A power of attorney can be deposited with a bank holding a trust account with the express purpose of empowering the attorney in fact (as trustee) to operate the account. A springing power of attorney is one that takes effect only once the principal is declared mentally incapacitated.

Full Answer

How to get power of attorney in 5 steps?

Generally, a power of attorney (POA) is not designated for a trust. However, there could be instances when you might want to name the same person as your trustee and as your attorney-in-fact. A POA is a legal document that gives someone else the power to act on your behalf. A trust, on the other hand, is managed by a trustee.

Can a power of attorney be designated for a trust?

Jun 27, 2011 · A power of attorney is an essential estate planning document. It lets you appoint an agent to make a range of decisions for you in the event you become disabled (or in case you’re otherwise not available to be there, in person, for a legal or financial transaction).This helps to keep you out of living probate if you ever suffer a disabling injury or illness – instead of needing …

How do I appoint a power of attorney for my parent?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

Where can I get a copy of my power of attorney?

May 19, 2009 · A power of attorney is a separate document clearly identifiable as such by its title. The title should also note whether it is a durable power of attorney. The parties to the document should clearly be identified and the powers or limitations of the attorney in fact enumerated. Though a trust document can have parts that resemble a power of attorney, listing the powers …

Who has power in a trust?

16220. The trustee has the power to collect, hold, and retain trust property received from a settlor or any other person until, in the judgment of the trustee, disposition of the property should be made.

What is the difference between power of attorney and a trustee?

A Power of Attorney (POA) is a legal document that gives someone legal authority to act for you while you are still alive. The Trustee to an Estate is generally the person authorized to manage your estate's assets following your death.

Who holds the real power in a trust the trustee or the beneficiary?

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend ...Jun 22, 2021

Who has more power a trustee or beneficiary?

The trustee has the power to make management decisions regarding the trust, but the beneficiaries do not wield such power. However, the law gives beneficiaries certain rights, like requesting a trust accounting and receiving assets from the trustee in a timely manner.Feb 19, 2021

What Are The Different Types of Power of Attorney?

There are three different kinds of power of attorney privileges: 1. General: A general power of attorney gives the designated person or entity the...

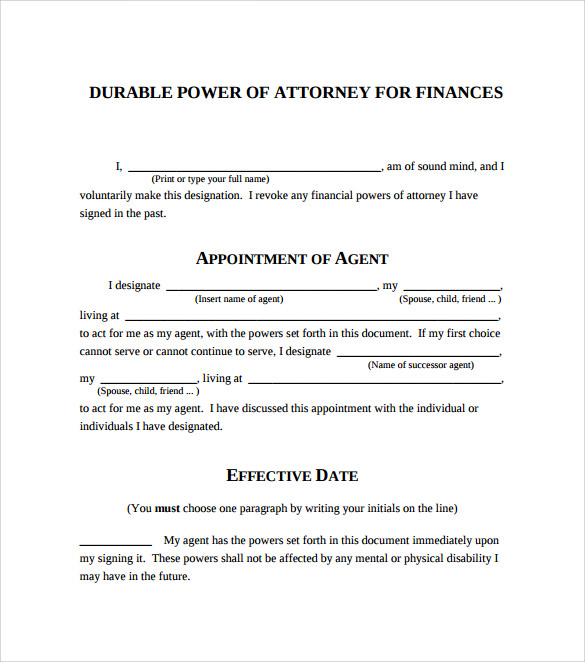

How Do I Create A Power of Attorney?

Most states offer simple forms to help you create a power of attorney for finances and legal documents. The document must be signed, witnessed and...

Who Can Grant Power of Attorney?

Anyone with the appropriate mental capacity can grant the power of attorney to another. The person granting the power of attorney is the "principal...

Can Power of Attorney Continue After incapacitation?

A power of attorney can only be created if the person granting the power of attorney understands what type of document they are signing. If the per...

Can The Power of Attorney Be Revoked?

The principal may not revoke the durable power of attorney after incapacitation. However, this is rarely an issue because legal incapacitation is m...

Should I Appoint A Power of Attorney When I Still Have Capacity?

Yes, you can only grant power of attorney when you have capacity or there will be no power of attorney to give. If the person has failed to appoint...

Popular Posts:

- 1. how much money does the attorney takes away from an accident check

- 2. who plays lucious attorney on.empire

- 3. why would a conflict attorney be put on a proof of compleyion cade

- 4. how too prosecute a district attorney

- 5. attorney general roland garrett what does he do

- 6. washington state attorney obligation to keep copies of files when transferred to new counsel

- 7. how many presidents have requested all previous attorney generals to resign

- 8. when was robert kennedy attorney general

- 9. how to fire real estate attorney

- 10. state attorney what is