What address do I send my taxes to Colorado?

How do I charge Colorado state taxes?

How do I make a payment to the Colorado Department of Revenue?

- Begin by accessing Revenue Online. ...

- Locate the “Payment Options” box on the Revenue Online homepage.

- Click “Make a Payment.”

- Read the information about the various service fees and processing timelines before selecting a payment option.

How do I remit sales tax in Colorado?

- Make the check or money order payable to the Colorado Department of Revenue.

- Write the Colorado Account Number (CAN) for the sales tax account on the check.

- Include the filing period dates and the words Sales Tax Return on the check.

What is Colorado retailer's use tax?

Is Colorado origin or destination based sales tax?

How long can the state of Colorado collect back taxes?

Can you pay taxes online?

How do I find my Colorado tax ID number?

What is a non physical location in Colorado sales tax?

What is the Colorado state sales tax?

What is a special district in Colorado?

Why is this important?

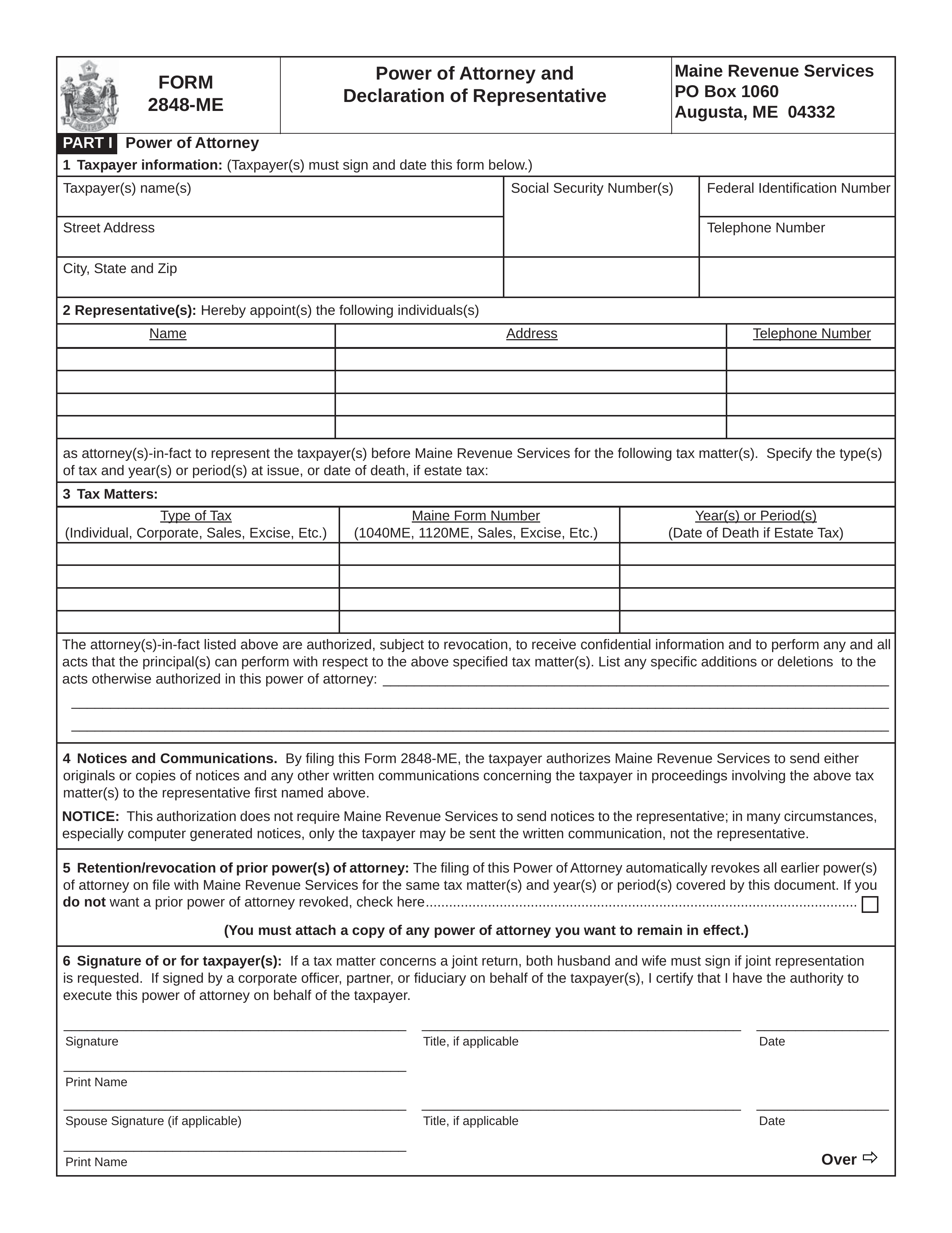

OnPay works with government entities on your behalf, reporting new hires to state labor departments, calculating tax rates, paying taxes and insurance contributions, and filing financial reports. To do this effectively, you will need to grant us Power of Attorney for each state where your company has a tax obligation.

Colorado Department of Revenue

You can add a Power of Attorney online with the Colorado Department of Revenue, or by completing the attached DOR form.

Returning your completed form

Email your completed Power of Attorney form [email protected]. If you have any questions, call us at (877)-328-6505. We'd love to help!

Colorado State Tax Power of Attorney Form

The Colorado State Tax Power of Attorney is supplied by the Department of Revenue and helps residents convey tax powers to their representation. The party issuing the authority has the choice of supplying their agent with a sweeping power that includes all tax-related matters or designating a more specific area of their tax liabilities.

Other Versions

City of Aurora Version ( § 130-66 & § 130-67) – For the specific use of delegating certain tax and licensing matters.

Related Forms

Durable (Financial) Power of Attorney – This form allows a principal to designate an array of financial powers to an attorney-in-fact including the authority to make certain tax preparations in their name. (This POA persists past the point of the principal’s incapacitation.)

More about the Colorado Form DR 0145 Individual Income Tax TY 2020

This is the Tax Information Designation and Power of Attorney for Representation. This allows the department to disclose your confidential tax information to your designee. You may designate a person, agency, firm or organization.

Other Colorado Individual Income Tax Forms

TaxFormFinder has an additional 64 Colorado income tax forms that you may need, plus all federal income tax forms .

Form Sources

Colorado usually releases forms for the current tax year between January and April. We last updated Colorado Form DR 0145 from the Department of Revenue in February 2021.

Historical Past-Year Versions of Colorado Form DR 0145

We have a total of eight past-year versions of Form DR 0145 in the TaxFormFinder archives, including for the previous tax year. Download past year versions of this tax form as PDFs here:

TaxFormFinder Disclaimer

While we do our best to keep our list of Colorado Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. Is the form on this page out-of-date or not working? Please let us know and we will fix it ASAP.

How to obtain death certificate?

The Department cannot provide information about a decedent's tax records without proper authorization. To establish that you have obtained such authorization, submit the following with your information request: 1 The decedent's complete name, address and social security number 2 A copy of the death certificate, and either 3 A copy of Power of Attorney 4 A copy of Letters Testamentary

What is a testamentary document?

The document grants the estate administrator, executor or personal representative of the deceased, authority to manage the affairs of the decedent in their estate. In addition to resolving tax matters, you might need Letters Testamentary to gain control of the decedent's assets.

Popular Posts:

- 1. how to find out if an attorney won a case

- 2. how to get power of attorney with a car

- 3. power of attorney documents how agent signs documents

- 4. how is an attorney ethics complaint researched by ethics

- 5. what happened to states attorney roger thompson of lincoln illinois

- 6. who can sign an attorney engagement letter

- 7. who is currently california attorney general 2015

- 8. what does pa stand for after an attorney name

- 9. how to change subtitles on crunchyroll app ace attorney

- 10. what happens if an attorney is sanctioned