What does a durable power of attorney do?

The preparing of legal paperwork can be high-priced and time-ingesting. However, with our preconfigured online templates, things get simpler. Now, using a Vanguard Durable Power Of Attorney Form takes a maximum of 5 minutes. Our state-specific online blanks and clear recommendations eradicate human-prone errors.

What should I do after I Sign my durable power of attorney?

Dec 11, 2018 · For example, Vanguard will accept an attorney-drafted POA, but for our clients’ convenience we offer our Vanguard Agent Authorization." Page 20 of "Understanding the Basics of Estate Planning," dated 2015. ... Once a full agent (also known as a durable power of attorney) is added, the agent will have complete control to act on your accounts.

How do I use a power of attorney (POA)?

Your plan rules determine how you can add a Power of Attorney.

What can I do if my client is incapacitated at Vanguard?

or for assistance in filling it out, call Vanguard at 800-662-2739. Mail the completed authorization and any other required documents to The Vanguard Group, P.O. Box 1110, Valley Forge, PA 19482-1110. 1. Notice THE PURPOSE OF THIS POWER OF ATTORNEY IS TO GIVE THE PERSON(S) YOU DESIGNATE (YOUR “AGENTS”) BROAD POWERS TO HANDLE

Why do financial firms want you to sign a POA?

Another reason many financial firms probably want you to sign their version of the POA is because your POA may be an old one that has been updated with a newly named POA but if the old POA is trying to do something shady (disgruntled family member stealing funds) by using the old POA then there is no way Vanguard would know that and they don't want the potential legal liability.

Can an agent stop a paper statement from being sent by mail?

Oddly enough, the agent authorization does not allow the agent to stop paper statements from being sent by mail. I seems the only way is to use the outside POA which is limited to one action at a time.

Does Pennsylvania have a power of attorney?

Yes, Pennsylvania has a low that says financial institutions have to accept it (so does Maryland). The law is called the Statutory Power of Attorney Act (or something similar). I’d remind them that if you have to sue them, they are on the hook for your attorney/legal fees.

Does North Carolina have a POA?

North Carolina also has a statue that allows a lawsuit against anyone not honoring a legally executed POA. Makes one wonder what is the point of having a POA if financial institutions put up all these roadblocks. A good revenue source for attorneys?

Can POA be eliminated?

The POA problem can be eliminated if your accounts are in trust and the trust has a disability provision where the successor trustee steps in if the grantor is disabled. The trust needs to spell out how a disability is determined, such as a doctor's statement. This is my understanding but I am not an attorney.

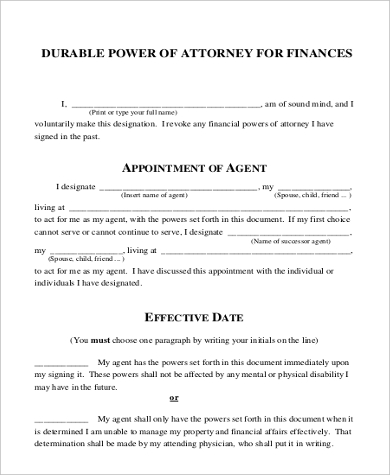

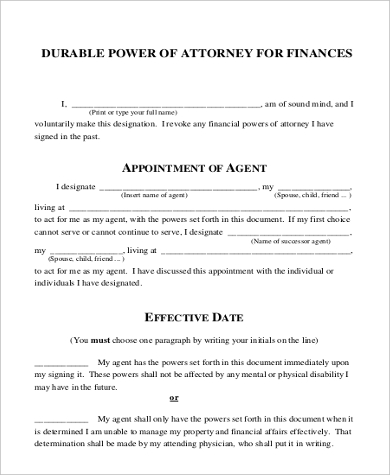

What is Durable Power of Attorney?

Durable POA. Durable powers of attorney hand over full control of the principal’s finances to the agent and do not terminate when the principal becomes incapacitated. This document can be rescinded if: Principal passes away. Agent becomes unable or unwilling to carry out their role. Principal revokes the POA.

What is POA in real estate?

In a property transaction, a POA will be filed by the realty agent in the appropriate real estate records as proof that the agent had the right to sign the deed in the principal’s name.

What is a POA?

General POA. A general POA grants overall control over the principal’s finances to an agent but terminates when the principal becomes incapacitated or unable to make his or her own decisions. At this point, it is usually replaced by guardianship, conservatorship, or a durable POA.

What is a power of attorney?

A power of attorney document lets you choose a trusted friend or relative to help you with your finances and/or health care decisions. After you sign it, the person you choose will take the power of attorney document to your medical providers, bank, school, and other places to make decisions and sign contracts just as if he or she were you. ...

What is the phone number for King County?

If you live outside King County, call the CLEAR hotline Monday-Friday from 9:15 am to 12:15 pm at 1-888-201-1014. You can also apply online at nwjustice.org/get-legal-help . If you live in King County, call 211 for information and referral to a legal services provider Monday-Friday from 8:00 am to 6:00 pm.

What is a springing power of attorney?

With a springing power of attorney, the authority to act on your behalf only kicks in after a doctor certifies that you’re incapacitated. (One drawback to keep in mind: That extra step can sometimes create delays.)

What happens if you are unable to manage your own affairs?

So if you are unable to manage your own affairs for any reason—for example, you’re unconscious in the hospital, or you develop severe dementia—your agent can step in and pay your bills or file your taxes, deposit checks in your bank account, manage your investments, handle insurance issues, and make many other important decisions. ...

What does it mean to have a power of attorney?

If you are an attorney, this means you have the power to act on someone else's behalf. You’ll often hear lawyers referred ...

Where to sign POA?

Sign the document in front of a notary. Every state requires you and your principal to sign the durable POA in the presence of a notary. If you’re not sure where to find a notary, you can use the Notary Locator provided by the American Society of Notaries.

Why are lawyers called attorneys?

You’ll often hear lawyers referred to as attorneys-at-law, or simply as attorneys, because they have the power to act on behalf of their clients in particular legal situations. Likewise, when someone, as the principal, grants you durable power of attorney, you become their agent.

What are financial decisions?

Financial decisions include the ability to access all bank, retirement, and credit accounts, sign income tax returns, collect Social Security or other government benefits, sell stocks and make investments, and manage the principal's real estate. ...

Who is Jennifer Mueller?

Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

Can a principal revoke a POA?

Understand your principal can revoke your authority at any time. If your principal's condition improves, or if she decides she no longer wants a POA, she can revoke it whenever she wants as long as she's mentally competent.

What is an affidavit for power of attorney?

An affidavit is a sworn written statement. A third party may require you, as the Attorney-in-Fact, to sign an affidavit stating that you are validly exercising your duties under the Power of Attorney. If you want to use the Power of Attorney, you do need to sign the affidavit if so requested by the third party.

What is a power of attorney?

A Power of Attorney empowers an Attorney-in-Fact to do certain specified things for the Principal during the Principal's lifetime. A Living Trust also allows a person, called a "trustee," to do certain things for the maker of the trust during that person's lifetime but these powers also extend beyond death.

What is an attorney in fact?

An Attorney-in-Fact is looked upon as a "fiduciary" under the law. A fiduciary relationship is one of trust. If the Attorney-in-Fact violates this trust, the law may punish the Attorney-in-Fact both civilly (by ordering the payments of restitution and punishment money) and criminally (probation or jail).

Can a person sign a durable power of attorney?

Yes. At the time the Durable Power of Attorney is signed, the Principal must have mental capacity. Although a Durable Power of Attorney is still valid if and when a person becomes incapacitated, the Principal must understand what he or she is signing at the moment of execution.

What is the responsibility of a fiduciary?

You, as a fiduciary, have the responsibility to consider both the safety of the Principal's capital and the reasonable production of income. This is a balancing act in which you need to decide how much income the Principal requires and how much capital must be sacrificed, if any, to generate that income.

Can a durable power of attorney be terminated?

Even a Durable Power of Attorney, however, may be terminated under certain circumstances if court proceedings are filed.

Popular Posts:

- 1. how to pay for divorce attorney fees

- 2. who was the attorney general during the waco massacres

- 3. what do you need to become a district attorney

- 4. what happens if you can't afford an attorney in a civil suit

- 5. what does the attorney general and solicitor general

- 6. my workers comp attorney wants me to take what ever the company is offering

- 7. where to obtain a power of attorney

- 8. how much does it cost for power of attorney papers

- 9. who is the texas attorney general

- 10. how long is the attorney general term