As executor of an estate, deciding whether to hire a lawyer for probate can be difficult. On one hand, you want to be sure you carry out your loved one’s wishes after their death. However, on the other hand, lawyers for probate are extremely costly – and often unnecessary!

Full Answer

How do I settle an estate in New York without formal accounting?

Sep 10, 2020 · On one hand, you want to be sure you carry out your loved one’s wishes after their death. However, on the other hand, lawyers for probate are extremely costly – and often unnecessary! Believe it or not, you do not always need to hire a lawyer for probate to successfully settle an estate. In fact, there are a plethora of good reasons to choose to represent yourself …

How do you probate a will without a lawyer?

3. Most experts agree that personality differences are the main cause of conflict during the division process of an estate settlement. Without understanding these differences, keeping the peace and avoiding conflict will be much more difficult to accomplish. Rule # 3 – Try to gain an understanding of personality types of the other heirs involved. It is important to understand the …

How to avoid conflict during an estate settlement?

Jul 04, 2021 · In fact, anyone can interact with the court system and you can do probate without a lawyer. However, there may be times when a lawyer is necessary during probate. Let's go over the general steps of the probate process and discuss how to probate a will without a lawyer if possible. Note that even if a lawyer is needed, you can hire them for very specific issues and …

How many steps does it take to settle an estate?

Oct 05, 2009 · From the facts presented, it appears as though there is very little, if anyhting, to be administered in the estate. Plus, it appears that most if not all of the estate would go to repay Medicaid. Although I would recommend that you discuss the matter with an atorney, there is no requirement that you retain an attorney for any legal matter.

Do you need a lawyer to administer an estate?

You aren't required to use a lawyer - however probate is usually arranged through a lawyer, Public Trust or a statutory trustee company. This is because all the documents must be set out in a specific way according to the laws of probate.

Does an executor have to show accounting to beneficiaries?

To summarize, the executor does not automatically have to disclose accounting to beneficiaries. However, if the beneficiaries request this information from the executor, it is the executor's responsibility to provide it. In most cases, the executor will provide informal accounting to the beneficiaries.Dec 24, 2021

How long does it take to settle an estate?

The Basics of Probate Timelines Unfortunately, every estate is different, and that means timelines can vary. A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.6 days ago

Can beneficiaries demand to see deceased bank statements?

Some times beneficiaries want to see more detailed documents such as a Deceased's bank statement or pension documentation. Strictly speaking a beneficiary has no entitlement as of right to such documentation and it is your discretion as Executor whether or not to disclose it. The nature of the beneficiary's interest.Jun 19, 2019

Can an executor sell property of the estate without all beneficiaries approving?

Yes. An executor can sell a property without the approval of all beneficiaries. The will doesn't have specific provisions that require beneficiaries to approve how the assets will be administered. However, they should consult with beneficiaries about how to share the estate.Sep 30, 2020

What does an executor have to disclose to beneficiaries?

One of the Executor's duties is to inform all next of kin and beneficiaries of: The deceased's death; The appointment of themselves as an Executor/Administrator; Their inheritance – be it a specific item, cash sum or share of the estate.

Is there a time limit on winding up an estate?

There are certain aspects, such as registering the death, which have set time limits, however, the full estate administration process will be different for each case. In general, it can take anywhere from six months to 18 months to wind up an estate.

Can a bank release funds without probate?

Banks will usually release money up to a certain amount without requiring a Grant of Probate, but each financial institution has its own limit that determines whether or not Probate is needed. You'll need to add up the total amount held in the deceased's accounts for each bank.

Rudolf J. Karvay

From the facts presented, it appears as though there is very little, if anyhting, to be administered in the estate. Plus, it appears that most if not all of the estate would go to repay Medicaid. Although I would recommend that you discuss the matter with an atorney, there is no requirement that you retain an attorney for any legal matter.

Thomas Martin Kernan

Unfortunately, the greatly simplified and less expensive "small estate proceeding" is not an option in your case because you cannot use it to administer an estate containing real estate.

Who is the personal representative of an estate?

The personal representative of an estate (executor or administrator) is a fiduciary, a legally appointed representative who is responsible for managing the estate assets for ultimate distribution to the beneficiaries.

What is the personal representative's responsibility?

3. Mismanagement of the assets. One of the personal representative’s responsibilities is to secure and protect the estate assets. A personal representative risks charges of negligence if stock is not sold in a timely manner before it drops in value.

Does Pennsylvania have inheritance tax?

Pennsylvania has an inheritance tax . Even in estates where the tax percentage is zero, the tax return must still be filed. Make an error on the return, such as missing a deduction, the early tax payment period, or overstate the tax due, and you’ll cost the estate money. 3.

Do it yourself probate?

However, probate – the court monitored process of distributing the assets of a deceased – can become a headache for the inexperienced. There are those who think that probating is just a bunch of paperwork that can be acquired on-line.

How long do creditors have to file a claim against an estate?

A creditor will have 30 days after publication of the notice to come forward with a claim against the estate. Once 30 days have passed, when you distribute the estate, you won’t be liable for any claims from creditors you didn't have notice from. Step 7. If necessary, apply for a grant of probate or administration.

Who must put the interests of the estate before their own interests?

The personal representative must put the interests of the estate before their own interests. This is the case even if — especially if — they have a personal interest in the assets, or they’re a beneficiary or heir.

What happens when a loved one dies?

When a loved one dies, someone has to deal with their property and debts. The process can be time-consuming and intimidating. We’ve broken it down into 10 main steps. Learn how to settle an estate.

What happens if a person leaves a will?

Debts must be paid, assets may have to be sold, and the property must be distributed. If the deceased left a will, the executor named in it settles the estate. If there isn’t a will (or if the named executors won’t be acting) then a person can apply to court to become administrator to take charge of the estate.

How long after a grant of probate can you distribute your estate?

If you needed to get a grant of probate or administration, the law says you can’t distribute the estate until 210 days after the grant was issued. You do this to make sure that no one is going to make a claim against the estate. This may include a spouse or child challenging the will, a creditor claiming a debt owed, or a spouse making a spousal home claim.

Who approves a statement of accounts?

The beneficiaries or heirs must approve your statement of accounts. Ask them to sign a release. In it, they agree not to make any claims against you as personal representative. They do this in consideration of the distribution they receive from the estate.

Can you transfer an estate into your name?

Once you have the grant of probate or administration, you’ll be able to transfer the estate assets into your name as personal representative. You can then settle the deceased’s debts and any expenses that you incur in the course of administering the estate.

What is the final responsibility of a deceased person?

Your final responsibility is to distribute the deceased’s remaining property, after all debts and taxes are paid, to the beneficiaries named in his will. Most states require that you get court approval first. You’ll probably have to file a final accounting, explaining everything you did on behalf of the estate, and provide receipts and bank records for the transactions. Once the debts are paid and the property is distributed, after your final accounting is filed, the court will likely close the case and you'll be relieved of your duties.

Can you be an executor of an estate without an attorney?

You can act as executor or administrator of a probate estate without an attorney in most cases. To be successful, you'll have to understand the local rules in your state and county, as well as the laws regarding the rights, duties and responsibilities of an estate administrator or executor.

Is it too late to start probate?

If you start probate proceedings then discover that you’re in over your head, you can hire an attorney mid-process – it’s not too late. You should also consider hiring an accountant for the estate as well. You can’t ask courthouse staff for help.

Is probate more complex than estate?

Probate is more complex in some states than in others, and the estate itself might throw up some warning flags that you need professional legal help. Consider contacting an attorney if: The deceased didn’t leave a will. This is called an intestate estate and can involve more complex probate rules. The beneficiaries and heirs are bickering ...

What is a waiver and consent?

The waivers and consents are considered a contract and a binding legal document on all parties. When the property is distributed, the fiduciary’s attorney will need to obtain a receipt and release by each party who received property from the estate.

Is Albert Goodwin a good attorney?

Albert Goodwin is a great attorney. He worked very hard to resolve my case in an efficient and timely manner. He is very knowledgeable and trustworthy. I would highly recommend him.

Popular Posts:

- 1. what to look for in an attorney to write one's will

- 2. in wv what is required to revoke a duriable power of attorney

- 3. how to become a non attorney representative

- 4. who is the attorney general in wayne county ny

- 5. attorney who represents bakersfield police department

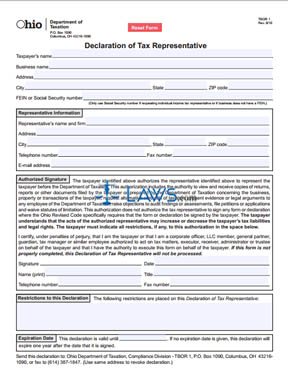

- 6. if i have power of attorney, do i have to fill out a special form when doing taxes

- 7. how to get to attorney mongoluzo from 63 barbara street

- 8. what is dar 2 attorney code

- 9. how to file a lawsuit against district attorney

- 10. ar what point in the home buying process massachusetts do i need an attorney?