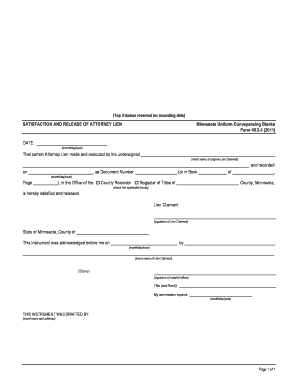

Attorney's Lien

- Definition. The right of a lawyer to hold a client's property until the client pays for legal services provided.

- Illustrative caselaw. See, e.g. Gargano v. Liberty Intern. Underwriters, Inc., 572 F.3d 45 (1st Cir. 2009).

- See also

Is an attorney allowed to assert a lien for?

Attorney's Lien. The right of a lawyer to hold a client's property or money until payment has been made for legal aid and advice given. In general, a lien is a security interest used by a creditor to ensure payment by a debtor for money owed. Since an attorney is entitled to payment for services performed, the attorney has a claim on a client's property until compensation is duly made.

How does attorney lien work?

What is an Attorney's Lien? It is a judgement placed on an individual property in order to recover the lost revenue from failure of paying a bill or taxes. And if the debt is still unpaid, the lien holder or the Attorney has the power to liquidate the lien asset to raise the funds being owed.

What is the legal definition of a lien?

Attorney’s lien refers to the right of a lawyer to hold a client's property or money until payment has been made for legal aid and advice given. The property may include business files, official documents, and money awarded by a court. Lien refers to the legal right a person has on another’s property if an obligation is not discharged.

What should I look for in an attorney?

Attorney liens are the ultimate sign of a broken relationship between attorney and client. Part 1 discussed what an attorney lien is and Part 2 highlighted the requirements and limitations of an attorney lien. This final part will discuss the two most favored types of attorney liens: retaining liens and charging liens. Retaining Liens

What is attorney's lien Philippines?

The retaining lien is the right of the attorney to retain the funds, documents, and papers of his client which have lawfully come into his possession until his lawful fees and disbursements have been paid and to apply such funds to the satisfaction thereof.

What is a fee lien?

A charging lien is an attorney's right to a portion of the judgment that was won for the client through professional services. It is a specific lien and only covers a lawyer's claim on money obtained in a particular action.

What is a charging lien in California?

An attorney's lien (also known as a “charging” lien) is a lien that secures an attorney's compensation against the funds or judgment recovered by the attorney for the client. Fletcher v. Davis, 33 Cal. 4th 61, 66 (2004).

What is a charging lien in Florida?

Florida common law recognizes two types of attorney's liens: the charging lien and the retaining lien. The charging lien may be asserted when a client owes the attorney for fees or costs in connection with a specific matter in which a suit has been filed.Jun 28, 2021

What is the difference between fees and costs?

To recap: fees are the amount paid for the attorneys' time and effort working on your case, costs are the amount paid for out-of-pocket expenses on your case. Every case will have both fees and costs.Dec 13, 2018

How is the practice of law defined?

Definition Of The Practice Of Law (1) The "practice of law" is the application of legal principles and judgment with regard to the circumstances or objectives of a person that require the knowledge and skill of a person trained in the law.

What is a medical lien in California?

In a California personal injury case, a medical lien authorizes payment of medical bills directly to a health care provider from the settlement or judgment. In essence, it lets the patient receive medical services “on credit” to be repaid once the case is resolved.

When can an attorney withdraw from a case Florida?

Rule 4-1.16(a) of the Rules Regulating The Florida Bar sets out several situations where withdrawal is mandatory. Withdrawal is mandatory when the client discharges you, when you are too sick to continue, or when continued representation will result in a violation of the Rules of Professional Conduct.Jan 1, 2002

What is an attorney's lien?

An attorney’s lien allows an attorney to hold onto or make a claim against a client’s assets until he has received payment. One type of attorney’s lien is called a charging lien. This type of lien is made against a settlement or judgment a client receives.

What is a retaining lien?

A retaining lien is another type of attorney’s lien. With this type of lien, an attorney may have a right to any money or property the client receives during a case, regardless of whether it is related to the legal action in which the attorney is involved.

How do attorneys make money?

Attorneys typically earn money by collecting legal fees in exchange for legal document preparation, representation, and advice. In some cases, clients may pay their attorneys for their services up front. This is not always the case, however, and an attorney may have to wait to receive his fees at the end of the case or once settlement is made. ...

Who is Nicole Madison?

Nicole Madison. Nicole’s thirst for knowledge inspired her to become a MyLawQuestions writer , and she focuses primarily on topics such as homeschooling, parenting, health, science, and business. When not writing or spending time with her four children, Nicole enjoys reading, camping, and going to the beach.

What is an attorney's lien?

What is an Attorney’s Lien? It is a judgement placed on an individual property in order to recover the lost revenue from failure of paying a bill or taxes. And if the debt is still unpaid, the lien holder or the Attorney has the power to liquidate the lien asset to raise the funds being owed.

What is a charging lien?

A charging lien is a means for an attorney to claim the money incurred in a specific action suit. The attorney has the right to a percentage of any judgment that has been acquired for the client through the lawyer’s services.

What happens when an attorney is discharged?

When an attorney is discharged and/or allowed to withdraw from a case, he still maintains the duty to protect his former client’s interests through the transition to new counsel, including providing case file information to the new attorney.

What is contingency fee agreement?

Contingency fee agreements – the type of contract most plaintiffs sign in personal injury cases – also bring special limitations. If your contract provides that you will owe your attorney nothing unless he recovers money for you, he cannot try to make you pay him anything unless and until that case is successful.

Can an attorney file a lien on my fees and costs?

Your attorney’s ability to file a lien for his fees and costs may hinge, among other factors, on whether his withdrawal was reasonable. If, for example, he withdrew from your case without giving a reason (or because he decided to become a professional golfer instead), and his withdrawal damaged your case, the court may well support you in your decision not to pay him for the work he did. If, however, his withdrawal was necessary or reasonable and if the court approved the withdrawal, it is likely that he will be able to recover reasonable fees and costs for the work he did, according to the terms of your contract.

What is attorney lien?

Attorney liens are the ultimate sign of a broken relationship between attorney and client. Part 1 discussed what an attorney lien is and Part 2 highlighted the requirements and limitations of an attorney lien.

What is a retaining lien?

In essence, a retaining lien is a way for your former attorney to hold your file hostage until he receives payment or an assurance that he will be paid out of the settlement or award received in your case.

What is a lien on an attorney?

An attorney’s lien (also termed a “charging lien”) is a lien that secures an attorney’s compensation “upon the fund or judgment” recovered by the attorney for the client.

What is attorney-client relationship?

The common attorney-client relationship in its simplest form is: the potential client signs a fee agreement retaining the attorney, the attorney performs the requested work, the client achieves an end result, and the attorney gets paid. The unfortunate reality, however, is that sometimes a retained client fail to pay its attorney for some (or all) of the legal work that the attorney performed. When this occurs, the attorney is left in a difficult divide between complying with the attorney’s ethical obligations and enforcing the attorney’s right to be paid. So how can the attorney ethically enforce its right to be paid while still complying with the Professional Rules all attorneys are bound by? Is it even possible? The answer is in one small word “liens.”

What Is A Construction Lien?

A construction lien is a legal instrument that enables contractors, subcontractors, laborers and material suppliers to enforce payment for the services, labor and materials that they provide for building or home remodeling projects.

Common Terms In Construction Law

Notice of Commencement: Notices of commencement (NC) are signed by the owner and recorded in the County Public Records. An NC is posted at the job site and contains the names and addresses of the owner, contractor, surety and others upon whom the lien must be served.

Prerequisites

Lien Limitations

- Whether you’ve failed to pay him or not, your attorney is still ethically obligated to avoid prejudicing the interests of your case. This basic rule applies very differently depending on the circumstances, but if the lien might hurt your chances in court, there is a higher likelihood that it will be denied. Contingency fee agreements – the type of contract most plaintiffs sign in person…

Acceptable Reasons to Withdraw

- Your attorney’s ability to file a lien for his fees and costs may hinge, among other factors, on whether his withdrawal was reasonable. If, for example, he withdrew from your case without giving a reason (or because he decided to become a professional golfer instead), and his withdrawal damaged your case, the court may well support you in your decision not to pay him f…

Responsibilities After Withdrawal

- When an attorney is discharged and/or allowed to withdraw from a case, he still maintains the duty to protect his former client’s interests through the transition to new counsel, including providing case file information to the new attorney. Though the option of retaining case files as security for unpaid fees is often available, it is limited by law, as will be discussed in Part 3. An a…

Popular Posts:

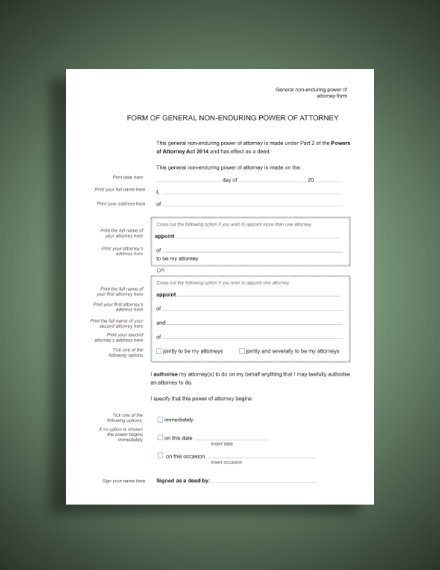

- 1. where can i get power of attorney in washington state

- 2. power of attorney vs. executor who has more say so?

- 3. what is a criminal defence attorney

- 4. how to become arag attorney

- 5. how to make a spouse pay for a divorce attorney

- 6. what are next steps after hospital bill going to attorney

- 7. what is 18b attorney

- 8. who is nominated for attorney general

- 9. who can i talk to if i cant afford an attorney

- 10. what is state's designation attorney memo of withdrawal