In the likely event you get the call and there is no plan in place, the fundamental elements of a plan include:

- A checklist of what to do when fraud is discovered

- Be discreet when fraud is discovered, keep as few people in the know as possible

- Board notification

- Collect and preserve data

- Notify counsel and trusted professionals

- Limited internal investigation

- Suspend the fraudster

- Hire a forensic accountant

Full Answer

What happens if a lawyer gives false evidence?

(3) offer evidence that the lawyer knows to be false. If a lawyer, the lawyer’s client, or a witness called by the lawyer, has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal.

When can a lawyer withdraw from representing a client?

[A] lawyer may withdraw from representing a client if: (3) the client has used the lawyer’s services to perpetrate a crime or fraud; (4) the client insists upon taking action that the lawyer considers repugnant or with which the lawyer has a fundamental disagreement;

When are allegations of fraud sufficient to prove fraud?

Where the fraud alleged involves a highly interdependent scheme in which both parties benefited, allegations that a defendant actively assisted and facilitated the fraudulent scheme itself, as opposed to assisting in the preparation of the documents themselves, are sufficient.

Can a Department of Justice lawyer perform when a client lies?

And the Department of Justice lawyers are confronted with how to perform when a client lies. Further, the uber-client, the ultimate superior of the Executive Branch, contradicted representations made by the Department of Justice lawyers to the various courts.

What is the DOJ rule for withdrawing a lawyer?

What is the ABA opinion on noise withdrawal?

What is the rule for a lawyer to withdraw from a client's representation?

What is the ABA Center for Professional Responsibility?

Why did the Department of Commerce v. New York say the information provided from the Department of Commerce to the courts did?

What does "knows" mean in law?

What does "knows" mean in the Model Rules?

See 4 more

About this website

What do you do if you discover fraud?

Article: 6 Steps to Take after Discovering FraudDon't pay any more money. ... Collect all the pertinent information and documents. ... Protect your identity and accounts. ... Report the fraud to authorities. ... Check your insurance coverage, and other financial recovery steps.More items...

What does a lawyer do if they know their client is lying?

When a lawyer has actual knowledge that a client has committed perjury or submitted false evidence, the lawyer's first duty is to remonstrate with the client in an effort to convince the client to voluntarily correct the perjured testimony or false evidence.

What would you do if you suspect a client was lying about their claim insurance?

The California Department of Insurance has a Consumer Hotline to serve the needs of the public. If you have any information regarding fraudulent insurance activity, you may call the Consumer Hotline at 800-927- 4357. All suspected insurance fraud reported to the Consumer Hotline is forwarded to the Fraud Division.

How do you identify fraudsters?

10 warning signs of fraudUnrecognizable accounts on your credit report or inaccurate information.Bills or statements unexpectedly stop arriving by US mail. ... Checks are significantly out of order on your bank statement.Unreasonable denial of credit.Banks and financial institutions freeze accounts unexpectedly.More items...

What to do if a client is lying?

Let the client know you expect the truth But no matter the client, it is wise to spend a few minutes, and a paragraph in your retainer agreement, setting out the expectation that the client is going to be truthful and forthright during your representation.

What is the difference between perjury and false statements?

And for perjury, the statement must be literally false and made with intent to deceive or mislead. In contrast, making false statements applies when people lie to the government regardless of whether it's under oath or not.

Can a lawyer drop a client for lying?

In extreme cases, where you know your clients are lying, presenting perjured testimony would violate the Rules of Professional Conduct and require you to drop them.

What happens when someone lies to their insurance?

At best, you will have to remember your lie the entire time you are dealing with your insurer. They will most likely record calls and other interactions with you to uncover any discrepancies in your claim. At worst, you could face criminal penalties leading to fines and even jail time.

Is a lawyer obligated to tell the truth?

Lawyers must be honest, but they do not have to be truthful. A criminal defense lawyer, for example, in zealously defending a client, has no obligation to actively present the truth. Counsel may not deliberately mislead the court, but has no obligation to tell the defendant's whole story.

Can a lawyer drop a client for lying?

In extreme cases, where you know your clients are lying, presenting perjured testimony would violate the Rules of Professional Conduct and require you to drop them.

Is a lawyer obligated to tell the truth?

Lawyers must be honest, but they do not have to be truthful. A criminal defense lawyer, for example, in zealously defending a client, has no obligation to actively present the truth. Counsel may not deliberately mislead the court, but has no obligation to tell the defendant's whole story.

How do you respond to a lie in court?

There are steps that another person can take whether a party or an observer to inform the court of lies.Provide Testimony. A person who knows that someone else has lied to the court may be called as a witness by the adverse party. ... Cross-Examination. ... Provide Evidence. ... Perjury. ... Jury Instruction. ... Legal Assistance.

What is it called when you lie under oath?

In short, a false statement is perjury when it is made under oath or made under penalty of perjury. Two separate statutes define the crime of perjury under federal law.

How To Deal With A Lying Client - Above the LawAbove the Law

A very long time ago, I had an issue with a client. He claimed to have brought some paperwork to my office the day before. But my spidey sense suspected that he wasn’t being truthful.

When is it okay for a lawyer to lie? - American Bar Association

Everyone knows that lawyers are not allowed to lie — to clients, courts or third parties. But once you get beyond deliberate false statements, the scope of the obligations to truth and integrity become less clear. What about reckless and negligent statements that are false? What about misleading statements and implications about the extent of your knowledge? What about omissions? When is it ...

What if a lawyer knows his client is lying? - Quora

Answer (1 of 6): There are two ways to think about this question. One, exemplified by the answer about O.J. Simpson, could be characterized as asking how a criminal defense attorney can defend a potentially (or obviously) guilty person. The answer is that the defendant in a criminal case is entit...

blogs.findlaw.com

We would like to show you a description here but the site won’t allow us.

Dealing With Clients Who Lie: What Can You Ethically Do?

Rule 1.6." Rule 3.3(b). So, while a lawyer’s duties of loyalty and confidentiality require the lawyer to explore options other than disclosure of client confidences, such disclosure may on occasion be required.

You think your client is going to lie on the stand—The classic ...

Confidentiality, embodied by the attorney-client relationship, is a bedrock principle of our legal system. It contributes to the trust that is the hallmark of the client-lawyer relationship.

What happens when an internal accountant sees the same type of reports?

When an internal accountant sees essentially the same types of reports and data period after period, they may not notice changes that have gradually occurred, which could indicate potentially fraudulent activity. One procedure to address this situation is to consider bringing in an outside consultant, preferably someone who is a certified fraud examiner, to evaluate fraud prevention processes that are in place and offer suggestions for other methods.

What is the most trusted advisor to a company?

The most trusted adviser to a company is often their attorney. One way of protecting your clients is to remind them to consider fraud prevention. The attorney will not usually be directly involved in the development of fraud prevention and/ or detection processes, but they are the ideal advisor to remind their clients of the need to be vigilant.

Why do companies need an attorney?

The company attorney can provide a valuable role in reminding their clients that regardless of their size, any company can be the victim of employee fraud. Often management is so caught up in working in the business that they fail to work on the business. This can be particularly true with fraud prevention. A proactive reminder from their company attorney can save the client many thousands of dollars and the heartache of having to file fraud charges against a once-trusted employee.

When employees are aware that monitoring is taking place there is a significant deterrent effect for those employees who may give?

When employees are aware that monitoring is taking place there is a significant deterrent effect for those employees who may give in to temptation or stress. Protecting the company’s valued employees from their own potential mistakes is as much a part of effective internal controls as protecting the other assets of the company. In particular, this strategy is very effective for type two and type three employees.

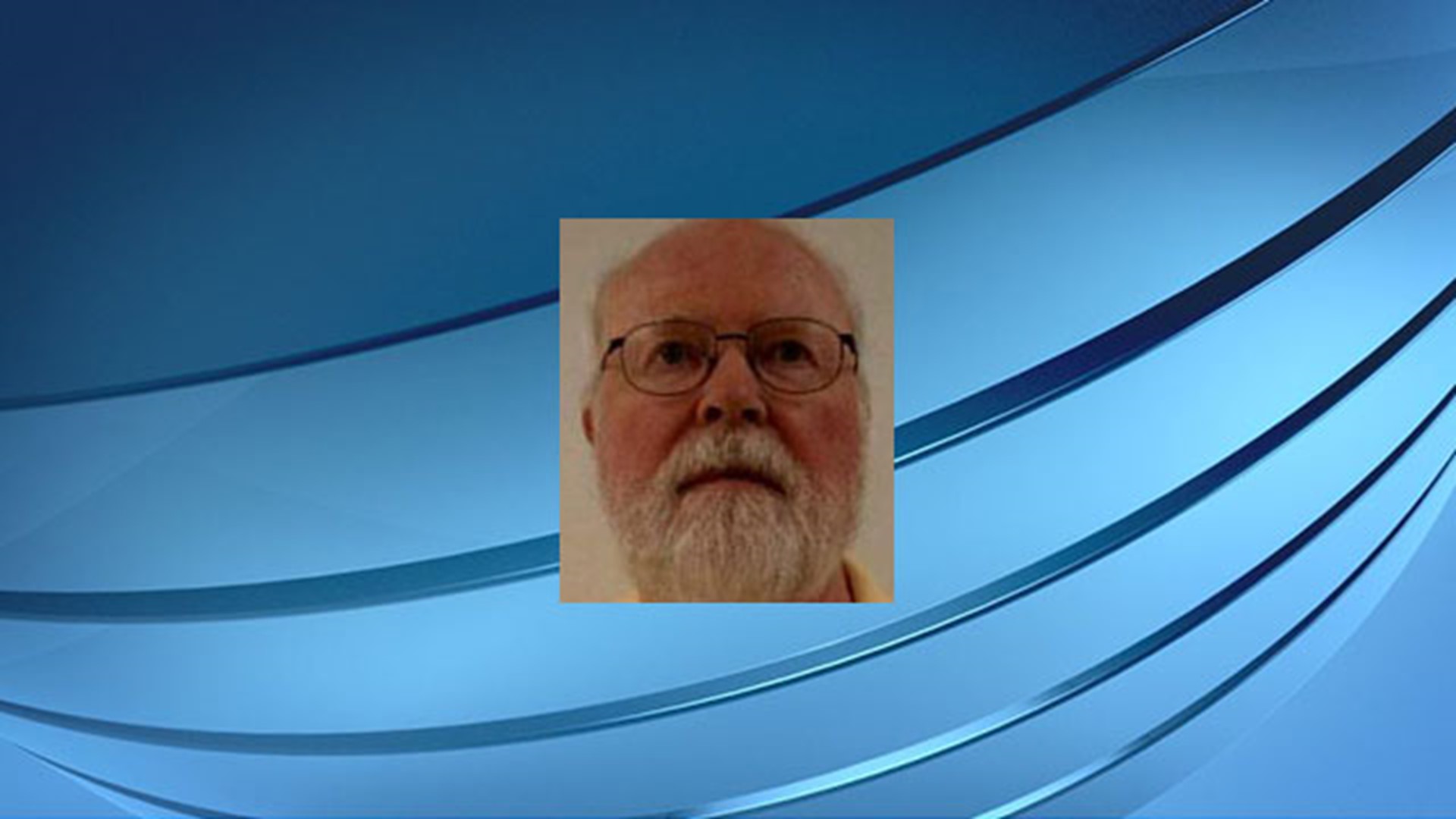

Who is Joe Epps?

Joe Epps is a CPA and CFE with over 30 years of experience in forensic accounting. His litigation support experience includes contract disputes, anti-trust, economic damages, fraud investigations, business valuation and intellectual property litigation. Joe is currently president of Epps Forensic Consulting and teaches a graduate course on forensic accounting at Arizona State University. For more information, please call (480) 595- 0943 or visit the website www.eppsforensics.com.

What is the DOJ rule for withdrawing a lawyer?

At least one district court case is requiring the DOJ lawyers seeking to withdraw to comply with a local rule in stating the reasons for withdrawal. This is consistent with Model Rule 1.16 (c): “A lawyer must comply with applicable law requiring notice to or permission of a tribunal when terminating a representation.

What is the ABA opinion on noise withdrawal?

ABA Formal Ethics Opinion 92-366, while perhaps most focused upon “noisy withdrawal,” concludes that: “A lawyer who knows or with reason believes that her services or work product are being used or are intended to be used by a client to perpetrate a fraud must withdraw from further representation of the client….”

What is the rule for a lawyer to withdraw from a client's representation?

The failure of the client to be truthful with the lawyer is grounds for the lawyer to withdraw from the representation. Rule 1.16 (b) (3), (4), and (5):

What is the ABA Center for Professional Responsibility?

ABA Center for Professional Responsibility is a national leader in developing and interpreting standards and scholarly resources in legal and judicial ethics, professional regulation, professionalism and client protection mechanisms.

Why did the Department of Commerce v. New York say the information provided from the Department of Commerce to the courts did?

New York, that the information provided from the Department of Commerce to the courts did not satisfy the obligations of the Administrative Procedures Act to justify adding a citizenship question to the census. The court said the explanation was “contrived” to cover-up the actual actions of the Secretary of Commerce. In other words, the client lied.

What does "knows" mean in law?

The definition of “knows” is distinct from the definition of “reasonably should know.”. That is defined in Rule 1.0 (j) saying that “a lawyer of reasonable prudence and competence would ascertain the matter in question.”. This is an important distinction that arises in other provisions of the Model Rules.

What does "knows" mean in the Model Rules?

It “denotes actual knowledge of the fact in question.” Knowledge “may be inferred from circumstances.” The definition of “knows” is distinct from the definition of “reasonably should know.” That is defined in Rule 1.0 (j) saying that “a lawyer of reasonable prudence and competence would ascertain the matter in question.”

What is the nexus between the aider and abettor?

New York case law stipulates that a nexus must exist between the aider and abettor and the primary fraud. This “nexus” can be made out by allegations as to the proposed aider’s knowledge of the fraud, and what he can therefore be said to have done with the intention of advancing the fraud’s commission. The nexus is not made out simply by allegations that would be sufficient to state a claim against the principal participants in the fraud. ( National Westminster Bank USA v. Weksel, 124 A.D.2d 144, 149 (N.Y. App. Div. 1st Dep’t 1987))

What is substantial assistance in fraud?

v. Metro. Life Ins. Co ., 64 A.D.3d 472, 476 (N.Y. App. Div. 1st Dep’t 2009)) Substantial assistance is more than mere performance of routine business services for the alleged fraudster. ( CRT Invs., Ltd. v BDO Seidman, LLP, 85 AD3d 470, 472, 925 N.Y.S.2d 439 (1st Dept 2011)) Even though the intent to commit fraud may be divined from the surrounding circumstances, this is not sufficient to constitute substantial assistance in the fraud. Under New York law, substantial assistance occurs when a defendant affirmatively assists, helps conceal, or fails to act when required to do so, thereby enabling the fraud to occur. The aider/abettor’s actions must also proximately cause the harm on which the primary liability is predicated. Where the primary fraud claim is predicated on misrepresentations in documents, substantial assistance usually involves assistance in the preparation or dissemination of the documents. Where the fraud alleged involves a highly interdependent scheme in which both parties benefited, allegations that a defendant actively assisted and facilitated the fraudulent scheme itself, as opposed to assisting in the preparation of the documents themselves, are sufficient. A defendant’s mere presence, even when accompanied by the passive receipt of emails, cannot constitute affirmative assistance. ( Nathel v. Siegal, 592 F. Supp. 2d 452, 458 (S.D.N.Y. 2008))

What is the knowledge required for aiding and abetting?

While the requisite level of knowledge necessary for aiding and abetting varies by state, New York and many other states require actual knowledge. The defendant attorney may try to rebut the presumption that he or she “knew” about the fraud. To combat this defense, plaintiffs may attach communications or e-mails indicating that the terms of the transaction had been communicated amongst the defendant and others involved to show actual knowledge. ( See Chambers v Weinstein, 44 Misc. 3d 1224 (A), 1224A (N.Y. Sup. Ct. 2014)) Likewise, a plaintiff may fail to state a cause of action for aiding and abetting fraud if the alleged conduct does not constitute substantial assistance in the commission of the underlying fraud. In Learning Annex, LP. V. Blank Rome, LLP ( Learning Annex, L.P. v. Blank Rome LLP, 106 A.D.3d 663 (N.Y. App. Div. 1st Dep’t 2013)), the plaintiff failed to state a cause of action against the defendant law firm because the alleged conduct, the defendant’s failure to disclose a voting agreement entered into between non-parties at a time when defendants did not represent plaintiff, did not constitute substantial assistance.

What is actual knowledge in Kirschner v. Oster?

Kirschner ( 77 AD3d 51, 55, 905 N.Y.S.2d 69 (1st Dept 2010)), the Appellate Division- First Department broadly construed the “actual knowledge” element of an aiding-and-abetting cause of action against lawyers, holding that plaintiffs may be able to sufficiently allege actual knowledge by inferring it from the surrounding circumstances, such as the nature of the objectionable client conduct known to the lawyer at the time legal services are rendered, and the nature of legal services rendered. ( Id )

What is the pitfall of choosing wrong?

One pitfall of choosing wrong is the risk that a lawyer could be sued for aiding and abetting fraud perpetrated by that client. To state a claim for aiding and abetting fraud, a plaintiff must allege: The existence of the underlying fraud; The defendant’s actual knowledge of the fraud by the primary wrongdoer; and.

Does knowledge of bad actors in securities documents allege actual knowledge?

New York courts have held that knowledge of bad actor’s criminal backgrounds, and knowledge of misrepresentations in securities documents do not sufficiently allege actual knowledge. ( Supra note 3.) Likewise, specific communications between parties are precisely the type of evidence expected to be within the defendant’s possession. Such communications accompanied by sufficiently pled facts allow the court to infer that the party knew of, or at least consciously disregarded fraudulent representations and omissions made to the innocent party. Such knowledge, or conscious disregard thereof, satisfies the element of actual knowledge. ( Supra note 4)

Can a lawyer choose whether or not to represent a client?

Unlike a bus, which is obligated to take every paying customer, a lawyer can choose whether or not to represent a potential client. Back in 1989, a bar review lecturer on professional responsibility taught that “a lawyer is not a bus.”.

What is a third source of claims against professionals?

third source of claims against professionals is other accused parties, often codefendants, who may seek to bring claims for contribution or indemnification, or claims by other names that seek to recoup the damages or expenses they had to pay as a re-sult of being sued themselves . Sometimes the plaintiffs bringing these contribution-type claims against professionals are other professionals. While perhaps a questionable strategy in many cases, it is not unheard of for professional firms to sue other professional firms for, in effect, helping the client company to mislead them. In addition, corporate insiders who are accused of committing the fraud sometimes choose to sue the profession-als who represented the corporation, whether it is because they think the claims are independently justified or as a strategy to deflect attention from their own conduct (or both).

What is the defense of in pari delicto?

One way an early dismissal can sometimes be achieved in client-fraud cases brought by the client or its bankruptcy representative is the defense of in pari delicto. In its classic form, this doctrine holds that a plaintiff who is at fault cannot recover against an-other alleged wrongdoer as long as the plaintiff’s fault is at least as severe as the defendant’s. In many client-fraud cases brought by the client, the professional will have a strong in pari delicto defense on the ground that the corporate client—the plaintiff—is charged with the wrongdoing of its executives and employees who committed fraud. Thus, a corporation charged with pri-mary responsibility for fraud should not be permitted to recover against another party—the professional defendant—for damages caused by the professional’s failure to stop the corporation’s own fraud. When its elements are established, in pari delicto typically defeats all of the plaintiff’s claims in their entirety, whether couched in tort or contract and whether the professional defen-dant’s wrongdoing was negligent or intentional.

What happens when a client's fraud is revealed?

When a client’s fraud is revealed, professionals may anticipate lawsuits from a variety of sources. One common plaintiff, in some ways the most dangerous, is the client itself or the client’s trustee or receiver. The fraudsters who ran the company ordi-narily lose power upon the fraud’s exposure, to be replaced by new management. More often than not, at least in my experience, the company that committed a major fraud is insolvent and soon is forced into bankruptcy or receivership. In that circumstance, the trustee, receiver, debtor-in-possession, creditors’ committee, or other successor-in-interest to the client company will take ownership of the client’s claims and can sue the professionals. Bankruptcy plans often provide for the creation of “litigation trusts” with no purpose other than to assert the estate’s claims against professionals and other third parties.

What is the DOJ rule for withdrawing a lawyer?

At least one district court case is requiring the DOJ lawyers seeking to withdraw to comply with a local rule in stating the reasons for withdrawal. This is consistent with Model Rule 1.16 (c): “A lawyer must comply with applicable law requiring notice to or permission of a tribunal when terminating a representation.

What is the ABA opinion on noise withdrawal?

ABA Formal Ethics Opinion 92-366, while perhaps most focused upon “noisy withdrawal,” concludes that: “A lawyer who knows or with reason believes that her services or work product are being used or are intended to be used by a client to perpetrate a fraud must withdraw from further representation of the client….”

What is the rule for a lawyer to withdraw from a client's representation?

The failure of the client to be truthful with the lawyer is grounds for the lawyer to withdraw from the representation. Rule 1.16 (b) (3), (4), and (5):

What is the ABA Center for Professional Responsibility?

ABA Center for Professional Responsibility is a national leader in developing and interpreting standards and scholarly resources in legal and judicial ethics, professional regulation, professionalism and client protection mechanisms.

Why did the Department of Commerce v. New York say the information provided from the Department of Commerce to the courts did?

New York, that the information provided from the Department of Commerce to the courts did not satisfy the obligations of the Administrative Procedures Act to justify adding a citizenship question to the census. The court said the explanation was “contrived” to cover-up the actual actions of the Secretary of Commerce. In other words, the client lied.

What does "knows" mean in law?

The definition of “knows” is distinct from the definition of “reasonably should know.”. That is defined in Rule 1.0 (j) saying that “a lawyer of reasonable prudence and competence would ascertain the matter in question.”. This is an important distinction that arises in other provisions of the Model Rules.

What does "knows" mean in the Model Rules?

It “denotes actual knowledge of the fact in question.” Knowledge “may be inferred from circumstances.” The definition of “knows” is distinct from the definition of “reasonably should know.” That is defined in Rule 1.0 (j) saying that “a lawyer of reasonable prudence and competence would ascertain the matter in question.”

Popular Posts:

- 1. what autjhorities from a medical power of attorney

- 2. what is attorney lien

- 3. how to be a patent attorney in us and canada

- 4. how to find out if a letter from attorney is legitimate

- 5. how much an attorney charge for us citizenship?

- 6. how to get power of attorney for deceased spous

- 7. when in 2017 will the attorney general be replaced?

- 8. when attorney discipline cleared

- 9. who was ohio attorney general in 2007

- 10. which character on "the walking dead" was a civil rights attorney?