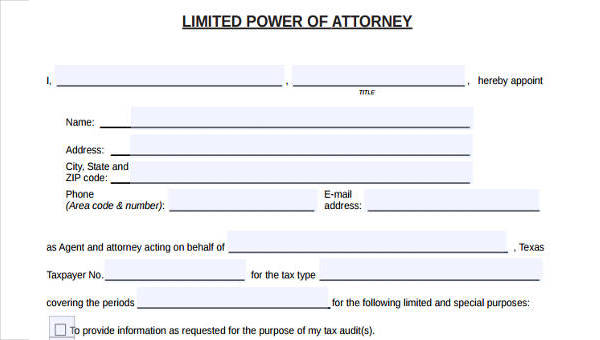

Fill Out the POA

- Your details, such as official name and address, should go into the section reserved for the principal.

- Your representative’s name and official address should go into the section reserved for the agent or attorney-in-fact.

- If you intend to designate more than one person as attorney-in-fact, do so in the secondary agent section. ...

- Read the general POA instructions on designating powers to your agent. ...

How to fill out a limited power of attorney form?

How to Fill Out a Power of Attorney. Locate Power of Attorney forms. Enter the full legal name of the person receiving the authority on the "agent" or "attorney-in-fact" line. Read the instructions for the provisions section carefully. Locate the space provided for other powers not listed on the form. Enter the date terms of the power of ...

How do you fill out a power of attorney paper?

How to Get Power of Attorney (5 Steps)

- Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. ...

- Select Your Power of Attorney. Durable ($) – Financial only. ...

- Signing Requirements. ...

- Holding and Accessing Original Copies. ...

- Cancelling Power of Attorney. ...

Does a power of attorney need to be filed with?

There is no need to file a durable power of attorney with any governmental entity at this time. In some cases, it may be necessary to record the power of attorney for instance, if it is used to sell real estate. However, you do not need to record the power of attorney in order to make it generally valid.

Do you need lawyer to fill out court forms?

When would you need an attorney: When filling out the court forms, there is most likely no need for an attorney unless you don’t understand what the will is instructing the executor to do. 2) Notify heirs and creditors

How do I fill out a power of attorney form in California?

1:216:08How to Fill Out a Durable Power of Attorney Form in California - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd then I would put my wife's name comma. And address and then each of my boys. And their addressesMoreAnd then I would put my wife's name comma. And address and then each of my boys. And their addresses try to fit it all into that line. And then it says to grant all of the following powers.

How do you fill out a Florida durable power of attorney?

How to Fill Out a Florida DPOA FormStep 1: Designate an agent. First, choose someone you trust to be your agent. ... Step 2: Grant authority. Then, mark on the form which areas of your life you want to give the agent legal power over. ... Step 3: Ensure your form is durable. ... Step 4: Sign and date the form.

How do I get power of attorney in Illinois?

Steps for Making a Financial Power of Attorney in IllinoisCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Recorder of Deeds.More items...

What is a Florida durable power of attorney?

A Florida durable power of attorney form represents a way in which an individual, or principal, can have someone act for them with regard to their finances and other areas of life. The durable type of POA stays in effect even if the principal ends up in a situation where he or she cannot think or act or communicate.

Does a power of attorney need to be recorded in Florida?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

Do you need a lawyer for power of attorney in Florida?

A power of attorney is an important and powerful legal document, as it is authority for someone to act in someone else's legal capacity. It should be drawn by a lawyer to meet the person's specific circumstances. Pre-printed forms may fail to provide the protection or authority desired.

Does a power of attorney have to be filed with the court in Illinois?

For real estate transaction, Illinois requires the filing of a standard power of attorney form called the Illinois Statutory Short Form Power of Attorney for Property. It is a boilerplate document anyone can fill out, sign, and have notarized with the help of a licensed attorney.

Can I do power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Does power of attorney need to be activated?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

Does power of attorney override a will?

Can a Power of Attorney change a will? It's always best to make sure you have a will in place – especially when appointing a Power of Attorney. Your attorney can change an existing will, but only if you're not 'of sound mind' and are incapable to do it yourself. As ever, these changes should be made in your interest.

What are the types of power of attorney in Florida?

Four Types of Power of Attorney in Florida and What They MeanDurable Power of Attorney. This type of power of attorney is the most common. ... Special or Limited Power of Attorney. ... Healthcare or Medical Power of Attorney. ... Florida Real Estate Power of Attorney.

Can I do power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Who can witness a durable power of attorney in Florida?

Witnessing and Notarizing the POA To finalize a POA in Florida, the document must be: witnessed by two people, and. signed before a notary public.

Who can be witness for power of attorney?

An attorney's signature must also be witnessed by someone aged 18 or older but can't be the donor. Attorney's can witness each other's signature, and your certificate provider can be a witness for the donor and attorneys.

Can the notary be a witness in Florida?

The answer is YES! A notary can count as the second witness, even if they did not sign in that capacity on the instrument. But, the notary must have signed in the presence of the other witness and the testator in order to be valid, as required by 732.502.

Why Have Power of Attorney?

Accidents happen. Any person who should become incapacitated through an accident or illness would need to make arrangements beforehand for their financial and medial affairs.

What does revocation of power of attorney mean?

Revocation Power of Attorney – To cancel or void a power of attorney document.

What is a general power of attorney?

General ($) Power of Attorney – Grants identical financial powers as the durable version. Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent.

What is an advance directive?

An advance directive, referred to as a “living will” or “medical power of attorney”, lets someone else handle health care decisions on someone else’s behalf and in-line with their wishes. These powers include: Everyday medical decision-making; End-of-life decisions; Donation of organs;

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What does durable mean in financials?

Durable ($) – Financial only. Remains in-effect if the Principal becomes *incapacitated.

How many steps are required to get a power of attorney?

An individual may get power of attorney for any type in five (5) easy steps:

What Is a General Power Of Attorney?

You can also use the general power of attorney to authorize someone to make financial and medical decisions on your behalf. The legal document will enable your agent to carry out activities, such as paying your bills, accessing your IRA accounts to withdraw money, filing taxes and signing contracts on your behalf.

How to fill out POA?

2. Fill Out the POA 1 Your details, such as official name and address, should go into the section reserved for the principal. 2 Your representative’s name and official address should go into the section reserved for the agent or attorney-in-fact. 3 If you intend to designate more than one person as attorney-in-fact, do so in the secondary agent section. The people you include in that section will act on your behalf if the first agent is not in a position to do so. 4 Read the general POA instructions on designating powers to your agent. You must be as clear and specific as possible. So, be sure also to include the duration a power of attorney will be in effect and the particular authority you are giving to your agent.

What is POA in business?

If you are looking to legally authorize another person to act on your behalf concerning business and personal matters, creating a power of attorney (POA) makes sense. However, your choice of power of attorney will depend on the extent to which you would like your representative to perform tasks on your behalf.

How to get a power of attorney notarized?

Take the power of attorney document and your state identification to a notary public. Sign and date the paper and ask him to notarize your signature. Make copies of the document for yourself and your agents.

How to eliminate powers of attorney?

A general power of attorney gives your agent broad authority, but you usually can eliminate some powers if you want to do so by putting a line through the powers. Follow the power of attorney's directions for the powers section. Write in any other powers you're giving that are not shown on the form using specific wording.

Is a POA valid until you sign it?

Another issue to bear in mind is whether your general POA will be immediate or springing. An immediate POA becomes valid the moment you sign it . However, a springing power of attorney only becomes active in the future if a specified condition has been met. The situation could include you becoming physically or mentally incapacitated.

Can you download a POA template?

So, select the one you want carefully. Bear in mind that if you find an online POA template, you must download and print it.

What is a non-durable power of attorney?

General (Non-Durable) Power of Attorney – Grants the same financial powers listed in the durable form except that it does not remain in effect if the principal becomes incapacitated or mentally disabled.

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

Why do people use power of attorney?

A: People most frequently use a power of attorney for financial or healthcare reasons. Say you want someone to act on your behalf for when you fall ill in the future, you would use a Medical (Health Care) Power of Attorney so your agent could make health care decisions on your behalf. If you are in a rare situation and want to give specific powers that aren’t financially or medically related, you can create a Limited (Special) Power of Attorney.

What is a revocation of a power of attorney?

Revocation of Power of Attorney – To cancel a current power of attorney arrangement.

What is personal property?

Personal Property – The agent shall have the right to acquire, purchase, exchange, lease, or sell any type of personal item. This means that the agent can use the funds by the principal to purchase a necessary item or sell assets that the agent deems to be in the principal’s best interest.

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

What happens if the principal owns an IRA?

Retirement Plans – If the principal owns any IRA’s, 401 (k)’s, or any other retirement plans with benefits that the agent may have the vested power to alter or withdraw any funds from the account they deem to be to the best interest of the principal.

How long does a tax authorization stay in effect?

Tax Information Authorization stays in effect until you revoke the authorization or your designee withdraws it.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

How to authorize a power of attorney?

Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

Where is my tax authorization?

Your Tax Information Authorization is recorded on the Centralized Authorization File (CAF) unless Line 4, Specific Use is checked. The record lets IRS assistors verify your permission to speak with your representative about your private tax-related information.

What does authorization of a qualifying representative do?

Your authorization of a qualifying representative will also allow that individual to receive and inspect your confidential tax information.

What is a 2848 form?

About Form 2848, Power of Attorney and Declaration of Representative. Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

What happens if my power of attorney is unable to act?

If your agent is unable to act for you, your power of attorney will end unless you have named a successor agent (a replacement). You may also name a second successor (replacement) agent. Revoking a Power of Attorney.

What is a power of attorney?

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (you are the “principal”). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself. This power of attorney does not authorize ...

Can you cancel a power of attorney if you die?

Unless you say otherwise, the agent's authority will continue until you die or revoke the power of attorney, or the agent resigns or is unable to act for you. This form will not revoke or cancel a power of attorney previously signed by you unless you add that the previous power of attorney is revoked by this power of attorney.

Does Nebraska have automated forms?

Automated forms through Legal Aid of Nebraska: Users of this website are welcome to use the free automated question/answer forms through Legal Aid. Power of Attorney self-help forms

Is an agent entitled to be paid?

Your agent is entitled to be reasonably paid for his or her services unless you state otherwise in the Special Instructions.

Do power of attorney forms need to be filed with court?

Power of Attorney forms are not filed with a court; however, it is very important to keep the form in a secure place where it will not be damaged. Additionally, it is very important that all people involved with the power of attorney form are aware of the location of the form for future reference.

by State

by Type

What Is Power of Attorney?

- Power of attorney is the designation of granting power to a person (agent) to handle the affairs of someone else (principal).The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under state law. The most common types transfer financial or medical powers to someone else in the …

How to Get Power of Attorney

- Step 1– Understanding Your Needs

- Step 2– Selecting Your Agent (Attorney in Fact)

- Step 3– Creating the Document

- Step 4– Signing / Execution

How to Sign A Power of Attorney

- A power of attorney must be signed by the principal in the presence of a Notary Public, Two (2) Witnesses, or bothdepending on state laws. Signing Laws 1. DurablePower of Attorney (50-State List) 2. MedicalPower of Attorney (50-State List) 3. VehiclePower of Attorney (50-State List)

Signing as The Agent

- When the agent signs documents on behalf of the principal, they should sign in the following manner:

Frequently Asked Questions

Popular Posts:

- 1. who played district attorney darnell

- 2. what is an ada attorney?

- 3. georgia attorney who protect men against stalking

- 4. what is the job of the us attorney quizlet

- 5. how to become an attorney in missouri

- 6. how to become power of attorney and what it means

- 7. how many witnesses are required in sc for health care power of attorney

- 8. who has to sing a power of attorney

- 9. who is the best dui attorney in bakersfield ca

- 10. why it's important to be an attorney