How to Make Limited Power of Attorney

- Decide the Powers. Make sure to carefully word the responsibilities of the Agent to ensure that he or she has the rights to act in your place ...

- Select the Agent. It’s important to choose someone that can be trusted and usually involves a family member or friend.

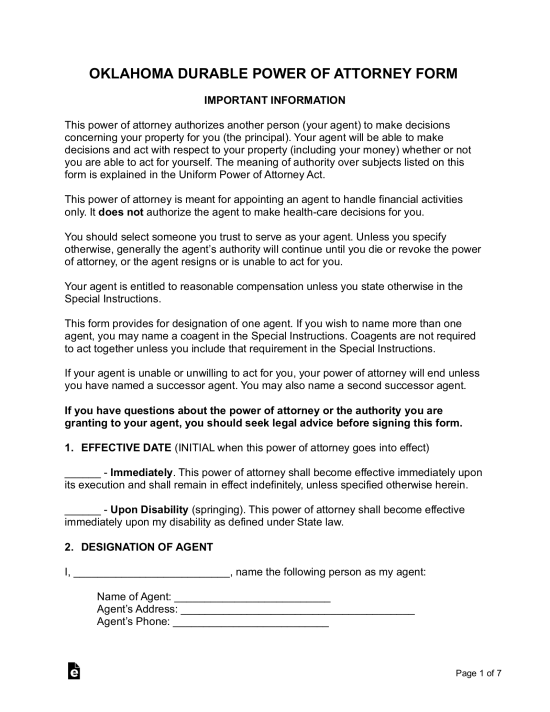

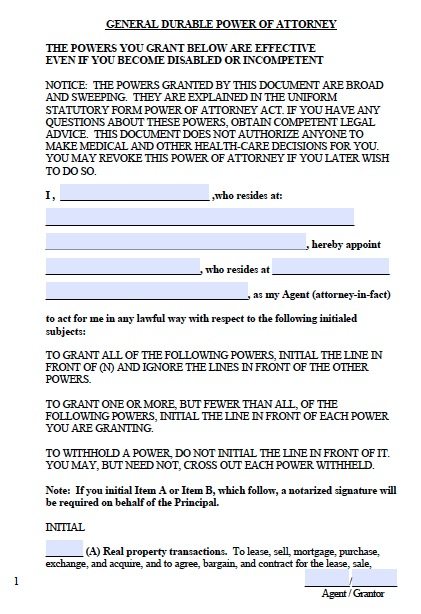

- Write the POA. Download in Adobe PDF, Microsoft Word (.docx), or Open Document Text (.odt). ...

- Signing. Sign this form falls under “financial” related use, it must be authorized in accordance with State ‘Durable’ Laws.

- Using the Form. Like any other power of attorney assignment, whenever the agent uses their right to act in the presence of the principal this form must ...

How do I execute a limited power of attorney?

Properly execute the limited power of attorney according to your state laws. Depending on the state in which you live, you may need to sign and date the limited power of attorney in the presence of witnesses or a notary.

Why do I need a limited power of attorney?

Common reasons for a Limited Power of Attorney are financial or real estate management, traveling out of the country, and to sign or obtain documentation on your behalf (i.e., Internal Revenue Service IRS, Social Security Administration SSA).

What are the requirements for a power of attorney?

Check your state's requirements. Requirements for power of attorney are similar in most states, but some have special forms. Usually, the document granting power of attorney must identify the principal, identify the agent, and specify exactly what legal acts the agent is entitled to perform.

What is a free free limited power of attorney form?

Free Free Limited (Special) Power of Attorney Forms A limited power of attorney allows a person to designate someone else to take care of specific financial activities on his or her behalf. The action may be as small as picking up mail to as dynamic as selling real estate to the benefit of the person being represented.

Why would someone do a specific or limited power of attorney?

A Limited Power of Attorney can give someone the authority to sign a legal document for a specific transaction. For instance, a limited power of attorney may be used to enable a real estate agent to handle a closing on behalf of a buyer or seller who is far away.

Does a limited power of attorney need to be notarized in Florida?

Execution Requirements In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

What is the downside of being a power of attorney?

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.

Can a limited power of attorney draw checks?

Many times, a talent manager or agent will have their client sign a limited power of attorney so that they may cash their client's checks on their behalf. The manager or agent will receive and cash the check, take their commission, and issue a new check (minus their percentage) to the client.

Can I do power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

How much does a power of attorney cost in Florida?

$250 to $500How much does a power of attorney cost in Florida? Though a power of attorney can be drafted online and later notarized for less than $100, it is best to consult a lawyer when completing such an important legal document. That being said, the average legal fees range from $250 to $500.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

What are the two types of power of attorney?

There are different types of power of attorney and you can set up more than one.Ordinary power of attorney.Lasting power of attorney (LPA)Enduring power of attorney (EPA)

Can two siblings have power of attorney?

Generally speaking, while it is good to include your spouse or siblings, consider the fact that they may not be around or have the inclination to sort out your wishes when the time comes. If possible, include two attorneys as standard and a third as a back-up should one of the attorneys not be able to act.

Can a power of attorney be for limited time?

The PoA may be made for a limited or indefinite period of time. The PoA should state if the attorney can sub-delegate the powers delegated to him or her to another person and that the PoA shall be valid even in the event you are incapacitated due to ill health.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.

What Can a Limited Power of Attorney Do?

A Limited or Special Power of Attorney can act on a Principal's behalf during specific transactions or dealings, be they financial, business, healthcare or any number of other instances. Depending on the authority you grant them, an agent can:

Why Would You Set Up a Limited Power of Attorney?

Setting up a Limited POA can be smart for a number of reasons. They can be a useful tool if you just want to be prepared for the unthinkable...like you become suddenly incapacitated. Or, they can be a great layer of protection for those times when you’re simply just unavailable.

What is the Difference Between Power of Attorney and Limited Power of Attorney?

Limited Power of Attorney differs from the regular POA or Financial POA most people are more familiar with. LPOA allows for greater restrictions and provisions and can be incredibly specific, which makes it a great tool for defined instances where a more blanket authority might be more than you need.

How Long is a Limited Power of Attorney Good For?

A Limited Power of Attorney is good for as long as you establish it. In contrast to a General POA, which expires only if you revoke it or once you pass away, Limited POAs are designed to be valid for a specific amount of time. This means you can set a date for it to lapse, and it will only be enforced up to that point.

How Do I Set Up a Limited Power of Attorney?

Setting up a Limited Power of Attorney isn’t difficult. You simply specify what power (s) you’re granting your Agent, and decide on the date those powers will expire. You can be as specific and granular as you like, or you can be a bit more general - ultimately, it just depends on what your goals and needs are.

Why do I need a limited power of attorney?

Common reasons for a Limited Power of Attorney are financial or real estate management, traveling out of the country, and to sign or obtain documentation on your behalf (i.e., Internal Revenue Service IRS, Social Security Administration SSA).

What is the phrase below the signature line for a limited power of attorney?

If the agent is signing a document on behalf of the principal, they must sign and then use the phrase below the signature line “Acting as POA”. The completed and signed limited power of attorney form should always be kept in a safe and easy to access place while not in use.

How to cancel a power of attorney?

(1) Enter a revocation date into the form. Upon the specified date, the document will no longer be valid and your agent will no longer be able to act on stated powers. (2) When the agent’s action or responsibility has been completed, the limited power of attorney will cease to be valid. (3) The Principal may complete a Revocation of Power of Attorney Form at any time to cancel their limited power of attorney.

How many copies of a document should be made for each party?

There should be at least two (2) copies of the form made for each of the parties.

How many witnesses do you need to sign a principal's signature?

The Principal should obtain two witnesses to attest to the Principal’s signature as this step is a requirement in most states. Both witnesses must sign, print name, and give addresses.

Can a power of attorney act for the principal?

Otherwise, the agent is not legally allowed to act for the principal.

Can a limited power of attorney be repealed?

The date will be documented and agreed upon or it can be repealed by the principal. Under certain circumstances, the Limited Power of Attorney will automatically become null. These include your death, the agent’s death, and you become mentally or physically incapacitated.

What is a power of attorney?

In the United States, a Power of Attorney enables a person to legally make medical, financial, and certain personal decisions (such as recommending a guardian) for another person. You may need to grant someone power of attorney if you are incapable of handling all or part of your affairs for a period of time.

When does a durable power of attorney go into effect?

It often will not go into effect until the person who grants the power of attorney becomes incapacitated.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

Can a person with a power of attorney be conservatorship?

If the person is already mentally incapacitated and did not grant power of attorney in a living will, it may be necessary to get conservatorship or adult guardianship . In most regards, the authority held by a guardian is similar to (but more limited than) those held by someone with power of attorney.

Do you need to notarize a power of attorney?

Have the power of attorney document notarized. Some states require the agent and the principal to sign the power of attorney document in front of a notary. Even if your state does not require notarization, notarization eliminates any doubt regarding the validity of the principal's signature.

Is a power of attorney void?

If the power of attorney purports to transfer a power that cannot be transferred under the law, that part of the power of attorney is void. For instance, even if the principal and the agent agree, the agent cannot write or execute a will for the principal. Any such will is not valid.

What is a limited power of attorney?

What Is Limited Power of Attorney? Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner.

What is LPOA in portfolio management?

An LPOA gives the portfolio manager the authority to buy and sell assets, pay fees, and handle various necessary forms. Certain critical account functions still can be made only by the account holder, including cash withdrawals and a change of beneficiary.

What is a springing power?

Springing Powers: An LPOA that has springing powers becomes active only if it is triggered by a specific event, usually the death or incapacitation of the account owner. It is typically used with a will or a family living trust.

What is a POA?

Clients typically complete a power of attorney (POA) form when they open an account with a portfolio manager. Most forms give clients the option to choose between an LPOA or a full power of attorney. A limited power of attorney restricts the authorization to a specific sphere, such as investment management. The client must designate an attorney in ...

Who must sign a portfolio manager form?

Once completed, both the client and the attorney or attorneys in fact must sign the form.

Can a portfolio manager withdraw money from a bank account?

The portfolio manager is never permitted to withdraw money from the account or change the beneficiaries. An account holder may specify other exceptions to the limited power of attorney. A limited power of attorney, as opposed to a general power of attorney, restricts the authority of the designated individual to a specific sphere.

1. Free Limited (Special) Power of Attorney Form – PDF – eForms

How to Make Limited Power of Attorney — Step 1 – Decide the Powers · Step 2 – Select the Agent · Step 3 – Write the POA · Step 4 – Signing · Step 5 – Using the Ohio · Pennsylvania · Michigan · Florida (1) …

2. Free Free Limited (Special) Power of Attorney Forms

How to Get Limited Power of Attorney? Step 1 – Download. Step 2 – Fill it in with the Attorney in Fact (representative) present to make sure you are both in (4) …

5. What is a Limited Power of Attorney? – NextGen Wealth

Aug 24, 2020 — Limited power of attorney allows for someone else to make specific decisions on your behalf but is limited by restrictions set in place by (14) …

6. 4 Types of Power of Attorney You May Need to Get Notarized

Sep 12, 2018 — 2. Special or Limited Power of Attorney. If you’re looking to narrow down what your agent can do on your behalf, you’ll want to (17) …

7. Consumer Pamphlet: Florida Power of Attorney – The Florida Bar

What are the differences between limited, general, and durable powers of attorney? A “limited power of attorney” gives the agent authority to conduct a specific (21) …

10. A Guide to Power of Attorney for Elderly Parents – Caring.com

Jul 16, 2021 — A limited power of attorney limits the agent to make decisions about specific tasks. It is often used to authorize someone to pay bills or (29) …

What is a limited power of attorney?

A limited power of attorney is a document that gives the named person, the agent or attorney-in-fact, with the legal authority to perform certain actions on behalf of the person who signs the document (known as the principal). A limited power of attorney doesn’t provide the agent with full authority over the principal. It outlines only the decisions that the agent may make for the principal. For example, a financial manager may have their client sign a limited power of attorney that allows the financial manager to invest their money without specifically speaking with the client to gain their consent. A limited power of attorney may also be known as a special power of attorney.

What is limited POA?

Scope and Limitations: A limited POA may apply to a single area of activity, such as the handling of investments. For example, an investment manager, acting as agent, may have authority to:

What is a POA for children?

This is our guide to power of attorney (POA) forms for American-born children of undocumented parents. While there are numerous situations in which POAs are useful, we focus here on undocumented families. POAs are important documents to have in place for families with undocumented members should they face detainment or deportation. In a moment in which political capital is increasingly spent on “securing borders” and arousing fears of undocumented immigrants, we hope this guide helps alleviate a small amount of the stress undocumented families constantly live with by providing tips for how to put processes and documents in place to protect your loved ones in the event of a detainment.

How long is a limited POA valid?

permanent or temporary period of time listed in the document. A limited power of attorney can be valid for a day or weekend, or last for years. The number and frequency of actions that might be required from the power of attorney.

What is a revocation clause in a power of attorney?

Any relevant paperwork, accounts, negotiations, or other relevant information which the agent needs should be detailed. Power to Revoke: This is often referred to as a revocation clause. Most limited powers of attorney contain a clause explaining how it may be revoked.

What power does an agent have?

The power listed may be that the agent has the right to cash the checks sent to them that are made payable to the author. The agent takes their commission out of that amount and then provides the rest of the funds to the author (generally in the form of writing a new check).

What is the specific details of the limited authority that further describe the actions, authority and liberties given to the power of

The specific details of the limited authority that further describe the actions, authority and liberties given to the power of attorney. It’s imperative that the principal details the agent's authority to sign documents or give instructions in the best interest of the person giving them the power.

Limited Power of Attorney Sample

To get a limited power of attorney form, download one of our free templates (PDF & Word) and start drafting your limited power of attorney.

Limited Power of Attorney

Alternatively, you can use our document builder to create a complete, custom LPOA.

How to Fill Out a Limited Power of Attorney Form

Once you’ve decided what specific powers you want to give your agent, you can begin filling the limited power of attorney form to legally grant those powers.

What Is Limited Power of Attorney?

A limited power of attorney form grants someone the authority to represent you and act on your behalf. It restricts this authorization to a specific task the agent will carry out, or it can limit PoA to a time frame.

How Is Limited Power of Attorney Different From Other Subtypes?

A power of attorney form allows an agent to carry out financial transactions, make legal or medical decisions, and generally act on behalf of another person who can’t perform certain actions or make decisions.

What Does a Limited Power of Attorney Form Look Like?

You can find free limited power of attorney forms online. These forms typically have the following sections.

Step 1 – Basic Information of Principal and Agent

Step 2 – Powers

Step 3 – Revocation

Step 4 – State Law

Step 5 – Acceptance of Appointment

Step 6 – Witnesses

Step 7 – Notary Public

- Once the form has been completed by all parties, the Principal should bring their limited power of attorney form to their local Notary. A Notary can be found at your local bank and they will most often give their services for free or at a small charge.

Popular Posts:

- 1. when the attorney became a partner he received

- 2. how to file for divorce in texas without hiring an attorney

- 3. what did rep sheila jackson lee hand fords attorney during hearing break

- 4. how to leagally change power of attorney to protect the elderly when family will do nothing

- 5. why did my attorney tell me i didnt need to attend my settlement conference

- 6. how to find what type of attorney you need

- 7. who was the last two attorney generals?

- 8. what does a new attorney general mean

- 9. where to deduct attorney fees on ss income

- 10. how to work a dui attorney