How does a person with power of attorney sign documents?

Dec 20, 2019 · The proper way to sign as power of attorney is to first write the principal’s signature. This shows that you’re acting on the principal’s behalf, and not your own. And remember to use the principal’s full legal name. If you see their name listed on any pre-existing paperwork at the institution, be sure to replicate its format.

How to sign as a power of attorney?

Sep 04, 2020 · When you sign a document as someone’s attorney-in-fact, your signature needs to make it clear that you—not they—are signing the document and that you are acting under the authority of a power of attorney. To understand how this works, let’s suppose your name is Jill Jones and you have power of attorney to act for your friend, Sam Smith.

What is a signature power of attorney?

Feb 18, 2009 · If you have been named as “Attorney in Fact” by a Grantor through a Power of Attorney document, there is only one method that any document should ever be signed under this authority. When signing on behalf of a Grantor as Attorney-in-Fact, you should always sign YOUR OWN NAME, followed by the words “ Power of Attorney “. Do NOT sign the Grantor’s name — …

What are the requirements for a power of attorney?

Apr 26, 2017 · As a mobile notary and signing agent, you run into Power of Attorney scenarios a lot, so it would benefit you to MASTER them. People use a Power of Attorney ...

How do you sign a document on behalf of someone?

The ordinary process for other documents such as letters, forms or general legal documents is that you write 'p. p' before your signature, to demonstrate that you are signing for someone else. This will show the reader that you've signed with the authority of the intended signee.Jan 22, 2021

How do you sign with permission?

The letters "p.p." before your signature on behalf of your brother indicate that the signature is under procuration (that is, on behalf of another with permission). You may type or handwrite the letters just to the left of your signature to indicate that you are signing under procuration.

How do you sign as power of attorney UK?

How to make a lasting power of attorneyChoose your attorney (you can have more than one).Fill in the forms to appoint them as an attorney.Register your LPA with the Office of the Public Guardian (this can take up to 20 weeks).

How do you electronically sign permission?

Open the email with a request to digitally sign your document.Click the link. ... Agree to electronic signing. ... Click each sign tag and follow the instructions to add your electronic signature where required to sign or initial.Adopt a signature to save your signature information.Confirm your signature by clicking FINISH.

How do you sign a document you don't agree with?

If the performance document doesn't make it clear, you can also write in "I disagree with the contents of this document" next to your signature. This is often the best way to avoid being insubordinate, but to make sure that your signature won't be misinterpreted later.

Who can witness a signature on a power of attorney?

Here are the rules on who can witness a lasting power of attorney this time: The witness must be over 18. The same witness can watch all attorneys and replacements sign. Attorneys and replacements can all witness each other signing.

Can I write my own power of attorney UK?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Who can witness a signature?

Consequently, the ideal witness under English law is a person aged 18 or over, who is not a party to the deed, has no commercial or financial interest in the subject matter of the deed and no close personal relationship with the person whose signature they are witnessing.Oct 13, 2020

Why do people sign powers of attorney?

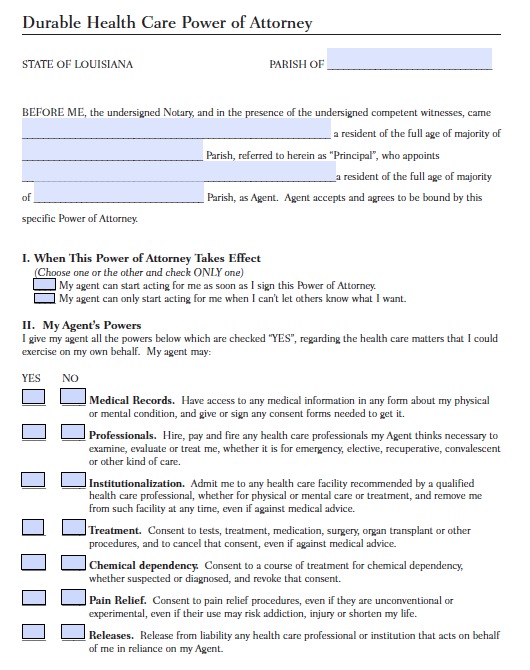

People also commonly sign health care powers of attorney to give someone else the authority to make medical decisions if they are unable to do so. Powers of attorney have other uses as well.

When to bring a power of attorney?

Always bring your power of attorney document with you when you transact business on someone else’s behalf and make sure the people you do business with know that you are acting under a power of attorney.

What does it mean when you sign a document as an attorney in fact?

When you sign a document as someone’s attorney-in-fact, your signature needs to make it clear that you—not they—are signing the document and that you are acting under the authority of a power of attorney. To understand how this works, let’s suppose your name is Jill Jones and you have power of attorney to act for your friend, Sam Smith.

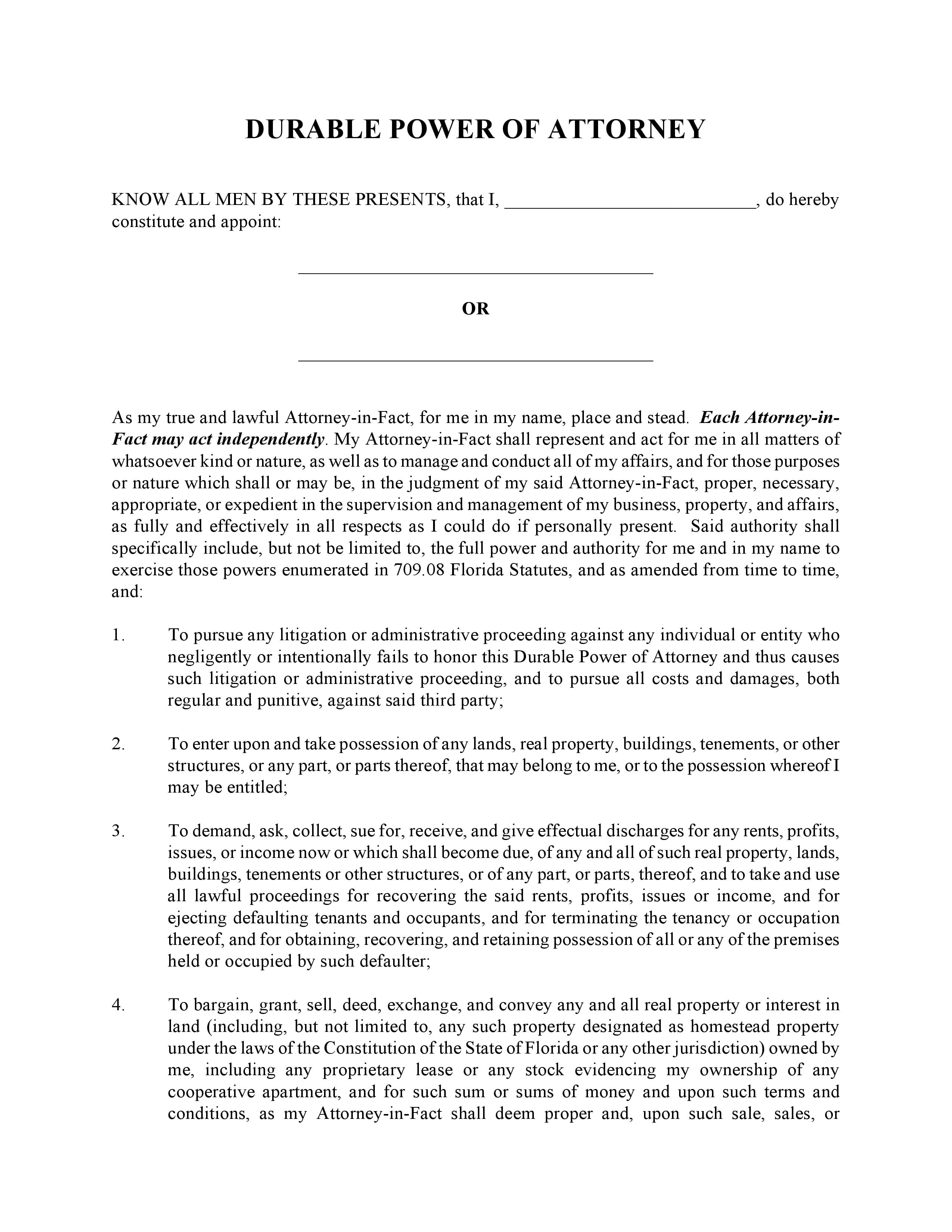

What is a power of attorney?

A power of attorney is a legal document that gives someone the authority to sign documents and conduct transactions on another person’s behalf. A person who holds a power of attorney is sometimes called an attorney-in-fact.

What is a person who holds a power of attorney called?

A person who holds a power of attorney is sometimes called an attorney-in-fact. Many people sign a financial power of attorney, known as a durable power of attorney, to give a friend or family member the power to conduct financial transactions for them if they become incapacitated. People also commonly sign health care powers ...

What happens if you sign a document in your own name?

If you sign a document in your own name without indicating that you are acting under a power of attorney, you could be held personally responsible for the transaction. If you sign only the principal’s name, you could face criminal or civil penalties for fraud or forgery.

Can a power of attorney be used for business?

Don't exceed your authority. A power of attorney document may give you broad power to transact business, or your powers may be more limited. Make sure you understand what you are and aren’t allowed to do as attorney-in-fact, and consult a lawyer if you need clarification. You could face civil or criminal penalties for unauthorized transactions.

What happens if you sign a power of attorney without a name?

If you sign only your own name without the words Power of Attorney, the signature provided is not a clear indication that the execution of the contract is done on behalf of the Grantor . If you sign the name of the Grantor instead of your own as Power of Attorney, the validity of the signature could be questioned later, ...

When signing on behalf of a grantor as an attorney in fact, should you always sign your own name?

When signing on behalf of a Grantor as Attorney-in-Fact, you should always sign YOUR OWN NAME, followed by the words “ Power of Attorney “ . Do NOT sign the Grantor’s name — EVER! By signing your own name with the words “Power of Attorney” after your name to any contract or other legal document, the person receiving the documents signed by you on ...

Steps for Signing as Power of Attorney

The main point you need to know when learning how to sign as attorney-in-fact is that the agent must note that they are legally signing on the principal’s behalf. In other words, it must be clear in the power of attorney signature that that agent’s signature belongs to them and not to the principal.

Duties of an Attorney-in-Fact

When signing a power of attorney on behalf of the principal, it is important to never exceed the authority given in the POA. Therefore, it is vital to understand the duties of an attorney-in-fact to ensure you never overstep the limitations of the document. This is dependent on the type of power of attorney that has been established.

Conclusions

Acting as power of attorney on behalf of another person does carry high levels of responsibility. As the agent, using their power and authority incorrectly could result in a criminal or civil lawsuit.

How to sign a power of attorney?

To sign as a power of attorney, start by signing the principal's full legal name. If you're dealing with a financial account, sign their name the same way it's listed on the account. Next, write the word "by" on the line below the principal's name and sign your own name.

What happens if you don't check a POA?

This means if you don't check anything, the agent won't have any powers.

What does POA mean?

When someone gives you power of attorney (POA) in the United States, it means you have the authority to access their financial accounts and sign financial or legal documents on their behalf. POA is given using a legal POA document that has been drafted and executed according to your state's law.

What does it mean to be an attorney in fact?

When the document goes into effect, you become that person's attorney in fact, which means you act as their agent. Generally, to sign documents in this capacity, you will sign the principal's name first, then your name with the designation "attorney in fact" or "power of attorney.". Steps.

What to put after principal name?

Following your name, you need to add a word or phrase that shows how you have the power to legally sign the principal's name for them. Without this, your signature won't be binding. Typically you'll use the phrase "attorney in fact" or "power of attorney.". For example: "Sally Sunshine, by Molly Moon, attorney in fact.".

Who is Jennifer Mueller?

Jennifer Mueller is an in-house legal expert at wikiHow . Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006. This article has been viewed 109,911 times.

When does a POA go into effect?

Your POA agreement should specify exactly when the POA will go into effect, how long it will last, and what duties and powers the agent has under the agreement. Some POA agreements go into effect when signed, while others are designed to go into effect only when a specified event happens.

When signing as a power of attorney, is it important to state that you are acting on behalf of the principal?

When signing as power of attorney, it is very important to clearly state that you are acting on behalf of the principal and not contracting for any debt or transaction personally.

What is a POA for elders?

How to Sign as Power of Attorney for Your Elderly Parent. A power of attorney (PO A) document is written authorization that enables a person (called the “principal”) to appoint a trusted relative or friend (called the “agent” or “attorney-in-fact”) to manage specific health care decisions or legal and financial responsibilities for them.

Do you need a copy of a power of attorney?

Have a copy of the power of attorney document on hand when you sign anything on behalf of the principal. The POA may already be on file with the institution you are working with, but the process is often quicker and easier if you can produce the document upon request.

Can you sign a power of attorney without a signature?

Regardless of how the signature appears, never sign your name without indicating in writing that you are signing as attorney-in-fact. Use the following pointers for how to sign using power of attorney to avoid any issues. Have a copy of the power of attorney document on hand when you sign anything on behalf of the principal.

Who can sign a tax return for another person?

If you are an administrator, conservator, designee, executor, guardian, receiver, trustee of a trust, personal representative, or other person acting in a fiduciary capacity for another person , you are authorized to sign a tax return for the other person upon notice to the IRS of your authority. This notice, generally given on Form 56, must state the name and address of the taxpayer, as well as the type of tax and the tax year or years involved.

What is a non-IRS POA?

A non-IRS POA may be used, but it MUST contain the taxpayer’s name and mailing address, social security number, the name and address of the agent or representative, the type of tax involved (“income tax”), the federal tax form number (1040, 1040A, etc.), the specific year(s) involved, a clear expression of the authority granted, and the taxpayer’s dated signature. To be authorized as the taxpayer’s representative (as opposed to agent), the non-IRS POA must also contain or have attached to it a signed and dated statement made by the representative referred to as the Declaration of Representative (which can be found in Part II of Form 2848). If the non-IRS power of attorney does not contain all the information listed, the IRS will not accept it.

Do you have to sign your own tax return?

Generally, a taxpayer is required to sign his or her own return; this requirement is in place to protect the taxpayer, but there are times when it is not possible. The IRS has procedures in place to handle many of these situations, but the requirements are not intuitive and the steps required are not apparent.

Popular Posts:

- 1. how to apply for federal attorney license in ohio

- 2. what obligations does an attorney have to an attorney the client fired from the case

- 3. what accusation did vanzetti make against the prosecuting attorney mr. katzman

- 4. what to do if your identity is stolen attorney general

- 5. what does an attorney need to do to become a realtor pennsylvania

- 6. when does va votw for attorney general

- 7. who is the attorney general of the united states today

- 8. what constitutes a 93a violation by an attorney

- 9. is there an attorney present when they set bail

- 10. what i the maximum amount an attorney can charge on a med mad case