If you fire a lawyer to whom you have paid a retainer, you are entitled to a refund of whatever money remains of the retainer after the lawyer is paid for his services up through the time you fired him. Once you fire him, he must prepare and give you a written accounting of the funds and a refund check.

Full Answer

How do I check the status of my Maryland refund?

You can check the status of your current year refund online, or by calling the automated line at (410) 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us to check on your refund. Remember to include your name, Social Security number and refund amount in your e-mail request.

Why is my Maryland tax refund taking so long?

Feb 18, 2019 · Don't delay. Maryland tax attorney Jim Liang can help you: Determine if you are owed a refund Calculate the deadline by which you must claim your refund Advise on your best course of action to get your overpayment refunded. To start getting your refund claim processed, contact the Law Office of Jim Liang for a free consultation.

How to demand a refund from an attorney?

Feb 11, 2020 · To check the status of your Maryland state refund online, go to https://interactive.marylandtaxes.gov/INDIV/refundstatus/home.aspx. In order to view status information, you will be prompted to enter: Then, click “Check Status” to view refund status. Individual taxpayers can check the status of their refund by going to the Comptroller of …

How do I fire an attorney and get a refund?

This is called a retainer. If you fire a lawyer to whom you have paid a retainer, you are entitled to a refund of whatever money remains of the retainer after the lawyer is paid for his services up through the time you fired him. Once you fire him, he must prepare and give you a written accounting of the funds and a refund check.

Does Maryland have a buyers remorse law?

Quick general answer: Maryland law generally does not provide a cooling-off period for buyers to change their minds, according to the state attorney general's website, www.marylandattorneygeneral.gov.Jun 7, 2019

How do I file a complaint with the Maryland attorney general?

To file a complaint, you can use our General Complaint Form:Click here to file a complaint online.Click here to print, complete, and send in the form.Call the Consumer Protection Division Hotline at (410) 528-8662 Mon. -Fri. 9am - 3pm.

Can you cancel a contract in Maryland?

No. Many consumers mistakenly believe all contracts allow a 3-day cooling-off period to cancel. Generally, there's no cooling-off period after you sign a contract. (In Maryland, only a few types of transactions, such as door-to-door sales contracts, allow you a certain number of days to cancel.)

How long do you have to cancel a contract in MD?

The Door-to-Door Sales Act gives consumers certain rights, including the right to cancel the contract without any penalty or obligation by sending a notice of cancellation to the seller by midnight of the fifth business day, or seventh business day if the buyer is at least 65 years old, following the sale.

What is the Maryland Consumer Protection Act?

What is the Consumer Protection Act? As relevant to this guide, the Consumer Protection Act (CPA) prohibits a person (usually a landlord) from engaging in “unfair and deceptive procedures” when renting or leasing property.Jan 19, 2022

Who can I complain to about Md unemployment?

The first step in the complaint process is to complete and sign a written complaint form. Complaint forms are available online, or by visiting the Commission. You may also call the Commission at 410-230-6231 or 1-888-218-5925 to request that a complaint form be mailed to you.

Can you dispute a signed contract?

Parties can disagree on on the terms after signing the contract or feel that the other party did not hold up their end of the agreement. Contracts are commonly disputed over the following: Mistakes and errors in the terms of the contract. Fraud or coercion.

Is an email legally binding in Maryland?

The Court of Special Appeals of Maryland has acknowledged that e-mails satisfy the Statute of Frauds in MEMC Elec. Materials, Inc. v. ... Essentially, the Court of Special Appeals held that a party can bind itself to a contract under the Statute of Frauds merely be sending an email with a signature block.Jan 21, 2016

Can a seller back out of a contract in Maryland?

In Maryland, a seller can get out of a real estate contract if the buyer's contingencies are not met—these include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

What is the statute of limitations for breach of contract in Maryland?

three yearsStatute of Limitations In Maryland, you must file a breach of contract lawsuit within three years of the date of the breach.Mar 11, 2019

How do I sue for breach of contract in Maryland?

To sue for breach of contract, your attorney first has to show that an oral or written enforceable contract exists. To be enforceable, the agreement must have had: An offer – by one party to perform an act or to refrain from performing the act. Acceptance – of the offer by the other party.

How can a contract be mutually void?

Termination of contract by mutual consent takes place when a contract is no longer being followed, if the contract can no longer be performed, or the parties involved ceased operating the business. When these situations occur, the parties can formally terminate the agreement in writing.

How long do you have to claim your tax refund?

If you are owed a refund from the overpayment of tax, you must claim the refund within either three years from the time your original tax return was due or two years from the time the tax was paid — whichever was later — unless you did not file your tax return. If you did not file your tax return, you must claim the refund within two years from the time the tax was paid. The IRS will not issue a tax refund if these time periods (or statutes of limitations) have passed.

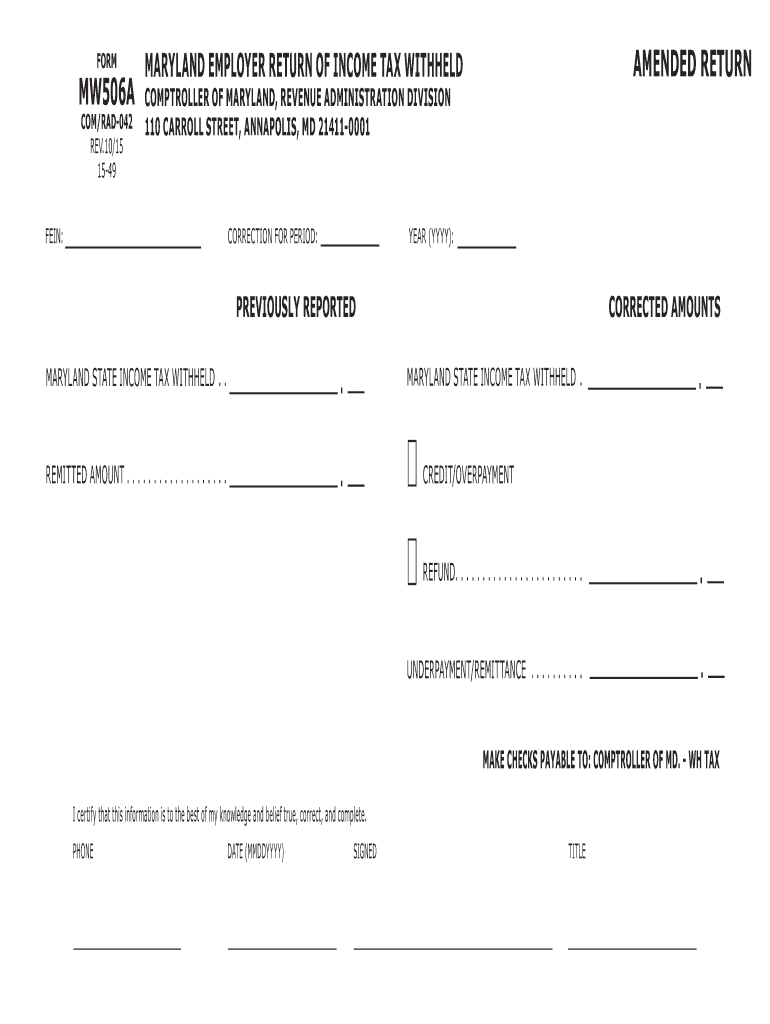

When are refunds due for taxes?

The majority of taxpayers file a claim for a tax refund by filing their annual tax return, which is generally due by April 15. If you overpaid taxes for a previous year and have already filed your original tax return, you can claim a refund by filing either Form 1040X to amend a previous year's originally filed individual tax return or Form 1120X to amend a previous year's originally filed corporation tax return. If a refund claim is for taxes other than income taxes, you can make the claim on Form 843. Claims made on Form 843 must include a statement of facts as to why you are entitled to the tax refund.

What can cause a delay in my Maryland refund?

A number of things can cause a Maryland refund delay. Here are some of them:

Need more Maryland refund and tax information?

For more information on Maryland refunds, visit https://www.marylandtaxes.gov/individual/index.php.

Need more tax guidance?

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H&R Block to help you get the support you need when it comes to filing taxes.

What to do if you disagree with your attorney?

Bar Association Assistance. If you and your former attorney disagree on the amount of refund you are due, you can usually get help. State and local agencies that regulate attorney conduct in each state, called bar associations, often offer fee arbitration services.

What happens if you lose a contingency agreement?

In a contingency arrangement, you pay no fees up front, and if you lose, you owe your attorney nothing. If you win, however, the attorney retains a set percentage as his fee. Since you do not give the lawyer any money up front, you cannot demand a refund if you fire the attorney before trial. On the other hand, if you replace him with another attorney and continue the litigation, he may and probably will claim part of any attorney fees won by your new counsel.

How long does it take to get a refund from a retailer?

Retailers are required to clearly post their refund policy unless they offer a full cash refund, exchange, or store credit within seven days of the purchase date.

Do merchants have to accept returns?

While merchants are required to accept returns in only certain situations, some states have laws governing the disclosure of refund and return policies. State refund and return laws are summarized below. For more information, see FindLaw's section on " Product Warranties and Returns .".

Do refunds have to be displayed?

Often, refund policies must be prominently displayed at the place of purchase in order to be valid. Many states, in addition to the protections of the federal Cooling-Off Rule, allow consumers to rescind club memberships or other special sales contracts within a specified number of business days.

What are the lemon laws in Maryland?

Maryland's lemon law applies to a car, light truck or motorcycle that is registered in Maryland, has been driven less than 18,000 miles, has been owned less than 24 months, and has: 1 A brake or steering failure that was not corrected after the first repair attempt, and that causes the vehicle to fail Maryland's safety inspection; or 2 Any one problem that substantially impairs the use and market value of the vehicle that was not corrected in four repair attempts; or 3 Any number of problems that substantially impair the use or market value of the vehicle that have caused it to be out of service for a cumulative total of 30 or more days. For more information, visit our publication on Maryland's Lemon Law.

How to tell if a company is reliable?

How can I tell if a company is reliable? The Consumer Protection Division cannot tell you if a company is reliable , but the Division can tell you if anyone has filed a complaint against the business and if so, how the complaint was resolved. Call the Consumer Protection Division's hotline at (410) 528-8662.

How to evict a tenant?

To evict a tenant, a landlord must go to District Court to get a judgment against the tenant. If a landlord moves your belongings out of your home, changes the locks, or cuts off utilities without a court order, you should call the police and an attorney or a legal services organization.

Can you cancel a contract after 3 days?

No. Many consumers mistake nly believe all contracts allow a 3-day cooling-off period to cancel. Generally, there's no cooling-off period after you sign a contract. (In Maryland, only a few types of transactions, such as door-to-door sales contracts, allow you a certain number of days to cancel.) However, if the dealer promised finance terms, such as a certain interest rate or monthly payment, and is unable to honor those terms, you can't be forced to accept other terms and may cancel the contract.

Is there a fee for returning a vehicle?

There are no fees involved in the process of returning a vehicle. However, if a replacement vehicle is titled at the same time, a title fee will be collected and additional excise tax may be charged if the tax credit due is less than the excise tax charged for the replacement vehicle.

Can you transfer your registration to another vehicle?

You may be eligible to transfer the registration to another vehicle if a replacement vehicle is purchased. If a replacement vehicle is not purchased, the registration plates, stickers and registration card must be returned for cancellation.

Can I get a refund if I bought a car from a dealer?

Yes, you may be eligible for a refund or tax credit in either scenario, “buy back” or “lemon law.”. If you did not receive a replacement vehicle from the dealer, check with the dealer to be sure that a refund request has been submitted to the MVA; usually the dealer handles refund requests on the customer’s behalf.

Evelyn Watts Cloninger

If you signed a retainer agreement for certain services to be performed in a specific case for a flat, nonrefundable fee, you may not be entitled to the money back. However, if she truly did not perform the services for which she was hired, then she owes you some money back.

Earl Kenneth Mallory

If you believe that you were wronged, and the attorney did not earn the money she took, file a Florida Bar Complaint.#N#https://www.floridabar.org/TFB/TFBResources.nsf/Attachments/AB230E7DCCC3B75385256B29004BD6DC/$FILE/Inquiry%20Complaint%20Form.pdf?OpenElement

Michael Prozan

Your description of her conduct sounds incomplete. Know that I do not practice law in Florida.#N#If you are saying that you paid her $5,000 and she did nothing, well, then you two had a contract and she did not perform and if your version is true, then yes, you...

Popular Posts:

- 1. jacksonville attorney who sued trump

- 2. an attorney may be helpful when a business negotiates a franchise agreement

- 3. who has donald trump chosen for attorney general

- 4. how can a defence attorney defend a criminal

- 5. how is an amicus attorney helpful for a divorce case

- 6. how many durable power of attorney should you have

- 7. attorney who represent family members

- 8. how can you alert a judge of attorney collusion

- 9. how do i make a legal copy of durable power of attorney documents?

- 10. how come cohen tapes are not protected by attorney client privileges