorney for your parent?

Arranging a power of attorney for your parent is a good way to open up a discussion with them about their wishes and needs for the future. Jeter continues, “Having those respective POAs in place means that an elderly parent has had time to think about what they really want for their medical care and their finances when they aren’t coherent to make such decisions.”

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

What is a medical POA?

A medical POA is different from a living will , which states what medical procedures a principal does and does not want done. In the case of a medical POA, the agent can make all health care decisions for the principal. Because of this, your parent needs to make their wishes known to the agent before they’re incapacitated. The American Bar Association has detailed information available about medical powers of attorney and the process of giving someone that power.

What to do if you are unsure of the meaning of a power of attorney?

If you are at all unsure of the meaning or consequences of signing the document, consult with an attorney to clarify everything first. The attorney will ensure that the document you sign is legally binding and that it conveys all of the powers you want it to, but nothing more. As with any document, the person that is signing and granting power of attorney must have the mental capacity to do so and must know what they are signing, or the document will not be valid.

What is an example of a power of attorney?

An example would be if someone develops dementia as they age or is unconscious after having been in a car accident. If a valid power of attorney exists prior to the principal’s incapacitation, then the agent has full authority to make decisions on the principal’s behalf, to the extent they were granted in the power of attorney document.

What is a power of attorney for health care?

Health Care: A health care power of attorney authorizes the agent to make medical decisions on behalf of the principal in the event that the principal is unconscious, or not mentally competent to make their own medical decisions.

Why is a power of attorney important?

A power of attorney is especially important in the event of incapacitation. Someone is considered legally incapacitated when their decision-making skills are either temporarily or permanently impaired due to injury, illness, or a disability.

What to do if you are unsure of the meaning of a document?

If you are at all unsure of the meaning or consequences of signing the document, consult with an attorney to clarify everything first. The attorney will ensure that the document you sign is legally binding and that it conveys all of the powers you want it to, but nothing more. As with any document, the person that is signing and granting power ...

Can a power of attorney be used after a principal's incapacitation?

Important to note is that in order for a power of attorney to remain valid after a principal’s incapacitation, it must be a durable power of attorney. To create a durable power of attorney, specific language confirming that to be the principal’s intent must be included in the document.

Is a power of attorney durable?

If the document does not contain language saying the power of attorney is durable, then the power of attorney is considered non-durable and it becomes invalid as soon as the principal becomes incapacitated.

Popular Posts:

- 1. who is sidney rosenthal the attorney

- 2. what to do if an attorney over bills you

- 3. how does someone become attorney general

- 4. how old is lisa bloom attorney

- 5. power of attorney language when signing a deed

- 6. what type of attorney handles agricultural contract disputes

- 7. attorney who helped justify torture

- 8. showing knight running over both men but which knight's attorney said helps his client's self-defen

- 9. what can i expect from a company that i hired an worker's comp attorney

- 10. how much can i charge as an attorney