How much power does your power of attorney actually have?

The powers granted to an agent with a Power of Attorney will vary depending on the type of POA and any limitations that the principal chooses to include in the POA. General and Durable Power of Attorneys allows the agent to perform just about any action on behalf of a principal.

How much does it cost to obtain power of attorney?

Depending on what needs to be done, a power of attorney can range anywhere from $75 to as much as $450. Typically, a power of an attorney for a single person is going to be cheaper than for a couple. The costs, in the end, will depend on the route you take.

How to prove that someone is power of attorney?

There are generally four ways these privileges may be granted:

- Limited Power of Attorney. Gives an agent the power to act for a very limited purpose.

- General POA. Usually implemented when the principal is competent, but needs ongoing help managing their affairs).

- Durable Power of Attorney. Either limited or general in scope, but extends beyond incapacitation.

- Springing POA. ...

How much does a durable power of attorney cost?

How much does a power of attorney cost? Depending on what needs to be done, a power of attorney can range anywhere from $75 to as much as $450. Typically, a power of an attorney for a single person is going to be cheaper than for a couple. The costs, in the end, will depend on the route you take.

How much does a power of attorney cost in Canada?

You can prepare a Power of Attorney with a lawyer. The 2019 legal rates for a financial PoA are $150-$200 according to Canadian Lawyer Magazine. Or you can use an interactive online service like the one at LegalWills.ca.

How much does it cost for power of attorney in Australia?

Fees for Wills, Enduring Power of Attorney and Enduring GuardianshipOne Document – Will or Enduring Power of Attorney or Enduring GuardianshipFeesTotalCouple$320.00$350.00Single Person$210.00$225.00Two Documents – Will and/or Power of Attorney and/or Enduring Guardian AppointmentCouple$465.00$500.007 more rows

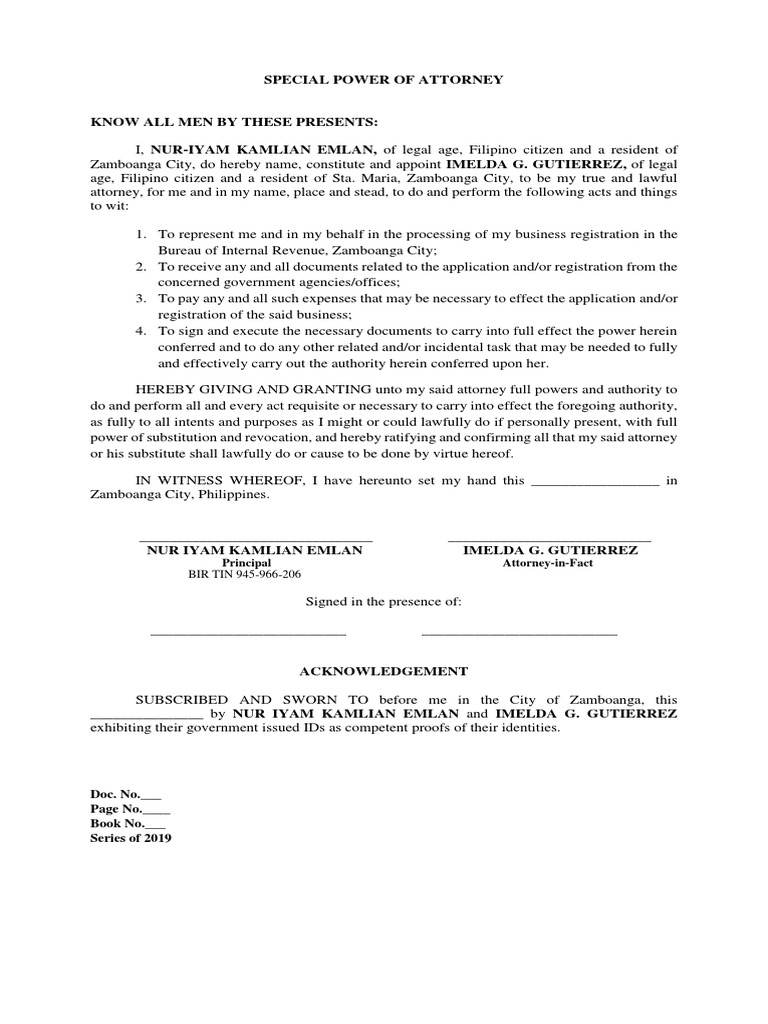

How much is special power of attorney in the Philippines?

1. How much does it cost to have a Special Power of Attorney? The cost of notarization varies depending on the location and the notary public. Rates could range from Php 500 to Php 1,000 or higher.

How do I get a power of attorney in South Africa?

The Power of Attorney needs to be signed by the principal, giving the agent authority to act on his/her behalf. The principal's signature has to be co-signed by at least one witness to confirm that it was indeed the principal signing the document.

Can I do power of attorney myself?

In order to make a power of attorney, you must be capable of making decisions for yourself. This is called having mental capacity – see under heading, When does someone lack mental capacity? You can only make a power of attorney which allows someone else to do things that you have a right to do yourself.

How do I give someone power of attorney Australia?

How Do I Appoint a Power of Attorney? (2021 Update)You can appoint a Power of Attorney by simply completing a form.This form needs to be signed and witnessed.You can also revoke it at any time, by putting your revocation in writing.

How do I get power of attorney in the Philippines?

Step-by-Step Guide on getting a Special Power of Attorney in the PhilippinesSTEP 1: Prepare a SPA (you can use the format above) and print 4 copies on a long bond paper.STEP 2: Go to the lawyer's office and sign the document. ... STEP 3: Pay the fee and get your SPA notarized. ... Requirements:More items...•

How long is the validity of special power of attorney in the Philippines?

However, the Special Power of Attorney is already expired as it is indicated in the document that its validity is only one year from the date of the sale of the property to my seller.

Does special power of attorney need to be notarized?

A special power of attorney may need to be notarized to have legal authority.

How long is a power of attorney valid in South Africa?

South African common law determines that a power of attorney terminates once the principal becomes mentally incapacitated. In other words, when a principal is no longer able to perform the act in question himself, the agent can no longer do it for him.

Do you have to register a power of attorney with the bank?

The LPA must be registered with the Office of the Public Guardian (OPG), then attorneys must register their powers with each financial provider the donor holds an account with. This legal arrangement remains in place even if your mental faculties decline, but must be set up before that happens.

How long is general power of attorney valid for?

Also note here that a PoA has to be registered at the Sub-Registrar's Office to get a legal validity. Another important thing to note here is that a PoA remains valid only till the life of the principal. Within their lifetime also, one can revoke the PoA.

How much does a lawyer charge for a POA?

A consumer could probably expect to pay a lawyer less than $200 for a POA in most cities. Many also offer reasonably priced estate planning packages that include a financial power of attorney, a medical power of attorney, a living will and a last will and testament. All these documents are important for ensuring an elder’s wishes are respected and their affairs are taken care of both in life and after their passing.

How much does a notary charge?

Most states set maximum fee limits for basic notarial acts to keep prices reasonable. Fees range from $2 to $10 per signature and some notaries will come to clients who are hospitalized or otherwise unable to travel. There may be additional travel fees associated with notary visits.

Why is POA important?

This is particularly important when drawing up a financial POA because it grants the agent legal authority over all financial decisions, including selling property, paying taxes, managing investments, Medicaid planning, paying for where the principal will live and deciding how their money will be spent.

What is a POA?

A power of attorney (POA) document is one of the most important legal tools that family caregivers must have to effectively manage their aging loved ones’ health care and/or finances. Without these documents, a caregiver (known as the agent) lacks the legal authority to handle important decisions on behalf of their elder (known as the principal).

Can you name multiple children on a POA?

Therefore, attorneys (myself included) don’t normally recommend naming multiple adult children on a POA document to share the role of agent for an aging parent. This is known as a joint power of attorney and can be highly problematic. With this type of POA, all agents must act jointly and come to agreement on each matter before any action can be ...

Do POAs go into effect immediately?

If a principal wants to place any limitations on their agent’s power, then an attorney will need to tailor the language in this document accordingly. There is a great deal riding on the way in which a POA document is written, and there are several different kinds of powers of attorney. Some POAs go into effect immediately but end upon ...

Can a real estate attorney review estate documents?

Real attorneys in our network can review your estate planning documents to make sure they're done right and answer your pressing questions .

Can you refund third party processing fees?

What it doesn't cover: We can't refund third-party processing fees (e.g. paid directly to our service partners or to facilitate fulfilling your order like courier fees) once you make a purchase. And, we can't refund filing fees once we submit your paperwork to the government.

How much does a power of attorney cost?

How Much Does Power of Attorney Cost? On average, power of attorney in costs about $375 with average prices ranging from $250 to $500 in the US for 2020 to have a lawyer create a power of attorney for you according to PayingForSeniorCare. Some sites allow you to create a POA online for about $35 but you will also have to get it notarized ...

How much does it cost to create a POA?

Some sites allow you to create a POA online for about $35 but you will also have to get it notarized for about $50. However, AgingCare suggests that you should have a lawyer create a POA for you as online documents come with no professional counsel, no legal witnesses, no customization, and no quality insurance.

How much does a power of attorney cost?

Depending on what needs to be done, a power of attorney can range anywhere from $75 to as much as $450. Typically, a power of an attorney for a single person is going to be cheaper than for a couple. The costs, in the end, will depend on the route you take. If you were to file the paperwork on your own and use an online service, for instance, the costs could be in the $100 to $150 range; however, if you were to use an attorney, then the costs could be as much as $700 or even more if the case was complex and/or you needed to draft a living will as well.

What are the extra costs of a power of attorney?

What are the extra costs? Some attorneys often require additional costs to cover other aspects of the legal process such as medical expenses and treatments. Usually, the lawyer who is appointed a contract for the medical power of attorney does not have any right to deal with financial transactions.

What does it mean to have a lasting power of attorney?

The lasting Power of Attorney is something that you have to work and deal with if you are someone who is mentally and physically incapacitated due to some accident or ailment.

Why do people need power of attorney?

Because of the personal nature of these decisions, you are able to choose whomever you would like. Essentially, the power of attorney is given when the person becomes incapacitated to do work or to fulfill their own obligations. In other cases, the document is applied temporarily when the person cannot be in that particular place ...

What is a power of attorney?

For many people, the power of attorney, sometimes referred to as a “DPOA,” acts a piece of paper that authorizes another person to do legal tasks and actions on their behalf. These legal actions and tasks most often have to do with money, but it can also involve medical decisions.

Do you have to request a new document every time an old one expires?

This means that you will not have to request a new one every time the old document expires. Of course, if you are looking for a document that is longer lasting, then you will have to work with someone who you can trust, especially in terms of financial obligations and transactions.

Does a power of attorney have an expiration date?

Lasting Power of Attorneys’ would also be added costs. Typically, the document will have an expiration stated on when it will be legal. For the longer time frames, you can expect to pay for an added expense.

9 Answers

While cheap forms from the office supply store are certainly available, and probably better than nothing, the small fee that a good elder law attorney charges for his or her preparation of a durable power of attorney for financial and legal matters would be money well spent.

Popular Questions

The nursing home is holding my Mother "hostage" with a POA that was forged. Any help?

Related Questions

How do you invoke power of attorney when the aging parent is no longer making sound financial decisions?

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

How long is a minor power of attorney good for?

Valid for a temporary period of time, usually between six (6) months to one (1) year, which is dependent on the State’s laws.

What is a non-durable power of attorney?

General (Non-Durable) Power of Attorney – Grants the same financial powers listed in the durable form except that it does not remain in effect if the principal becomes incapacitated or mentally disabled.

Why do people use power of attorney?

A: People most frequently use a power of attorney for financial or healthcare reasons. Say you want someone to act on your behalf for when you fall ill in the future, you would use a Medical (Health Care) Power of Attorney so your agent could make health care decisions on your behalf. If you are in a rare situation and want to give specific powers that aren’t financially or medically related, you can create a Limited (Special) Power of Attorney.

What is a revocation of a power of attorney?

Revocation of Power of Attorney – To cancel a current power of attorney arrangement.

Does power of attorney matter in which state?

A: The power of attorney must be tailored for the state in which your parent resides. It does not matter which state you live in, as long as the power of attorney is applicable to the principal’s state of residence, which in this case is your parent, is what matters.

Do you need originals for a power of attorney?

For Medical Power of Attorney, some hospitals require that originals be present so it is recommended that originals be given to the agent (s).

How much does a power of attorney charge in Pennsylvania?

Most Agents will charge on an hourly basis, but there are occasions where they will charge on a flat fee amount on a monthly basis. I most commonly see hourly rates for family members acting as Agent in the $20.00 to $40.00 range.

Who is acting as an agent under a power of attorney?

Typically, a son or daughter will be the person acting as Agent under a power of attorney document on behalf of their parents. Before setting a fee structure, an Agent should know that there are two groups that could bring payment complaints. They are: The children and beneficiaries of the incapacitated person.

Do hard working agents deserve pay?

Overall, a hard working Agent deserves payment. They have day-to-day decisions, worries and obligations that others cannot understand unless they have been in that position. Others might think the Agent just drops by a couple of times a week to check on the incapacitated person.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What does revocation of power of attorney mean?

Revocation Power of Attorney – To cancel or void a power of attorney document.

How many steps are required to get a power of attorney?

An individual may get power of attorney for any type in five (5) easy steps:

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Popular Posts:

- 1. what does a court appointed guardian or attorney do

- 2. how power of attorney living will works

- 3. the process of selecting a jury which permits an attorney to ask a jury

- 4. is an attorney needed when a child is invovled with a divorce

- 5. how to do a letter for client from attorney sample

- 6. what if i do not pay my attorney fees

- 7. how do you get power of attorney papers for an adult

- 8. telling someone i will consult with the attorney for what she done to me is considered as a threat?

- 9. i need a legal attorney who will file conspiracy

- 10. what is the difference between power of attorney and executor of estate